Stock Market Today: Rising Rates Put Another Scare Into Stocks

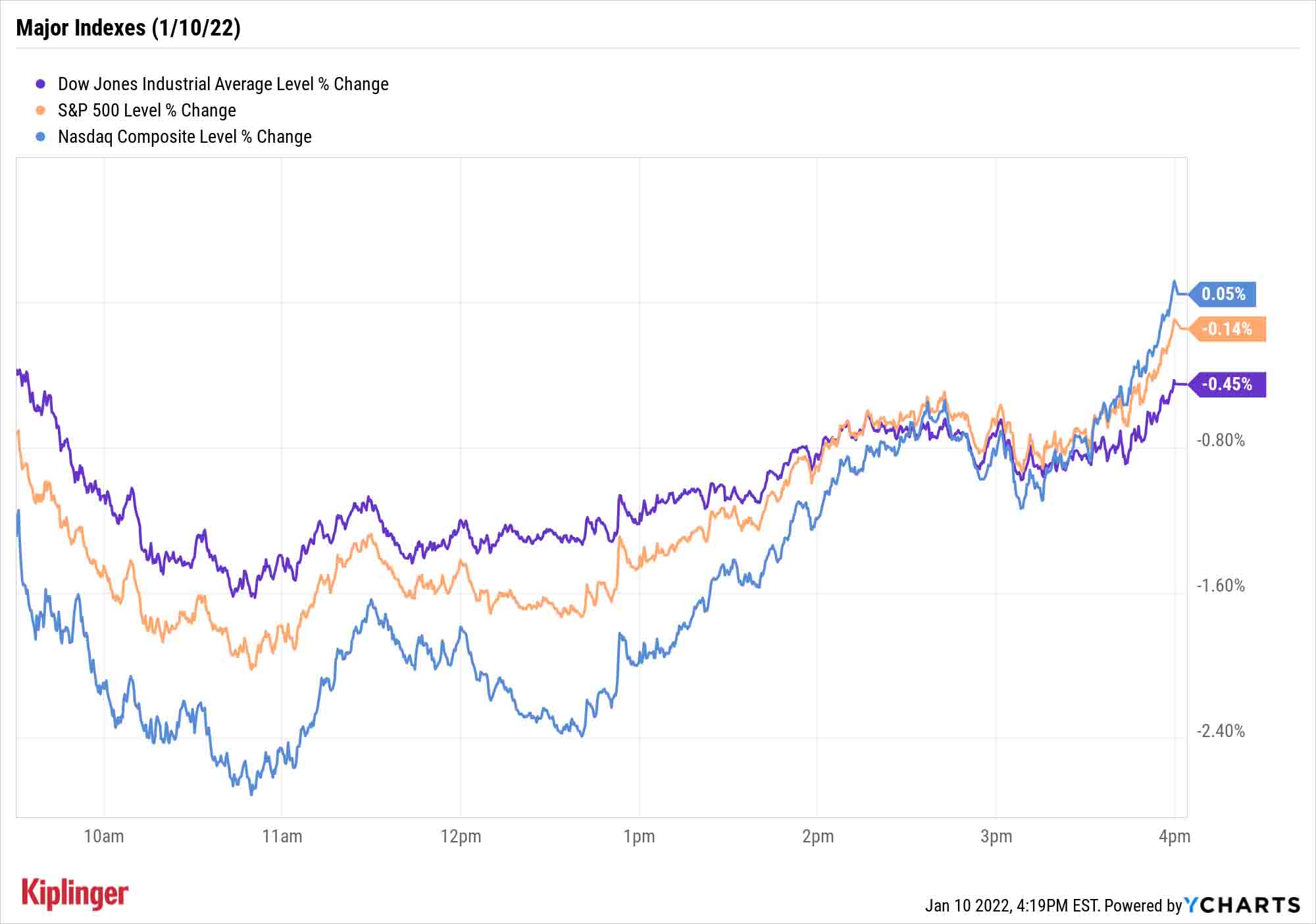

Another push higher in Treasury yields threatened a deep-red day for stocks, but the major indexes escaped with slight declines and even gains.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

More commotion in the bond markets sent equities off to a rocky start for the week – though what was shaping up to be a significant gashing turned out to be just a scrape.

The yield on the 10-year Treasury jumped yet again Monday, to as high as 1.808% after starting 2021 at 1.510%.

"While rates have been volatile throughout 2021, the 10-year has not reached this level since prior to the pandemic," says Lindsey Bell, chief money and markets strategist for Ally Invest. "Information received since the start of the new year is making the case for Mister Market that the Fed is going to raise rates and remove liquidity from the market at a faster pace than what was thought just over a week ago."

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

Remember: The Federal Reserve's members have signaled expectations for at least three hikes to the central bank's benchmark interest rate in 2022. Kiplinger forecasts the Fed will raise rates four times, and over the weekend, Goldman Sachs predicted the same. JPMorgan Chase (JPM) CEO Jamie Dimon upped the ante Monday, saying "I'd personally be surprised if it was just four."

However, heavy selling pressure Monday morning mercifully relaxed into the afternoon as 10-year rates backed off their highs.

Fresh off its worst week in 11 months, the Nasdaq Composite dropped by as much as 2.7% at its nadir, to 14,530 – just about 80 points from official correction territory (a drop of 10% or more from a peak) – but managed to finish with a marginal gain to 14,942. The Dow Jones Industrial Average (-0.5% to 36,068) and S&P 500 (-0.1% to 4,670) closed down but well off their intraday lows.

Other news in the stock market today:

- The small-cap Russell 2000 slipped by 0.4% to 2,171.

- Gold futures posted a marginal gain, settling at $1,798.80 an ounce.

- U.S. crude oil futures slipped 0.9% to end at $78.23 per barrel.

- Bitcoin, which sat at $41,912.19 on Friday afternoon, dropped below $40,000 earlier in Monday's session but recovered to $41,714.45, a 0.5% decline. (Bitcoin trades 24 hours a day; prices reported here are as of 4 p.m.)

- Take-Two Interactive (TTWO) is upping its stake in the mobile video game world, announcing today that it is buying Farmville creator Zynga (ZNGA) for $12.7 billion in cash and stock. This works out to $9.68 per ZNGA share – a 61.3% premium to last Friday's close. "This strategic combination brings together our best-in-class console and PC franchises, with a market-leading, diversified mobile publishing platform that has a rich history of innovation and creativity," said Strauss Zelnick, CEO of Take-Two Interactive. "We believe that we will deliver significant value to both sets of stockholders, including $100 million of annual cost synergies within the first two years post-closing and at least $500 million of annual net bookings opportunities over time." The deal is expected to close by the end of the second quarter as long as it gets the green light from regulators and shareholders. ZNGA shares soared 40.7% on the news, while TTWO fell 13.1% – potentially creating an attractive entry point for investors looking to pick up one of the best communication services stocks for 2022 at a discount.

- Moderna (MRNA) was a rare splash of bright green today, jumping 9.3% after the biotech's CEO Stephane Bancel told CNBC's "Squawk Box" on Monday that the company is working on a COVID-19 booster that will target the omicron variant. Bancel said MRNA believes this will be the "best strategy for a potential booster for the fall of 2022" after discussions with various public health officials. This comes as the Centers for Disease Control and Prevention (CDC) said immunocompromised individuals are now eligible for a fourth vaccine dose, as detailed Monday in our free A Step Ahead newsletter.

Will Earnings Jolt the Market?

Interest rates might be dominating headlines now, but a new potential market mover kicks off later this week.

It's the unofficial start of the fourth-quarter earnings season – and while you can check out a schedule of major reports here, big names to watch include Delta Air Lines (DAL), Wells Fargo (WFC) and BlackRock (BLK), which we've previewed here.

According to FactSet, analysts' estimated earnings growth rate for S&P 500 companies in Q4 2021 is 21.7% – if achieved, that would be the fourth consecutive quarter that earnings growth has topped 20%, which should give investors something to look forward to.

"While there are real risks, expectations for continued hiring and spending will support growth in expected earnings," says Jeff Buchbinder, chief equity strategist for LPL Financial, who adds that despite the risks of continued volatility "higher rates have usually been associated with strong market performance" too.

Investors looking for ways to potentially buy on the dip during short-term volatility could consider Kiplinger picks for the year ahead – such as our top stocks for 2022 or our best exchange-traded funds (ETFs).

That said, if you have a greater thirst for risk, and a speculative portfolio allocation you can afford to lose, you might consider swinging for the fences – with the pros' help, anyway.

While Wall Street analysts typically don't make bombastic calls, they have identified a few stocks that they see, ahem, "going to the moon" over the next year or so. These 30 names in particular have consensus buy targets implying at least 100% returns – and in many cases, much more. But watch out: This is a volatile bunch.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Kyle Woodley is the Editor-in-Chief of WealthUp, a site dedicated to improving the personal finances and financial literacy of people of all ages. He also writes the weekly The Weekend Tea newsletter, which covers both news and analysis about spending, saving, investing, the economy and more.

Kyle was previously the Senior Investing Editor for Kiplinger.com, and the Managing Editor for InvestorPlace.com before that. His work has appeared in several outlets, including Yahoo! Finance, MSN Money, Barchart, The Globe & Mail and the Nasdaq. He also has appeared as a guest on Fox Business Network and Money Radio, among other shows and podcasts, and he has been quoted in several outlets, including MarketWatch, Vice and Univision. He is a proud graduate of The Ohio State University, where he earned a BA in journalism.

You can check out his thoughts on the markets (and more) at @KyleWoodley.

-

Nasdaq Leads a Rocky Risk-On Rally: Stock Market Today

Nasdaq Leads a Rocky Risk-On Rally: Stock Market TodayAnother worrying bout of late-session weakness couldn't take down the main equity indexes on Wednesday.

-

Quiz: Do You Know How to Avoid the "Medigap Trap?"

Quiz: Do You Know How to Avoid the "Medigap Trap?"Quiz Test your basic knowledge of the "Medigap Trap" in our quick quiz.

-

5 Top Tax-Efficient Mutual Funds for Smarter Investing

5 Top Tax-Efficient Mutual Funds for Smarter InvestingMutual funds are many things, but "tax-friendly" usually isn't one of them. These are the exceptions.

-

Nasdaq Leads a Rocky Risk-On Rally: Stock Market Today

Nasdaq Leads a Rocky Risk-On Rally: Stock Market TodayAnother worrying bout of late-session weakness couldn't take down the main equity indexes on Wednesday.

-

Stocks Make More Big Up and Down Moves: Stock Market Today

Stocks Make More Big Up and Down Moves: Stock Market TodayThe impact of revolutionary technology has replaced world-changing trade policy as the major variable for markets, with mixed results for sectors and stocks.

-

Small Caps Step Up, Tech Is Still a Drag: Stock Market Today

Small Caps Step Up, Tech Is Still a Drag: Stock Market TodayEarly strength gave way to AI skepticism again as a volatile trading week ended on another mixed note.

-

AI Unwind Takes 2% Off the Nasdaq: Stock Market Today

AI Unwind Takes 2% Off the Nasdaq: Stock Market TodayMarkets are paying more and more attention to hyperscalers' plans to spend more and more money on artificial intelligence.

-

Big Change Coming to the Federal Reserve

Big Change Coming to the Federal ReserveThe Lette A new chairman of the Federal Reserve has been named. What will this mean for the economy?

-

Strong Jobs Report Leaves Markets Flat: Stock Market Today

Strong Jobs Report Leaves Markets Flat: Stock Market TodayInvestors, traders and speculators are taking time to weigh the latest labor market data against their hopes for lower interest rates.

-

Job Growth Sizzled to Start the Year. Here's Why It's Unlikely to Impact Interest Rates

Job Growth Sizzled to Start the Year. Here's Why It's Unlikely to Impact Interest RatesThe January jobs report came in much stronger than expected and the unemployment rate ticked lower to start 2026, easing worries about a slowing labor market.

-

I'm a 55-Year-Old Dad. Here’s How My 28-Year-Old Daughter Showed Me That AXP Is Still a Solid Investment

I'm a 55-Year-Old Dad. Here’s How My 28-Year-Old Daughter Showed Me That AXP Is Still a Solid InvestmentAmerican Express stock is still a solid investment because management understands the value of its brand and is building a wide moat around it.