Is This a New Bull Market? Or the Same Old Bear?

The rally since March has been historic, but it still needs to prove itself.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

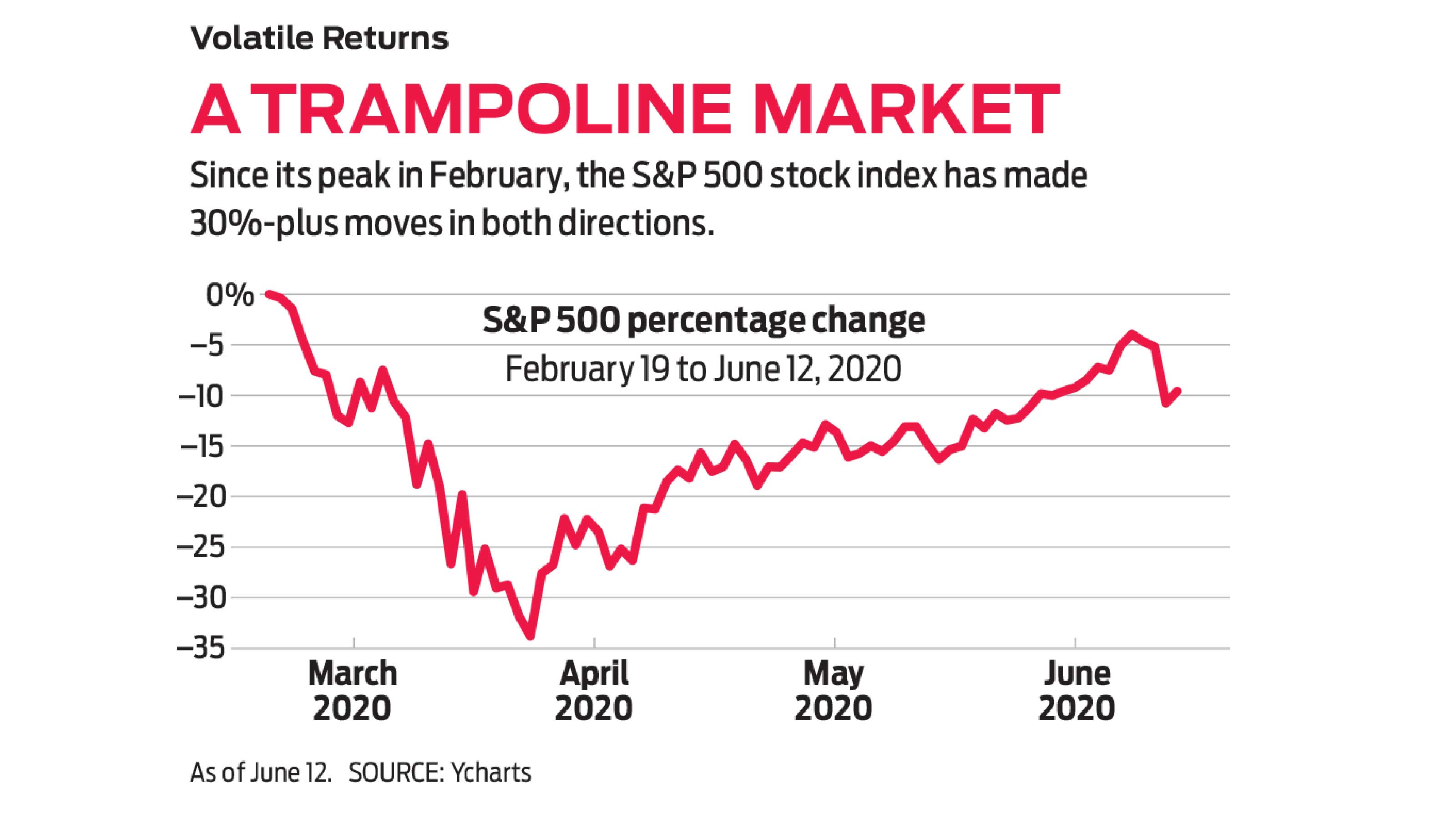

Stocks have rallied so sharply in the past few months that it prompts a question: Are we in a new bull market? With the S&P 500 index up 36% since its March 23 low through mid June, the answer seems an obvious yes. And yet, plenty of veteran Wall Streeters say the bull isn’t official yet, and we’ve seen some cracks in the rally.

Conventional wisdom says stocks are in a bull market once they’re up at least 20% from the market’s low. (A bear market is typically thought of as a 20% drop from the high.) But given that bear markets are often punctuated by powerful rallies that ultimately fade, it’s important to add a time element to a bull-market assessment. Sam Stovall, the chief investment strategist at investment research firm CFRA, defines a bull market as a gain of at least 20% plus a span of six months without the market undercutting its prior low.

Official or not, however, Stovall is a bull. CFRA’s 12-month target for the S&P 500 is 3435, 13% higher than its June 12 close. “I think the March 23 low will eventually be regarded as the start of the new bull market,” says Stovall. “The reason for my optimism is the massive amount of stimulus” injected into the market and the economy by the Federal Reserve and Congress. CFRA is most bullish on the communication services, health care and information technology sectors.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

Doug Ramsey, chief investment officer and portfolio manager at the Leuthold Group, remains dubious. “The current rally is either the first up-leg of a new bull market or the second-largest bear-market rally in the past 125 years,” he says. On the one hand, you’ve got unprecedented monetary and fiscal stimulus. On the other hand, says Ramsey, price-earnings multiples at the market’s March low remained much higher than in other post-WWII market troughs, making it the priciest bear-market low in history—if it stands. “I still think there’s a chance we could break below those lows,” he says. “I’m trying to look at the glass as half-full, but how can we embark on a multiyear bull market when we’re at valuations that are so much higher than what they were at the same stage of the last bull market?”

A close above the 3386 level for the S&P 500, eclipsing its February high, would settle the question of bull-market status. But investors who wait for that will have missed out on a 50% gain. Conversely, “even if you’re very confident that a new bull market has begun, that doesn’t mean you can’t lose serious money from here,” Ramsey says.

Stay in the game. The debate makes clear that trying to time your investments to coincide with market tops and bottoms is rarely the best strategy. Keeping your portfolio aligned with your age and stage in life, with more-frequent rebalancing in volatile markets, is a better way to reap more-consistent rewards.

It’s also important to remember that even young bulls need an occasional breather. It took only 50 trading days for the S&P 500 to climb nearly 40% from its March low—the biggest 50-day surge since the 1950s, eclipsing the lightning-fast start of the 1982 bull market. That’s a good sign, says senior market strategist Ryan Detrick at investment firm LPL Financial. He says stock prices could be higher this time next year. More immediately, the market looks a little frothy. “We have near-term worries given this historic run,” he says.

Don’t be surprised by more volatility—a hallmark of both the bull and bear aspects of this market. As Detrick reminds us: “There are no roller coasters that can replicate what stocks have done so far in 2020.”

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Anne Kates Smith brings Wall Street to Main Street, with decades of experience covering investments and personal finance for real people trying to navigate fast-changing markets, preserve financial security or plan for the future. She oversees the magazine's investing coverage, authors Kiplinger’s biannual stock-market outlooks and writes the "Your Mind and Your Money" column, a take on behavioral finance and how investors can get out of their own way. Smith began her journalism career as a writer and columnist for USA Today. Prior to joining Kiplinger, she was a senior editor at U.S. News & World Report and a contributing columnist for TheStreet. Smith is a graduate of St. John's College in Annapolis, Md., the third-oldest college in America.

-

Over 65? Here's What the New $6K 'Senior Deduction' Means for Medicare IRMAA Costs

Over 65? Here's What the New $6K 'Senior Deduction' Means for Medicare IRMAA CostsTax Breaks A new deduction for people over age 65 has some thinking about Medicare premiums and MAGI strategy.

-

U.S. Congress to End Emergency Tax Bill Over $6,000 Senior Deduction and Tip, Overtime Tax Breaks in D.C.

U.S. Congress to End Emergency Tax Bill Over $6,000 Senior Deduction and Tip, Overtime Tax Breaks in D.C.Tax Law Here's how taxpayers can amend their already-filed income tax returns amid a potentially looming legal battle on Capitol Hill.

-

5 Investing Rules You Can Steal From Millennials

5 Investing Rules You Can Steal From MillennialsMillennials are reshaping the investing landscape. See how the tech-savvy generation is approaching capital markets – and the strategies you can take from them.

-

I'm a 55-Year-Old Dad. Here’s How My 28-Year-Old Daughter Showed Me That AXP Is Still a Solid Investment

I'm a 55-Year-Old Dad. Here’s How My 28-Year-Old Daughter Showed Me That AXP Is Still a Solid InvestmentAmerican Express stock is still a solid investment because management understands the value of its brand and is building a wide moat around it.

-

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have TodayAdvanced Micro Devices stock is soaring thanks to AI, but as a buy-and-hold bet, it's been a market laggard.

-

If You'd Put $1,000 Into UPS Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into UPS Stock 20 Years Ago, Here's What You'd Have TodayUnited Parcel Service stock has been a massive long-term laggard.

-

How the Stock Market Performed in the First Year of Trump's Second Term

How the Stock Market Performed in the First Year of Trump's Second TermSix months after President Donald Trump's inauguration, take a look at how the stock market has performed.

-

If You'd Put $1,000 Into Lowe's Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into Lowe's Stock 20 Years Ago, Here's What You'd Have TodayLowe's stock has delivered disappointing returns recently, but it's been a great holding for truly patient investors.

-

If You'd Put $1,000 Into 3M Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into 3M Stock 20 Years Ago, Here's What You'd Have TodayMMM stock has been a pit of despair for truly long-term shareholders.

-

If You'd Put $1,000 Into Coca-Cola Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into Coca-Cola Stock 20 Years Ago, Here's What You'd Have TodayEven with its reliable dividend growth and generous stock buybacks, Coca-Cola has underperformed the broad market in the long term.

-

What Fed Rate Cuts Mean For Fixed-Income Investors

What Fed Rate Cuts Mean For Fixed-Income InvestorsThe Fed's rate-cutting campaign has the fixed-income market set for an encore of Q4 2024.