Stock Market Today: Stocks Slip on NYE, Still Deliver a Terrific 2021

2021's final session had little in the way of fireworks, but stocks nonetheless locked in a stellar year of gains.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

Wall Street might have exited 2021 with a whimper, but most investors will look back kindly on a sterling year for stocks.

Friday's action was typical for New Year's Eve: Little news or data meant a low-volume, low-movement session in which just one sector (communication services, off 1.4%) finished with a move of more than 1% in either direction.

Pfizer (PFE, +1.1%) rose after the U.K. approved its Paxlovid COVID-19 antiviral treatment for those older than 18. PFE also got a boost from data published by the Centers for Disease Control and Prevention showing its coronavirus vaccine generated mostly mild side effects in children ages 5 to 11.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

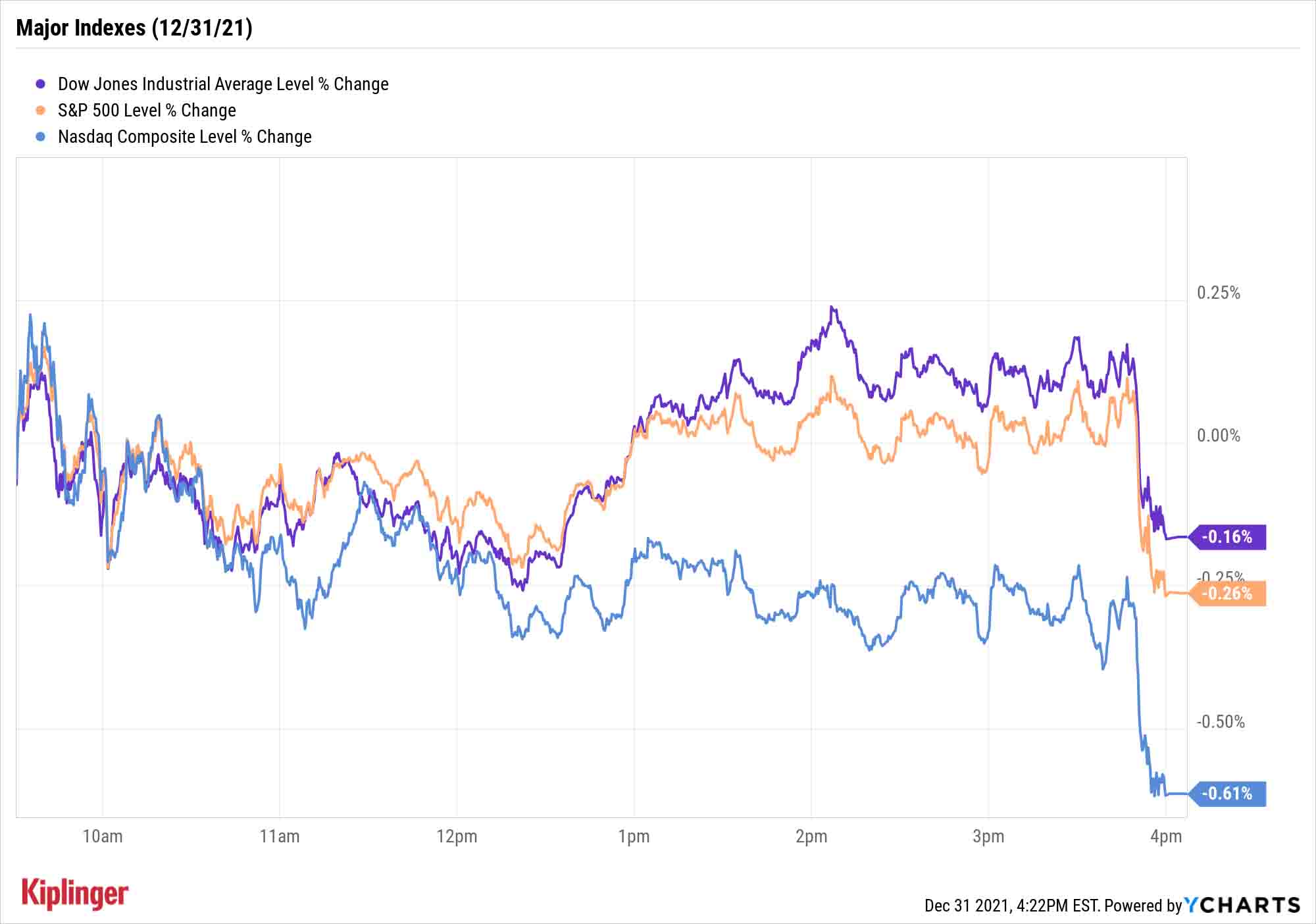

But broadly speaking, stocks merely went through the motions Friday, with a late-day swoon ensuring modest declines for the major indexes. The Dow Jones Industrial Average (-0.2% to 36,338), S&P 500 (-0.3% to 4,766) and Nasdaq Composite (-0.6% to 15,644) all closed in the red. So too did the small-cap Russell 2000, which was off 0.1% to 2,245.

Here's some better news: All of the major indexes enjoyed robust gains in 2021. For the year, the S&P 500 rose 26.9%, the Nasdaq added 21.4%, the DJIA increased 18.7% and the Russell 2000 closed up 13.7%.

We'll do it all over again in 2022, starting Monday, Jan. 3. Unlike other stock market holidays, New Year's Day is observed by Wall Street only if it falls on a weekday.

Other news in the stock market today:

- U.S. crude oil futures dropped sharply, by 2.3%, to $75.21 per barrel, but still closed out 2021 with returns of more than 55%.

- Gold futures posted a 0.8% gain to $1,828.60 per ounce on Friday, but finished the year with a 3.6% decline.

- Bitcoin prices stumbled into the finish, declining 2.8% to $45,879.97 on New Year's Eve. That said, Bitcoin gained more than 58% in 2021. (Bitcoin trades 24 hours a day; prices reported here are as of 4 p.m.)

- A couple of the S&P 500's worst stocks came from the media industry, with Discovery (DISCA, -3.7%) and Viacom (VIAC, -3.0%) posting moderate losses on no news.

- Mohawk Industries (MHK, +2.4%) and Bio-Techne (TECH, +1.7%) were among the index's top stocks Friday.

Looking Back at a Phenomenal 2021

When 2022 arrives, we'll resume our examinations of the best investing opportunities for the new year. But for now, let's take a moment to celebrate the fruits of 2021.

"This year will go down as one of the best ever for the bulls," says Ryan Detrick, chief market strategist for LPL Financial. "The fact that 2021 had the second most all-time highs ever [at 70 for the S&P 500, only behind 1995's 77] probably tells the story better than nearly any other. The S&P 500 had only one 5% pullback all year, and that was during the Evergrande worries in September/October."

Detrick adds that every single month of 2021 included a new all-time high – only the second time that's ever happened, with the first coming in 2014 – and that the current bull market has doubled faster than any other.

As for individual stocks, more than two-thirds of the Dow finished 2021 in positive territory. Our look at the industrial average's best and worst components shows that the top performers finished the year with gains of more than 50%.

And yet as stunning as those returns might be, they're nowhere close to those generated by the best-performing stocks of the much broader Russell 1000, which encompasses the market's 1,000 largest stocks. The 25 best bets recorded gains of at least 93% in 2021. Most of the names at least doubled, while shareholders in 2021's market leader enjoyed eye-popping returns of more than 700%.

Read on as we look at the 25 best-performing stocks of 2021.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Kyle Woodley is the Editor-in-Chief of WealthUp, a site dedicated to improving the personal finances and financial literacy of people of all ages. He also writes the weekly The Weekend Tea newsletter, which covers both news and analysis about spending, saving, investing, the economy and more.

Kyle was previously the Senior Investing Editor for Kiplinger.com, and the Managing Editor for InvestorPlace.com before that. His work has appeared in several outlets, including Yahoo! Finance, MSN Money, Barchart, The Globe & Mail and the Nasdaq. He also has appeared as a guest on Fox Business Network and Money Radio, among other shows and podcasts, and he has been quoted in several outlets, including MarketWatch, Vice and Univision. He is a proud graduate of The Ohio State University, where he earned a BA in journalism.

You can check out his thoughts on the markets (and more) at @KyleWoodley.

-

Nasdaq Leads a Rocky Risk-On Rally: Stock Market Today

Nasdaq Leads a Rocky Risk-On Rally: Stock Market TodayAnother worrying bout of late-session weakness couldn't take down the main equity indexes on Wednesday.

-

Quiz: Do You Know How to Avoid the "Medigap Trap?"

Quiz: Do You Know How to Avoid the "Medigap Trap?"Quiz Test your basic knowledge of the "Medigap Trap" in our quick quiz.

-

5 Top Tax-Efficient Mutual Funds for Smarter Investing

5 Top Tax-Efficient Mutual Funds for Smarter InvestingMutual funds are many things, but "tax-friendly" usually isn't one of them. These are the exceptions.

-

Nasdaq Leads a Rocky Risk-On Rally: Stock Market Today

Nasdaq Leads a Rocky Risk-On Rally: Stock Market TodayAnother worrying bout of late-session weakness couldn't take down the main equity indexes on Wednesday.

-

Stocks Make More Big Up and Down Moves: Stock Market Today

Stocks Make More Big Up and Down Moves: Stock Market TodayThe impact of revolutionary technology has replaced world-changing trade policy as the major variable for markets, with mixed results for sectors and stocks.

-

Small Caps Step Up, Tech Is Still a Drag: Stock Market Today

Small Caps Step Up, Tech Is Still a Drag: Stock Market TodayEarly strength gave way to AI skepticism again as a volatile trading week ended on another mixed note.

-

AI Unwind Takes 2% Off the Nasdaq: Stock Market Today

AI Unwind Takes 2% Off the Nasdaq: Stock Market TodayMarkets are paying more and more attention to hyperscalers' plans to spend more and more money on artificial intelligence.

-

Strong Jobs Report Leaves Markets Flat: Stock Market Today

Strong Jobs Report Leaves Markets Flat: Stock Market TodayInvestors, traders and speculators are taking time to weigh the latest labor market data against their hopes for lower interest rates.

-

I'm a 55-Year-Old Dad. Here’s How My 28-Year-Old Daughter Showed Me That AXP Is Still a Solid Investment

I'm a 55-Year-Old Dad. Here’s How My 28-Year-Old Daughter Showed Me That AXP Is Still a Solid InvestmentAmerican Express stock is still a solid investment because management understands the value of its brand and is building a wide moat around it.

-

Dow Hits New High Ahead of January Jobs Report: Stock Market Today

Dow Hits New High Ahead of January Jobs Report: Stock Market TodayA weak reading on December retail sales was in focus ahead of Wednesday's delayed labor market data.

-

Tech Stocks Fuel Strong Start to the Week: Stock Market Today

Tech Stocks Fuel Strong Start to the Week: Stock Market TodayThe blue-chip Dow Jones Industrial Average extended its run above 50,000 on Monday and there are plenty of catalysts to keep the 30-stock index climbing.