Stock Market Today: Dow Hits New Record, Nasdaq Takes a Spill

The 10-year Treasury yield is closing in on levels not seen since November.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

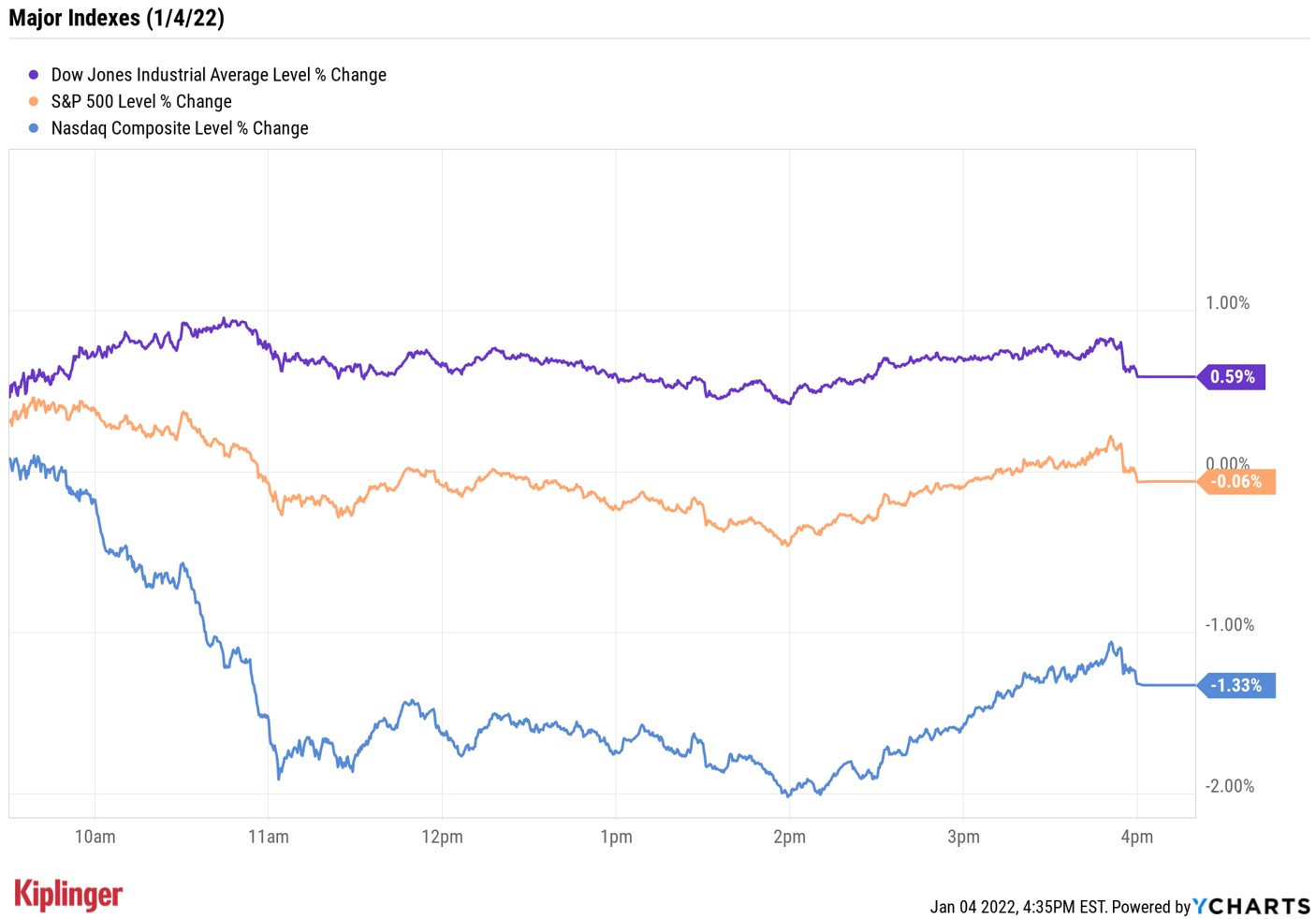

Monday's fairly broad market rally turned into more of a two-pronged move Tuesday as economic data and rising interest rates sparked gains in cyclical stocks.

The Institute for Supply Management's purchasing managers' index reading for December declined 2.3 points to 58.7, well below estimates for 60.0 (anything above 50 represents expansion). However, Barclays economist Jonathan Millar saw in the numbers "significant easing of supply pressures, which is an encouraging sign with disruptions from the omicron variant likely not fully reflected in December."

Also dragging on stocks was another hike in the 10-year Treasury, whose yield reached 1.68% to close in on highs not seen since November. That helped spark cyclical sectors including financials (+2.6%), energy (+3.5%) and industrials (+2.0%), but it proved a weight on technology (-1.1%) and consumer discretionaries (-0.6%).

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

"If this all sounds familiar that's because it is as we've seen these bouts of Treasury volatility drive massive rotations within equity markets throughout much of last year," says Michael Reinking, senior market strategist with the New York Stock Exchange.

As for the major indexes?

The Dow Jones Industrial Average gained 0.6% to easily rewrite the record books with a close at 36,799, while the S&P 500 Index slightly dipped from yesterday's new high, to 4,793. The Nasdaq Composite took a dive, however, off 1.3% to 15,622.

Other news in the stock market today:

- The small-cap Russell 2000 jumped 1.1% to 2,268.

- U.S. crude oil futures rose 1.2% to settle at $76.99 per barrel.

- Gold futures edged up 0.8% to $1,814.60 per ounce.

- Bitcoin tacked on 0.8% to $46,256.15. (Bitcoin trades 24 hours a day; prices reported here are as of 4 p.m.)

- Ford Motor (F) stock surged 11.8% after the Detroit automaker said it would almost double annual production of its electric F-150 pickup by mid-2023. The company is slated to start taking orders for the pickup tomorrow, Jan. 5.

- Fellow carmaker General Motors (GM) was another big mover today, jumping 7.5%. This came after GM said dealer inventories totaled 199,662 at the end of the fourth quarter, up 55% from the record low of 128,757 at the end of the third quarter. Nevertheless, CFRA Research analyst Garrett Nelson maintained a Hold rating on GM, saying "we remain skeptical that GM's new EV offerings will be as successful from a sales perspective as those of competitors such as Ford and Tesla, noting that most models will not be coming to market until 2023 or beyond."

Buckle Up, We Could Be in for a Bumpy Ride

The early innings of 2022 could be a doozy, especially if you're overweight a few sectors in particular.

"Given the rising threat of the omicron variant and its potential impact on economic conditions and consumer behavior, the first quarter of 2022 will likely feature the elevated volatility that we saw in the fourth quarter of 2021," says David Keller, chief market strategist at StockCharts.com.

"The deepest pullback in the S&P 500 [in 2021] was only about 6%, while most years will experience at least one drawdown of over 10%. Higher volatility also suggests a higher probability of deeper corrective phases, so 2022 may return back to the normal routine of at least one steeper drawdown of over 10%. … I would not be surprised if that deeper pullback occurs in the first quarter."

Two sectors stand out as particularly vulnerable given both their sensitivity to interest-rate moves of late and their sky-high valuations: technology firms and consumer discretionary companies, which are the priciest pockets of the markets based on expected earnings for the year to come.

The latter is number one with a bullet, at a multiple of 31.1 versus 21.1 for the S&P 500. Such high prices can act as a natural handicap against returns, especially in a volatile market, so individual-stock investors will have to be particularly discriminating when evaluating opportunities for the year ahead.

As we near the end of our sector-by-sector look-ahead, check out our latest: the top consumer discretionary picks for 2022.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Kyle Woodley is the Editor-in-Chief of WealthUp, a site dedicated to improving the personal finances and financial literacy of people of all ages. He also writes the weekly The Weekend Tea newsletter, which covers both news and analysis about spending, saving, investing, the economy and more.

Kyle was previously the Senior Investing Editor for Kiplinger.com, and the Managing Editor for InvestorPlace.com before that. His work has appeared in several outlets, including Yahoo! Finance, MSN Money, Barchart, The Globe & Mail and the Nasdaq. He also has appeared as a guest on Fox Business Network and Money Radio, among other shows and podcasts, and he has been quoted in several outlets, including MarketWatch, Vice and Univision. He is a proud graduate of The Ohio State University, where he earned a BA in journalism.

You can check out his thoughts on the markets (and more) at @KyleWoodley.

-

Quiz: Do You Know How to Avoid the "Medigap Trap?"

Quiz: Do You Know How to Avoid the "Medigap Trap?"Quiz Test your basic knowledge of the "Medigap Trap" in our quick quiz.

-

5 Top Tax-Efficient Mutual Funds for Smarter Investing

5 Top Tax-Efficient Mutual Funds for Smarter InvestingMutual funds are many things, but "tax-friendly" usually isn't one of them. These are the exceptions.

-

AI Sparks Existential Crisis for Software Stocks

AI Sparks Existential Crisis for Software StocksThe Kiplinger Letter Fears that SaaS subscription software could be rendered obsolete by artificial intelligence make investors jittery.

-

Stocks Make More Big Up and Down Moves: Stock Market Today

Stocks Make More Big Up and Down Moves: Stock Market TodayThe impact of revolutionary technology has replaced world-changing trade policy as the major variable for markets, with mixed results for sectors and stocks.

-

Small Caps Step Up, Tech Is Still a Drag: Stock Market Today

Small Caps Step Up, Tech Is Still a Drag: Stock Market TodayEarly strength gave way to AI skepticism again as a volatile trading week ended on another mixed note.

-

AI Unwind Takes 2% Off the Nasdaq: Stock Market Today

AI Unwind Takes 2% Off the Nasdaq: Stock Market TodayMarkets are paying more and more attention to hyperscalers' plans to spend more and more money on artificial intelligence.

-

Strong Jobs Report Leaves Markets Flat: Stock Market Today

Strong Jobs Report Leaves Markets Flat: Stock Market TodayInvestors, traders and speculators are taking time to weigh the latest labor market data against their hopes for lower interest rates.

-

I'm a 55-Year-Old Dad. Here’s How My 28-Year-Old Daughter Showed Me That AXP Is Still a Solid Investment

I'm a 55-Year-Old Dad. Here’s How My 28-Year-Old Daughter Showed Me That AXP Is Still a Solid InvestmentAmerican Express stock is still a solid investment because management understands the value of its brand and is building a wide moat around it.

-

Dow Hits New High Ahead of January Jobs Report: Stock Market Today

Dow Hits New High Ahead of January Jobs Report: Stock Market TodayA weak reading on December retail sales was in focus ahead of Wednesday's delayed labor market data.

-

Tech Stocks Fuel Strong Start to the Week: Stock Market Today

Tech Stocks Fuel Strong Start to the Week: Stock Market TodayThe blue-chip Dow Jones Industrial Average extended its run above 50,000 on Monday and there are plenty of catalysts to keep the 30-stock index climbing.

-

Dow Adds 1,206 Points to Top 50,000: Stock Market Today

Dow Adds 1,206 Points to Top 50,000: Stock Market TodayThe S&P 500 and Nasdaq also had strong finishes to a volatile week, with beaten-down tech stocks outperforming.