Stock Market Today: Stocks Suffer Whiplash After Russian Energy Ban

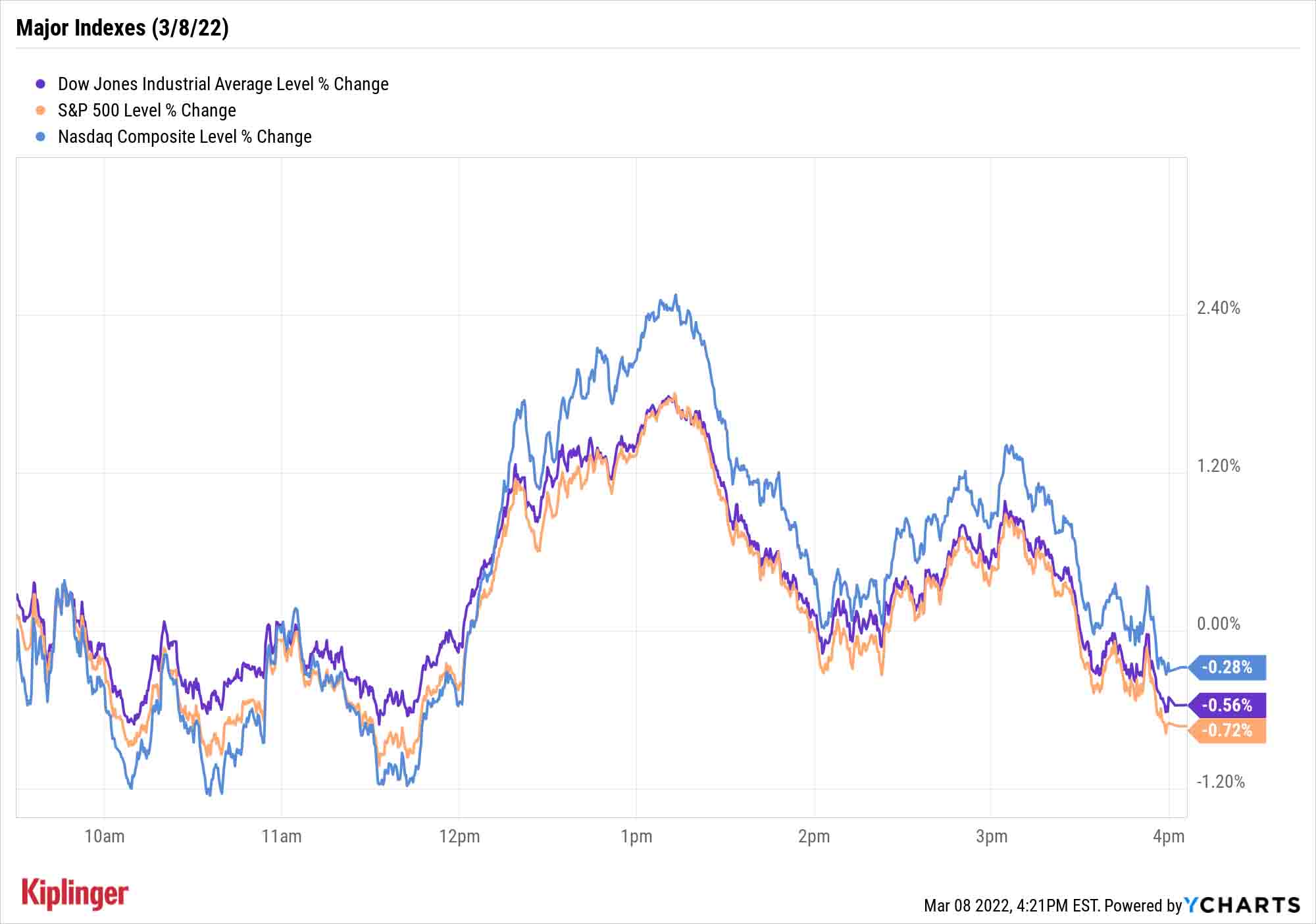

The market went round-trip on Tuesday, bouncing from modest losses to significant gains before slipping back into the red.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Mr. Market's roller-coaster ride continued apace Tuesday, as indications that the U.S. would ban the import of Russian energy became real.

After days of speculation about whether America would take this next step, President Joe Biden announced the U.S. would cease imports of Russian crude oil, natural gas and coal.

"The decision today is not without cost here at home," Biden said. "Putin's war is already hurting American families at the gas pump. Since Putin began his military build-up at Ukrainian borders … the price of gas at the pump in America went up 75 cents. And with this action, it's going to go up further."

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

U.S. crude oil prices unsurprisingly continued their recent climb, settling up 3.6% to $123.70 per barrel – a closing level not seen since August 2008, but also well off intraday highs above $129.

"The crude supply outlook will struggle to make up for Russian supplies over the next few months, so whatever pricing dips occur could be short-lived," says Edward Moya, senior market strategist at currency data provider OANDA.

The prospect of sustained high crude prices helped the energy sector (+1.6%) score another win, with the likes of Valero Energy (VLO, +7.8%) and Schlumberger (SLB, +7.1%) leading the pack. A few battered areas of the market, including travel, also rebounded – Booking Holdings (BKNG, +4.5%), United Airlines (UAL, +3.3%) and Carnival (CCL, +2.3%) all finished well in the green.

The major indexes were all over the place throughout the day, swinging from modest losses early to robust gains, then pulling back into the red by the closing bell. The Dow Jones Industrial Average was off 0.6% to 32,632, the S&P 500 declined 0.7% to 4,170 and the Nasdaq Composite slipped 0.3% further into bear-market territory to 12,795.

Other news in the stock market today:

- The small-cap Russell 2000 bucked the trend, finishing up 0.6% to 1,963.

- Gold futures rose 2.4% to settle at $2,043.30 an ounce.

- Bitcoin recovered after a difficult Monday, gaining 2.5% to $38,515.23. (Bitcoin trades 24 hours a day; prices reported here are as of 4 p.m.)

- Dick's Sporting Goods (DKS, +2.1%) reported adjusted earnings of $3.64 per share in its fourth quarter on $3.35 billion in revenue, more than the $3.43 per share and $3.31 billion analysts were expecting. Same-store sales also rose a higher-than-expected 5.9% for the three-month period. "Shares of DKS now trade well under 10.0x fiscal 2023 consensus estimates, which we see as significantly undervalued for a retailer with a strong omni-channel strategy and capital return program," says CFRA Research analyst Zachary Warring (Buy). "We continue to like DKS's exposure to Golf which is seeing unprecedented growth, brand partnerships, omnichannel execution and growing market share in the sporting goods market."

- Dish Network (DISH) jumped 5.1% after UBS Global Research analyst John Hodulik upgraded the communications services stock to Buy from Neutral (Hold). DISH has "an attractive risk/reward bounded by spectrum value on the downside and optionality of the next-gen, cloud-based, 5G wireless network on the upside," the analyst writes in a note. "Questions remain regarding DISH's wireless business model, but we believe DISH's network build protects the company's spectrum licenses, whose value serves as a backstop."

- Caterpillar (CAT) gained 6.8% on the back of an upgrade. Jefferies analyst Stephen Volkmann lifted his outlook on the construction equipment company to Buy from Hold, calling CAT a "long-term inflation hedge." Volmann notes that the "recent turmoil in Eastern Europe fundamentally reshapes global commodity markets, driving structurally higher pricing and after years of underinvestment capacity additions and supply diversification will be necessary in both mining and oil & gas sectors," though he concedes that "new projects will take time."

Beat Back Volatility With Cold, Hard Cash

One of the best pieces of advice for fading the market's current volatility hearkens to a basic tenet of the buy-and-hold crowd: Sit back and collect dividends.

"If you are looking for less volatility these days, shares of dividend paying companies can often offer some stability when the volatility index (VIX) spikes," says Lindsey Bell, chief markets and money strategist for Ally Invest. "Perhaps now more than ever, prioritizing profitability and steady operations might be a safe move for your portfolio. As inflation fears persist, owning shares in firms that generate strong cash flows today could help buffer your risk of higher consumer prices over the next year."

Any list of sturdy dividend stocks is going to begin with the Dividend Aristocrats – 66 companies that have raised their payouts annually, without interruption, for at least 25 years (but often much longer). But investors can go after dividends in myriad other ways.

Oil and gas master limited partnerships (MLPs), for instance, can help you enjoy energy-market gains while netting yields in the 8%-9% range.

Or, you can specifically target dividend stocks of different stripes that have gone on sale this year. These seven income plays are hanging from the bargain rack right now, and each of them provides a better yield (by varying amounts) than the S&P 500 average.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Kyle Woodley is the Editor-in-Chief of WealthUp, a site dedicated to improving the personal finances and financial literacy of people of all ages. He also writes the weekly The Weekend Tea newsletter, which covers both news and analysis about spending, saving, investing, the economy and more.

Kyle was previously the Senior Investing Editor for Kiplinger.com, and the Managing Editor for InvestorPlace.com before that. His work has appeared in several outlets, including Yahoo! Finance, MSN Money, Barchart, The Globe & Mail and the Nasdaq. He also has appeared as a guest on Fox Business Network and Money Radio, among other shows and podcasts, and he has been quoted in several outlets, including MarketWatch, Vice and Univision. He is a proud graduate of The Ohio State University, where he earned a BA in journalism.

You can check out his thoughts on the markets (and more) at @KyleWoodley.

-

Why Some Michigan Tax Refunds Are Taking Longer Than Usual This Year

Why Some Michigan Tax Refunds Are Taking Longer Than Usual This YearState Taxes If your Michigan tax refund hasn’t arrived, you’re not alone. Here’s what "pending manual review" means and how to verify your identity if needed.

-

If You'd Put $1,000 Into Caterpillar Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into Caterpillar Stock 20 Years Ago, Here's What You'd Have TodayCaterpillar stock has been a remarkably resilient market beater for a very long time.

-

Good Stock Picking Gives This Primecap Odyssey Fund a Lift

Good Stock Picking Gives This Primecap Odyssey Fund a LiftOutsize exposure to an outperforming tech stock and a pair of drugmakers have boosted recent returns for the Primecap Odyssey Growth Fund.

-

If You'd Put $1,000 Into Caterpillar Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into Caterpillar Stock 20 Years Ago, Here's What You'd Have TodayCaterpillar stock has been a remarkably resilient market beater for a very long time.

-

Dow Dives 521 Points as Goldman, AmEx Slide: Stock Market Today

Dow Dives 521 Points as Goldman, AmEx Slide: Stock Market TodayNews of Block's massive layoffs exacerbated AI worries across the financial sector.

-

Big Nvidia Numbers Take Down the Nasdaq: Stock Market Today

Big Nvidia Numbers Take Down the Nasdaq: Stock Market TodayMarkets are struggling to make sense of what the AI revolution means across sectors and industries, and up and down the market-cap scale.

-

Nasdaq Soars Ahead of Nvidia Earnings: Stock Market Today

Nasdaq Soars Ahead of Nvidia Earnings: Stock Market TodayWednesday's risk-on session was sparked by strong gains in tech stocks and several crypto-related names.

-

Dow Absorbs Disruptions, Adds 370 Points: Stock Market Today

Dow Absorbs Disruptions, Adds 370 Points: Stock Market TodayInvestors, traders and speculators will hear from President Donald Trump tonight, and then they'll listen to Nvidia CEO Jensen Huang tomorrow.

-

Dow Loses 821 Points to Open Nvidia Week: Stock Market Today

Dow Loses 821 Points to Open Nvidia Week: Stock Market TodayU.S. stock market indexes reflect global uncertainty about artificial intelligence and Trump administration trade policy.

-

Stocks Shrug Off Tariff Ruling, Weak GDP: Stock Market Today

Stocks Shrug Off Tariff Ruling, Weak GDP: Stock Market TodayMarket participants had plenty of news to sift through on Friday, including updates on inflation and economic growth and a key court ruling.

-

Stocks Drop as Iran Worries Ramp Up: Stock Market Today

Stocks Drop as Iran Worries Ramp Up: Stock Market TodayPresident Trump said he will decide within the next 10 days whether or not the U.S. will launch military strikes against Iran.