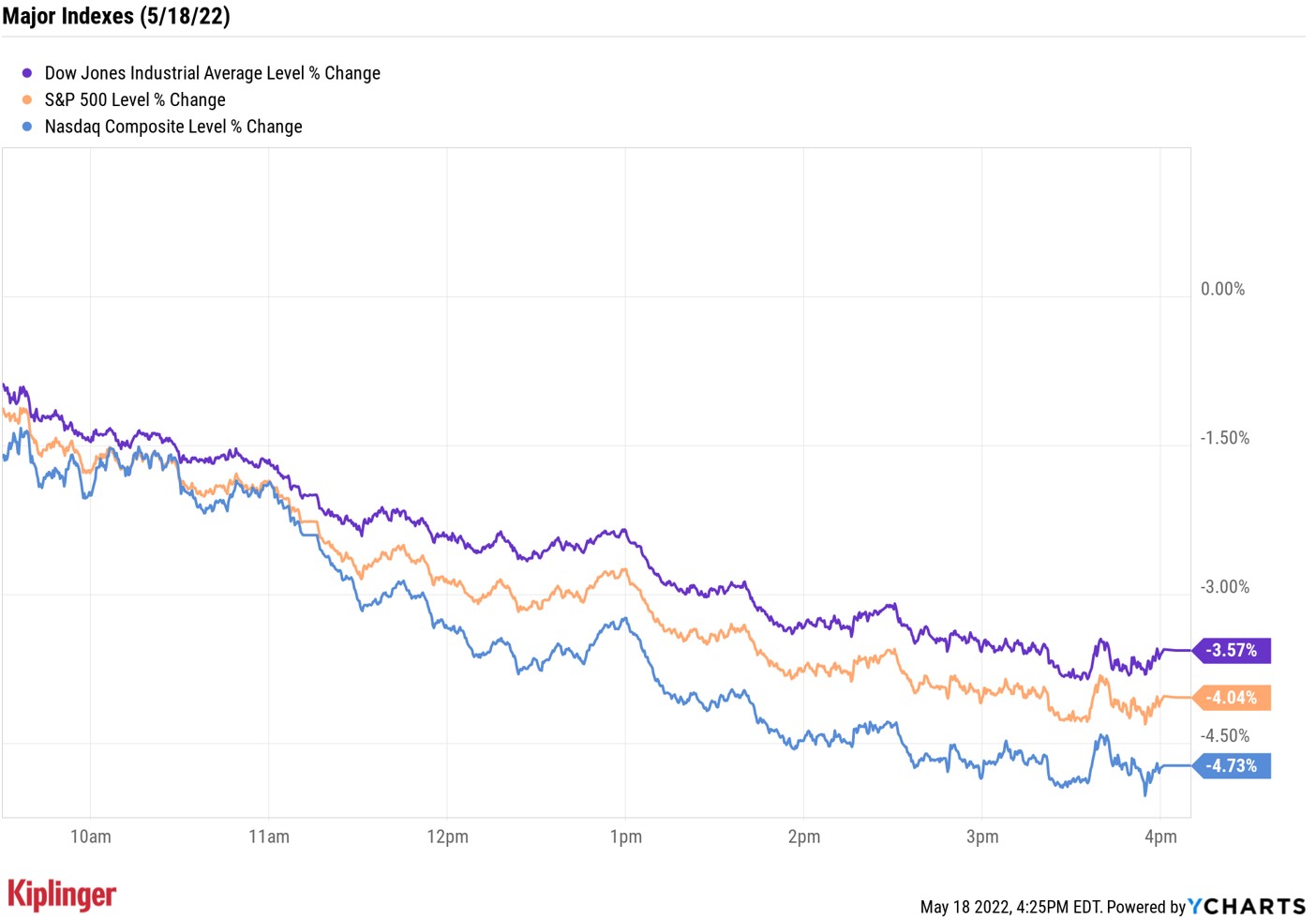

Stock Market Today: Dow Sinks 1,164 Points in Worst Day Since June 2020

The S&P 500 and Nasdaq each lost over 4% in a broad-market selloff.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

Retail earnings week took a big turn for the worse Wednesday.

A day after Walmart (WMT, -6.8%) sounded the alarm with a mixed quarterly report that suggested inflation was taking a toll on American consumers, Target (TGT, -24.9%) confirmed those concerns with an equally problematic set of results. That in turn sparked a deep blood-letting across most consumer stocks and sent the Dow to its worst single-day decline since June 2020.

As we detailed in today's free A Step Ahead newsletter, Target topped Wall Street's expectations for quarterly revenues, but it missed profit estimates by a country mile and issued a disappointing full-year operating profit. While consumer spending remained strong, it shifted from more discretionary purchases to staples such as groceries, plus spending on items such as luggage hinted that consumers are preparing to shift their dollars toward experiences rather than goods. Meanwhile, TGT projected it could need to absorb roughly $1 billion in other inflation-related costs, such as higher fuel and diesel prices.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

"The Charlie Brown shirt market continues, with big moves up and down seemingly every day," says Ryan Detrick, chief market strategist for LPL Financial. "Worries over inflation and a hawkish Fed are nothing new, but now add in worries over profit margins and the impact of inflation on the consumer, and you have the recipe for a big down day."

A big down day indeed.

Consumer-oriented sectors took Target's news the worst. Consumer discretionaries (-6.6%) led the market lower, but typically defensive consumer staples (-6.4%) weren't much better, with other stores such as Dollar General (DG, -11.1%) and Costco (COST, -12.5%) swooning in sympathy with TGT.

As far as the broader indexes were concerned? The Dow Jones Industrial Average plunged 3.6% to 31,490 – its worst single-session loss since a 6.9% decline on June 11, 2020. The S&P 500 Index was even worse, off 4% to 3,923 as all 11 of its sectors closed in the red. And the Nasdaq Composite suffered a 4.7% drop to 11,418.

Other news in the stock market today:

- The small-cap Russell 2000 shed 3.6% to 1,774.

- U.S. crude oil futures sank 2.5% to settle at $109.59 per barrel.

- Gold futures edged nearly 0.2% lower to finish at $1,815.90 an ounce.

- Bitcoin fell 2.7% to $29,237.10. (Bitcoin trades 24 hours a day; prices reported here are as of 4 p.m.)

- TJX Companies (TJX) was a rare splash of green today, adding 7.1% after the TJ Maxx parent reported earnings. In its first quarter, TJX reported adjusted earnings of 68 cents per share, more than analysts were expecting. However, revenue of $11.4 billion fell short of Wall Street's estimate."TJX believes profitability will improve throughout 2023 which we also see as a reasonable assumption as inventory levels normalize across retailers and TJX returns to pre-pandemic margin levels," says CFRA Research analyst Zachary Warring (Strong Buy). "Marmaxxx, the company's largest division, boasted +3% gain in comp store sales while HomeGoods fell 7% in Q1. TJX continues to return capital to shareholders, repurchasing $600 million in shares in Q1 and $307 million in dividends."

The Best Stocks for a Bear Market

Today's selloff brought the dreaded "B" word back into focus. Although bear markets are very unpleasant for investors to watch unfold, they are a fact of life when it comes to market cycles.

"There have been 17 bear (or near-bear markets) since World War II," says Detrick. The average drop for the S&P 500 was nearly 30% and lasted nearly a full year, he adds. But history suggests those losses could accelerate should the U.S. economy enter a recession. Specifically, bear markets that coincided with recessions typically lasted 15 months and saw losses of 34% for the S&P 500.

The Nasdaq entered bear-market territory awhile back, but the S&P 500 has so far managed to avoid that fate. Bear markets are classified as a decline of 20% from the most recent high. Based on where the broad-market index finished Wednesday, it's off just 18.2% from its Jan. 3 peak.

Although it can be scary for investors to put their money into the market at a time like this, there are stocks that tend to fare better than others in this type of environment. The best stocks for bear markets tend to be those that have a defensive business, a long history of dividend growth and relatively low volatility. Here, we've gathered 10 stocks that fit those criteria and get consensus Buy recommendations from industry analysts to boot. Check them out.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Kyle Woodley is the Editor-in-Chief of WealthUp, a site dedicated to improving the personal finances and financial literacy of people of all ages. He also writes the weekly The Weekend Tea newsletter, which covers both news and analysis about spending, saving, investing, the economy and more.

Kyle was previously the Senior Investing Editor for Kiplinger.com, and the Managing Editor for InvestorPlace.com before that. His work has appeared in several outlets, including Yahoo! Finance, MSN Money, Barchart, The Globe & Mail and the Nasdaq. He also has appeared as a guest on Fox Business Network and Money Radio, among other shows and podcasts, and he has been quoted in several outlets, including MarketWatch, Vice and Univision. He is a proud graduate of The Ohio State University, where he earned a BA in journalism.

You can check out his thoughts on the markets (and more) at @KyleWoodley.

-

Nasdaq Leads a Rocky Risk-On Rally: Stock Market Today

Nasdaq Leads a Rocky Risk-On Rally: Stock Market TodayAnother worrying bout of late-session weakness couldn't take down the main equity indexes on Wednesday.

-

Quiz: Do You Know How to Avoid the "Medigap Trap?"

Quiz: Do You Know How to Avoid the "Medigap Trap?"Quiz Test your basic knowledge of the "Medigap Trap" in our quick quiz.

-

5 Top Tax-Efficient Mutual Funds for Smarter Investing

5 Top Tax-Efficient Mutual Funds for Smarter InvestingMutual funds are many things, but "tax-friendly" usually isn't one of them. These are the exceptions.

-

Nasdaq Leads a Rocky Risk-On Rally: Stock Market Today

Nasdaq Leads a Rocky Risk-On Rally: Stock Market TodayAnother worrying bout of late-session weakness couldn't take down the main equity indexes on Wednesday.

-

Stocks Make More Big Up and Down Moves: Stock Market Today

Stocks Make More Big Up and Down Moves: Stock Market TodayThe impact of revolutionary technology has replaced world-changing trade policy as the major variable for markets, with mixed results for sectors and stocks.

-

Small Caps Step Up, Tech Is Still a Drag: Stock Market Today

Small Caps Step Up, Tech Is Still a Drag: Stock Market TodayEarly strength gave way to AI skepticism again as a volatile trading week ended on another mixed note.

-

AI Unwind Takes 2% Off the Nasdaq: Stock Market Today

AI Unwind Takes 2% Off the Nasdaq: Stock Market TodayMarkets are paying more and more attention to hyperscalers' plans to spend more and more money on artificial intelligence.

-

Strong Jobs Report Leaves Markets Flat: Stock Market Today

Strong Jobs Report Leaves Markets Flat: Stock Market TodayInvestors, traders and speculators are taking time to weigh the latest labor market data against their hopes for lower interest rates.

-

I'm a 55-Year-Old Dad. Here’s How My 28-Year-Old Daughter Showed Me That AXP Is Still a Solid Investment

I'm a 55-Year-Old Dad. Here’s How My 28-Year-Old Daughter Showed Me That AXP Is Still a Solid InvestmentAmerican Express stock is still a solid investment because management understands the value of its brand and is building a wide moat around it.

-

Dow Hits New High Ahead of January Jobs Report: Stock Market Today

Dow Hits New High Ahead of January Jobs Report: Stock Market TodayA weak reading on December retail sales was in focus ahead of Wednesday's delayed labor market data.

-

Tech Stocks Fuel Strong Start to the Week: Stock Market Today

Tech Stocks Fuel Strong Start to the Week: Stock Market TodayThe blue-chip Dow Jones Industrial Average extended its run above 50,000 on Monday and there are plenty of catalysts to keep the 30-stock index climbing.