ESG Disclosure Standards Go Global With ISSB Launch

The International Sustainability Standards Board will attempt to deliver ESG reporting standards that also focus on investor needs and building company value.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

Anyone who has dipped a toe in environmental, social, and governance (ESG) investing knows that there is an alphabet soup of reporting standards aiming to measure corporate adherence to sustainability.

Because government regulators have been reluctant to establish mandatory reporting standards, a host of mostly nonprofit groups have worked for decades to build consensus among the private sector, governments, investors, and stakeholders to build out voluntary reporting systems, such as the Global Reporting Initiative (GRI), or the Carbon Disclosure Project (CDP).

Companies were left to pick and choose between reporting frameworks, confounding investors’ ability to compare companies across platforms – and in some cases, enabling greenwashing by companies able to cherry-pick data for a particular reporting system.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

Enter the International Sustainability Standards Board (ISSB), a new effort to merge many ESG disclosure standards into one, and to encourage the uptake of these standards globally.

An Introduction to the ISSB

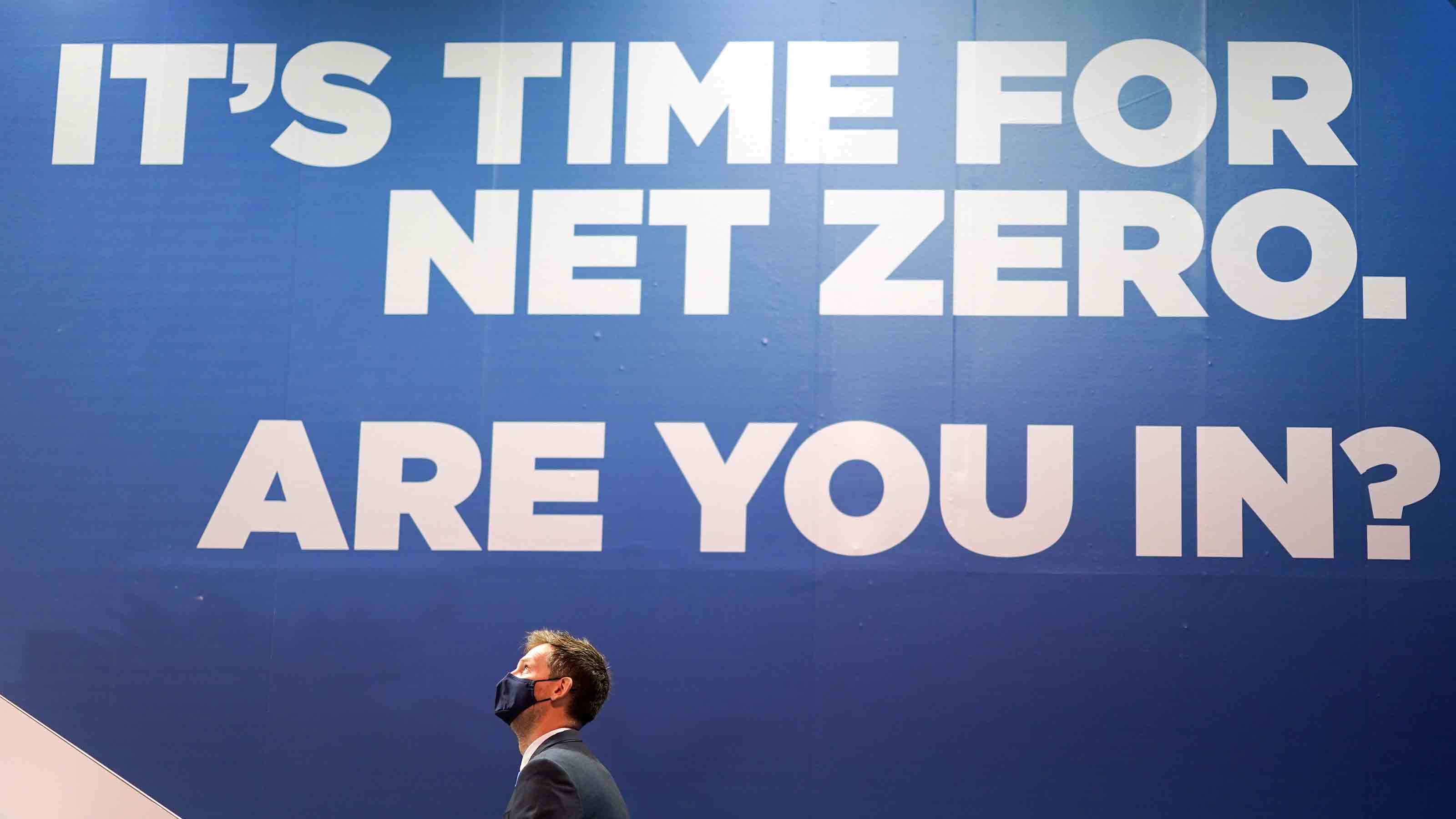

The International Sustainability Standards Board was announced this week at the COP26 global climate conference in Glasgow. Thirty-eight governments expressed support for the standards, including the U.S.

The ISSB will be managed by the International Financial Reporting Standards (IFRS) body, based in Germany. The IFRS released a working draft of climate-related disclosures that will be vetted over the next few months, and released in mid- to late 2022.

Erkki Liikanen, chair of the IFRS Foundation Trustees, says "Sustainability, and particularly climate change, is the defining issue of our time. To properly assess related opportunities and risks, investors require high-quality, transparent and globally comparable sustainability disclosures that are compatible with the financial statements. Establishing the ISSB and building on the innovation and expertise of … others will provide the foundations to achieve this goal."

The International Organization of Securities Commissions (IOSCO) will oversee the ISSB, and its goal is to ensure that ESG disclosure is as standardized and universal as financial reporting. IOSCO says that it had made clear "in 2020 that it was not happy with either the fragmented way private-sector standard setting for sustainability was developing or with the scale of the risk of greenwashing."

Will the ISSB Have Teeth?

A key question is how the ISSB will ensure buy-in from regulators and companies, who often complain that ESG reporting is not based on materiality (financial performance).

Happily, the IFRS Foundation established "first principles" for the ISSB standards. These include a focus on investor needs, on building company value, and other approaches that, according to the CFA Institute, "are explicitly intended to facilitate economic decision making."

Whether companies are required to report on the finalized ISSB climate reporting standards will depend in part on geography and timing. The European Commission is working with various reporting bodies to develop mandatory ESG reporting for roughly 49,000 large companies operating in the European Union or trading on EU exchanges. These standards will likely be published in 2022, implemented in 2023 and first reported on by companies in 2024, and they will be incorporating ISSB standards as appropriate for the EU region.

For U.S.-based companies with operations in the European Union, subsidiaries might be required to report based on these standards. Or the parent companies might decide that using EU standards is simpler than adopting multiple standards.

The IOSCO might also prove pivotal to adoption of some form of ISSB standards in the US. The IOSCO counts as members 95% of the world's securities markets – including the Securities and Exchange Commission (SEC). According to Reuters, the IOSCO could push for harmonization of ESG reporting.

The SEC this year issued preliminary guidance for climate disclosure by U.S. companies. Although there appears to be broad support for this effort within the SEC, it is by no means universal, and may be subject to political pressure.

Still, if executed well, the ISSB could lead to standardized, reliable ESG data on a universe of global companies, with a strong underpinning of materiality.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Ellen writes and edits retirement stories. She joined Kiplinger in 2021 as an investment and personal finance writer, focusing on retirement, credit cards and related topics. She worked in the mutual fund industry for 15 years as a manager and sustainability analyst at Calvert Investments. She earned a master’s from U.C. Berkeley in international relations and Latin America and a B.A. from Haverford College.

-

Nasdaq Leads a Rocky Risk-On Rally: Stock Market Today

Nasdaq Leads a Rocky Risk-On Rally: Stock Market TodayAnother worrying bout of late-session weakness couldn't take down the main equity indexes on Wednesday.

-

Quiz: Do You Know How to Avoid the "Medigap Trap?"

Quiz: Do You Know How to Avoid the "Medigap Trap?"Quiz Test your basic knowledge of the "Medigap Trap" in our quick quiz.

-

5 Top Tax-Efficient Mutual Funds for Smarter Investing

5 Top Tax-Efficient Mutual Funds for Smarter InvestingMutual funds are many things, but "tax-friendly" usually isn't one of them. These are the exceptions.

-

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have TodayAdvanced Micro Devices stock is soaring thanks to AI, but as a buy-and-hold bet, it's been a market laggard.

-

If You'd Put $1,000 Into UPS Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into UPS Stock 20 Years Ago, Here's What You'd Have TodayUnited Parcel Service stock has been a massive long-term laggard.

-

If You'd Put $1,000 Into Lowe's Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into Lowe's Stock 20 Years Ago, Here's What You'd Have TodayLowe's stock has delivered disappointing returns recently, but it's been a great holding for truly patient investors.

-

If You'd Put $1,000 Into 3M Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into 3M Stock 20 Years Ago, Here's What You'd Have TodayMMM stock has been a pit of despair for truly long-term shareholders.

-

If You'd Put $1,000 Into Coca-Cola Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into Coca-Cola Stock 20 Years Ago, Here's What You'd Have TodayEven with its reliable dividend growth and generous stock buybacks, Coca-Cola has underperformed the broad market in the long term.

-

If You Put $1,000 into Qualcomm Stock 20 Years Ago, Here's What You Would Have Today

If You Put $1,000 into Qualcomm Stock 20 Years Ago, Here's What You Would Have TodayQualcomm stock has been a big disappointment for truly long-term investors.

-

If You'd Put $1,000 Into Home Depot Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into Home Depot Stock 20 Years Ago, Here's What You'd Have TodayHome Depot stock has been a buy-and-hold banger for truly long-term investors.

-

If You'd Put $1,000 Into Bank of America Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into Bank of America Stock 20 Years Ago, Here's What You'd Have TodayBank of America stock has been a massive buy-and-hold bust.