Stock Market Today: Stocks Sizzle on Russian Troop Withdrawal Reports

Oil prices, on the other hand, plummeted on news Moscow is pulling back some troops from the Ukrainian border.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Stocks soared at the open Tuesday after Russian President Vladimir Putin said Moscow had begun to withdraw some troops from the Ukrainian border – raising hopes that military conflict between the two countries might yet be avoided.

"Ukraine headlines continue to drive the day-to-day volatility," says Michael Reinking, senior market strategist for the New York Stock Exchange. "As there are reports of some Russian troop withdrawal, there is an unwind of much of the movement seen across financial markets over the last few days."

This included a big drop in energy stocks, which fell 1.1% as U.S. crude futures retreated from seven-year highs (declining 3.6% to end at $92.07 per barrel).

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

On the other hand, technology was the biggest gainer today – jumping 2.6% – on news that Intel (INTC, +1.8%) is buying Israeli chip manufacturer Tower Semiconductor (TSEM, +42.1%) for roughly $5.4 billion.

"While we have no incremental knowledge as to the validity of these reports, we would not be surprised to see INTC taking such a step to bolster its foundry aspirations," says Deutsche Bank analyst Ross Seymore (Hold). "We expect to learn more about the company's foundry strategy at its upcoming analyst meeting on Feb. 17, regardless of if Tower is part of those plans."

Also in focus today was the latest inflation update, with the Labor Department reporting the producer price index – which measures how much suppliers are charging businesses for goods – rose a seasonally adjusted 1% month-over-month in January. On an annualized basis, producer prices surged 9.7%.

"The big picture is that inflation has gained momentum and broadened in the economy," says Bill Adams, chief economist for Comerica Bank. "The Russia-Ukraine conflict was a factor behind January's increase in prices; energy prices rose amid fears that the conflict would slow Russian deliveries of natural gas and oil to global markets. But prices of other goods also rose rapidly in January, as did prices of services."

Smith adds that omicron likely played a role too, with the variant causing many Americans to be out of work because they were either sick or quarantining.

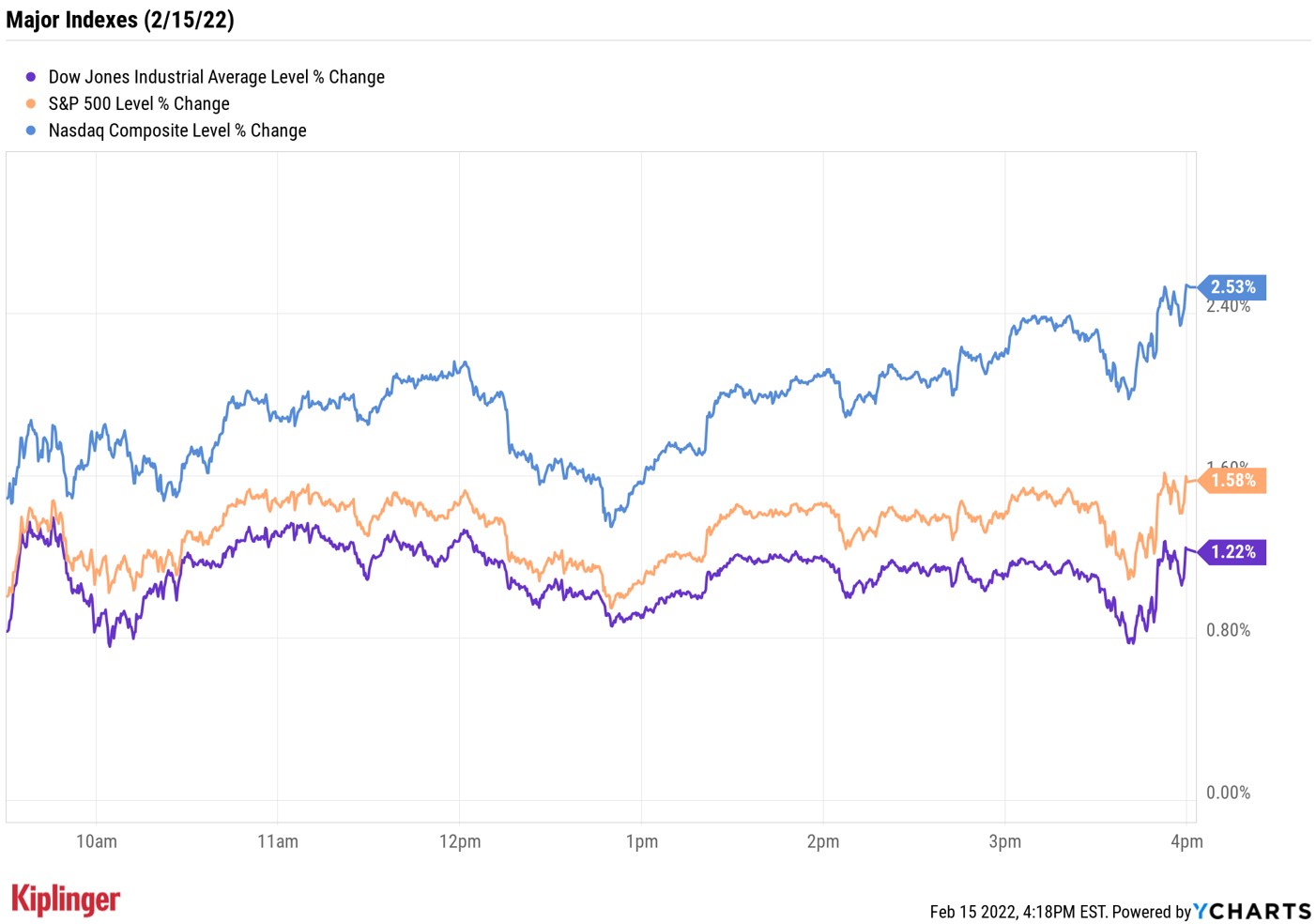

At the close, the Nasdaq Composite was up 2.5% at 14,139, the S&P 500 Index was 1.6% higher at 4,471 and the Dow Jones Industrial Average had added 1.2% to finish at 34,988.

Other news in the stock market today:

- The small-cap Russell 2000 surged 2.8% to 2,076.

- Gold futures shed 0.7% to settle at $1,856.20 an ounce, marking their first loss in eight days.

- Bitcoin caught a bid too, spiking 4.7% to $44,191.53. (Bitcoin trades 24 hours a day; prices reported here are as of 4 p.m.)

- The Intel news was a shot in the arm for the rest of the semiconductor industry, too. Nvidia (NVDA) was out in front, jumping 9.2% ahead of its fourth-quarter earnings report, which was due out after Wednesday's close. Also making significant advances were Advanced Micro Devices (AMD, +6.3%), Micron (MU, +6.8%) and Qualcomm (QCOM, +4.8%). The relief rally was no doubt welcomed with open arms by chip-stock investors; the S&P Semiconductors Select Industry Index was off by more than 18% year-to-date heading into today's session.

- Restaurant Brands International (QSR, +3.6%) – the Canadian parent company of Burger King, Popeyes and Tim Hortons – headed higher on the back of a strong fourth-quarter earnings report. Revenues of $1.55 billion and adjusted profits of 74 cents per share each topped analysts' estimates. A particular point of progress were global digital sales, which popped by 67% year-over-year across 2021, to $10 billion, accounting for 30% of overall revenues.

Buffett's Latest Buys and Sells

M&A news was likely on the mind of Buffettologists last night following the release of Berkshire Hathaway's (BRK.B) latest holdings list.

Warren Buffett, chairman and CEO of Berkshire, unveiled his latest transactions Monday evening via a 13F filing with the Securities and Exchange Commission. While the filing showed the famed investor ended 2021 much like he started it – with lots of selling – it also revealed he made some interesting additions to the Berkshire Hathaway equity portfolio in the fourth quarter as well.

Most notably was Buffett's new stake in Activision Blizzard (ATVI) in the final quarter of 2021. The well-timed purchase came just ahead of Microsoft's (MSFT) late-January $68.7 billion bid for the video game maker.

But that was far from the Oracle of Omaha's only change. All told, Uncle Warren initiated three new stakes, completely exited two positions and adjusted his exposure to eight other stocks. Read on to see Buffett's complete list of stock buys and sells from Q4 2021.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

With over a decade of experience writing about the stock market, Karee Venema is the senior investing editor at Kiplinger.com. She joined the publication in April 2021 after 10 years of working as an investing writer and columnist at a local investment research firm. In her previous role, Karee focused primarily on options trading, as well as technical, fundamental and sentiment analysis.

-

Timeless Trips for Solo Travelers

Timeless Trips for Solo TravelersHow to find a getaway that suits your style.

-

A Top Vanguard ETF Pick Outperforms on International Strength

A Top Vanguard ETF Pick Outperforms on International StrengthA weakening dollar and lower interest rates lifted international stocks, which was good news for one of our favorite exchange-traded funds.

-

Is There Such a Thing As a Safe Stock? 17 Safe-Enough Ideas

Is There Such a Thing As a Safe Stock? 17 Safe-Enough IdeasNo stock is completely safe, but we can make educated guesses about which ones are likely to provide smooth sailing.

-

If You'd Put $1,000 Into Caterpillar Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into Caterpillar Stock 20 Years Ago, Here's What You'd Have TodayCaterpillar stock has been a remarkably resilient market beater for a very long time.

-

Dow Dives 521 Points as Goldman, AmEx Slide: Stock Market Today

Dow Dives 521 Points as Goldman, AmEx Slide: Stock Market TodayNews of Block's massive layoffs exacerbated AI worries across the financial sector.

-

Big Nvidia Numbers Take Down the Nasdaq: Stock Market Today

Big Nvidia Numbers Take Down the Nasdaq: Stock Market TodayMarkets are struggling to make sense of what the AI revolution means across sectors and industries, and up and down the market-cap scale.

-

Nasdaq Soars Ahead of Nvidia Earnings: Stock Market Today

Nasdaq Soars Ahead of Nvidia Earnings: Stock Market TodayWednesday's risk-on session was sparked by strong gains in tech stocks and several crypto-related names.

-

Dow Absorbs Disruptions, Adds 370 Points: Stock Market Today

Dow Absorbs Disruptions, Adds 370 Points: Stock Market TodayInvestors, traders and speculators will hear from President Donald Trump tonight, and then they'll listen to Nvidia CEO Jensen Huang tomorrow.

-

Nvidia Earnings: Updates and Commentary February 2026

Nvidia Earnings: Updates and Commentary February 2026Nvidia reported earnings after the closing bell on February 25, and the AI bellwether's results came in higher than expected once again.

-

Stocks Make More Big Up and Down Moves: Stock Market Today

Stocks Make More Big Up and Down Moves: Stock Market TodayThe impact of revolutionary technology has replaced world-changing trade policy as the major variable for markets, with mixed results for sectors and stocks.

-

I'm a 55-Year-Old Dad. Here’s How My 28-Year-Old Daughter Showed Me That AXP Is Still a Solid Investment

I'm a 55-Year-Old Dad. Here’s How My 28-Year-Old Daughter Showed Me That AXP Is Still a Solid InvestmentAmerican Express stock is still a solid investment because management understands the value of its brand and is building a wide moat around it.