Stock Market Today: Tech Takes Off as Stocks Swing Higher

A gaggle of technology and tech-esque names finished with solid gains on a Monday that saw 10 out of 11 sectors finish in the black.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Investors enjoyed broad-based gains on Monday as the market pendulum again swung in the bulls' direction, despite a quiet day on both the news and data fronts.

"Rather than developing a case for a pending directional move, including a potential major correction, we think the market is just exhibiting higher volatility and greater uncertainty at this time," says Lowry Research, CFRA's technical advisory service.

In the leadership position today were technology and other growth-oriented sectors, possibly unleashed by dimming prospects for sweeping tax changes. Republicans continue to balk at President Joe Biden's infrastructure plan – which includes a hike in the corporate tax rate – even after the White House lowered the price tag from more than $2.2 trillion to $1.7 trillion.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

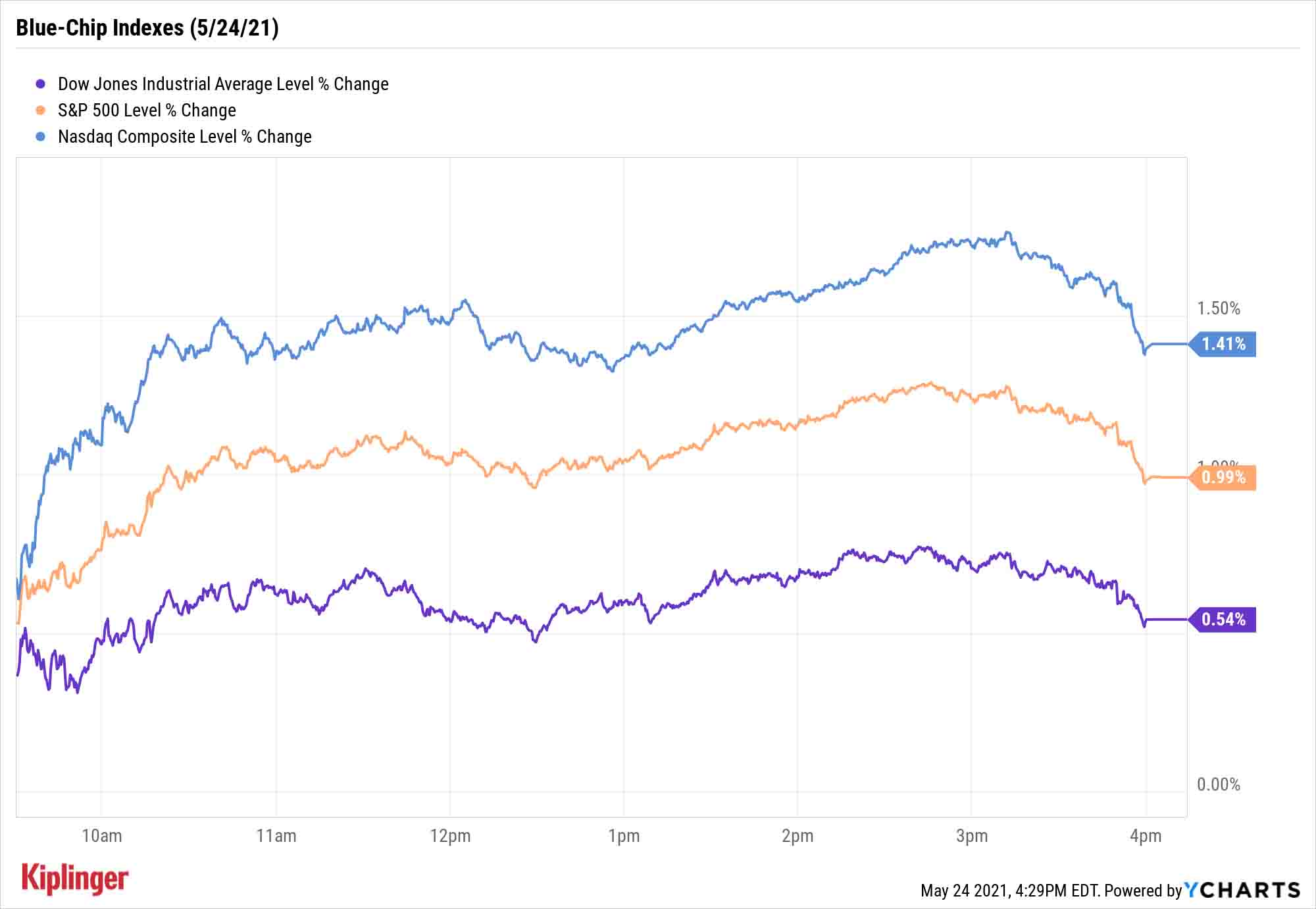

Tesla (TSLA, +4.4%), Facebook (FB, +2.7%) and Google parent Alphabet (GOOGL, +2.9%) all notched solid gains to lead the Nasdaq Composite 1.4% higher to 13,661. The S&P 500, meanwhile, advanced 1.0% to 4,197.

The Dow Jones Industrial Average extended its win streak to three with a more modest 0.5% gain to 34,393, also buoyed by tech; Cisco Systems (CSCO, +1.8%), Microsoft (MSFT, +2.3%) and Intel (INTC, +1.6%) were among the industrial average's top performers.

Other action in the stock market today:

- The Russell 2000 climbed 0.5% to 2,227.

- Virgin Galactic Holdings (SPCE, +27.6%) was a notable gainer on Wall Street today, after the company completed a successful test flight of its spacecraft VSS Unity on Saturday. It was SPCE's first spaceflight since early 2019.

- Beyond Meat (BYND, +10.0%) got a lift after shares of the plant-based meat maker received a double upgrade from Jefferies. The firm lifted its rating on BYND stock to Outperform from Underperform (the equivalents of Buy and Sell, respectively) on expectations that food service sales will bounce back as more restaurants reopen.

- U.S. crude oil futures spiked 3.9% to end at $66.05 per barrel. Boosting black gold were reports that negotiations over a possible revival of the Iran nuclear deal might be postponed until after the country's presidential election in June, which means U.S. sanctions on Tehran will remain in place for the time being.

- Gold futures edged up 0.4% to settle at $1,884.50 an ounce.

- The CBOE Volatility Index (VIX) retreated by 8.7% to 18.40.

- Bitcoin prices were up 9.3% from Friday afternoon to $39,660.14, though that hardly tells the whole story. It and other cryptocurrencies crashed over the weekend, with Bitcoin prices slumping to nearly $30,000 before staging an aggressive recovery. (Bitcoin trades 24 hours a day; prices reported here are as of 4 p.m. each trading day.)

Cash Is King

The next few months are likely to reward patience and maturity – a generous way of saying that analysts are increasingly expecting modest gains ahead.

"The pickup in inflation and related concerns about the Federal Reserve pulling back support offer evidence of an economic cycle getting a bit older. Older cycles tend to bring more moderate stock market gains," says Jeffrey Buchbinder, equity strategist for LPL Financial.

But he adds that, given a backdrop of an improving economy, ongoing federal stimuli and rising vaccination rates, "We would not expect pullbacks to last very long, and any potential corrections are likely to be shallow. We would be looking for opportunities to add equities on potential dips."

In other words: If you can keep your head during down days, you should be able to poach a value buy or two – whether you're targeting smaller, low-dollar-cost shares such as these 10 dirt-cheap stocks, or Wall Street juggernauts such as these five potential-packed large caps.

But if you're looking for an X-factor as you evaluate stocks in the bargain bin, keep your eye on cash – free cash flow (FCF), to be specific.

Companies that continuously have gobs of cash left over after tackling their expenses and investments can do a number of useful things with it: pay a dividend, buy back shares or engage in some transformational M&A. We've scoured the holdings of several funds that focus on FCF to identify 10 standout stocks that know how to make cash … and know how to use it.

Kyle Woodley was long SPCE as of this writing.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Kyle Woodley is the Editor-in-Chief of WealthUp, a site dedicated to improving the personal finances and financial literacy of people of all ages. He also writes the weekly The Weekend Tea newsletter, which covers both news and analysis about spending, saving, investing, the economy and more.

Kyle was previously the Senior Investing Editor for Kiplinger.com, and the Managing Editor for InvestorPlace.com before that. His work has appeared in several outlets, including Yahoo! Finance, MSN Money, Barchart, The Globe & Mail and the Nasdaq. He also has appeared as a guest on Fox Business Network and Money Radio, among other shows and podcasts, and he has been quoted in several outlets, including MarketWatch, Vice and Univision. He is a proud graduate of The Ohio State University, where he earned a BA in journalism.

You can check out his thoughts on the markets (and more) at @KyleWoodley.

-

Americans, Even With Higher Incomes, Are Feeling the Squeeze

Americans, Even With Higher Incomes, Are Feeling the SqueezeA 50-year mortgage probably isn’t the answer, but there are other ways to alleviate the continuing sting of high prices

-

Hiding the Truth From Your Financial Adviser Can Cost You

Hiding the Truth From Your Financial Adviser Can Cost YouHiding assets or debt from a financial adviser damages the relationship as well as your finances. If you're not being fully transparent, it's time to ask why.

-

How to Manage a Disagreement With Your Financial Adviser

How to Manage a Disagreement With Your Financial AdviserKnowing how to deal with a disagreement can improve both your finances and your relationship with your planner.

-

If You'd Put $1,000 Into Caterpillar Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into Caterpillar Stock 20 Years Ago, Here's What You'd Have TodayCaterpillar stock has been a remarkably resilient market beater for a very long time.

-

Dow Absorbs Disruptions, Adds 370 Points: Stock Market Today

Dow Absorbs Disruptions, Adds 370 Points: Stock Market TodayInvestors, traders and speculators will hear from President Donald Trump tonight, and then they'll listen to Nvidia CEO Jensen Huang tomorrow.

-

AI Unwind Takes 2% Off the Nasdaq: Stock Market Today

AI Unwind Takes 2% Off the Nasdaq: Stock Market TodayMarkets are paying more and more attention to hyperscalers' plans to spend more and more money on artificial intelligence.

-

Stocks Sink With Alphabet, Bitcoin: Stock Market Today

Stocks Sink With Alphabet, Bitcoin: Stock Market TodayA dismal round of jobs data did little to lift sentiment on Thursday.

-

Nasdaq Slides 1.4% on Big Tech Questions: Stock Market Today

Nasdaq Slides 1.4% on Big Tech Questions: Stock Market TodayPalantir Technologies proves at least one publicly traded company can spend a lot of money on AI and make a lot of money on AI.

-

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have TodayAdvanced Micro Devices stock is soaring thanks to AI, but as a buy-and-hold bet, it's been a market laggard.

-

Nasdaq Drops 172 Points on MSFT AI Spend: Stock Market Today

Nasdaq Drops 172 Points on MSFT AI Spend: Stock Market TodayMicrosoft, Meta Platforms and a mid-cap energy stock have a lot to say about the state of the AI revolution today.

-

S&P 500 Tops 7,000, Fed Pauses Rate Cuts: Stock Market Today

S&P 500 Tops 7,000, Fed Pauses Rate Cuts: Stock Market TodayInvestors, traders and speculators will probably have to wait until after Jerome Powell steps down for the next Fed rate cut.