Stock Market Today: Stocks Jolted Awake as Oil Enters Bear Market

Oil slumps below $100 per barrel and into bear territory, providing the equity market with some much-needed relief.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Another precipitous decline in oil prices, as well as hints of an easing in other inflationary pressures, managed to snap losing streaks across the major indexes Tuesday.

U.S. crude oil futures continued their recent dive, shedding 6.4% to $96.44 per barrel – enough to put the commodity into bear-market territory from its March 8 highs. Oil was dragged down by ongoing peace talks between Ukraine and Russia, as well as a surge in China's COVID-19 caseload, which could spark additional shutdowns that could reduce demand.

Also Tuesday, the Bureau of Labor Statistics reported that February's U.S. producer prices increased 0.8% month-over-month (10% year-over-year), coming in slightly less hot than expectations for 0.9% growth.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

"Prices excluding food, energy and trade rose only modestly, suggesting some easing in core inflation," says Barclays economist Pooja Sriram. However, she warns the relief might be short-lived.

"We expect to see increased momentum in food prices going ahead, due to the disruption in food supply caused by the Ukraine-Russia conflict. Energy prices are also likely to contribute solidly to both producer and consumer price pressures in the near term given the swings in oil prices."

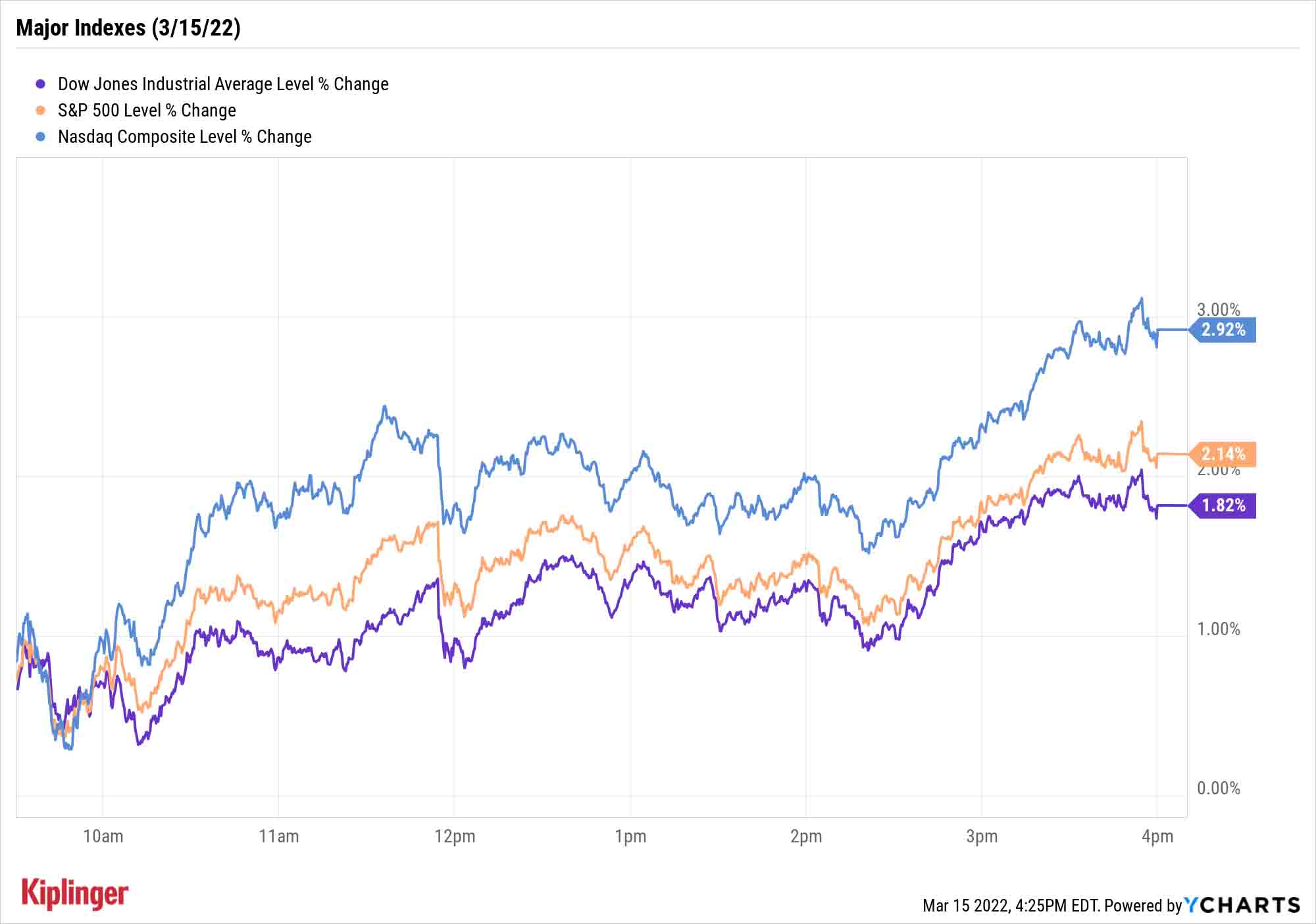

After a dismal Monday session, tech stocks (+3.4%) and consumer discretionary companies (+3.4%) were out in front of Tuesday's rally. The Nasdaq soared 2.9% higher to 12,948, followed by the S&P 500 (+2.1% to 4,262) and Dow (+1.8% to 33,544).

Other news in the stock market today:

- The small-cap Russell 2000 rallied 1.4% to 1,968.

- Gold futures retreated 1.6% to end at $1,929.70 an ounce.

- Bitcoin advanced 2.4% to $39,767.28. (Bitcoin trades 24 hours a day; prices reported here are as of 4 p.m.)

- AMC Entertainment (AMC) shot up 6.8% today after the movie chain said it agreed to buy a $27.9-million stake in Denver-based gold miner Hycroft Mining Holding (HYMC). This works out to roughy 23.4 million HYMC shares and will give AMC an approximately 22% stake in the company. The news sparked major volatility in HYMC stock, which ended the day up 9.4% after nearly doubling at one point, AMC Entertainment CEO Adam Aron was scheduled to discuss the purchase on CNBC, but cancelled due to the wild volume in Hycroft shares today. "To state the obvious, one would not normally think that a movie theatre company’s core competency includes gold or silver mining," Aron said in AMC's press release. "In recent years, however, AMC Entertainment has had enormous success and demonstrated expertise in guiding a company with otherwise valuable assets through a time of severe liquidity challenge, the raising of capital, and strengthening of balance sheets, as well as communicating with individual retail investors. It is all that experience and skill that we bring to the table to assist the talented mining professionals at Hycroft."

- Airline stocks caught a bid today after several of the major carriers said bookings came in ahead of expectations, signaling increased travel demand. Delta Air Lines (DAL) jumped 8.7% after saying bookings are outpacing its 2019 numbers, while United Airlines (UAL, +9.2%) and American Airlines (AAL, +9.3%) also ended the day higher.

A Case for Small Caps

Many corners of the market are going to hinge sharply on how Russia's invasion of Ukraine plays out. But one area that might be set up for success either way is small-cap stocks.

Small caps have been severely beaten up since November, and the Russell 2000 Index of small companies has been in bear-market territory for more than a month. But BofA sees several reasons to be rosier on these stocks.

For one, they're a relative bargain compared to large caps, even after perking up from historical discounts a month ago. And Jill Carey Hall, head of U.S. Small/Mid Cap Strategy for BofA Securities, says that "while geopolitical conflict is typically a short-term negative for equities … we would continue to prefer domestically-oriented U.S. small caps over large caps in the current backdrop.

"History suggests that small caps outperformed on a cumulative basis over the full Cold War period, and saw particularly strong outperformance during the 1970s/early 80s," she adds.

Investors looking to dive right in might consider these 12 top small-cap stocks for 2022. But if the risk of investing in small individual companies seems a little high, you can always spread it over hundreds or even thousands of companies via small-cap exchange-traded funds (ETFs). These 10 small-cap ETFs in particular provide a wealth of ways to leverage companies that sport little market capitalizations, but mighty growth potential.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Kyle Woodley is the Editor-in-Chief of WealthUp, a site dedicated to improving the personal finances and financial literacy of people of all ages. He also writes the weekly The Weekend Tea newsletter, which covers both news and analysis about spending, saving, investing, the economy and more.

Kyle was previously the Senior Investing Editor for Kiplinger.com, and the Managing Editor for InvestorPlace.com before that. His work has appeared in several outlets, including Yahoo! Finance, MSN Money, Barchart, The Globe & Mail and the Nasdaq. He also has appeared as a guest on Fox Business Network and Money Radio, among other shows and podcasts, and he has been quoted in several outlets, including MarketWatch, Vice and Univision. He is a proud graduate of The Ohio State University, where he earned a BA in journalism.

You can check out his thoughts on the markets (and more) at @KyleWoodley.

-

Timeless Trips for Solo Travelers

Timeless Trips for Solo TravelersHow to find a getaway that suits your style.

-

A Top Vanguard ETF Pick Outperforms on International Strength

A Top Vanguard ETF Pick Outperforms on International StrengthA weakening dollar and lower interest rates lifted international stocks, which was good news for one of our favorite exchange-traded funds.

-

Is There Such a Thing As a Safe Stock? 17 Safe-Enough Ideas

Is There Such a Thing As a Safe Stock? 17 Safe-Enough IdeasNo stock is completely safe, but we can make educated guesses about which ones are likely to provide smooth sailing.

-

If You'd Put $1,000 Into Caterpillar Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into Caterpillar Stock 20 Years Ago, Here's What You'd Have TodayCaterpillar stock has been a remarkably resilient market beater for a very long time.

-

Dow Dives 521 Points as Goldman, AmEx Slide: Stock Market Today

Dow Dives 521 Points as Goldman, AmEx Slide: Stock Market TodayNews of Block's massive layoffs exacerbated AI worries across the financial sector.

-

Big Nvidia Numbers Take Down the Nasdaq: Stock Market Today

Big Nvidia Numbers Take Down the Nasdaq: Stock Market TodayMarkets are struggling to make sense of what the AI revolution means across sectors and industries, and up and down the market-cap scale.

-

Nasdaq Soars Ahead of Nvidia Earnings: Stock Market Today

Nasdaq Soars Ahead of Nvidia Earnings: Stock Market TodayWednesday's risk-on session was sparked by strong gains in tech stocks and several crypto-related names.

-

Dow Absorbs Disruptions, Adds 370 Points: Stock Market Today

Dow Absorbs Disruptions, Adds 370 Points: Stock Market TodayInvestors, traders and speculators will hear from President Donald Trump tonight, and then they'll listen to Nvidia CEO Jensen Huang tomorrow.

-

Dow Loses 821 Points to Open Nvidia Week: Stock Market Today

Dow Loses 821 Points to Open Nvidia Week: Stock Market TodayU.S. stock market indexes reflect global uncertainty about artificial intelligence and Trump administration trade policy.

-

Stocks Shrug Off Tariff Ruling, Weak GDP: Stock Market Today

Stocks Shrug Off Tariff Ruling, Weak GDP: Stock Market TodayMarket participants had plenty of news to sift through on Friday, including updates on inflation and economic growth and a key court ruling.

-

Stocks Drop as Iran Worries Ramp Up: Stock Market Today

Stocks Drop as Iran Worries Ramp Up: Stock Market TodayPresident Trump said he will decide within the next 10 days whether or not the U.S. will launch military strikes against Iran.