Stock Market Today: S&P 500 Sets New High as Biden Blesses Stimulus

The S&P 500, Dow and Russell 2000 all finished Thursday with new record closes after President Joe Biden signed his $1.9 trillion stimulus bill a day earlier than planned.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

Stocks enjoyed a day of widespread gains in the wake of promising employment data and the finalization of a much-anticipated booster shot to the economy.

The Labor Department said Thursday that first unemployment filings for the week ended March 6 declined by 42,000 to 712,000 – the lowest total since early November. That also was below estimates for 725,000 applications for jobless benefits.

Stocks were further energized by President Joe Biden, who signed his $1.9 trillion plan into law on Thursday – a day ahead of schedule. That gets the ball rolling on a number of programs, most notably $1,400 stimulus checks to millions of Americans.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

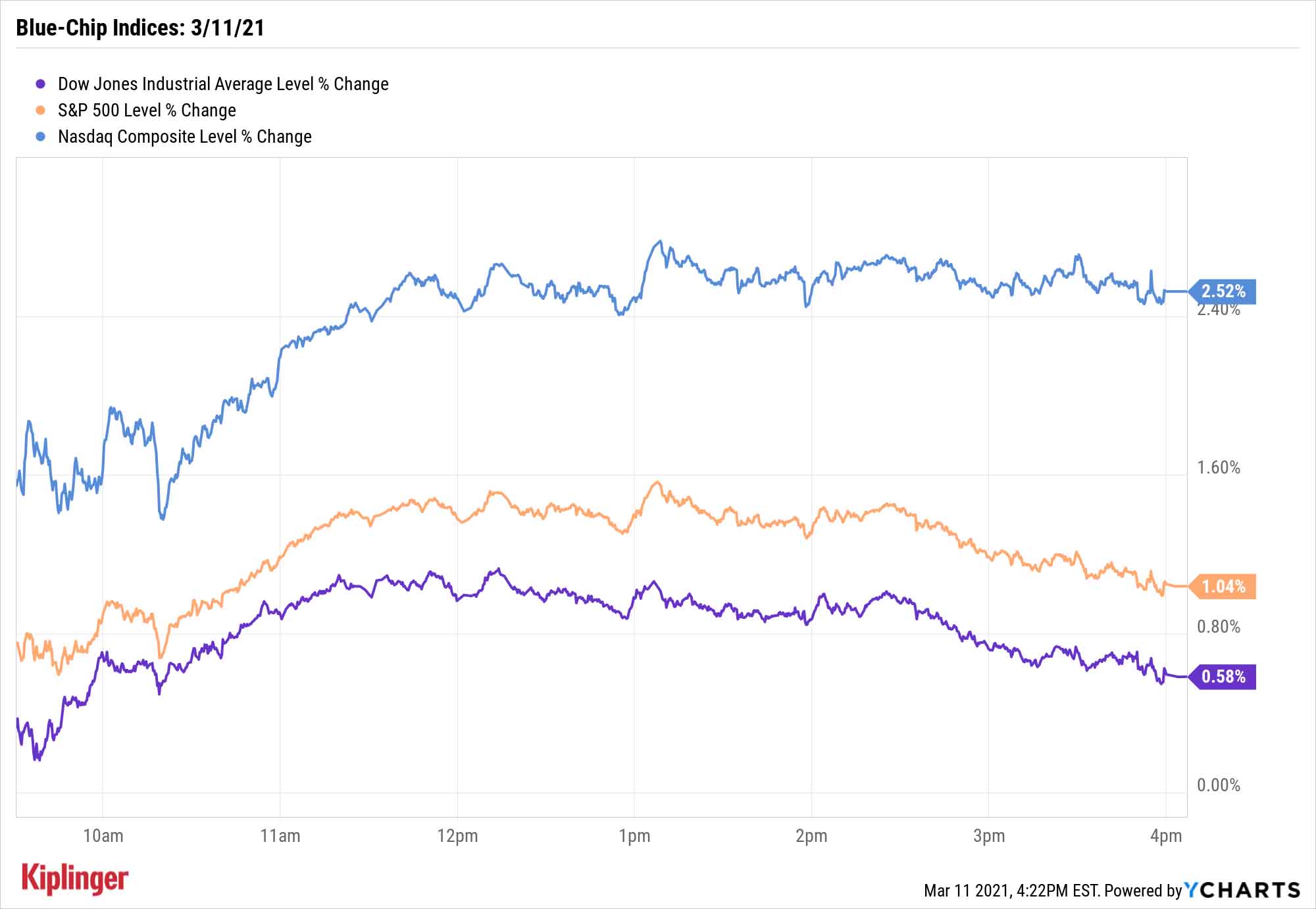

The Dow Jones Industrial Average finished 0.6% higher to a record 32,485, and the S&P 500 gained 1.0% to 3,939 to surpass its February all-time highs. The small-cap Russell 2000 also enjoyed a record close, up 2.3% to 2,338. But out in front today was the Jekyll-and-Hyde Nasdaq Composite, up 2.5% to 13,398 thanks to the likes of Facebook (FB, +3.4%), Nvidia (NVDA, +4.2%) and Tesla (TSLA, +4.7%).

Other action in the stock market today:

- U.S. crude oil futures jumped 2.3% to settle at $65.92 per barrel.

- Gold futures finished marginally higher at $1,722.60 per ounce.

- Bitcoin prices continued their streak, gaining 2.1% to $57,506. (Bitcoin trades 24 hours a day; prices reported here are as of 4 p.m. each trading day.)

What's Next?

Naturally, given the forward-looking nature of the stock market, Wall Street's pros are casting a wary eye to the future even as they celebrate today's advances.

For instance, Brad McMillan, chief investment officer for Commonwealth Financial Network, says "The passage of the new COVID stimulus bill means that short-term risks to the economy are largely eliminated," but adds that "as economic risks recede, however, fears of overheating and inflation are rising. This will only push rates higher, which will create a headwind for markets."

"Markets have generally reacted positively to the additional fiscal spending measures," adds Charlie Ripley, senior investment strategist for Allianz Investment Management, "but stimulus eventually wears off, and investors will have to be prepared to cross that bridge when it comes."

That doesn't mean the party's totally over; largely speaking, analysts continue to suggest value stocks and reflation-trade plays as opposed to growthier strategies.

But one area of growth that continues to see voracious investing appetite is initial public offerings (IPOs), which allow people to grab a bite of previously private companies.

Korean e-commerce play Coupang (CPNG) went public today and jumped 40.7% from its $35 IPO pricing; Roblox (RBLX, +6.3%), a gaming and game-creation platform popular with kids, added to its 54.4% first-day gains from its Wednesday direct listing (an alternative to IPOs that also brings private companies public).

So, what's coming public next? We've crossed Coupang, Roblox and a few other offerings off our running list of upcoming IPOs and replaced them with additional familiar tech and consumer brands expected to hit the markets over the next few months. Check them out!

Kyle Woodley was long NVDA and RBLX as of this writing.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Kyle Woodley is the Editor-in-Chief of WealthUp, a site dedicated to improving the personal finances and financial literacy of people of all ages. He also writes the weekly The Weekend Tea newsletter, which covers both news and analysis about spending, saving, investing, the economy and more.

Kyle was previously the Senior Investing Editor for Kiplinger.com, and the Managing Editor for InvestorPlace.com before that. His work has appeared in several outlets, including Yahoo! Finance, MSN Money, Barchart, The Globe & Mail and the Nasdaq. He also has appeared as a guest on Fox Business Network and Money Radio, among other shows and podcasts, and he has been quoted in several outlets, including MarketWatch, Vice and Univision. He is a proud graduate of The Ohio State University, where he earned a BA in journalism.

You can check out his thoughts on the markets (and more) at @KyleWoodley.

-

Nasdaq Leads a Rocky Risk-On Rally: Stock Market Today

Nasdaq Leads a Rocky Risk-On Rally: Stock Market TodayAnother worrying bout of late-session weakness couldn't take down the main equity indexes on Wednesday.

-

Quiz: Do You Know How to Avoid the "Medigap Trap?"

Quiz: Do You Know How to Avoid the "Medigap Trap?"Quiz Test your basic knowledge of the "Medigap Trap" in our quick quiz.

-

5 Top Tax-Efficient Mutual Funds for Smarter Investing

5 Top Tax-Efficient Mutual Funds for Smarter InvestingMutual funds are many things, but "tax-friendly" usually isn't one of them. These are the exceptions.

-

Stocks Make More Big Up and Down Moves: Stock Market Today

Stocks Make More Big Up and Down Moves: Stock Market TodayThe impact of revolutionary technology has replaced world-changing trade policy as the major variable for markets, with mixed results for sectors and stocks.

-

AI Unwind Takes 2% Off the Nasdaq: Stock Market Today

AI Unwind Takes 2% Off the Nasdaq: Stock Market TodayMarkets are paying more and more attention to hyperscalers' plans to spend more and more money on artificial intelligence.

-

Tech Stocks Fuel Strong Start to the Week: Stock Market Today

Tech Stocks Fuel Strong Start to the Week: Stock Market TodayThe blue-chip Dow Jones Industrial Average extended its run above 50,000 on Monday and there are plenty of catalysts to keep the 30-stock index climbing.

-

Dow Adds 1,206 Points to Top 50,000: Stock Market Today

Dow Adds 1,206 Points to Top 50,000: Stock Market TodayThe S&P 500 and Nasdaq also had strong finishes to a volatile week, with beaten-down tech stocks outperforming.

-

Dow Leads in Mixed Session on Amgen Earnings: Stock Market Today

Dow Leads in Mixed Session on Amgen Earnings: Stock Market TodayThe rest of Wall Street struggled as Advanced Micro Devices earnings caused a chip-stock sell-off.

-

Nasdaq Slides 1.4% on Big Tech Questions: Stock Market Today

Nasdaq Slides 1.4% on Big Tech Questions: Stock Market TodayPalantir Technologies proves at least one publicly traded company can spend a lot of money on AI and make a lot of money on AI.

-

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have TodayAdvanced Micro Devices stock is soaring thanks to AI, but as a buy-and-hold bet, it's been a market laggard.

-

Nasdaq Drops 172 Points on MSFT AI Spend: Stock Market Today

Nasdaq Drops 172 Points on MSFT AI Spend: Stock Market TodayMicrosoft, Meta Platforms and a mid-cap energy stock have a lot to say about the state of the AI revolution today.