Stock Market Today: Stocks End Down on Another Roller-Coaster Day

The major indexes stage another comeback Tuesday but this time can't escape declines; Microsoft falls after hours despite an earnings beat.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Another day, another market session of gut-wrenching volatility.

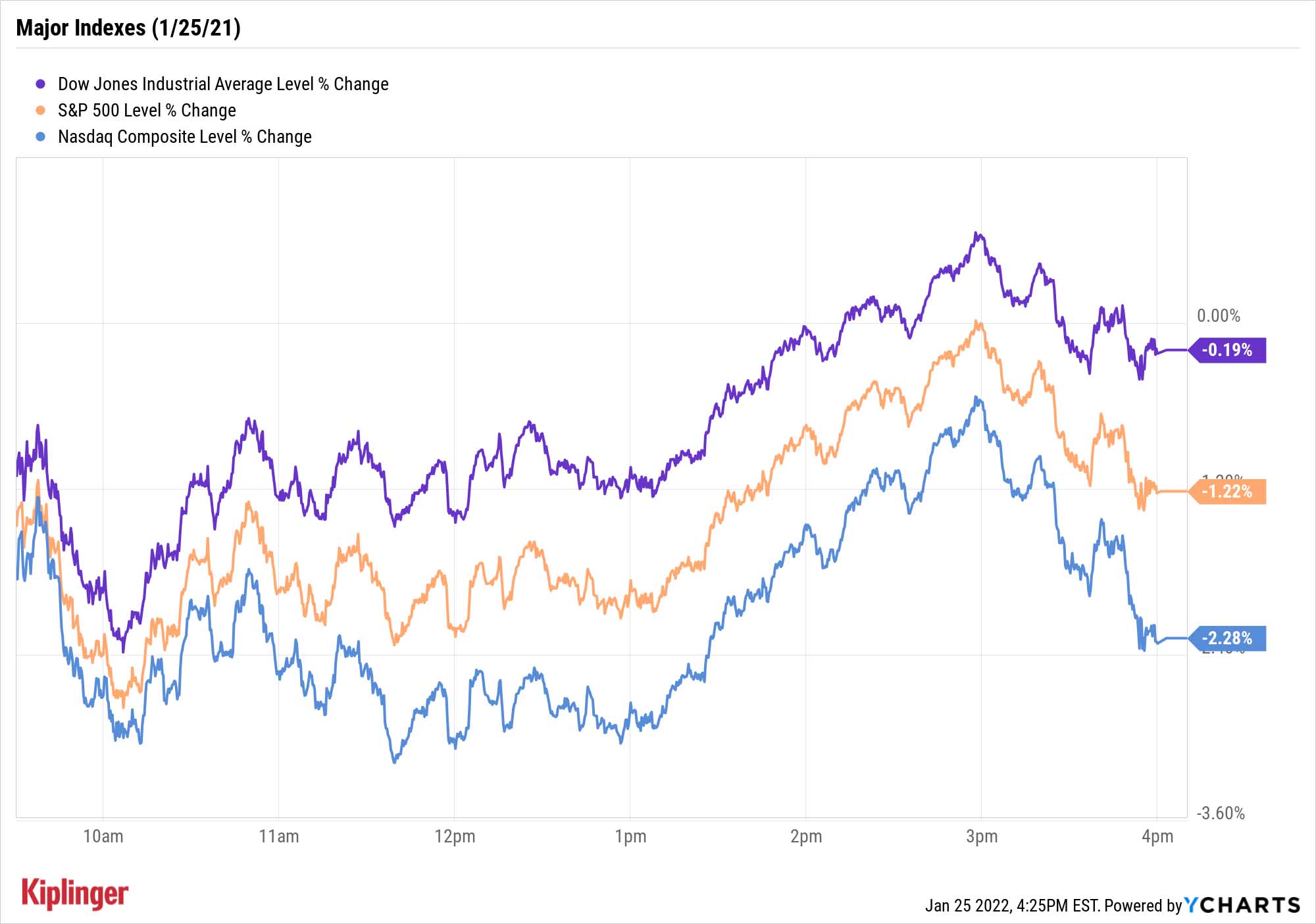

Like Monday, Tuesday's action saw a precipitous market plunge in the morning hours before the bulls took over in the afternoon – though unlike Monday, none of the major indexes managed to finish in positive territory.

One of the primary reasons for all the rips and dips, of course, is jitters over tomorrow's conclusion of the Federal Reserve's latest two-day meeting, when America's central bank is expected to continue projecting a recent hawkish bent, setting the stage for a potential March hike to its benchmark interest rate, likely the first of several across 2022.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

"It's been breathtaking to watch the dramatic change in expectations surrounding the Fed this year," says Kristina Hooper, Invesco chief global market strategist. "Estimates for rate hikes are all over the place, but they've been trending a lot higher in the past couple of weeks — and we've seen stocks and other risk assets fall in response. There are whispers that the Fed will end asset purchases at this week's meeting; others think the Fed could start to raise rates at this week's meeting.

"And some are anticipating as many as eight rate hikes this year — that may be worse than the giant eight-legged hairy spider under the bed that wanted to kidnap my daughter and bring her back to its human-sized web."

Leading the way in an uneven market was the energy sector (+3.8%), where stocks including ConocoPhillips (COP, +4.9%) and EOG Resources (EOG, +4.5%) were buoyed by U.S. crude oil prices (+2.8% to $85.60 per barrel). Oil surged amid heightening tensions not just between Ukraine and Russia, but also in the Middle East; the United Arab Emirates intercepted two missiles targeting an air base near its capital, Abu Dhabi, an attack it blamed on Iran-backed Houthi rebels.

Financial stocks (+0.5%) were relatively strong, too, as American Express (AXP, +8.8%) clobbered fourth-quarter revenue and profit expectations thanks to record levels of card spending.

The Dow Jones Industrial Average, off 819 points at the session lows, recovered to post a far more modest 66-point, 0.2% decline to 34,297. The S&P 500 (-1.2% to 4,356) and Nasdaq Composite (-2.3% to 13,539) also finished off the bottom, but with more substantial declines.

Microsoft (MSFT, -2.7%) was off another 3% or so in early after-hours trading following a solid top- and bottom-line beat for its fiscal second quarter. Revenues of $51.73 billion were up 20% year-over-year and topped expectations for $50.88 billion. Earnings of $2.48 per share also easily topped estimates of $2.31. Leading the company's quarter was a 25.5% pop in revenue growth in the Intelligent Cloud segment, which includes Azure, GitHub and other products.

Other news in the stock market today:

- The small-cap Russell 2000 declined 1.5% to 2,004.

- Gold futures rose 0.6% to settle at $1,852.50 an ounce.

- Bitcoin futures were off slightly, down 0.8% to $36,886.86. (Bitcoin trades 24 hours a day; prices reported here are as of 4 p.m.)

- General Electric (GE) stock took a 6.0% dive after the industrial conglomerate reported its fourth-quarter results. While GE reported adjusted earnings per share of 92 cents and free cash flow of $8.3 billion – more than the 84 cents per share and $3.2 billion analysts were expecting – revenue of $20.3 billion fell short of the consensus estimate for $21.4 billion in sales.

- Higher-than-expected adjusted fourth-quarter earnings ($2.13 reported vs. $2.12 expected) and an upbeat full-year forecast gave Johnson & Johnson (JNJ) stock a 2.9% boost, even as the pharmaceutical giant's $24.8 billion in revenues fell short of the $25.3 billion analysts' were anticipating. CFRA Research analyst Stewart Glickman maintained a Buy rating on JNJ in the wake of earnings. "JNJ noted that its net debt position is now its lowest in almost five years, even as research and development rose 20% in 2021, which we think could spur management to boost dividends or perhaps pursue acquisitions (in our view, we see the latter as more likely)," he says.

- Nvidia (NVDA) fell 4.5% after Bloomberg News reported the semiconductor giant is preparing to abandon its bid for U.K. chip designer Arm, according to people familiar with the matter. The potential deal, which was first announced in September 2020, has faced numerous regulatory hurdles. Per the Bloomberg report, Softbank, which owns Arm, may be considering taking the company public.

The Newest Dividend Aristocrats

Coming soon to an index near you: the coronation of new dividend royalty.

When investors put together their income portfolios, some hone in on high yield, others focus on high-frequency (read: monthly) payers, and still others try to stack several stocks that reliably grow their dividends over time.

Dividend growth boasts numerous benefits, among them achieving higher yields over time for simply holding onto the stocks you already like, and having something of a built-in cushion against inflation – after all, if your dividend isn't growing but the costs of goods and services are, the effective income you're receiving from those stocks is effectively shrinking.

When it comes to dividend growth, it's hard to do it better than the S&P 500 Dividend Aristocrats – payout champions that have raised their annual distributions for at least 25 years without interruption. And as of February, this peerage will be a little different.

S&P Dow Jones Indices recently announced a few changes to the Aristocrats, effective before the open of business on Feb. 1, that will see two new companies join their ranks … and a name that was once synonymous with fat dividends be dethroned. Check out the link above to discover who's in, who's gone and who remains.

Kyle Woodley was long NVDA as of this writing.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Kyle Woodley is the Editor-in-Chief of WealthUp, a site dedicated to improving the personal finances and financial literacy of people of all ages. He also writes the weekly The Weekend Tea newsletter, which covers both news and analysis about spending, saving, investing, the economy and more.

Kyle was previously the Senior Investing Editor for Kiplinger.com, and the Managing Editor for InvestorPlace.com before that. His work has appeared in several outlets, including Yahoo! Finance, MSN Money, Barchart, The Globe & Mail and the Nasdaq. He also has appeared as a guest on Fox Business Network and Money Radio, among other shows and podcasts, and he has been quoted in several outlets, including MarketWatch, Vice and Univision. He is a proud graduate of The Ohio State University, where he earned a BA in journalism.

You can check out his thoughts on the markets (and more) at @KyleWoodley.

-

Timeless Trips for Solo Travelers

Timeless Trips for Solo TravelersHow to find a getaway that suits your style.

-

A Top Vanguard ETF Pick Outperforms on International Strength

A Top Vanguard ETF Pick Outperforms on International StrengthA weakening dollar and lower interest rates lifted international stocks, which was good news for one of our favorite exchange-traded funds.

-

Is There Such a Thing As a Safe Stock? 17 Safe-Enough Ideas

Is There Such a Thing As a Safe Stock? 17 Safe-Enough IdeasNo stock is completely safe, but we can make educated guesses about which ones are likely to provide smooth sailing.

-

If You'd Put $1,000 Into Caterpillar Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into Caterpillar Stock 20 Years Ago, Here's What You'd Have TodayCaterpillar stock has been a remarkably resilient market beater for a very long time.

-

Dow Dives 521 Points as Goldman, AmEx Slide: Stock Market Today

Dow Dives 521 Points as Goldman, AmEx Slide: Stock Market TodayNews of Block's massive layoffs exacerbated AI worries across the financial sector.

-

Big Nvidia Numbers Take Down the Nasdaq: Stock Market Today

Big Nvidia Numbers Take Down the Nasdaq: Stock Market TodayMarkets are struggling to make sense of what the AI revolution means across sectors and industries, and up and down the market-cap scale.

-

Dow Absorbs Disruptions, Adds 370 Points: Stock Market Today

Dow Absorbs Disruptions, Adds 370 Points: Stock Market TodayInvestors, traders and speculators will hear from President Donald Trump tonight, and then they'll listen to Nvidia CEO Jensen Huang tomorrow.

-

Dow Loses 821 Points to Open Nvidia Week: Stock Market Today

Dow Loses 821 Points to Open Nvidia Week: Stock Market TodayU.S. stock market indexes reflect global uncertainty about artificial intelligence and Trump administration trade policy.

-

AI Unwind Takes 2% Off the Nasdaq: Stock Market Today

AI Unwind Takes 2% Off the Nasdaq: Stock Market TodayMarkets are paying more and more attention to hyperscalers' plans to spend more and more money on artificial intelligence.

-

I'm a 55-Year-Old Dad. Here’s How My 28-Year-Old Daughter Showed Me That AXP Is Still a Solid Investment

I'm a 55-Year-Old Dad. Here’s How My 28-Year-Old Daughter Showed Me That AXP Is Still a Solid InvestmentAmerican Express stock is still a solid investment because management understands the value of its brand and is building a wide moat around it.

-

Stocks Sink With Alphabet, Bitcoin: Stock Market Today

Stocks Sink With Alphabet, Bitcoin: Stock Market TodayA dismal round of jobs data did little to lift sentiment on Thursday.