Stock Market Today: Interest Rate Moves, Debt Worries Roil Stocks

Stocks took a gut punch Tuesday as the 10-year Treasury yield climbed again and Senate Republicans blocked a bill to raise the debt limit.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

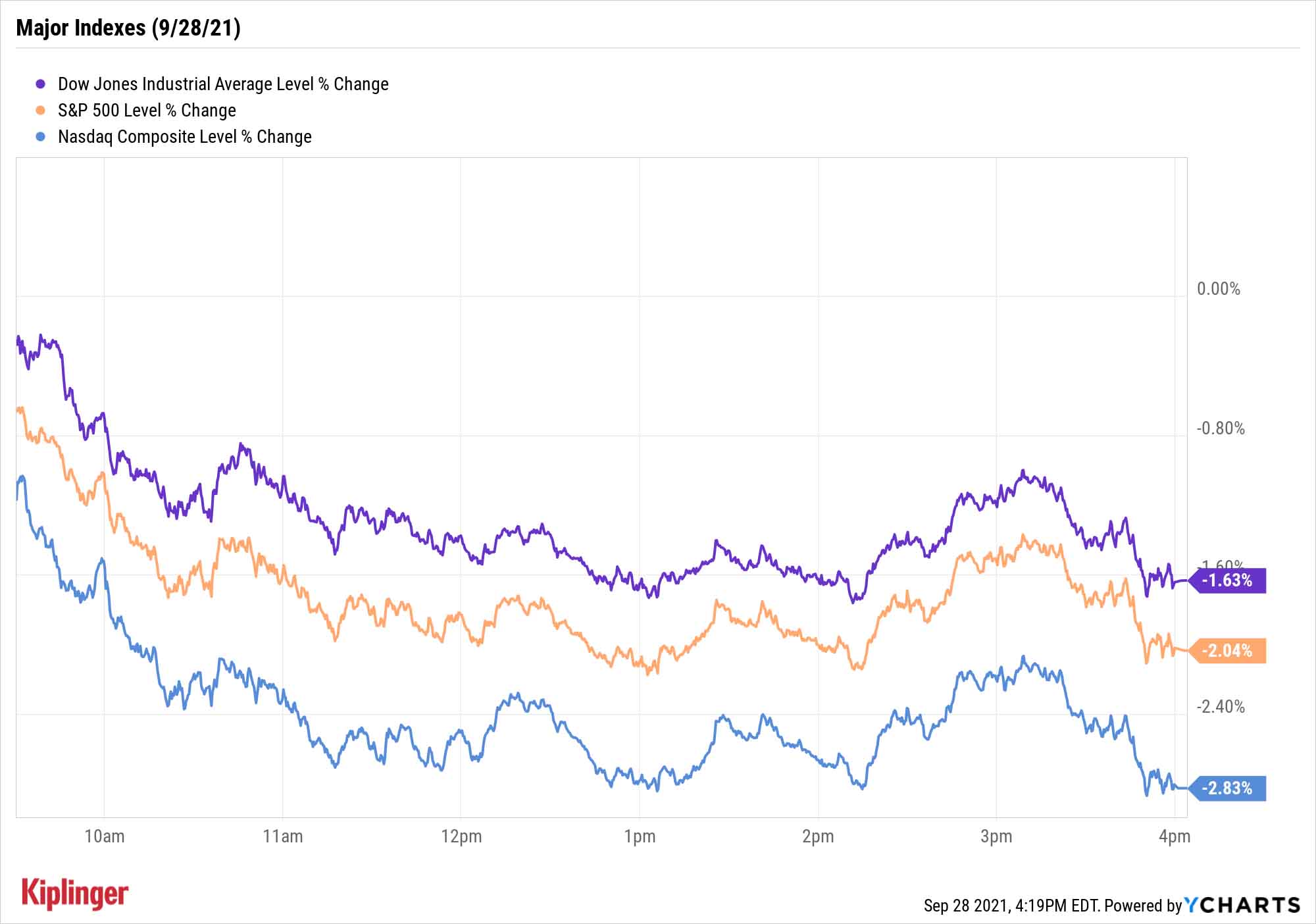

The stock market swooned on Tuesday amid another surge in Treasury yields and signs of trouble in Washington.

On the latter front, Senate Republicans on Monday evening blocked a bill that would raise the debt limit and avoid a government shutdown; Treasury Secretary Janet Yellen warned that the U.S. Treasury would run out of money by Oct. 18.

Today, meanwhile, yields on the 10-year Treasury note continued to sprint higher, reaching an intraday peak of 1.567% – a level it last hit in June – after eclipsing 1.5% yesterday.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

That sent stock investors to the exits: The Dow Jones Industrial Average declined 1.6% to 34,299, the S&P 500 fell 2.0% to 4,352, and the Nasdaq Composite dipped 2.8% to 14,546.

"Anytime we see the 10-year UST yield move such a dramatic amount in a short period of time, especially off of low starting levels, it generally coincides with a market selloff of some magnitude," says Brian Price, head of investment management for Commonwealth Financial Network.

Rate-sensitive mega-cap tech and communication stocks were hit worst, with Microsoft (MSFT, -3.6%), Facebook (FB, -3.7%) and Google parent Alphabet (GOOGL, -3.7%) among the day's notable losers; energy (+0.3%) was the only sector that finished in the green.

"It is not surprising to see value and cyclical stocks hold up better than their growth counterparts given the increase in yields," Price adds.

Other news in the stock market today:

- The small-cap Russell 2000 was knocked 2.3% lower to 2,229.

- Huntsman (HUN) bucked the bearish trend on Wall Street after hedge fund Starboard Value unveiled a roughly $500 million, or 8.4%, stake in the chemical firm, according to the Wall Street Journal. The activist investor is looking to push for changes at HUN in order to boost the share price, said people familiar with the matter, though no specifics were given. The stock closed up 6.3% today to bring its year-to-date gain to more than 18%.

- Ford Motor (F) was another one of just a handful of stocks to finish in positive territory, gaining 1.1%. This came after the automaker on Monday unveiled an $11.4 billion plan to build new facilities in Tennessee and Kentucky to produce electric vehicles (EV) and the batteries to power them. The initiative will be a joint venture between Ford and South Korean battery cell provider SK Innovation. CFRA analyst Garrett Nelson reiterated his Buy rating on F stock after the announcement, saying it "helps reassure investors at a time when many are on edge about the duration and impact of semiconductor shortages, which has inordinately impacted Ford relative to other automakers." Additionally, he sees Ford's EV strategy as the "most prudent and balanced" among major original equipment manufacturers.

- U.S. crude oil futures shed 0.2% to settle at $72.59 per barrel, snapping a five-day winning streak.

- Gold futures gave back 0.8% to finish at $1,737.50 an ounce.

- The CBOE Volatility Index (VIX) rocked 23.9% higher to 23.25.

- Bitcoin prices weren't immune from Tuesday's jitters. The cryptocurrency declined 3.3% to $41,607.45. (Bitcoin trades 24 hours a day; prices reported here are as of 4 p.m. each trading day.)

About That Debt Ceiling

America's debt ceiling situation bears close monitoring until it's resolved. Chris Zaccarelli, chief investment officer for Independent Advisor Alliance, details the risks:

"The political argument this week is over the debt ceiling – a law that limits how much money the Treasury Department can raise to pay for expenses that Congress has already approved. Failure to raise the debt ceiling – which will take an act of Congress – could result in the U.S. defaulting on its debt, which could create massive disruptions to financial markets worldwide."

Many strategists see Congress escaping this fate in the 11th hour as it has several times in the past – Zaccarelli, for instance, thinks Congress "most likely" will raise the debt ceiling before the end of the week.

Still, volatility and downside could very well persist as long as debt-ceiling uncertainty is in play.

As always: Don't panic, just be prepared.

In this case, assess some of the safety valves you have at your disposal. First to mind are traditional defensive sectors such as consumer staples and utilities. And, of course, you've got bonds. Even "safe" fixed-income could take a hit in the event of a default, but ultimately, shorter-term bonds provide a lot of protection against a plethora of risks. Here, we look at seven such bond funds that can provide some ballast:

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Kyle Woodley is the Editor-in-Chief of WealthUp, a site dedicated to improving the personal finances and financial literacy of people of all ages. He also writes the weekly The Weekend Tea newsletter, which covers both news and analysis about spending, saving, investing, the economy and more.

Kyle was previously the Senior Investing Editor for Kiplinger.com, and the Managing Editor for InvestorPlace.com before that. His work has appeared in several outlets, including Yahoo! Finance, MSN Money, Barchart, The Globe & Mail and the Nasdaq. He also has appeared as a guest on Fox Business Network and Money Radio, among other shows and podcasts, and he has been quoted in several outlets, including MarketWatch, Vice and Univision. He is a proud graduate of The Ohio State University, where he earned a BA in journalism.

You can check out his thoughts on the markets (and more) at @KyleWoodley.

-

Nasdaq Leads a Rocky Risk-On Rally: Stock Market Today

Nasdaq Leads a Rocky Risk-On Rally: Stock Market TodayAnother worrying bout of late-session weakness couldn't take down the main equity indexes on Wednesday.

-

Quiz: Do You Know How to Avoid the "Medigap Trap?"

Quiz: Do You Know How to Avoid the "Medigap Trap?"Quiz Test your basic knowledge of the "Medigap Trap" in our quick quiz.

-

5 Top Tax-Efficient Mutual Funds for Smarter Investing

5 Top Tax-Efficient Mutual Funds for Smarter InvestingMutual funds are many things, but "tax-friendly" usually isn't one of them. These are the exceptions.

-

AI Unwind Takes 2% Off the Nasdaq: Stock Market Today

AI Unwind Takes 2% Off the Nasdaq: Stock Market TodayMarkets are paying more and more attention to hyperscalers' plans to spend more and more money on artificial intelligence.

-

Stocks Sink With Alphabet, Bitcoin: Stock Market Today

Stocks Sink With Alphabet, Bitcoin: Stock Market TodayA dismal round of jobs data did little to lift sentiment on Thursday.

-

Nasdaq Slides 1.4% on Big Tech Questions: Stock Market Today

Nasdaq Slides 1.4% on Big Tech Questions: Stock Market TodayPalantir Technologies proves at least one publicly traded company can spend a lot of money on AI and make a lot of money on AI.

-

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have TodayAdvanced Micro Devices stock is soaring thanks to AI, but as a buy-and-hold bet, it's been a market laggard.

-

Nasdaq Drops 172 Points on MSFT AI Spend: Stock Market Today

Nasdaq Drops 172 Points on MSFT AI Spend: Stock Market TodayMicrosoft, Meta Platforms and a mid-cap energy stock have a lot to say about the state of the AI revolution today.

-

S&P 500 Tops 7,000, Fed Pauses Rate Cuts: Stock Market Today

S&P 500 Tops 7,000, Fed Pauses Rate Cuts: Stock Market TodayInvestors, traders and speculators will probably have to wait until after Jerome Powell steps down for the next Fed rate cut.

-

S&P 500 Hits New High Before Big Tech Earnings, Fed: Stock Market Today

S&P 500 Hits New High Before Big Tech Earnings, Fed: Stock Market TodayThe tech-heavy Nasdaq also shone in Tuesday's session, while UnitedHealth dragged on the blue-chip Dow Jones Industrial Average.

-

Dow Rises 313 Points to Begin a Big Week: Stock Market Today

Dow Rises 313 Points to Begin a Big Week: Stock Market TodayThe S&P 500 is within 50 points of crossing 7,000 for the first time, and Papa Dow is lurking just below its own new all-time high.