Stock Market Today: New COVID Strain Sinks Stocks in Short Session

The WHO assigned the new strain the Greek letter "Omicron" and designated it a "variant of concern."

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

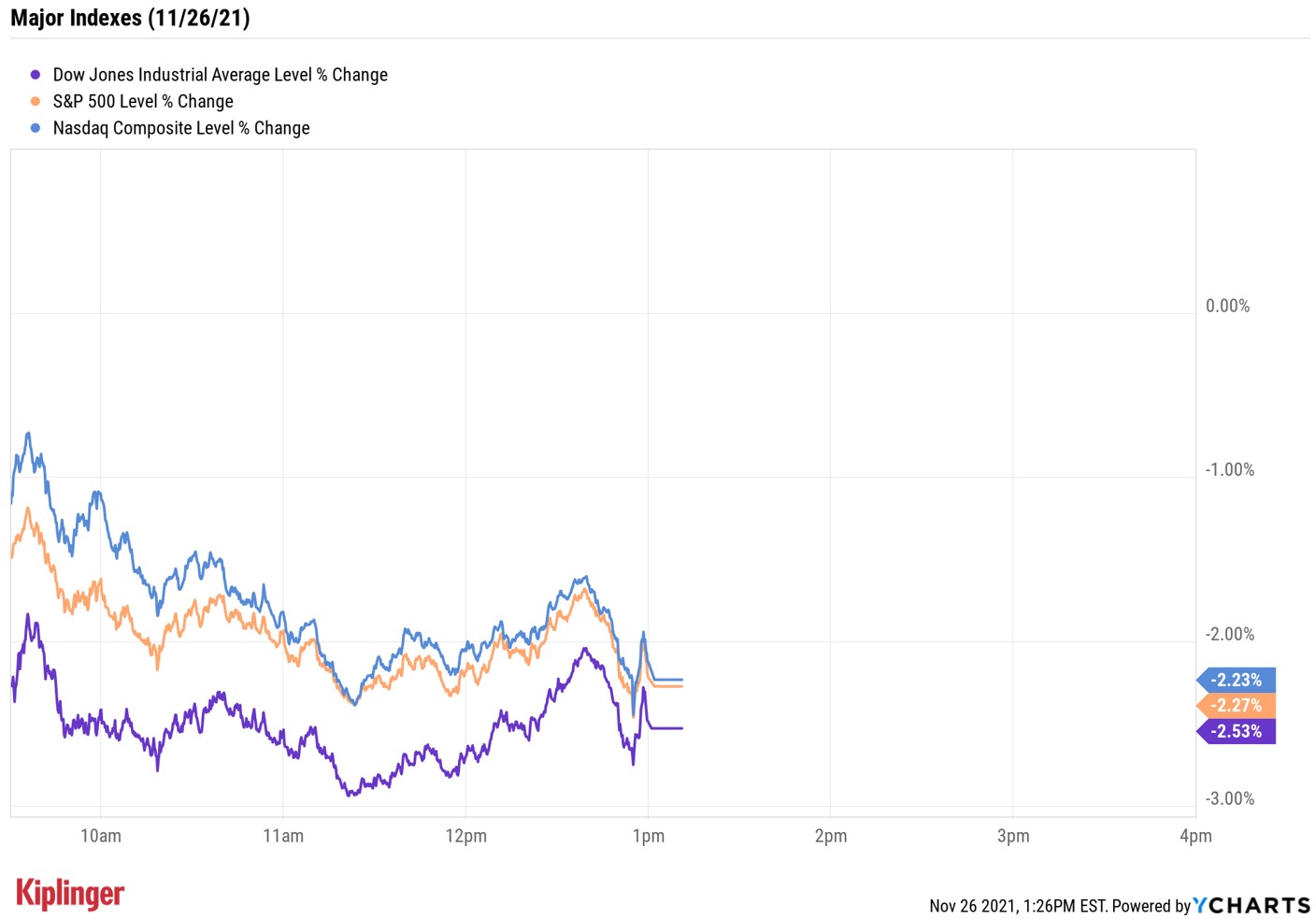

Thought you were in for a quiet day of post-Thanksgiving trading?

Sorry, just the opposite as stocks spiraled downward in today's abbreviated session.

The reason? A new strain of COVID-19 – B.1.1.529, which was assigned the Greek letter "Omicron" by the World Health Organization (WHO) – that possesses several mutations and was identified recently in Africa, with cases detected in Hong Kong and Europe as well.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

"The new COVID variant has dominated attention and led to a sharp selloff among risk assets this morning, and will be closely followed just as a number of countries have moved to tighten up restrictions and even enter lockdowns once again," says Jonathan Jayarajan, research analyst at Deutsche Bank.

Not much is known about this new strain, but several countries have already restricted travel to and from South Africa, including the U.K., France, Germany and Singapore, and the WHO scheduled an emergency meeting Friday where they labeled it a "variant of concern."

When the closing bell mercifully rang during this sell-first, ask-questions-later session, the Dow Jones Industrial Average was down 2.5% at 34,899 – its worst day of the year – the S&P 500 Index was off 2.3% at 4,594 and the Nasdaq Composite was 2.2% lower at 15,491.

But it wasn't just stocks that got hit. Oil prices were down 13.1% to $68.15 per barrel – their lowest settlement since mid-September.

Other news in the stock market today:

- The small-cap Russell 2000 plummeted 3.7% to 2,245.

- Gold futures eked out a marginal gain to settle at $1,785.50 an ounce.

- Bitcoin wasn't spared from the selling, sinking 5.6% to $54,256.53. (Bitcoin trades 24 hours a day; prices reported here are as of 1 p.m.)

- Amid today's COVID-induced broad-market plunge, traditional reopening plays sold off. Airlines and cruise stocks were among the hardest hit, with names like American Airlines (AAL, -8.8%), Delta Air Lines (DAL, -8.3%), Carnival (CCL, -11.0%) and Norwegian Cruise Lines (NCLH, -11.4%) all ending sharply in the red.

- On the flip side, several vaccine makers and stay-at home stocks got a bid. Pfizer (PFE, +6.1%), BioNTech (BNTX, +14.2%), Peloton Interactive (PTON, +5.7%) and Zoom Video Communications (ZM, +5.7%) were some of the day's biggest gainers.

Don't Panic

Yes, uncertainty around the new strain is spooking global investors and comes "on the heels of markets beginning to price in a faster pace of policy tightening [from the U.S. Federal Reserve]," say analysts at the Wells Fargo Investment Institute (WFII).

And both of these events occur ahead of a debt-ceiling debate that is about to ramp up again on Capitol Hill (the stopgap bill passed by Congress in late September only runs through Dec. 3) – which could exacerbate volatility.

Still, WFII's analysts note that "the global economy continues to be on solid ground, and fiscal and monetary policy remain supportive, despite some deceleration." As such, they recommend looking past these short-term concerns and taking advantage of the pullback in stocks by buying equities.

While they highlight financials and technology as two of their preferred sectors, we also recommend dividend-paying stocks, which can help investors ride out market volatility with a bit less stress.

Dividend stocks come in a range of flavors, whether it be with those that pay shareholders on a monthly basis or with those that are boosting their dividends by a substantial amount. Here, we've compiled a list of companies that appear to be in their prime dividend-growth days and have announced income increases of between 100% and 650% this year.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

With over a decade of experience writing about the stock market, Karee Venema is the senior investing editor at Kiplinger.com. She joined the publication in April 2021 after 10 years of working as an investing writer and columnist at a local investment research firm. In her previous role, Karee focused primarily on options trading, as well as technical, fundamental and sentiment analysis.

-

Nasdaq Leads a Rocky Risk-On Rally: Stock Market Today

Nasdaq Leads a Rocky Risk-On Rally: Stock Market TodayAnother worrying bout of late-session weakness couldn't take down the main equity indexes on Wednesday.

-

Quiz: Do You Know How to Avoid the "Medigap Trap?"

Quiz: Do You Know How to Avoid the "Medigap Trap?"Quiz Test your basic knowledge of the "Medigap Trap" in our quick quiz.

-

5 Top Tax-Efficient Mutual Funds for Smarter Investing

5 Top Tax-Efficient Mutual Funds for Smarter InvestingMutual funds are many things, but "tax-friendly" usually isn't one of them. These are the exceptions.

-

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have TodayAdvanced Micro Devices stock is soaring thanks to AI, but as a buy-and-hold bet, it's been a market laggard.

-

If You'd Put $1,000 Into UPS Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into UPS Stock 20 Years Ago, Here's What You'd Have TodayUnited Parcel Service stock has been a massive long-term laggard.

-

If You'd Put $1,000 Into Lowe's Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into Lowe's Stock 20 Years Ago, Here's What You'd Have TodayLowe's stock has delivered disappointing returns recently, but it's been a great holding for truly patient investors.

-

If You'd Put $1,000 Into 3M Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into 3M Stock 20 Years Ago, Here's What You'd Have TodayMMM stock has been a pit of despair for truly long-term shareholders.

-

If You'd Put $1,000 Into Coca-Cola Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into Coca-Cola Stock 20 Years Ago, Here's What You'd Have TodayEven with its reliable dividend growth and generous stock buybacks, Coca-Cola has underperformed the broad market in the long term.

-

If You Put $1,000 into Qualcomm Stock 20 Years Ago, Here's What You Would Have Today

If You Put $1,000 into Qualcomm Stock 20 Years Ago, Here's What You Would Have TodayQualcomm stock has been a big disappointment for truly long-term investors.

-

If You'd Put $1,000 Into Home Depot Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into Home Depot Stock 20 Years Ago, Here's What You'd Have TodayHome Depot stock has been a buy-and-hold banger for truly long-term investors.

-

If You'd Put $1,000 Into Bank of America Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into Bank of America Stock 20 Years Ago, Here's What You'd Have TodayBank of America stock has been a massive buy-and-hold bust.