Collectible Vintage Photos Emerge as Investable Asset Class

Many of the most valuable vintage photos are sports-related, and limited supply and high demand, as well as careful and trusted authentication, are key.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

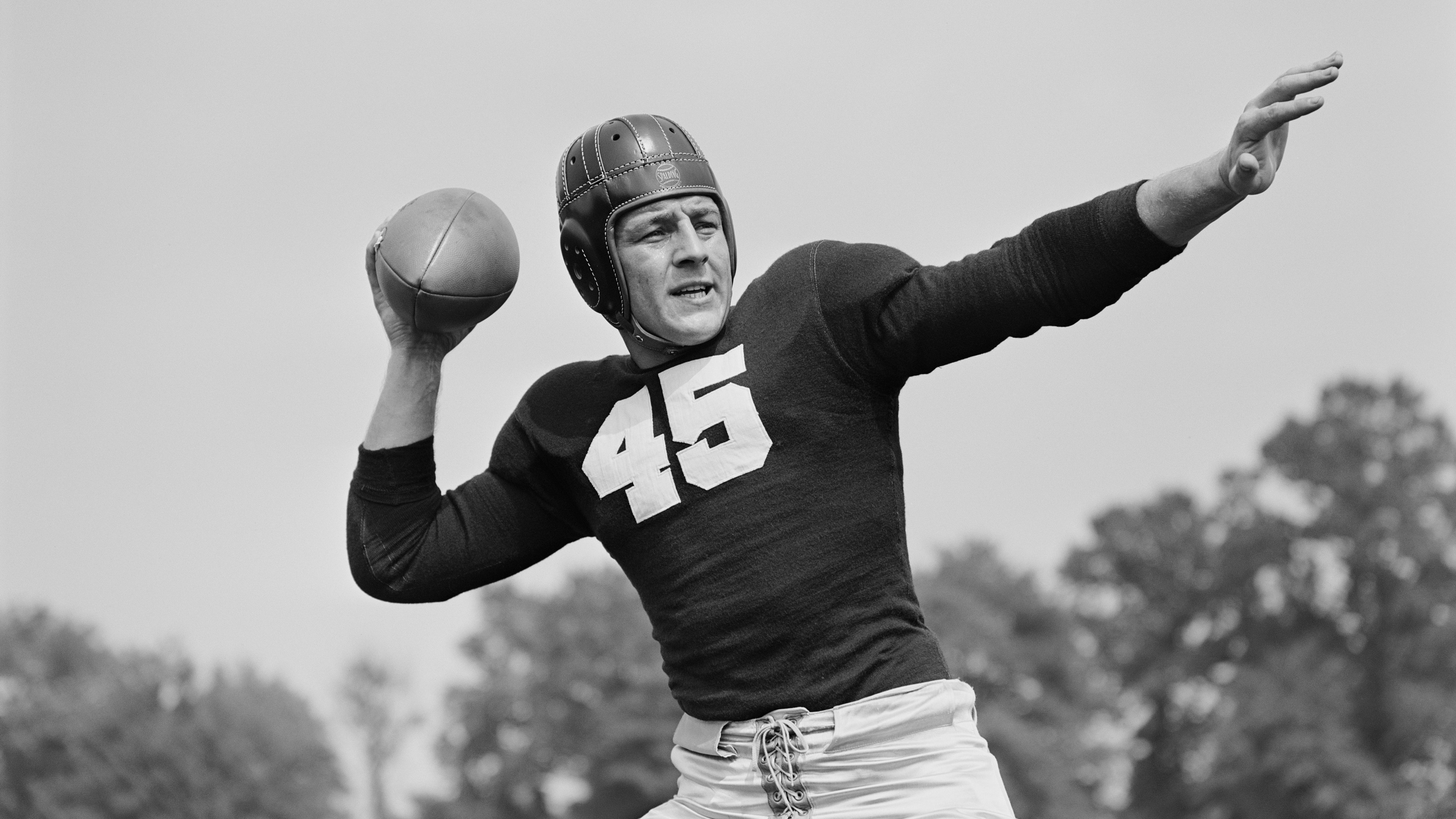

With global financial markets sliding sideways, visionary investors are on the lookout for new asset classes. One tangible subclass you can actually see with your eyes is worth checking out: vintage photos.

Fine art pieces have long been found in the portfolios of high-net-worth individuals and institutions — and even pooled, in recent years, and turned into quasi-securities. The unique digital images known as NFTs (non-fungible tokens) were a massive craze-turned-crash.

Vintage photographs occupy a different space, more closely adjacent to the world of rare collectibles. Many of the most valuable vintage photos are sports-related: In 2020, a 110-year-old photo of legendary baseball player Ty Cobb sold for an eye-popping $390,000. Auction houses like Robert Edward, Heritage, Lelands and even eBay routinely facilitate trades of images for tens of thousands of dollars each.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

As with collectibles like sports trading cards and autographs, the key to value in vintage photographs is not only limited supply and high demand but careful and trusted authentication. Investment-grade vintage photographs tend to be authenticated by one of a handful of well-known firms, such as PSA (where Mark Cuban and Kevin Durant are significant investors).

PSA was also instrumental in the creation of a system for grading vintage photographs that has become the market standard. Photos are classified as being one of four types, based on proximity to the original negative. Types III and IV, the least valuable, are produced from duplicate negatives. Type II photos come from the original negative but were made two or more years after the photo was taken. Type I photos are printed from the original negative within two years of the original event.

Most or all investment-grade vintage are either Type I or Type II photos. The $390,000 Cobb image was judged to be a Type I photo, taken and developed on the same day (July 23, 1910) by a known photographer, Charles Conlon of the New York Evening Telegram).

As with all forms of art, the value of a vintage photograph has a subjective element that is dependent on the content and composition of the image itself. Original photos of timeless celebrities will always have value, even if they aren’t particularly vintage. A 1993 print of British model Kate Moss by fashion photographer Albert Watson sold for $25,000 in 2017.

But in a world that is now and will forever be awash in cheap digital content, all types of high-grade vintage photographs have the power to hold collectors’ and investors’ attention.

In line with fine art and collectibles, a driving force in the vintage photo market is a community of passionate enthusiasts and connoisseurs who find satisfaction in owning rare things of beauty or historical significance. But vintage photos have also drawn an increasing number of investors primarily interested in financial return and diversification.

As for how investors can access this market, there’s no single or simple answer, but the more reputable auction houses and well-known dealers are good places to start.

Even for those with a passion for collecting will want to limit asset subclasses like vintage photos to 10% or so of your overall portfolio. (I’m a sports memorabilia collector, and my collection, acquired over several decades, hovers around this mark in mine.)

It’s also good to remember that these aren’t necessarily highly liquid assets and that they’re better suited to longer holding periods. Within your portfolio, I think it’s useful to think in terms of three pools: one up to 10 years, one from 11 to 20 years and a third that’s 20-plus years. All tangible collectible assets should go into the latter two pools.

This also means that serious investors/collectors will have a mindset of buying during market downturns, just as with financial assets. But while collectibles markets will soften during financial downturns, such assets can be surprisingly non-correlated to other markets, in particular the stock market. That’s a useful feature for wealth management planning and may be particularly relevant if today’s sideways trend continues.

The many disruptions on the horizon for our AI-infused world may help stoke the deep-rooted human longing for tangible assets and simpler moments. Together, I see those factors continuing to drive the market for vintage photographs. That means some pictures will be worth not only a thousand words, but tens or hundreds of thousands of dollars.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Tom Ruggie, ChFC®, CFP®, founded Destiny Family Office, a Destiny Wealth Partners firm, to help clients manage the increasing complexities inherent in their business and personal lives. He has identified three key areas where his firm can make a significant difference: presenting a compelling sphere of investments, including alternative, direct and co-investment opportunities; creating a special emphasis on high-end collectors whose collections signify significant alternative investments; and strengthening the firm’s private trust capabilities. Ruggie has become one of the most respected financial advisers in the industry, receiving national recognition and rankings including: 7x Forbes Best-in-State Wealth Advisors (including 2024; #1 N Florida), InvestmentNews Awards RIA Team of the Year (2024), Forbes Top 250 RIA Firms (2023), Forbes Finance Council since 2016, 12x Barron’s Top 1200 Financial Advisors (including 2024), InvestmentNews Top 75 Fastest-Growing Fee-Only RIAs (2023), 12x Financial Advisor Magazine America’s Top RIAs (including 2024), 3x Family Wealth Report Awards Finalist (2024), USA Today Best Financial Advisory Firms (2023).

-

Quiz: Do You Know How to Avoid the "Medigap Trap?"

Quiz: Do You Know How to Avoid the "Medigap Trap?"Quiz Test your basic knowledge of the "Medigap Trap" in our quick quiz.

-

5 Top Tax-Efficient Mutual Funds for Smarter Investing

5 Top Tax-Efficient Mutual Funds for Smarter InvestingMutual funds are many things, but "tax-friendly" usually isn't one of them. These are the exceptions.

-

AI Sparks Existential Crisis for Software Stocks

AI Sparks Existential Crisis for Software StocksThe Kiplinger Letter Fears that SaaS subscription software could be rendered obsolete by artificial intelligence make investors jittery.

-

Social Security Break-Even Math Is Helpful, But Don't Let It Dictate When You'll File

Social Security Break-Even Math Is Helpful, But Don't Let It Dictate When You'll FileYour Social Security break-even age tells you how long you'd need to live for delaying to pay off, but shouldn't be the sole basis for deciding when to claim.

-

I'm an Opportunity Zone Pro: This Is How to Deliver Roth-Like Tax-Free Growth (Without Contribution Limits)

I'm an Opportunity Zone Pro: This Is How to Deliver Roth-Like Tax-Free Growth (Without Contribution Limits)Investors who combine Roth IRAs, the gold standard of tax-free savings, with qualified opportunity funds could enjoy decades of tax-free growth.

-

One of the Most Powerful Wealth-Building Moves a Woman Can Make: A Midcareer Pivot

One of the Most Powerful Wealth-Building Moves a Woman Can Make: A Midcareer PivotIf it feels like you can't sustain what you're doing for the next 20 years, it's time for an honest look at what's draining you and what energizes you.

-

I'm a Wealth Adviser Obsessed With Mahjong: Here Are 8 Ways It Can Teach Us How to Manage Our Money

I'm a Wealth Adviser Obsessed With Mahjong: Here Are 8 Ways It Can Teach Us How to Manage Our MoneyThis increasingly popular Chinese game can teach us not only how to help manage our money but also how important it is to connect with other people.

-

Looking for a Financial Book That Won't Put Your Young Adult to Sleep? This One Makes 'Cents'

Looking for a Financial Book That Won't Put Your Young Adult to Sleep? This One Makes 'Cents'"Wealth Your Way" by Cosmo DeStefano offers a highly accessible guide for young adults and their parents on building wealth through simple, consistent habits.

-

Global Uncertainty Has Investors Running Scared: This Is How Advisers Can Reassure Them

Global Uncertainty Has Investors Running Scared: This Is How Advisers Can Reassure ThemHow can advisers reassure clients nervous about their plans in an increasingly complex and rapidly changing world? This conversational framework provides the key.

-

I'm a Real Estate Investing Pro: This Is How to Use 1031 Exchanges to Scale Up Your Real Estate Empire

I'm a Real Estate Investing Pro: This Is How to Use 1031 Exchanges to Scale Up Your Real Estate EmpireSmall rental properties can be excellent investments, but you can use 1031 exchanges to transition to commercial real estate for bigger wealth-building.

-

Should You Jump on the Roth Conversion Bandwagon? A Financial Adviser Weighs In

Should You Jump on the Roth Conversion Bandwagon? A Financial Adviser Weighs InRoth conversions are all the rage, but what works well for one household can cause financial strain for another. This is what you should consider before moving ahead.