Stock Market Today: Recovery Plays Lead the Way as Stocks Calmly Climb

Airlines, restaurants and cruise liners were among some of the session's biggest gainers in a smooth, fruitful Monday for stocks.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Wall Street kicked off the week with a surprisingly, refreshingly gentle Monday session with modest but steady movement across most of the market.

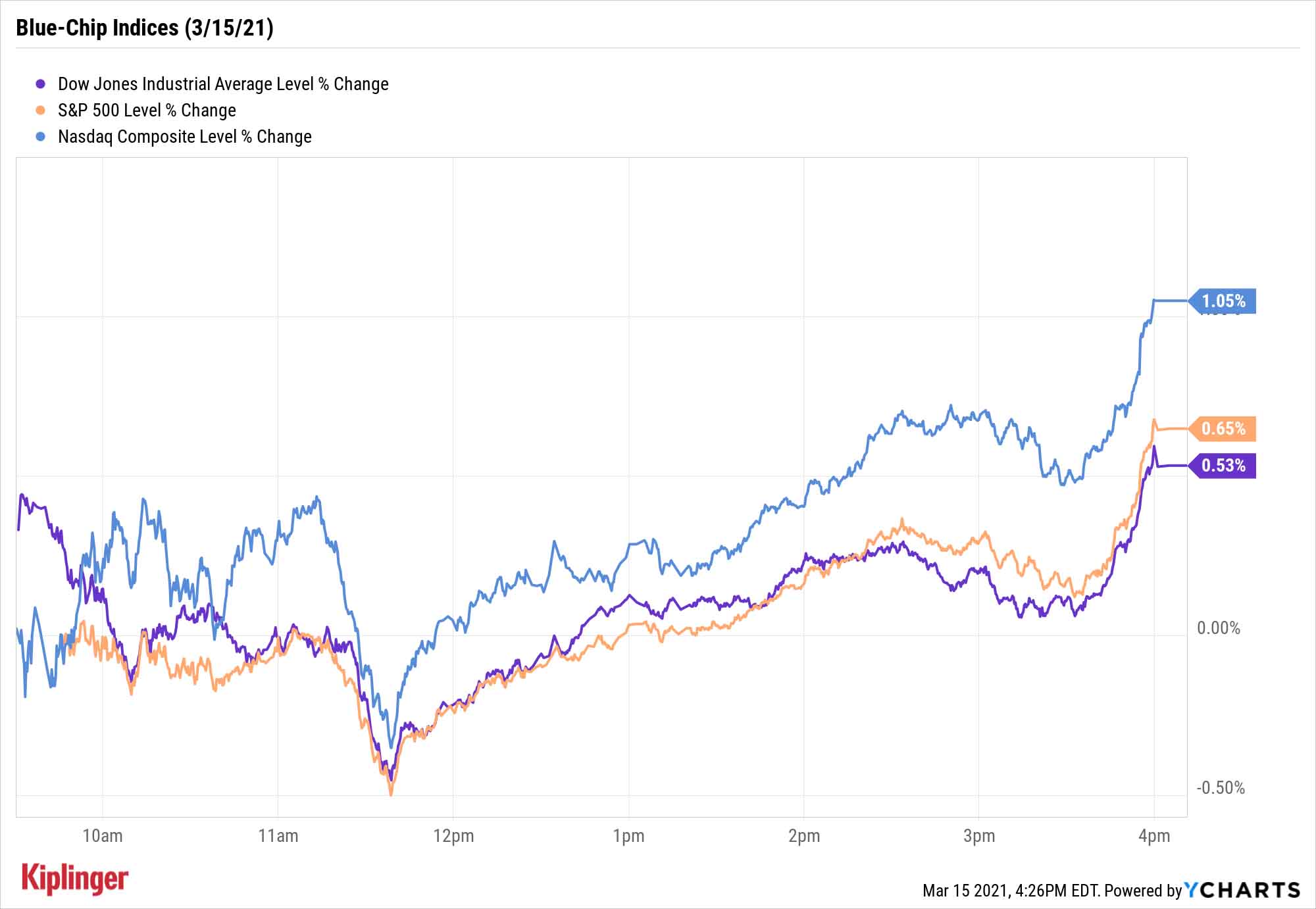

The tech-heavy Nasdaq Composite, which has spent much of the past few weeks lurching up and down on inflation fears, led the other major indices thanks to the likes of Apple (AAPL, +2.5%) and Facebook (FB, +2.0%).

But among the market's biggest leaders were a wide variety of "recovery" plays, including carriers such as United Airlines (UAL, +8.3%) and American Airlines (AAL, +7.7%), cruise lines including Carnival (CCL, +4.7%) and Norwegian Cruise Line Holdings (NCLH, +2.4%), and restaurant stocks such as McDonald's (MCD, +3.8%) and KFC/Taco Bell parent Yum! Brands (YUM, +3.0%).

Article continues belowFrom just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

"As vaccines become more widely available and the economy opens up, we should see a rapid increase in spending on services," says Raymond James Chief Economist Scott Brown. "One lesson from the 1918 pandemic is that people will be eager to make up for lost time (as we saw during the Roaring Twenties)."

The Nasdaq closed with a 1.1% gain to 13,459. The S&P 500 (+0.7% to 3,968), Dow Jones Industrial Average (+0.5% to 32,953) and Russell 2000 (+0.3% to 2,360) all finished with more modest improvements, but also all notched record closes.

Other action in the stock market today:

- U.S. crude oil futures slipped 0.2% to settle at $65.50 per barrel.

- Gold futures improved by 0.6% to $1,729.20 per ounce.

- Bitcoin prices soared to more than $61,000 over the weekend, but finished Monday 0.2% lower from Friday's levels to $56,657. (Bitcoin trades 24 hours a day; prices reported here are as of 4 p.m. each trading day.)

Start Monitoring What Investors Are Throwing Away

If this is all starting to sound familiar, that's because you've been hearing it for a while.

Analysts and strategists have been regularly and frequently beating the drum of an economic reopening that will reanimate cyclical sectors – which, by the way, will benefit all the more from weak year-over-year earnings and revenue comparisons.

But in investing, as in chess, it pays to think a few steps ahead.

Investors are increasingly piling into the reflation/recovery trade, and it's clear that to do so, some of them are cashing out of tech and other growth stocks that had been sporting sometimes outrageous valuations. That's worth keeping an eye on.

You could start building a wish list from some of our top tech picks from the start of the year, or our list of long-term S&P 500 buys that would look far more attractive on a dip. You could also look for opportunities in long-term trends that the coronavirus helped accelerate.

Take video game stocks, for instance. Wall Street's experts still project rampant growth for this industry in the years to come, but these companies' shares went ballistic during 2020 as COVID accelerated the trend. Now that they're starting to cool off as investors chase the next thing, these video game stocks could start approaching much more reasonable levels – and offer opportunity to new buyers.

Kyle Woodley was long NCLH as of this writing.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Kyle Woodley is the Editor-in-Chief of WealthUp, a site dedicated to improving the personal finances and financial literacy of people of all ages. He also writes the weekly The Weekend Tea newsletter, which covers both news and analysis about spending, saving, investing, the economy and more.

Kyle was previously the Senior Investing Editor for Kiplinger.com, and the Managing Editor for InvestorPlace.com before that. His work has appeared in several outlets, including Yahoo! Finance, MSN Money, Barchart, The Globe & Mail and the Nasdaq. He also has appeared as a guest on Fox Business Network and Money Radio, among other shows and podcasts, and he has been quoted in several outlets, including MarketWatch, Vice and Univision. He is a proud graduate of The Ohio State University, where he earned a BA in journalism.

You can check out his thoughts on the markets (and more) at @KyleWoodley.