Stock Market Today: Tech Stocks Lead Relief Rally

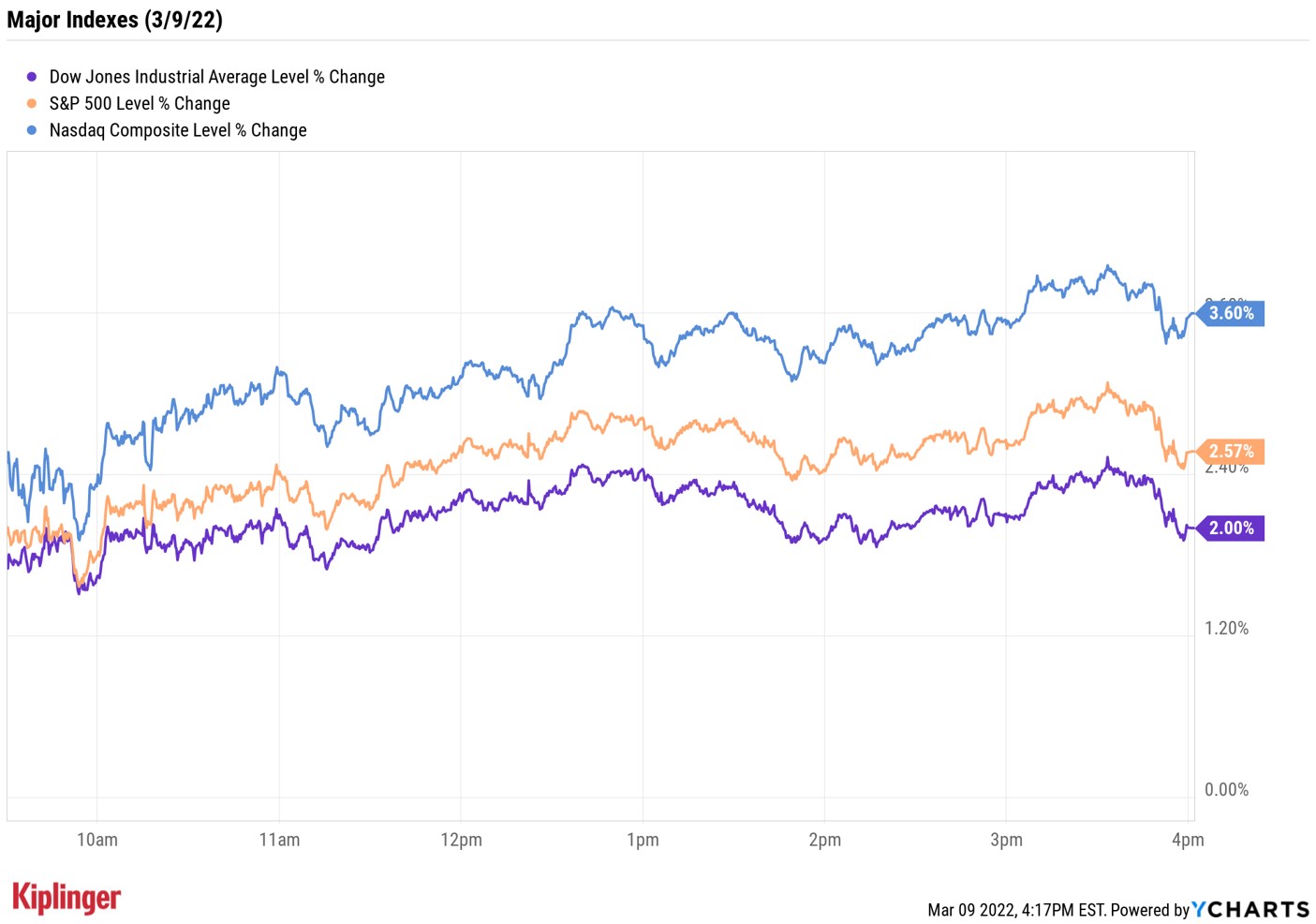

The Nasdaq had its best day since November 2020, while the S&P 500 posted its biggest one-day advance in almost two years.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

The markets staged a robust relief rally that saw all but two sectors – energy (-3.1%) and utilities (-0.7%) – finish in the green.

Boosting investor sentiment were headlines indicating that foreign ministers from Ukraine and Russia will meet in Turkey on Thursday – the first cabinet-level talks to be held between the two countries since the conflict began.

This follows reports Ukraine President Volodymyr Zelensky on Monday said he is open to a dialogue with Moscow.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

"Within equity markets, all the areas of the market that have been hit the hardest recently are snapping back sharply," says Michael Reinking, senior market strategist for the New York Stock Exchange. This included financials, which rose 3.7% after "a few more European banks overnight provided updates on Russian exposure which were not as bad as some had feared," as Reinking explained.

However, it was technology (+4.0%) that led the charge, with chip stocks Nvidia (NVDA, +7.0%) and Advanced Micro Devices (AMD, +5.2%) among the biggest gainers.

At the close, all three major benchmarks had snapped their four-day losing streak, with the Nasdaq Composite up 3.6% at 13,255, the S&P 500 Index 2.6% higher at 4,277 and the Dow Jones Industrial Average up 2% to 33,286.

It was the Nasdaq's best day since November 2020 and was enough to pull the tech-heavy index out of a bear market. The S&P 500, meanwhile, had its biggest one-day gain since June 2020, while the Dow's advance moved it out of correction of correction territory.

Other news in the stock market today:

- The small-cap Russell 2000 popped 2.7% to 2,016.

- U.S. crude futures retreated sharply from Tuesday's 13-year high, sinking 12.1% to settle at $108.70 per barrel.

- Gold futures slid 2.7% to end at $1,988.20 an ounce, snapping a four-day winning streak.

- Bumble (BMBL) shot up 41.9% after BMO Research analyst Daniel Salmon upgraded the dating app shares to Outperform. "Catalysts should be driven by the Bumble app and include international expansion milestones and new bundle launches, while new advertising/sponsorship opportunities will be tested over the near term (likely on BFF first) supporting multiple re-expansion," the analyst says. Raymond James analyst Andrew Marok (Outperform) also chimed in on BMBL, saying last night's earnings report came in "better-than-feared." Marok added that while Bumble's decision to pull operations out of Russia will create roughly $20 million in headwinds in fiscal 2022, its full-year guidance is still "ahead of expectations."

- Declining oil prices lit a fire under travel stocks. Carnival (CCL, +8.8%), Royal Caribbean (RCL, +5.5%), American Airlines (AAL, +5.9%) and United Airlines (UAL, +8.3%) were some of the day's biggest winners.

A Big Boom in Bitcoin Prices

Another big winner on Wall Street today: Bitcoin. The cryptocurrency jumped 11.3% to $41,807 (Bitcoin trades 24 hours a day; prices reported here are as of 4 p.m.) after President Biden signed an executive order aimed at regulating digital-asset transactions.

The administration outlined several objectives as part of an effort to assess digital assets at the federal level, which include financial inclusion and responsible innovation. The goal of the order is to help the U.S. "maintain technological leadership in this rapidly growing space," while "mitigating the risks for consumers, businesses, the broader financial system and the climate."

This regulation could continue to give cryptocurrencies a boost, says Anthony Denier, CEO of trading platform Webull. Digital assets have "definitely been at reputational risk for buying an asset class that is so volatile and derided. Oversight gives them a firmer ground to stand on."

There are plenty of ways for investors to gain exposure to the top cryptocurrencies too. In addition to stocks that are connected to crypto in some way, Wall Street is now flush with Bitcoin ETFs and other cryptocurrency funds. Read on as we highlight 17 funds focused on riding the crypto wave.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

With over a decade of experience writing about the stock market, Karee Venema is the senior investing editor at Kiplinger.com. She joined the publication in April 2021 after 10 years of working as an investing writer and columnist at a local investment research firm. In her previous role, Karee focused primarily on options trading, as well as technical, fundamental and sentiment analysis.

-

Dow Adds 1,206 Points to Top 50,000: Stock Market Today

Dow Adds 1,206 Points to Top 50,000: Stock Market TodayThe S&P 500 and Nasdaq also had strong finishes to a volatile week, with beaten-down tech stocks outperforming.

-

Ask the Tax Editor: Federal Income Tax Deductions

Ask the Tax Editor: Federal Income Tax DeductionsAsk the Editor In this week's Ask the Editor Q&A, Joy Taylor answers questions on federal income tax deductions

-

States With No-Fault Car Insurance Laws (and How No-Fault Car Insurance Works)

States With No-Fault Car Insurance Laws (and How No-Fault Car Insurance Works)A breakdown of the confusing rules around no-fault car insurance in every state where it exists.

-

Dow Adds 1,206 Points to Top 50,000: Stock Market Today

Dow Adds 1,206 Points to Top 50,000: Stock Market TodayThe S&P 500 and Nasdaq also had strong finishes to a volatile week, with beaten-down tech stocks outperforming.

-

Stocks Sink With Alphabet, Bitcoin: Stock Market Today

Stocks Sink With Alphabet, Bitcoin: Stock Market TodayA dismal round of jobs data did little to lift sentiment on Thursday.

-

Dow Leads in Mixed Session on Amgen Earnings: Stock Market Today

Dow Leads in Mixed Session on Amgen Earnings: Stock Market TodayThe rest of Wall Street struggled as Advanced Micro Devices earnings caused a chip-stock sell-off.

-

Nasdaq Slides 1.4% on Big Tech Questions: Stock Market Today

Nasdaq Slides 1.4% on Big Tech Questions: Stock Market TodayPalantir Technologies proves at least one publicly traded company can spend a lot of money on AI and make a lot of money on AI.

-

Fed Vibes Lift Stocks, Dow Up 515 Points: Stock Market Today

Fed Vibes Lift Stocks, Dow Up 515 Points: Stock Market TodayIncoming economic data, including the January jobs report, has been delayed again by another federal government shutdown.

-

Stocks Close Down as Gold, Silver Spiral: Stock Market Today

Stocks Close Down as Gold, Silver Spiral: Stock Market TodayA "long-overdue correction" temporarily halted a massive rally in gold and silver, while the Dow took a hit from negative reactions to blue-chip earnings.

-

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have TodayAdvanced Micro Devices stock is soaring thanks to AI, but as a buy-and-hold bet, it's been a market laggard.

-

Nasdaq Drops 172 Points on MSFT AI Spend: Stock Market Today

Nasdaq Drops 172 Points on MSFT AI Spend: Stock Market TodayMicrosoft, Meta Platforms and a mid-cap energy stock have a lot to say about the state of the AI revolution today.