Stock Market Today: UPS, Exxon Power Rally; Alphabet to Split 20-for-1

Investors enjoyed another session of broadly higher prices Tuesday; Google parent Alphabet announces 20-for-1 stock split

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

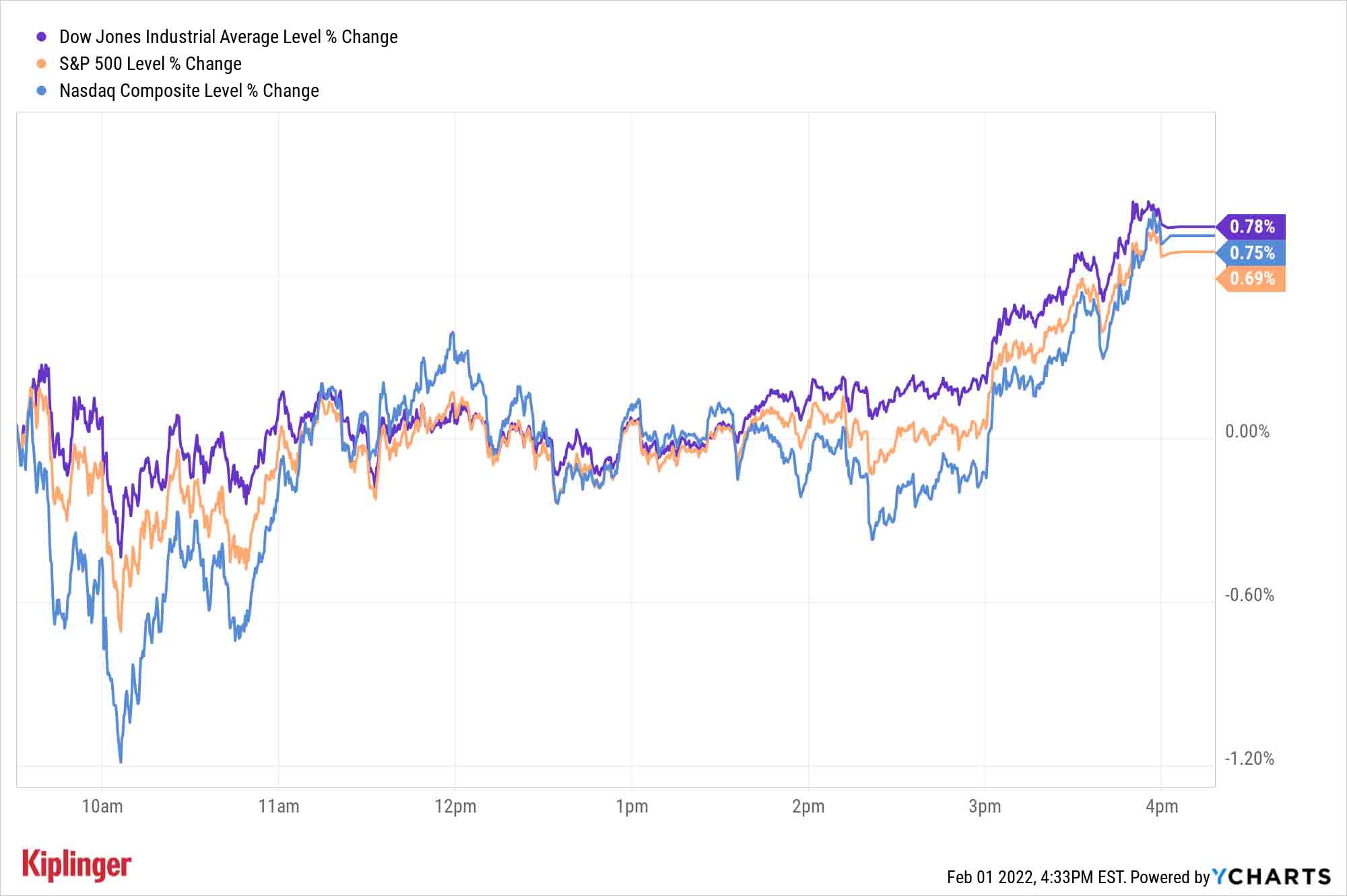

The first day of February trading was a relative yawner as the three major indexes finished Tuesday with modest gains. But given that investors just suffered the worst month for stocks since the COVID bear market, they were likely grateful for a quiet, positive session.

If not, they received something a little more exciting in the form of an Alphabet (GOOGL, +1.7%) stock split.

Earlier Tuesday, the Institute for Supply Management announced that its January manufacturing index declined by 1.1 points to 57.6. (Readings over 50.0 indicate expansion.) That was in line with expectations and showed continuing growth in the manufacturing sector, albeit at a slower pace than in December.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

"The composition of the report was soft, with a small increase in the employment component, but larger declines in the production and new orders components," says Goldman Sachs Economics Research.

The earnings calendar had a few events of note, too.

United Parcel Service (UPS, +14.1%) popped to an all-time high after easily topping the Street's quarterly earnings and revenue forecasts. The better-than-expected results reflected the ongoing surge in online shopping and CEO Carol Tome's efforts to increase profitability.

Meanwhile, Exxon Mobil (XOM, +6.4%) stock hit a level last seen in 2019. The energy major eclipsed fourth-quarter profit and sales expectations and said it would resume stock buybacks this quarter.

The Dow Jones Industrial Average climbed 0.8% to 35,405, the Nasdaq Composite gained 0.8% to 14,346 and the S&P 500 was 0.7% better to 4,546.

After the bell, Google parent Alphabet surged another 7% or so after announcing a massive Q4 beat and an equally sizable stock split. GOOGL reported 32% year-over-year revenue growth to a record $75.3 billion to easily beat estimates of $72.3 billion. Meanwhile, earnings of $30.69 per share easily cleared consensus expectations for $27.34.

The company also said its board of directors had approved a 20-for-1 stock split on each share of Class A, Class B and Class C stock. Shareholders still must approve the measure. If passed, shareholders of record as of the July 1, 2022, close, would receive on July 15, 2022, a dividend of 19 additional shares of the same class of stock for each share they held.

Other news in the stock market today:

- The small-cap Russell 2000 enjoyed a 1.1% improvement to 2,050.

- U.S. crude oil futures eked out a marginal gain to settle at $88.20 per barrel.

- Gold futures rose 0.3% to finish at $1,801.50 an ounce.

- Bitcoin waffled back and forth for most of the day and finished up just 0.1% higher, to $38,527.63. (Bitcoin trades 24 hours a day; prices reported here are as of 4 p.m.)

- AT&T (T) stock fell 4.2% today after the telecommunications firm said it will divest its WarnerMedia properties, which include HBO, CNN, TNT, TBS and Warner Bros. Studios, as part of its planned merger with Discovery (DISCA). The spinoff will give T shareholders 0.24 share for each share they currently own. AT&T also said it will slash its annual dividend, to $1.11 per share from $2.08 per share – a move that was widely expected and caused T to end its reign as an S&P 500 Dividend Aristocrat.

- Pitney Bowes (PBI) shares slumped 15.4% after the logistics company reported earnings. In its fourth quarter, PBI reported adjusted earnings of 6 cents per share, missing the consensus estimate for earnings of 11 cents per share. The firm also reported an 8.7% year-over-year decline in global e-commerce revenue, though total revenue of $983.7 million in revenue came in above analysts' average estimate for $691.6 million in sales.

- Cruise stocks were a bright spot on Wall Street today. Among the day's big winners were Carnival (CCL, +5.7%), Norwegian Cruise Line Holdings (NCLH, +3.7%) and Royal Caribbean Cruises (RCL, +4.4%).

The 'January Barometer' Bodes Poorly for Equities, But ...

January performance isn't the market indicator it used to be.

Ryan Detrick, chief market strategist for LPL Financial, recently examined the "January Barometer," first discussed in 1972 by Yale Hirsh of the Stock Trader's Almanac.

Traders sum it up like this: "As January goes, so goes the year."

Specifically, when the S&P 500 has closed January in the green, the index has finished up an average of 11.9% over the final 11 months, and higher 86% of the time. But when the S&P 500 finished January in the red, stocks rose just 2.7% on average in the final 11 months and were higher only 62% of the time.

The good news? "It is worth noting that the January Barometer has been broken lately," Detrick says. "In fact, nine of the past 10 times stocks were lower in January, the final 11 months were higher, with some huge gains in there."

The takeaway? Although hoary market sayings and historical indicators can be entertaining and occasionally useful, past performance – as always – is not indicative of future returns.

The wisest move most investors can make is to build a strong portfolio core tailored to their risk tolerances and goals. Vanguard is among a few fund providers that can help you prepare for just about any eventuality, for a song.

To that end, we've focused on handling 2022's specific challenges – inflation, rising interest rates – in our list of 2022's best Vanguard funds. These stock- and bond-funds are constructed to both benefit from and defend against many of this year's trends.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Kyle Woodley is the Editor-in-Chief of WealthUp, a site dedicated to improving the personal finances and financial literacy of people of all ages. He also writes the weekly The Weekend Tea newsletter, which covers both news and analysis about spending, saving, investing, the economy and more.

Kyle was previously the Senior Investing Editor for Kiplinger.com, and the Managing Editor for InvestorPlace.com before that. His work has appeared in several outlets, including Yahoo! Finance, MSN Money, Barchart, The Globe & Mail and the Nasdaq. He also has appeared as a guest on Fox Business Network and Money Radio, among other shows and podcasts, and he has been quoted in several outlets, including MarketWatch, Vice and Univision. He is a proud graduate of The Ohio State University, where he earned a BA in journalism.

You can check out his thoughts on the markets (and more) at @KyleWoodley.

-

5 Investing Rules You Can Steal From Millennials

5 Investing Rules You Can Steal From MillennialsMillennials are reshaping the investing landscape. See how the tech-savvy generation is approaching capital markets – and the strategies you can take from them.

-

The Tool You Need to Avoid a Post-Divorce Administrative Nightmare

The Tool You Need to Avoid a Post-Divorce Administrative NightmareLearn why a divorce decree isn’t enough to protect your retirement assets. You need a QDRO to divide the accounts to avoid paying penalties or income tax.

-

When Estate Plans Don't Include Tax Plans, All Bets Are Off

When Estate Plans Don't Include Tax Plans, All Bets Are OffEstate plans aren't as effective as they can be if tax plans are considered separately. Here's what you stand to gain when the two strategies are aligned.

-

Nasdaq Leads a Rocky Risk-On Rally: Stock Market Today

Nasdaq Leads a Rocky Risk-On Rally: Stock Market TodayAnother worrying bout of late-session weakness couldn't take down the main equity indexes on Wednesday.

-

Stocks Make More Big Up and Down Moves: Stock Market Today

Stocks Make More Big Up and Down Moves: Stock Market TodayThe impact of revolutionary technology has replaced world-changing trade policy as the major variable for markets, with mixed results for sectors and stocks.

-

Small Caps Step Up, Tech Is Still a Drag: Stock Market Today

Small Caps Step Up, Tech Is Still a Drag: Stock Market TodayEarly strength gave way to AI skepticism again as a volatile trading week ended on another mixed note.

-

AI Unwind Takes 2% Off the Nasdaq: Stock Market Today

AI Unwind Takes 2% Off the Nasdaq: Stock Market TodayMarkets are paying more and more attention to hyperscalers' plans to spend more and more money on artificial intelligence.

-

Strong Jobs Report Leaves Markets Flat: Stock Market Today

Strong Jobs Report Leaves Markets Flat: Stock Market TodayInvestors, traders and speculators are taking time to weigh the latest labor market data against their hopes for lower interest rates.

-

I'm a 55-Year-Old Dad. Here’s How My 28-Year-Old Daughter Showed Me That AXP Is Still a Solid Investment

I'm a 55-Year-Old Dad. Here’s How My 28-Year-Old Daughter Showed Me That AXP Is Still a Solid InvestmentAmerican Express stock is still a solid investment because management understands the value of its brand and is building a wide moat around it.

-

Dow Hits New High Ahead of January Jobs Report: Stock Market Today

Dow Hits New High Ahead of January Jobs Report: Stock Market TodayA weak reading on December retail sales was in focus ahead of Wednesday's delayed labor market data.

-

Tech Stocks Fuel Strong Start to the Week: Stock Market Today

Tech Stocks Fuel Strong Start to the Week: Stock Market TodayThe blue-chip Dow Jones Industrial Average extended its run above 50,000 on Monday and there are plenty of catalysts to keep the 30-stock index climbing.