Stock Market Today: New Month, Same Ol' Stomach-Churning Market

June kicked off with another up-and-down day as Wall Street digested signs of economic slowing and a more hawkish Fed.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

More pockmarks on the prospects for the U.S. economy sent America's major stock indexes into a near-360 during June's first trading session.

JPMorgan Chase (JPM, -1.8%) CEO Jamie Dimon unnerved some on Wall Street after telling a financial conference that he's preparing his own bank for more turbulent times to come. "You know, I said there's storm clouds, but I'm going to change it … it's a hurricane," he said, adding that investors should "brace yourself."

Economic data didn't help much to quell those fears. The Labor Department's Job Openings and Labor Turnover Survey (JOLTS) showed that job openings declined by 455,000 in April to 11.4 million, from 11.9 million in March. That sets up a possible cooling in the May jobs report due out Friday morning.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

"We've enjoyed 12 consecutive months of payroll growth north of 400,000, but that streak is close to an end," says Greg McBride, chief financial analyst at Bankrate. "Job growth will continue, but at a more modest pace in the months ahead as the Federal Reserve works to slow the economy and corral inflation."

However, also Wednesday, the Institute for Supply Management's May manufacturing report showed that manufacturing activity remained robust, delivering a reading of 56.1 last month vs. 55.4 in April and 54.5 expected. (Anything over 50 implies expansion.)

Following on remarks from Federal Reserve Governor Christopher Waller suggesting the central bank might need to continue tightening monetary policy, James Bullard, president of the Federal Reserve Bank of St. Louis, told the Economic Club of Memphis that "I think we're on the precipice of losing control of inflation expectations."

And San Francisco Fed President Mary Daly said the central bank should be aggressive with rate hikes until inflation is tamed. "We need to do that expeditiously, and I see a couple of 50-basis-point hikes immediately in the next couple of meetings to get there," she said.

That sent traders' views on the likelihood for another 50-basis-point hike in September to 60%, from 55% yesterday, according to the CME FedWatch Tool. Bonds sold off again as a result, sending the 10-year Treasury yield to as high as 2.95%.

Energy (+1.6%) was the only sector showing any real strength; U.S. crude oil futures improved by 0.5% to $115.26 per barrel as Shanghai began ending its two-month COVID-related lockdown.

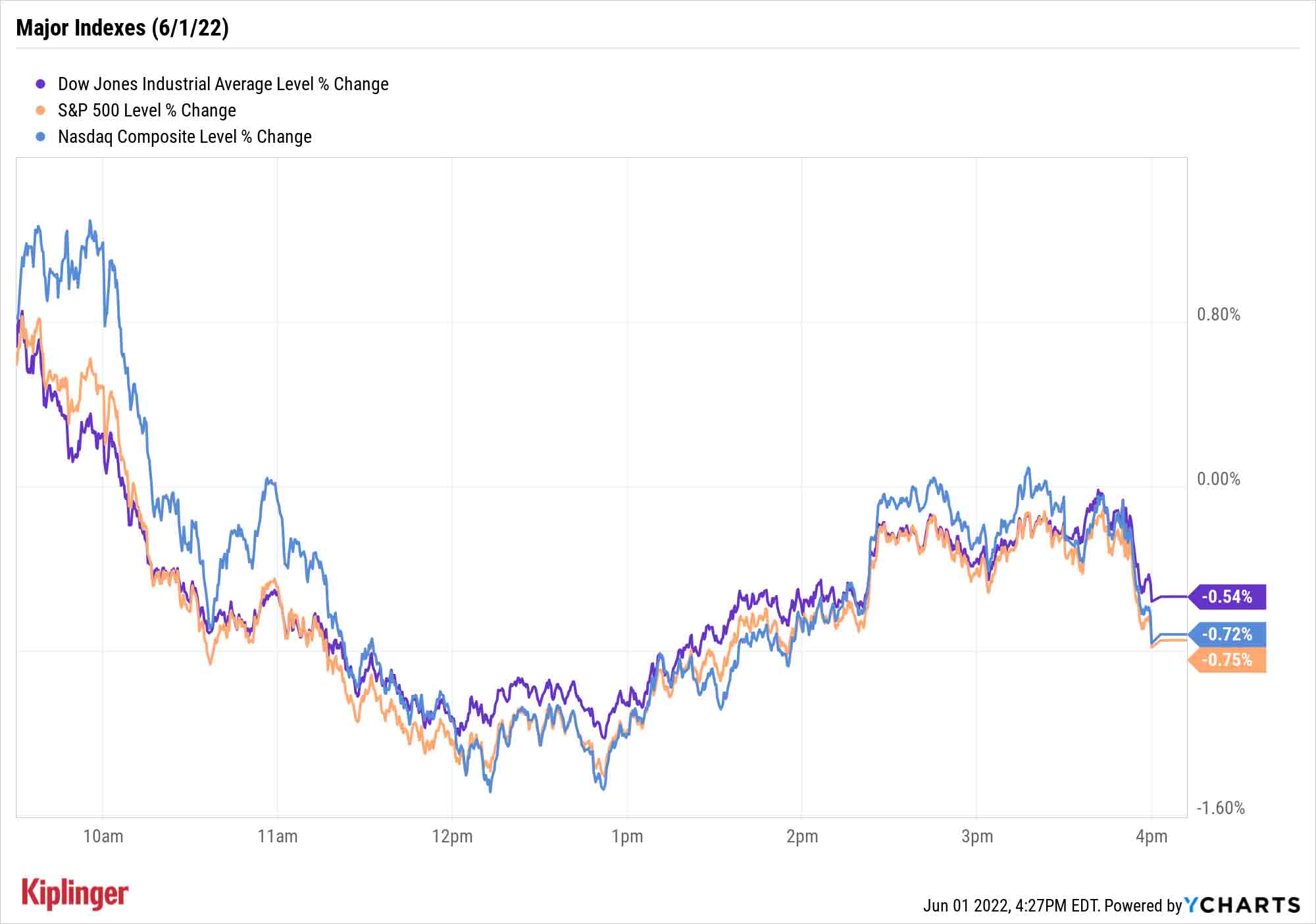

The major indexes, meanwhile, started in the green, plunged deep into the red by noon, then spent the rest of the afternoon clawing away at most (but not all) of those losses. The Dow Jones Industrial Average declined 0.5% to 32,813, the S&P 500 was down 0.8% to 4,101, and the Nasdaq Composite shed 0.7% to 11,994.

Other news in the stock market today:

- The small-cap Russell 2000 declined 0.5% to 1,854.

- Gold futures improved by 0.3% to $1,843.30 per ounce.

- Bitcoin declined 4.9% to $30,104.76. (Bitcoin trades 24 hours a day; prices reported here are as of 4 p.m.)

- Salesforce.com (CRM) shares rocketed ahead by 9.9% after the company topped first-quarter estimates and raised its full-year outlook. Profits of 98 cents per share and revenues of $7.41 billion topped views for 94 cents and $7.38 billion, respectively. Meanwhile, CRM now expects $4.74 to $4.76 per share in full-year adjusted earnings, versus $4.62 to $4.64 per share previously. "Last night Salesforce delivered a much better than feared April quarter and guidance which will be a major relief for tech investors showing that core enterprise demand is holding up well despite the macro and geopolitical swirls," says Wedbush's Daniel Ives, who rates the stock at Outperform.

Take a Shot on Chinese Stocks?

If it's any consolation (probably not), the U.S. isn't the only place in the world experiencing deep year-to-date losses and nauseating volatility.

Take China, for instance. This country has long been considered one of the greatest growth plays in emerging markets. However, hyper-strict governmental regulatory crackdowns in the technology space, as well as a resurgent wave of COVID that sparked shutdowns in several large population centers, have cut the Morningstar China Index's value by roughly a third in 2022.

Yes, Chinese equities have enjoyed a small bump of late as governmental figures have given a token nod to the country's enormous technology sector. But strategists are skeptical that this will translate into any substantial changes in the country's stance long-term. Other hurdles remain, too.

"Domestic consumption remains weak, the housing market is sluggish, the online retail sector is saturated and Chinese stocks continue to face the risk of being delisted from foreign exchanges," says BCA Research.

And yet, equity researchers remain extremely bullish on a number of Chinese stocks. Much of that has to do with valuation – excessive stock losses have made many of these companies attractive, even in a perilous macro environment. Beware that some of it merely reflects the potential for a near-term rebound, not necessarily confidence in a favorable long-term setup. Still, nimble investors looking to generate excess returns in a tumultuous 2022 might find a few candidates among these five Chinese picks.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Kyle Woodley is the Editor-in-Chief of WealthUp, a site dedicated to improving the personal finances and financial literacy of people of all ages. He also writes the weekly The Weekend Tea newsletter, which covers both news and analysis about spending, saving, investing, the economy and more.

Kyle was previously the Senior Investing Editor for Kiplinger.com, and the Managing Editor for InvestorPlace.com before that. His work has appeared in several outlets, including Yahoo! Finance, MSN Money, Barchart, The Globe & Mail and the Nasdaq. He also has appeared as a guest on Fox Business Network and Money Radio, among other shows and podcasts, and he has been quoted in several outlets, including MarketWatch, Vice and Univision. He is a proud graduate of The Ohio State University, where he earned a BA in journalism.

You can check out his thoughts on the markets (and more) at @KyleWoodley.

-

Farmers Brace for Another Rough Year

Farmers Brace for Another Rough YearThe Kiplinger Letter The agriculture sector has been plagued by low commodity prices and is facing an uncertain trade outlook.

-

Nasdaq Leads a Rocky Risk-On Rally: Stock Market Today

Nasdaq Leads a Rocky Risk-On Rally: Stock Market TodayPresident Trump said he will decide within the next 10 days whether or not the U.S. will launch military strikes against Iran.

-

Over 65? Here's What the New $6K Senior Tax Deduction Means for Medicare IRMAA

Over 65? Here's What the New $6K Senior Tax Deduction Means for Medicare IRMAATax Breaks A new tax deduction for people over age 65 has some thinking about Medicare premiums and MAGI strategy.

-

Stocks Drop as Iran Worries Ramp Up: Stock Market Today

Stocks Drop as Iran Worries Ramp Up: Stock Market TodayPresident Trump said he will decide within the next 10 days whether or not the U.S. will launch military strikes against Iran.

-

Nasdaq Leads a Rocky Risk-On Rally: Stock Market Today

Nasdaq Leads a Rocky Risk-On Rally: Stock Market TodayAnother worrying bout of late-session weakness couldn't take down the main equity indexes on Wednesday.

-

Stocks Make More Big Up and Down Moves: Stock Market Today

Stocks Make More Big Up and Down Moves: Stock Market TodayThe impact of revolutionary technology has replaced world-changing trade policy as the major variable for markets, with mixed results for sectors and stocks.

-

Small Caps Step Up, Tech Is Still a Drag: Stock Market Today

Small Caps Step Up, Tech Is Still a Drag: Stock Market TodayEarly strength gave way to AI skepticism again as a volatile trading week ended on another mixed note.

-

AI Unwind Takes 2% Off the Nasdaq: Stock Market Today

AI Unwind Takes 2% Off the Nasdaq: Stock Market TodayMarkets are paying more and more attention to hyperscalers' plans to spend more and more money on artificial intelligence.

-

Big Change Coming to the Federal Reserve

Big Change Coming to the Federal ReserveThe Lette A new chairman of the Federal Reserve has been named. What will this mean for the economy?

-

Strong Jobs Report Leaves Markets Flat: Stock Market Today

Strong Jobs Report Leaves Markets Flat: Stock Market TodayInvestors, traders and speculators are taking time to weigh the latest labor market data against their hopes for lower interest rates.

-

Job Growth Sizzled to Start the Year. Here's Why It's Unlikely to Impact Interest Rates

Job Growth Sizzled to Start the Year. Here's Why It's Unlikely to Impact Interest RatesThe January jobs report came in much stronger than expected and the unemployment rate ticked lower to start 2026, easing worries about a slowing labor market.