Stock Market Today: Good News on Pfizer Vaccine Keeps Investors Feeling Rosy

Early data showed a three-shot regimen for the Pfizer-BioNTech COVID-19 vaccine neutralized the omicron strain.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

Wednesday brought with it yet another positive development concerning the COVID omicron strain, but while it wasn't enough to drive a third day of aggressive gains, it was enough to keep many patches of the market in positive territory yet again.

This morning, Pfizer (PFE, -0.6%) and BioNTech (BNTX, -3.6%) said early data showed that a three-shot regimen (the original two shots and a booster) of their co-developed vaccine significantly neutralized the omicron strain, as compared to two shots alone.

Another good sign came from the bond market, which we said Monday in our free A Step Ahead newsletter was worth a close watch this week.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

"The development that I think is the most positive today is that the fixed income markets are finally starting to confirm the equity market bounce as the yield curve is starting to steepen," says Michael Reinking, senior market strategist for the New York Stock Exchange.

The two-year Treasury yield turned a bit lower after hitting recent highs earlier, he said, while the 10-year and 30-year yields each headed higher. (Reminder: A flat yield curve is sometimes considered a recessionary omen.)

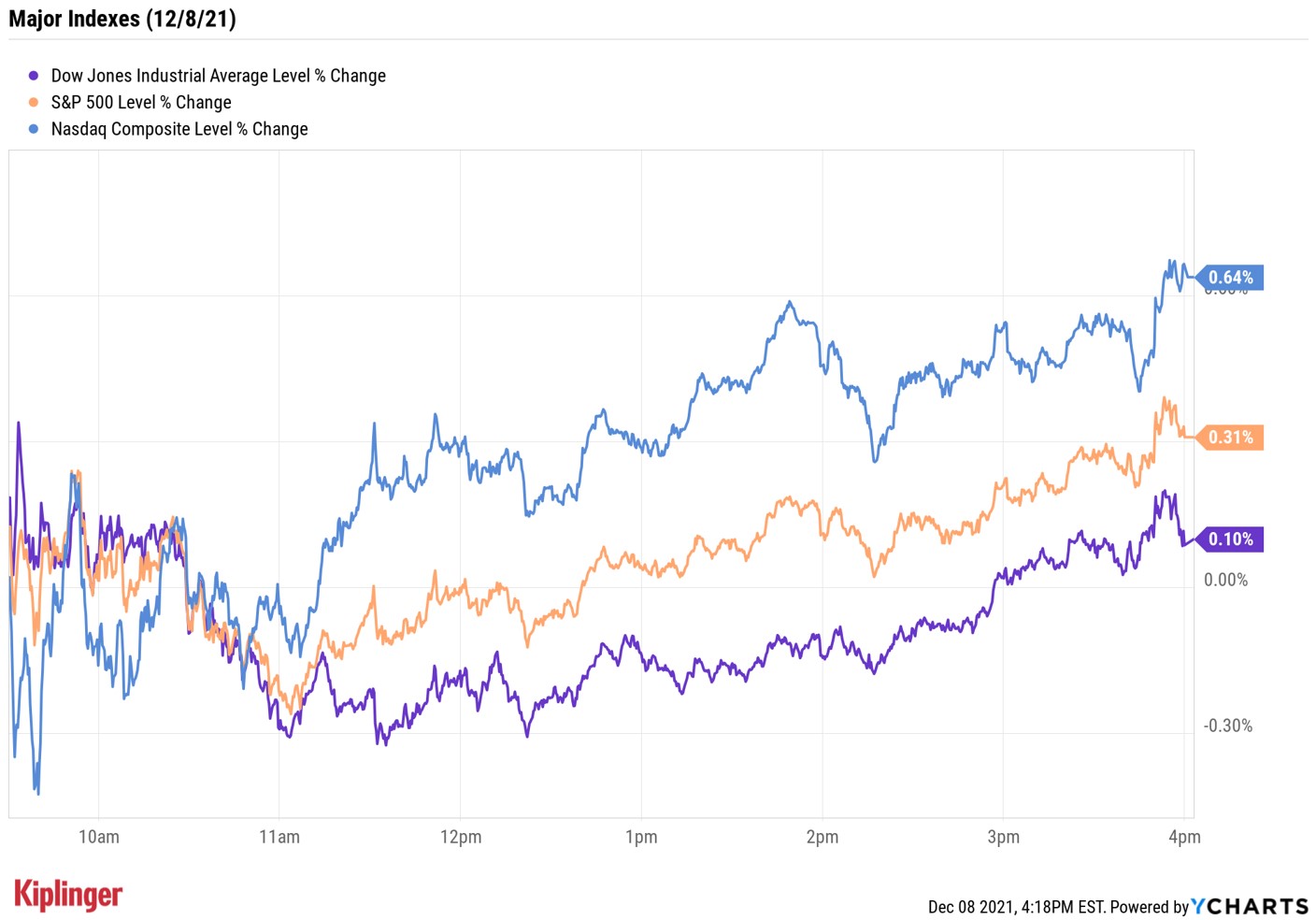

Gains in Apple (AAPL, +2.3%) and Meta Platforms (FB, +2.4%) led the Nasdaq Composite 0.6% higher to 15,786, while the S&P 500 Index (+0.3% to 4,701) and Dow Jones Industrial Average (+0.1% to 35,754) also finished modestly in the green.

Other news in the stock market today:

- The small-cap Russell 2000 tacked on 0.8% to end at 2,271.

- U.S. crude oil futures rose 0.4% to settle at $72.36 per barrel.

- Gold futures eked out a marginal gain to finish at $1,785.50 an ounce.

- Bitcoin tiptoed higher too, adding 0.5% to $50,748.90. (Bitcoin trades 24 hours a day; prices reported here are as of 4 p.m.)

- Stitch Fix (SFIX, -23.9%) was one of the biggest losers on Wall Street today after the online shopping company reported earnings. In its fiscal first quarter, SFIX reported a loss of 2 cents per share on $581 million in revenue, besting analysts' expectations for a per-share loss of 14 cents on $571 million in sales. However, the company's current-quarter revenue guidance of $505 million to $520 million fell short of the $585 million analysts are anticipating. Wedbush analyst Tom Nikic maintained a Neutral rating on SFIX in the wake of earnings. The only silver linings he sees are that the stock is cheap and expectations are low. Outside of that he calls the company's core "Fix" business "underwhelming" and the transition of the new "Freestyle" business as messy. "Until we see evidence/visibility of fundamental stabilization, we're comfortable avoiding this one," Nikic wrote in a note.

- Roku (ROKU) surged 18.2% after the streaming giant inked a multi-year deal with Google parent Alphabet (GOOGL) to keep the YouTube and YouTube TV apps on its platform. A previous agreement between the two companies expired in April and arguments over terms for a new deal had Google threatening to remove its apps from the Roku app store on Dec. 9. "This was not a typical carriage dispute around economics," says Susquehanna Financial Group analyst Shyam Patil. "ROKU said [in October] that GOOGL wanted ROKU to prioritize YouTube over other apps in search results, and demanded search, voice and data features that they do not ask for from other platforms." The fact that a deal was reached tells Patil that "ROKU's positioning in CTV [connected TV] is incredibly strong, and a place on the ROKU platform is a must-have for any content provider – even GOOGL." He has a Positive rating on ROKU, which is the equivalent of a Buy.

It's Always Better to Be Prepared

Today's good news may not last, and is a reminder that you should always know where the safety levers are for your investing strategy.

There's always a "next thing" – whether it's another strain of COVID, geopolitical tumult or some other bearish driver. And for those who like to actively manage their portfolios against such shocks, it's good to have a handy list of protective plays at the ready.

As we've looked ahead to 2022, we've already explored one of the major defensive sectors of the market – consumer staples – and today we've examined another: utility stocks.

To be fair, Wall Street strategists are largely bearish on utilities as we head into the new year, believing that investors will have much more luck in the market's riskier sectors as the economy continues to recover.

But utility stocks are always handy in a pinch (they outperformed all their peers during the worst of the omicron-inspired selling) given the mostly regulated nature of their business and the stability that comes with distributing life's most absolute basics: power, gas and water.

Here, we look at 12 of the most attractive-looking utilities, several of which also offer up sizable yields, for those looking to enhance their long-term dividend holdings.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Kyle Woodley is the Editor-in-Chief of WealthUp, a site dedicated to improving the personal finances and financial literacy of people of all ages. He also writes the weekly The Weekend Tea newsletter, which covers both news and analysis about spending, saving, investing, the economy and more.

Kyle was previously the Senior Investing Editor for Kiplinger.com, and the Managing Editor for InvestorPlace.com before that. His work has appeared in several outlets, including Yahoo! Finance, MSN Money, Barchart, The Globe & Mail and the Nasdaq. He also has appeared as a guest on Fox Business Network and Money Radio, among other shows and podcasts, and he has been quoted in several outlets, including MarketWatch, Vice and Univision. He is a proud graduate of The Ohio State University, where he earned a BA in journalism.

You can check out his thoughts on the markets (and more) at @KyleWoodley.

-

Nasdaq Leads a Rocky Risk-On Rally: Stock Market Today

Nasdaq Leads a Rocky Risk-On Rally: Stock Market TodayAnother worrying bout of late-session weakness couldn't take down the main equity indexes on Wednesday.

-

Quiz: Do You Know How to Avoid the "Medigap Trap?"

Quiz: Do You Know How to Avoid the "Medigap Trap?"Quiz Test your basic knowledge of the "Medigap Trap" in our quick quiz.

-

5 Top Tax-Efficient Mutual Funds for Smarter Investing

5 Top Tax-Efficient Mutual Funds for Smarter InvestingMutual funds are many things, but "tax-friendly" usually isn't one of them. These are the exceptions.

-

Nasdaq Leads a Rocky Risk-On Rally: Stock Market Today

Nasdaq Leads a Rocky Risk-On Rally: Stock Market TodayAnother worrying bout of late-session weakness couldn't take down the main equity indexes on Wednesday.

-

AI Unwind Takes 2% Off the Nasdaq: Stock Market Today

AI Unwind Takes 2% Off the Nasdaq: Stock Market TodayMarkets are paying more and more attention to hyperscalers' plans to spend more and more money on artificial intelligence.

-

Nasdaq Slides 1.4% on Big Tech Questions: Stock Market Today

Nasdaq Slides 1.4% on Big Tech Questions: Stock Market TodayPalantir Technologies proves at least one publicly traded company can spend a lot of money on AI and make a lot of money on AI.

-

Stocks Close Down as Gold, Silver Spiral: Stock Market Today

Stocks Close Down as Gold, Silver Spiral: Stock Market TodayA "long-overdue correction" temporarily halted a massive rally in gold and silver, while the Dow took a hit from negative reactions to blue-chip earnings.

-

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have TodayAdvanced Micro Devices stock is soaring thanks to AI, but as a buy-and-hold bet, it's been a market laggard.

-

Nasdaq Drops 172 Points on MSFT AI Spend: Stock Market Today

Nasdaq Drops 172 Points on MSFT AI Spend: Stock Market TodayMicrosoft, Meta Platforms and a mid-cap energy stock have a lot to say about the state of the AI revolution today.

-

S&P 500 Tops 7,000, Fed Pauses Rate Cuts: Stock Market Today

S&P 500 Tops 7,000, Fed Pauses Rate Cuts: Stock Market TodayInvestors, traders and speculators will probably have to wait until after Jerome Powell steps down for the next Fed rate cut.

-

S&P 500 Hits New High Before Big Tech Earnings, Fed: Stock Market Today

S&P 500 Hits New High Before Big Tech Earnings, Fed: Stock Market TodayThe tech-heavy Nasdaq also shone in Tuesday's session, while UnitedHealth dragged on the blue-chip Dow Jones Industrial Average.