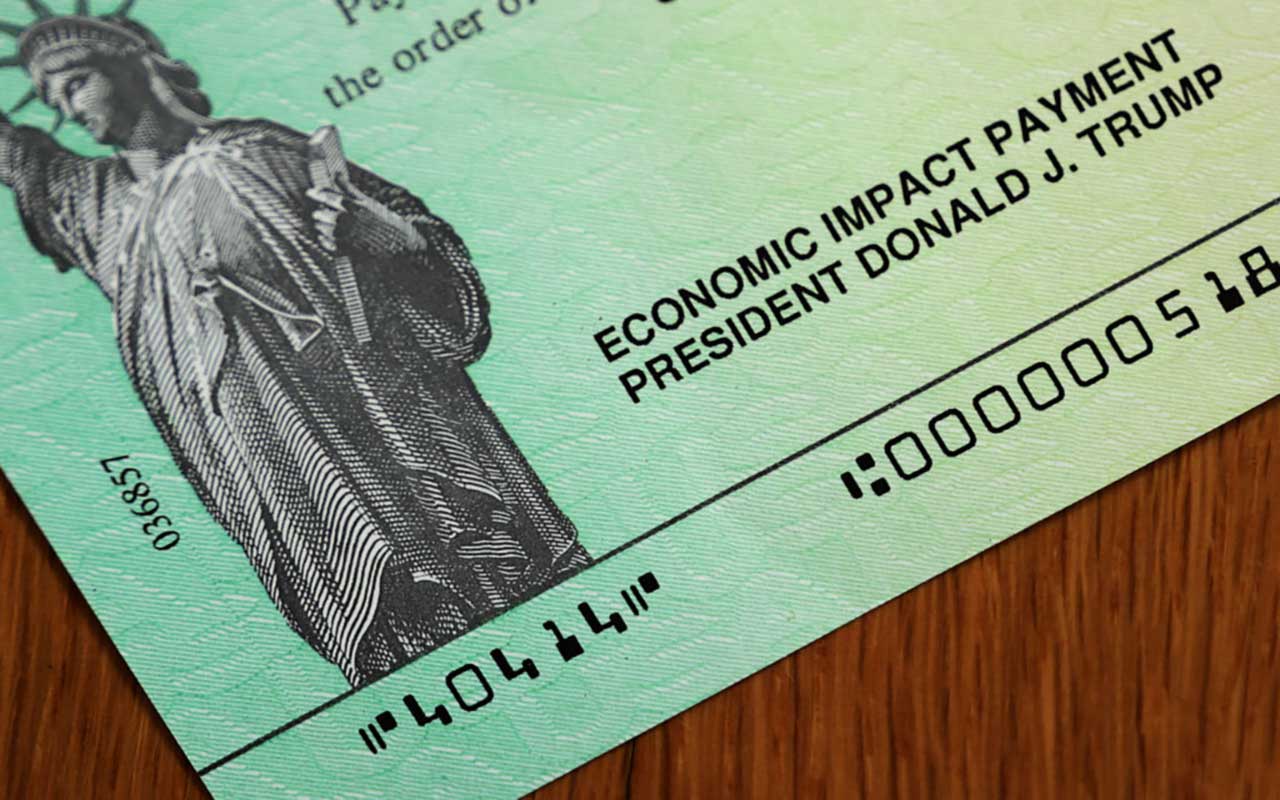

Where's My Paper Stimulus Check? Some People May Have to Wait Until September

The IRS is reportedly sending out 5 million paper checks per week. At that pace, some checks might not arrive for months.

If your stimulus payment isn't deposited directly into your bank account, the IRS will send you a paper check in the mail. They've already started sending out paper checks, so you could get your check at any time now. However, the IRS can only send out a certain number of checks at a time—estimated to be about 5 million per week. That means that it's going to take a while for them to crank out a paper check for the tens of millions of Americans who are scheduled to get one in their mailbox.

Expected Mailing Schedule for Paper Stimulus Checks

The IRS's plan is to first get paper stimulus checks to the people who need them the most. As a result, the lower your income, the sooner you'll get your money. That also means that people with higher incomes will get their check later—if they get one at all. (For taxpayers without children, stimulus check amounts are reduced to zero for single taxpayers with adjusted gross income above $99,000, head-of-household filers with AGI above $136,500, and joint filers with AGI above $198,000.)

Here's the estimated timetable for mailing paper stimulus checks:

Sign up for Kiplinger’s Free E-Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

Estimated IRS Schedule For Mailing Paper Checks

| Taxpayer Income | Date Check Mailed |

|---|---|

| $0 to $10,000 | April 24 |

| $10,001 to $20,000 | May 1 |

| $20,001 to $30,000 | May 8 |

| $30,001 to $40,000 | May 15 |

| $40,001 to $50,000 | May 22 |

| $50,001 to $60,000 | May 29 |

| $60,001 to $70,000 | June 5 |

| $70,001 to $80,000 | June 12 |

| $80,001 to $90,000 | June 19 |

| $90,001 to $100,000 | June 26 |

| $100,001 to $110,000 | July 3 |

| $110,001 to $120,000 | July 10 |

| $120,001 to $130,000 | July 17 |

| $130,001 to $140,000 | July 24 |

| $140,001 to $150,000 | July 31 |

| $150,001 to $160,000 | August 7 |

| $160,001 to $170,000 | August 14 |

| $170,001 to $180,000 | August 21 |

| $180,001 to $190,000 | August 28 |

| $190,001 to $200,000 | September 4 |

| All Others | September 11 |

People Who Receive Social Security or Other Government Benefits

The IRS has already started mailing stimulus checks to people receiving Social Security or Railroad Retirement Board (RRB) benefits. Unless you filed a tax return for 2018 or 2019, the IRS will use information from the Social Security Administration (or RRB) to calculate your payment and automatically deliver a payment to you. These non-filers will receive their payment by direct deposit, debit card or paper check—whichever way they normally receive government benefits.

Similar rules apply to people receiving veterans' benefits or Supplemental Security Income (SSI); however, payments won't go out to these people until mid-May if they didn't file a 2018 or 2019 tax return.

Signing Up for Direct Deposit

You are already scheduled to get an electronic payment if you signed up for direct deposit of a refund on your 2018 or 2019 tax return. In most other cases, you're probably scheduled to get a paper check.

However, if you're currently slated to receive a paper check, you still might be able to sign up for direct deposit (which in most cases means you'll get your money much faster). If you filed a 2018 or 2019 federal income tax return but didn't sign up for direct deposit (or didn't get a refund), go to the IRS's "Get My Payment" portal and see if it isn't too late to provide your bank account information to get an electronic payment. However, you might be out of luck if you don't do this before noon on May 13. (For more information, see Where's My Stimulus Check? Use the IRS's "Get My Payment" Portal to Find Out.)

If you're not required to file a tax return, go to the IRS's "Non-Filers: Enter Payment Info Here" tool to supply the IRS with the information it needs to process your payment. You generally don't need to use the non-filers tool if you receive any of the government benefits listed above. (For more information, see How to Get a Stimulus Check if You Don't File a Tax Return.)

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Rocky Mengle was a Senior Tax Editor for Kiplinger from October 2018 to January 2023 with more than 20 years of experience covering federal and state tax developments. Before coming to Kiplinger, Rocky worked for Wolters Kluwer Tax & Accounting, and Kleinrock Publishing, where he provided breaking news and guidance for CPAs, tax attorneys, and other tax professionals. He has also been quoted as an expert by USA Today, Forbes, U.S. News & World Report, Reuters, Accounting Today, and other media outlets. Rocky holds a law degree from the University of Connecticut and a B.A. in History from Salisbury University.

-

Stock Market Today: Trump's Copper Comments Cause a Stir

Stock Market Today: Trump's Copper Comments Cause a StirMarkets remain resilient and monetary policy makers stand fast against a rising tide of new terms of trade, including around copper.

-

Walmart Deals Go Head-to-Head with Amazon Prime Day: Our Anti-Prime Picks

Walmart Deals Go Head-to-Head with Amazon Prime Day: Our Anti-Prime PicksWalmart Deals runs through July 13, giving shoppers two extra days compared to Amazon Prime. Here are the best anti-Prime deals to consider.

-

Ask the Editor, July 4: Tax Questions on Inherited IRAs

Ask the Editor, July 4: Tax Questions on Inherited IRAsAsk the Editor In this week's Ask the Editor Q&A, we answer tax questions from readers on the rules on inheriting IRAs.

-

Ten Cheapest Places to Live in Virginia

Ten Cheapest Places to Live in VirginiaProperty Taxes The Commonwealth of Virginia has some cheap places to live. Here are a few if you hate paying property taxes.

-

IRS Watchdog: Three Problems the IRS Must Address in 2025

IRS Watchdog: Three Problems the IRS Must Address in 2025IRS The tax season is over, but new changes to the IRS can pose risks to your taxpayer experience.

-

Elon Musk and Most Taxpayers Don't Like What's in Trump's 'Big Beautiful Bill'

Elon Musk and Most Taxpayers Don't Like What's in Trump's 'Big Beautiful Bill'Tax Policy President Trump is betting big on his newest tax cuts, signed into law on July 4. But not everyone is on board.

-

Ask the Editor, June 27: Tax Questions on Disaster Losses, IRAs

Ask the Editor, June 27: Tax Questions on Disaster Losses, IRAsAsk the Editor In this week's Ask the Editor Q&A, we answer tax questions from readers on paper checks, hurricane losses, IRAs and timeshares.

-

2025 SALT Cap Could Hurt Top 'Hidden Home Cost'

2025 SALT Cap Could Hurt Top 'Hidden Home Cost'Tax Deductions The GOP tax bill could make hidden homeowner costs worse for you. Here’s how.

-

No Social Security Tax Changes in Trump’s 'Big Bill'? What Retirees Need to Know

No Social Security Tax Changes in Trump’s 'Big Bill'? What Retirees Need to KnowTax Policy Eliminating taxes on Social Security benefits is missing from President Trump’s tax overhaul. Here’s why and what an alternative offering could mean for retirement taxes.

-

Retire in the Bahamas With These Three Tax Benefits

Retire in the Bahamas With These Three Tax BenefitsRetirement Taxes Retirement in the Bahamas may be worth considering for high-net-worth individuals who hate paying taxes on income and capital gains.