Warren Buffett's Berkshire Hathaway Stock Is Taking Off

Berkshire Hathaway stock has been clobbering the broader market since the banking crisis set in.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

Berkshire Hathaway (BRK.B) stock continued its recent remarkable run Monday, helped by better-than-expected quarterly results, Wall Street lifting its price target on shares, and another successful performance by Chairman and CEO Warren Buffett (and partner Charlie Munger) at the holding company's annual meeting over the weekend.

Berkshire Hathaway stock gapped up as much as 2% soon after the opening bell, adding to a run of outperformance that began shortly after the crisis in regional bank stocks shook the broader market.

With a market capitalization of more than $715 billion, even just a single percentage point move in the BRK.B share price equates to more than $7 billion in shareholder value. More impressively, Berkshire Hathaway stock has added nearly 12% since hitting a year-to-date low on March 17 – a period in which the S&P 500 gained 5.5%.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

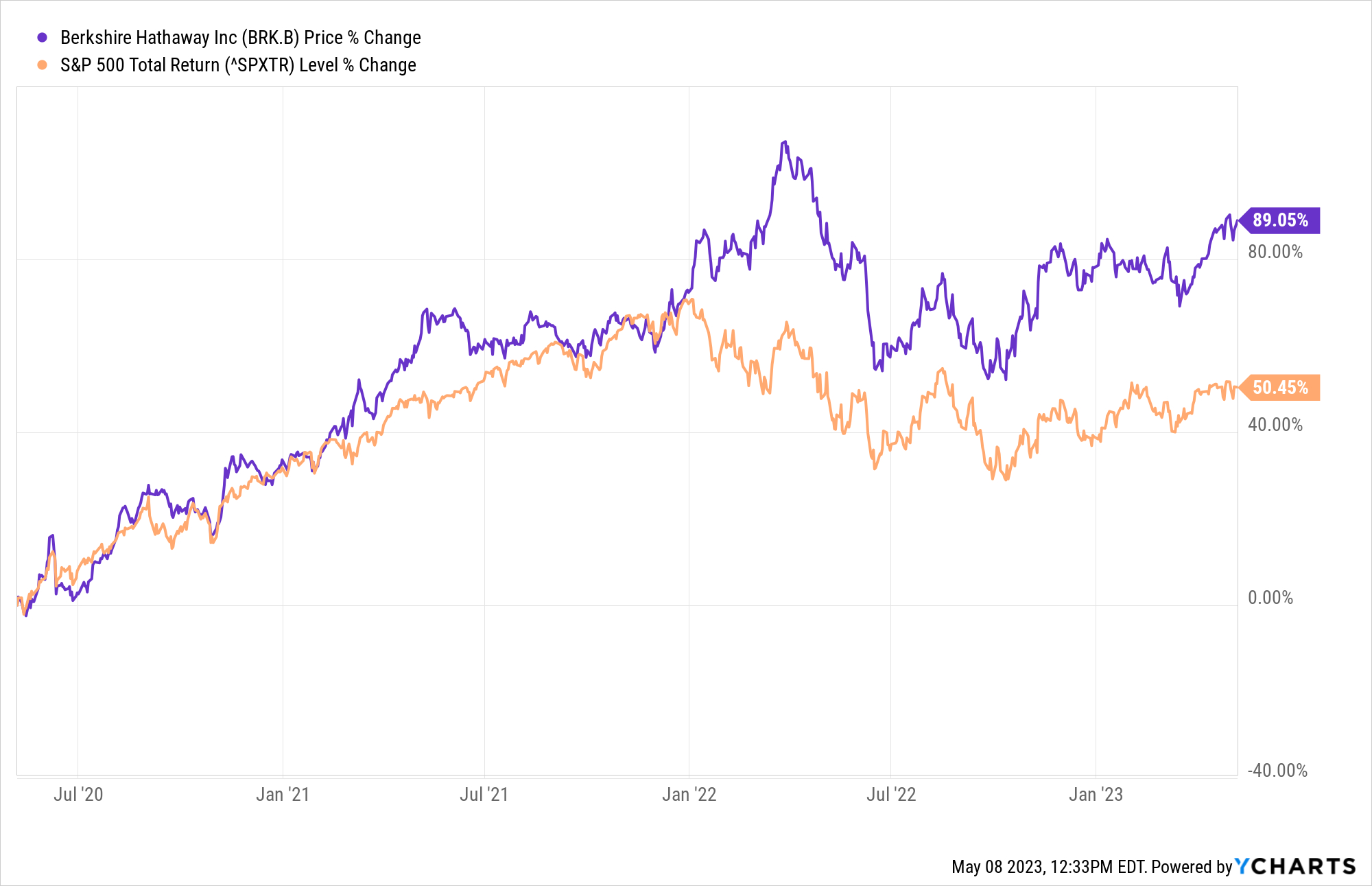

Berkshire Hathaway, of course, has been a market beater for decades. Indeed, it's one of the best stocks of the past 30 years. Perhaps less appreciated is how well Warren Buffett's conglomerate has done by shareholders since the early days of the pandemic. As you can see in the chart below, over the past three years, Berkshire Hathaway stock is up 89%, good for an annualized return of 22.5%.

By comparison, the S&P 500 generated a total return (price change plus dividends) of 50%, or 14.8% annualized. (Warren Buffett loves dividend stocks, but Berkshire Hathaway famously doesn't pay one itself.)

And after the latest Berkshire Hathaway annual meeting, BRK.B investors have to feel pretty good about Buffett & Co. maintaining the stock's market beating ways going forward.

Berkshire Hathaway stock outlook

"We viewed Berkshire's 2023 annual meeting as the best in several years with quality questions and insightful answers," writes UBS Global Research analyst Brian Meredith, who rates the stock at Buy.

The analyst praised Buffett's commitment to making investments in upgrading technology, data and analytics at Berkshire Hathaways' Geico insurance business, and liked what he heard about improving margins at subsidiary BNSF railway.

More importantly, Warren Buffett made clear that Berkshire Hathaway will not acquire Occidental Petroleum (OXY). Buffett guzzled up shares in the oil and gas company in 2022, and received regulatory approval to purchase up to 50% of OXY's shares outstanding. That fueled speculation that Berkshire would look to acquire the entire operation – which always seemed somewhat farfetched.

With an enterprise value (or theoretical takeout price) of more than $82 billion – plus a deal premium – OXY would have more than doubled the size of Berkshire Hathaway's largest ever acquisition. To date, the $44 billion in cash and debt-assumption Buffett paid for railroad operator BNSF in 2009 stands as the company record.

As for BRK.B stock, UBS lifted its target price to $377 from $371. That's modest, to be sure, but since only four analysts cover the stock, per S&P Global Market Intelligence, it did move the consensus needle. With an average price target of $361.33, analysts give Berkshire Hathaway stock implied upside of more than 10% in the next year or so.

One analyst rates shares at Strong Buy, one says Buy and two have them at Hold. That works out to a consensus recommendation of Buy, with mixed conviction.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Dan Burrows is Kiplinger's senior investing writer, having joined the publication full time in 2016.

A long-time financial journalist, Dan is a veteran of MarketWatch, CBS MoneyWatch, SmartMoney, InvestorPlace, DailyFinance and other tier 1 national publications. He has written for The Wall Street Journal, Bloomberg and Consumer Reports and his stories have appeared in the New York Daily News, the San Jose Mercury News and Investor's Business Daily, among many other outlets. As a senior writer at AOL's DailyFinance, Dan reported market news from the floor of the New York Stock Exchange.

Once upon a time – before his days as a financial reporter and assistant financial editor at legendary fashion trade paper Women's Wear Daily – Dan worked for Spy magazine, scribbled away at Time Inc. and contributed to Maxim magazine back when lad mags were a thing. He's also written for Esquire magazine's Dubious Achievements Awards.

In his current role at Kiplinger, Dan writes about markets and macroeconomics.

Dan holds a bachelor's degree from Oberlin College and a master's degree from Columbia University.

Disclosure: Dan does not trade individual stocks or securities. He is eternally long the U.S equity market, primarily through tax-advantaged accounts.

-

Nasdaq Leads a Rocky Risk-On Rally: Stock Market Today

Nasdaq Leads a Rocky Risk-On Rally: Stock Market TodayAnother worrying bout of late-session weakness couldn't take down the main equity indexes on Wednesday.

-

Quiz: Do You Know How to Avoid the "Medigap Trap?"

Quiz: Do You Know How to Avoid the "Medigap Trap?"Quiz Test your basic knowledge of the "Medigap Trap" in our quick quiz.

-

5 Top Tax-Efficient Mutual Funds for Smarter Investing

5 Top Tax-Efficient Mutual Funds for Smarter InvestingMutual funds are many things, but "tax-friendly" usually isn't one of them. These are the exceptions.

-

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have TodayAdvanced Micro Devices stock is soaring thanks to AI, but as a buy-and-hold bet, it's been a market laggard.

-

Dow Soars 588 Points as Trump Retreats: Stock Market Today

Dow Soars 588 Points as Trump Retreats: Stock Market TodayAnother up and down day ends on high notes for investors, traders, speculators and Greenland.

-

If You'd Put $1,000 Into UPS Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into UPS Stock 20 Years Ago, Here's What You'd Have TodayUnited Parcel Service stock has been a massive long-term laggard.

-

Stocks Struggle for Gains to Start 2026: Stock Market Today

Stocks Struggle for Gains to Start 2026: Stock Market TodayIt's not quite the end of the world as we know it, but Warren Buffett is no longer the CEO of Berkshire Hathaway.

-

If You'd Put $1,000 Into Lowe's Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into Lowe's Stock 20 Years Ago, Here's What You'd Have TodayLowe's stock has delivered disappointing returns recently, but it's been a great holding for truly patient investors.

-

If You'd Put $1,000 Into 3M Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into 3M Stock 20 Years Ago, Here's What You'd Have TodayMMM stock has been a pit of despair for truly long-term shareholders.

-

If You'd Put $1,000 Into Coca-Cola Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into Coca-Cola Stock 20 Years Ago, Here's What You'd Have TodayEven with its reliable dividend growth and generous stock buybacks, Coca-Cola has underperformed the broad market in the long term.

-

If You Put $1,000 into Qualcomm Stock 20 Years Ago, Here's What You Would Have Today

If You Put $1,000 into Qualcomm Stock 20 Years Ago, Here's What You Would Have TodayQualcomm stock has been a big disappointment for truly long-term investors.