Stock Market Today: S&P Inches Toward Bear Market

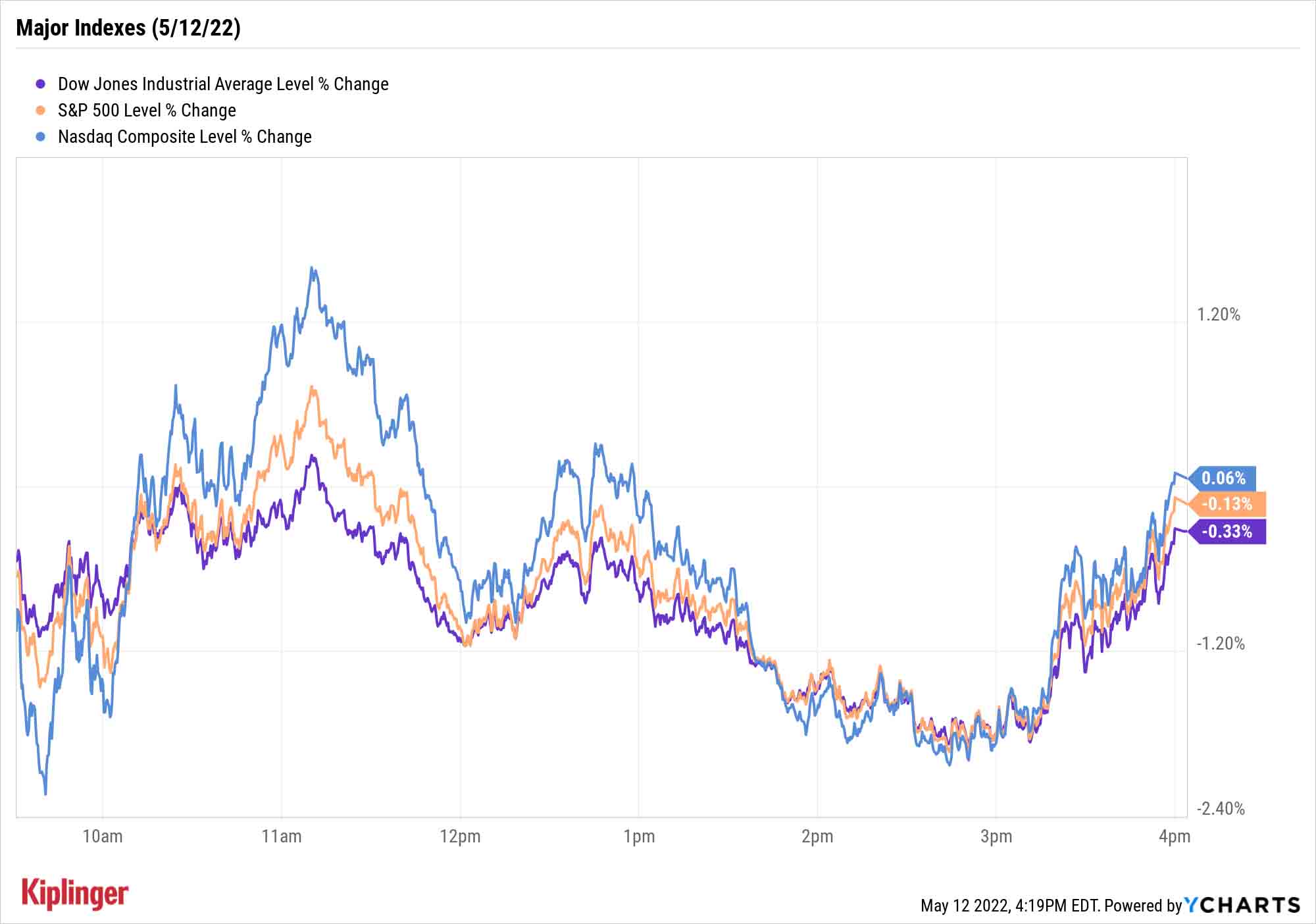

Another red-hot producer price index reading sent stocks on a choppy ride to modest losses Thursday.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

A day after Wall Street was told consumer prices continued to rise at an uncomfortably rapid rate in April, it learned the same about producer prices. The result was another choppy session that saw many stocks finish in the red.

The Bureau of Labor Statistics said Thursday that the producer price index (PPI) roared ahead by another 11% year-over-year last month – only a hair slower than March's record 11.5% print, and a touch higher than expectations.

"Given the clear inflation problem and the Fed's unwavering commitment to fighting it, the market may see more downside before it sees durable relief," says Liz Young, head of investment strategy at SoFi. "Despite the major drawdowns we've already seen in tech stocks and the Nasdaq broadly, we are still only two hikes into the tightening cycle and likely need to get through at least two more before we can confirm whether or not it's 'working.'"

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

Some experts emphasize additional sources of downward pressures on equities right now.

"Weakness/volatility in the crypto complex has increasingly been weighing on sentiment, and that was paramount again ahead of the open," says Michael Reinking, senior market strategist at the New York Stock Exchange. Bitcoin closed down another 3.1% to $28,572, bringing its year-to-date losses to 38%. (Bitcoin trades 24 hours a day; prices reported here are as of 4 p.m.)

In fact, the total market cap of all global cryptocurrencies has collapsed to roughly $1.2 trillion currently from about $3.0 trillion during its November 2021 peak.

The S&P 500 finished Thursday's roller-coaster session down 0.1% to 3,930; the benchmark index would need to decline by 2.4% to fall into bear-market territory. The Dow Jones Industrial Average also headed lower, by 0.3% to 31,730, while the Nasdaq Composite scratched out a marginal gain to 11,370.

Just about everything is starting to get swept up into this market downturn. For instance, Apple (AAPL, -2.7%), which had been relatively strong compared to many of its technology peers, finally buckled and joined its sectormates in bear-market territory today.

From a historical perspective, however, there's at least a little reason for hope.

"Currently, the S&P 500 is down 18% from the Jan. 2 peak and it has been 128 days," Ryan Detrick, chief market strategist for LPL Financial, said intraday Thursday. "Looking at all the corrections since 1980 shows the average one ends at about 88 days, so this correction is getting long in the tooth and could be nearing its conclusion. Additionally, the good news is, a year off the correction lows, stocks have been higher 22 out of 24 times with an average gain of 23.0%."

Other news in the stock market today:

- The small-cap Russell 2000 managed to advance 0.9% to 1,732.

- U.S. crude futures gained 0.4% to settle at $106.13 per barrel.

- Gold futures slid 1.6% to finish at $1,824.60 an ounce.

- Meme stocks were back in focus today, with GameStop (GME) spiking 10.1% and AMC Entertainment (AMC) gaining 8.0% on no apparent news. Still, shares of GME and AMC have had a terrible overall run so far in 2022, down about 40% and 60%, respectively, for the year-to-date.

- Tapestry (TPR) shot up 15.5% after the Kate Spade parent reported fiscal third-quarter earnings and revenue above Wall Street's estimates (51 cents per share on $1.44 billion actual vs. 41 cents per share on $1.42 billion est.) and said COVID-related lockdowns in China – which have weighed on demand for its products – will likely be lifted next month. Additionally, "TPR continues to repurchase shares aggressively and now plans to repurchase $1.6 billion worth of shares in fiscal 2022 and approved a new $1.5 billion share repurchase program, which represents over 20% of the company's market cap," says CFRA Research analyst Zachary Warring, who also said Tapestry is a top pick among luxury stocks.

- Bumble (BMBL) soared 26.8% after the online dating app said paying users jumped 7.2% in its first quarter. BMBL also reported revenue of $211.2 million, up 23.7% year-over-year and above than the $208.3 million Wall Street was expecting. "Product innovation and international expansion for Bumble will be the main company-specific drivers of 2022, and we continue to like the broader online dating space as COVID eases and singles look to connect in person again more," says BMO Research analyst Daniel Salmon, who has an Outperform (Buy) rating on BMBL.

Keep Punching Away in Your 401(k)

Even with the S&P 500 knocking on the door of a bear market, several experts are advising investors to simply hold their ground.

"This is not the time to get scared out of stocks," says Nancy Tengler, CEO and CIO of asset management firm Laffer Tengler Investments. "Investors need to be thinking about the fact that their 401(k) is the perfect dollar-cost average model because you are putting your money to work every two weeks."

Indeed, anyone participating in a 401(k) program is already investing at regular intervals. The key is to make the most of it. And Vanguard funds are among the better ways you can do that. While many investors know Vanguard as a low-cost index provider, those who prefer having a human at the helm should know that Vanguard has many tried-and-true actively managed products as well.

And chances are, if you have a 401(k), you have Vanguard funds at your disposal. Between actively managed, index and target-date retirement products, Vanguard accounts for roughly a third of the 100 most popular funds found in 401(k) plans.

Read on as we look at all of Vanguard's actively managed solutions among the most popular 401(k) offerings, including identifying which ones are worth buying, as well as which ones to avoid.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Kyle Woodley is the Editor-in-Chief of WealthUp, a site dedicated to improving the personal finances and financial literacy of people of all ages. He also writes the weekly The Weekend Tea newsletter, which covers both news and analysis about spending, saving, investing, the economy and more.

Kyle was previously the Senior Investing Editor for Kiplinger.com, and the Managing Editor for InvestorPlace.com before that. His work has appeared in several outlets, including Yahoo! Finance, MSN Money, Barchart, The Globe & Mail and the Nasdaq. He also has appeared as a guest on Fox Business Network and Money Radio, among other shows and podcasts, and he has been quoted in several outlets, including MarketWatch, Vice and Univision. He is a proud graduate of The Ohio State University, where he earned a BA in journalism.

You can check out his thoughts on the markets (and more) at @KyleWoodley.

-

Nasdaq Leads a Rocky Risk-On Rally: Stock Market Today

Nasdaq Leads a Rocky Risk-On Rally: Stock Market TodayAnother worrying bout of late-session weakness couldn't take down the main equity indexes on Wednesday.

-

Quiz: Do You Know How to Avoid the "Medigap Trap?"

Quiz: Do You Know How to Avoid the "Medigap Trap?"Quiz Test your basic knowledge of the "Medigap Trap" in our quick quiz.

-

5 Top Tax-Efficient Mutual Funds for Smarter Investing

5 Top Tax-Efficient Mutual Funds for Smarter InvestingMutual funds are many things, but "tax-friendly" usually isn't one of them. These are the exceptions.

-

Nasdaq Leads a Rocky Risk-On Rally: Stock Market Today

Nasdaq Leads a Rocky Risk-On Rally: Stock Market TodayAnother worrying bout of late-session weakness couldn't take down the main equity indexes on Wednesday.

-

Stocks Make More Big Up and Down Moves: Stock Market Today

Stocks Make More Big Up and Down Moves: Stock Market TodayThe impact of revolutionary technology has replaced world-changing trade policy as the major variable for markets, with mixed results for sectors and stocks.

-

Small Caps Step Up, Tech Is Still a Drag: Stock Market Today

Small Caps Step Up, Tech Is Still a Drag: Stock Market TodayEarly strength gave way to AI skepticism again as a volatile trading week ended on another mixed note.

-

AI Unwind Takes 2% Off the Nasdaq: Stock Market Today

AI Unwind Takes 2% Off the Nasdaq: Stock Market TodayMarkets are paying more and more attention to hyperscalers' plans to spend more and more money on artificial intelligence.

-

Strong Jobs Report Leaves Markets Flat: Stock Market Today

Strong Jobs Report Leaves Markets Flat: Stock Market TodayInvestors, traders and speculators are taking time to weigh the latest labor market data against their hopes for lower interest rates.

-

I'm a 55-Year-Old Dad. Here’s How My 28-Year-Old Daughter Showed Me That AXP Is Still a Solid Investment

I'm a 55-Year-Old Dad. Here’s How My 28-Year-Old Daughter Showed Me That AXP Is Still a Solid InvestmentAmerican Express stock is still a solid investment because management understands the value of its brand and is building a wide moat around it.

-

Dow Hits New High Ahead of January Jobs Report: Stock Market Today

Dow Hits New High Ahead of January Jobs Report: Stock Market TodayA weak reading on December retail sales was in focus ahead of Wednesday's delayed labor market data.

-

Tech Stocks Fuel Strong Start to the Week: Stock Market Today

Tech Stocks Fuel Strong Start to the Week: Stock Market TodayThe blue-chip Dow Jones Industrial Average extended its run above 50,000 on Monday and there are plenty of catalysts to keep the 30-stock index climbing.