Is the USA Still AAA?

With large budget deficits, our country's top-notch bond rating risks being downgraded.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

Is it possible that the U.S. Treasury could default on its bonds? Earlier this year, Standard & Poor's and Moody's, the two largest bond-rating agencies, rattled the investment world by declaring that U.S. Treasury bonds might be downgraded from their coveted triple-A rating because of large budget deficits. That means the two agenciesbelieve there's a chance that Uncle Sam will not pay all the interest or principal on his debt in a timely manner.

But the rating agencies are wrong. No matter how big the deficit, the U.S. will be able to pay interest and principal on its bonds. The reason is simple: Subject to the national debt ceiling, the Treasury can always go to the Federal Reserve and borrow an unlimited amount to pay off its debts.

Granted, such unlimited borrowing could cause serious inflation. But remember that except for a small portion of the debt that is indexed to inflation, the government's only promise is to repay bondholders with dollars. There is no guarantee whatsoever regarding what, if anything, those dollars will be worth.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

What if the Fed refuses the Treasury's request for money? Indeed, there is a law that requires the government to borrow its funds directly from investors and not from the central bank.

Yet in a cash crunch, it is Congress, not the Fed, that rules. Article I, Section 8 of the U.S. Constitution gives Congress the power to "coin money [and] regulate the value thereof." The Constitution contains no provision for a central bank, which was created by Congress in the Federal Reserve Act of 1913. So if Congress decided to abolish the Fed and take over monetary control, there could be no constitutional appeal.

That also means no corporation or municipality can ever be in a better position to pay off its indebtedness than the U.S. government. Because the Treasury can get access to as many dollars as it needs, it will always have an advantage over any firm, individual or other governmental unit that issues dollar-denominated debt.

The same is true of any country that denominates its bonds in its own currency. For that reason, S&P's recent downgrading of Japanese debt, which is issued in yen, makes no sense, either.

In contrast to the U.S. and Japan, the European Central Bank is under no obligation to bail out any debtor, even a sovereign country. But if, for example, Germany, Europe's strongest economy, were on the ropes, the ECB would most likely come through with the loans necessary to avert a default.

What About TIPS?

One valid question is whether Treasury inflation-protected securities are as secure as Treasury bonds (see ASK KIM: Skip TIPS For Now). If the government resorts to printing money to pay its obligations, that would spur inflation and require higher payments on these securities. It's possible to envision a hyperinflationary scenario in which prices rise faster than the government's ability to print notes, causing the Treasury to default on these bonds. But it's unlikely. There's a time lag in the application of the inflation rate to TIPS payments that will always allow the Treasury to come up with the required money.

Of course, whether the government can technically pay interest is secondary to the devastation that a hyperinflationary environment (think wheelbarrows full of cash) would wreak. If such an episode were to occur -- and I consider it extremely unlikely -- investors would be better off owning hard assets, such as gold, real estate and even stocks, than any sort of bond, whether inflation-protected or not.

Bottom line: The major threat to investors is not default but inflation, and that affects the returns on all bonds, both corporate and government. Inflation is the insidious, though technically legal, way in which the government defaults on its obligations.

Columnist Jeremy J. Siegel is a professor at the University of Pennsylvania's Wharton School and the author of Stocks for the Long Run and The Future for Investors.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

-

5 Vince Lombardi Quotes Retirees Should Live By

5 Vince Lombardi Quotes Retirees Should Live ByThe iconic football coach's philosophy can help retirees win at the game of life.

-

The $200,000 Olympic 'Pension' is a Retirement Game-Changer for Team USA

The $200,000 Olympic 'Pension' is a Retirement Game-Changer for Team USAThe donation by financier Ross Stevens is meant to be a "retirement program" for Team USA Olympic and Paralympic athletes.

-

10 Cheapest Places to Live in Colorado

10 Cheapest Places to Live in ColoradoProperty Tax Looking for a cozy cabin near the slopes? These Colorado counties combine reasonable house prices with the state's lowest property tax bills.

-

A Preview of the Fed Under Trump

A Preview of the Fed Under TrumpEconomic Forecasts John Taylor, a former Treasury official in the Bush administration, is a top candidate to replace Fed chair Janet Yellen.

-

Investors, Don't Fear Higher Rates

Investors, Don't Fear Higher Ratesinvesting Although interest rates will rise modestly in coming months, that should not derail the bull market.

-

Why Investors Shouldn't Be Afraid of Inflation

Why Investors Shouldn't Be Afraid of InflationEconomic Forecasts An inflation rate of 2% to 3% is good for stocks because it gives companies the power to raise prices, which helps boost profits.

-

A Positive Outlook for U.S. Interest Rates

A Positive Outlook for U.S. Interest RatesEconomic Forecasts Instead of the threat of deflation from weak growth and falling prices, the U.S. is facing the opposite: accelerating inflation.

-

Can the Fed Save the Stock Market?

Can the Fed Save the Stock Market?Markets In retrospect, it was ill-timed for the Federal Reserve to start hiking short-term interest rates. But that can easily be fixed.

-

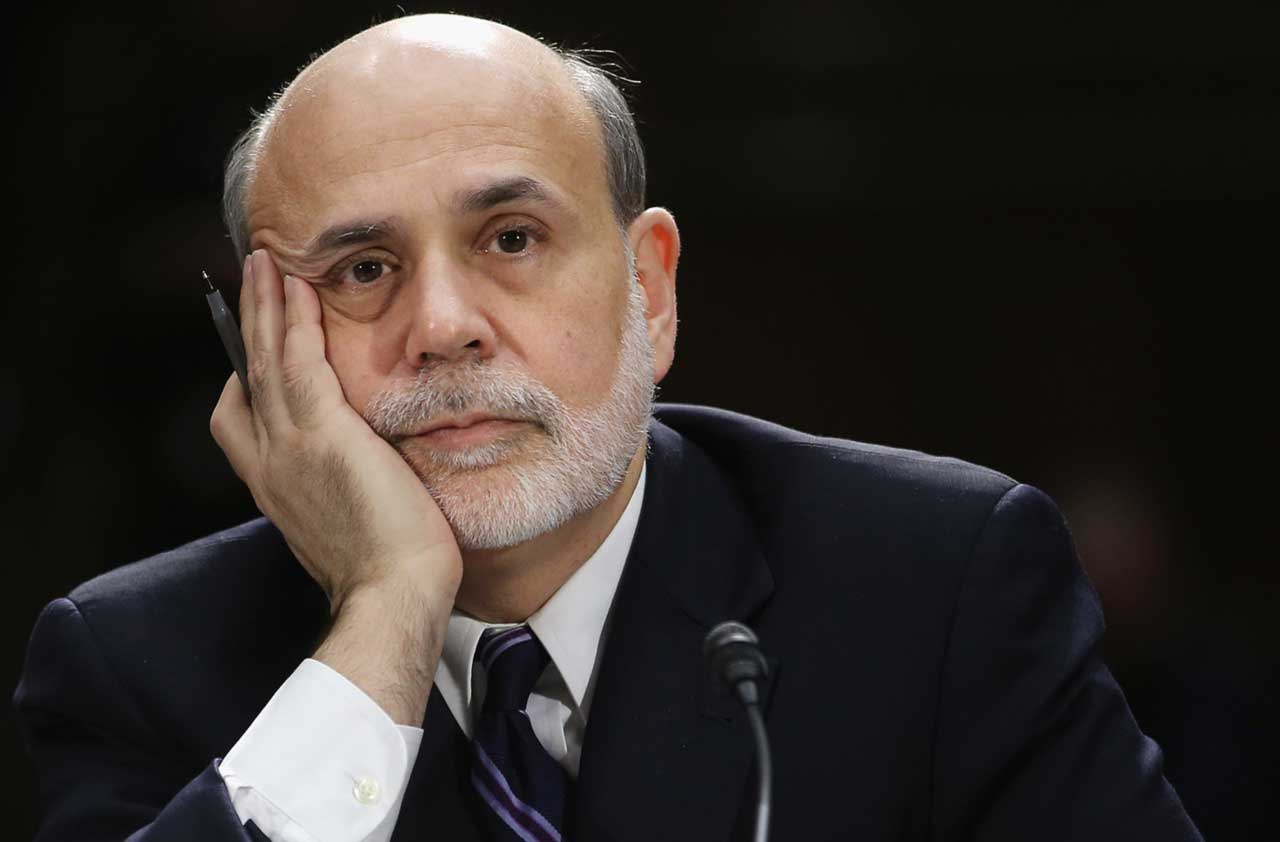

Bernanke's Ultimate Legacy

Bernanke's Ultimate Legacyinvesting The former Fed chairman's decisions in 2008 were an act of courage that averted an economic collapse far worse than we experienced.

-

Worries About China’s Economy Are Overblown

Worries About China’s Economy Are OverblownEconomic Forecasts Among the consequences of China's slowdown: lower commodity prices, which actually benefit the U.S.

-

Surviving the Greek Financial Crisis

Surviving the Greek Financial CrisisEconomic Forecasts Despite the recent friction, I believe the eurozone is stronger after putting down the Greek rebellion.