Don't Let Coulda, Woulda, Shoulda Derail Your Dreams

If you have a big goal, what's stopping you? Don't let life get in your way. Instead, do what my family did: Quit waiting for someday, and just do it.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

Have you ever wanted something badly but didn’t know how to make it happen?

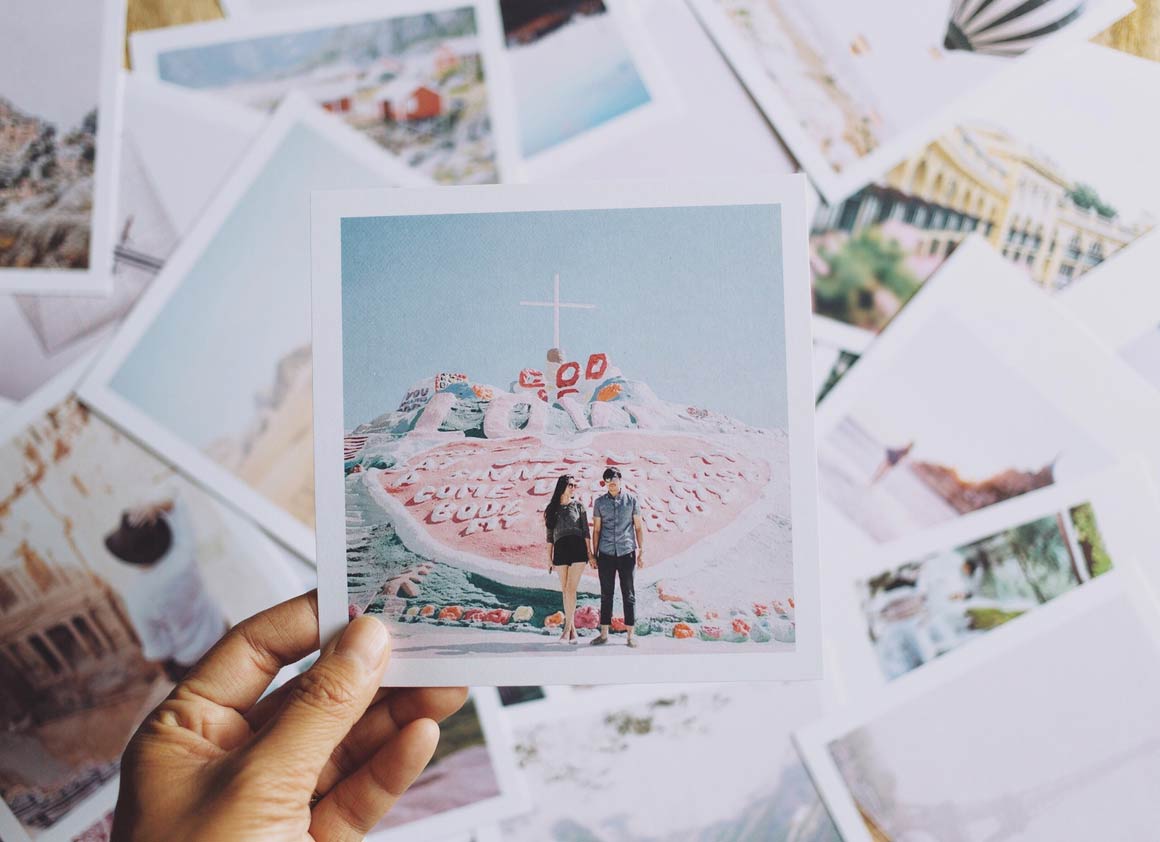

Then you should find inspiration in this post. My husband, Bryan, our three young boys and I recently returned from three months of travel in Spain, something I dreamed about for years but didn’t think we could swing. This is our story.

How It All Began

My father had an unexpected medical emergency. He was having major kidney issues in July 2016, and he didn’t look good after two surgeries in two days. As he laid weak on the hospital bed, my dad said, “Deb, you’ve been a good daughter.”

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

My only thought? He can’t die now. I returned home that night and sobbed. I prayed for dad’s healing. He awoke the next morning and started the recovery process. Yet I know that isn’t always the case.

Fast forward to January 2017. I wrote a blog post, “New Year = Fresh Start.” In that post, I briefly revisited the feelings from July 2016. Afterward, I started talking to my husband about my dream of taking our family to Europe for seven months before our middle son started kindergarten in August 2018. Bryan’s first reaction wasn’t positive; it seemed like too much work.

Yet “work” doesn’t deter me from following my dreams. Researching and planning are my forte.

Risky Business

Sometimes, the riskier thing is inaction. Not making the decision or deciding to “keep things the same” isn’t necessarily safer.

In February 2017, my husband’s grandmother, the matriarch of a very large, close-knit family, unexpectedly passed away. Grandma Pat was the only grandparent Bryan was close to. Something profoundly changed inside him, and my “big Europe trip” idea didn’t seem so crazy anymore.

Time for Change

Here are some of the reasons Bryan and I felt we both needed a change:

1. The Emotional Health of Our Family Was at Stake.

Our oldest son (then 7) was having difficulties at home and school. Our middle son (age 4) constantly complained that preschool was too long, and he wanted to stay home instead. We knew our youngest son (nearly 2) would be our last child, so we really wanted to make every moment count. Bryan suffered from tinnitus, a constant “ringing in the ears,” for the last two years. And I was a giant ball of stress — worried about my family while trying to grow two businesses.

2. Our Life Was Hurried.

Every minute of every day, we felt rushed. Running late became the norm. Eating dinner together as a family on weeknights was difficult. Bryan and I had to divide and conquer responsibilities on weeknights and weekends alike. We rarely rested! All these things that should be joyful (birthday parties, extended-family gatherings, sports) felt like burdens. There wasn’t a moment of breathing room in our calendars.

3. We Lacked Quality Time as a Couple.

When you are newly married with no kids, you and your spouse have ample time to spend together. But as you have children, dedicated time is increasingly hard to find. I was so overwhelmed managing our household and running two businesses that I started working nights and weekends. On a good night, Bryan and I would spend 30 minutes watching TV together in the family room — one of us in the recliner and the other on the couch on the opposite side of the room.

4. I Fell in Love with the Spanish mindset.

In 2001, I studied in Madrid for four months. “No te preocupes” was the Spanish way of life (meaning “do not worry”). I learned through experience that Spaniards took siestas daily. They frequently ate dinner together as families. They worked hard but played hard. The culture, music, food and natural beauty of Spain struck a chord in my heart. I vowed to return one day. Not for a week but hopefully several months.

Our Timeline

We became serious about planning the seven-month journey in March 2017. We even booked one-way flights to Barcelona for January 2018. Then, summer 2017 came. My mom, a normally healthy 65-year-old, had even more severe medical issues than my dad. She spent several weeks in the hospital and had numerous medical procedures. Again, through God’s grace, she recovered.

Last fall, Bryan and I discussed at length whether to continue with our 2018 travel plans. We decided that three months abroad would be more manageable than seven months for many reasons:

- We could use passports rather than apply for visas.

- My clients would be more understanding of meeting virtually for a shorter time span, and Bryan would have an easier time finding new employment if he was out of the workforce less.

- It’s more affordable. Accommodations, dining, and excursions in Europe add up the longer you’re there.

- Our kids hadn’t traveled much, and our oldest son hated the idea of leaving his friends for any amount of time.

- I continued to have concern for my mom’s health. A last-minute flight from Missouri to Florida is much more manageable than one from Spain to Florida.

- We’d return in time for baseball season!

Our fate wasn’t officially sealed until Bryan gave notice to his employer, Airbnb rentals were booked and return flights to the U.S. were secured. We did all of this in December 2017 — one month prior to our departure.

Coulda, Woulda, Shoulda

In retrospect, we should have finalized our Spain plans earlier. We kept my dream private and didn’t tell family or a handful of friends until late December 2017. We knew people would react differently and did not want others’ opinions to impact our decision to travel.

But now, having traveled, I wouldn’t trade the experience for anything. It brought my family closer together and challenged us in ways I couldn’t imagine. Stepping outside your comfort zone isn’t easy, but it’s worthwhile.

So, what BIG, HAIRY, AUDACIOUS GOAL (or dream) do you have? What’s preventing you from taking the next step to fulfill it?

P.S.: Stay tuned for Part 2 of our trip to Spain with my post on how we were able to swing our dream adventure financially.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Deborah L. Meyer, CFP®, CPA/PFS, CEPA and AFCPE® Member, is the award-winning author of Redefining Family Wealth: A Parent’s Guide to Purposeful Living. Deb is the CEO of WorthyNest®, a fee-only, fiduciary wealth management firm that helps Christian parents and Christian entrepreneurs across the U.S. integrate faith and family into financial decision-making. She also provides accounting, exit planning and tax strategies to family-owned businesses through SV CPA Services.

-

U.S. Congress to End Emergency Tax Bill Over $6,000 Senior Deduction and Tip, Overtime Tax Breaks in D.C.

U.S. Congress to End Emergency Tax Bill Over $6,000 Senior Deduction and Tip, Overtime Tax Breaks in D.C.Tax Law Here's how taxpayers can amend their already-filed income tax returns amid a potentially looming legal battle on Capitol Hill.

-

5 Investing Rules You Can Steal From Millennials

5 Investing Rules You Can Steal From MillennialsMillennials are reshaping the investing landscape. See how the tech-savvy generation is approaching capital markets – and the strategies you can take from them.

-

The Tool You Need to Avoid a Post-Divorce Administrative Nightmare

The Tool You Need to Avoid a Post-Divorce Administrative NightmareLearn why a divorce decree isn’t enough to protect your retirement assets. You need a QDRO to divide the accounts to avoid paying penalties or income tax.

-

I'm a Financial Planner: These Small Money Habits Stick (and Now Is the Perfect Time to Adopt Them)

I'm a Financial Planner: These Small Money Habits Stick (and Now Is the Perfect Time to Adopt Them)February gets a bad rap for being the month when resolutions fade — in fact, it's the perfect time to reset and focus on small changes that actually pay off.

-

One of the Most Powerful Wealth-Building Moves a Woman Can Make: A Midcareer Pivot

One of the Most Powerful Wealth-Building Moves a Woman Can Make: A Midcareer PivotIf it feels like you can't sustain what you're doing for the next 20 years, it's time for an honest look at what's draining you and what energizes you.

-

I'm a Wealth Adviser Obsessed With Mahjong: Here Are 8 Ways It Can Teach Us How to Manage Our Money

I'm a Wealth Adviser Obsessed With Mahjong: Here Are 8 Ways It Can Teach Us How to Manage Our MoneyThis increasingly popular Chinese game can teach us not only how to help manage our money but also how important it is to connect with other people.

-

Looking for a Financial Book That Won't Put Your Young Adult to Sleep? This One Makes 'Cents'

Looking for a Financial Book That Won't Put Your Young Adult to Sleep? This One Makes 'Cents'"Wealth Your Way" by Cosmo DeStefano offers a highly accessible guide for young adults and their parents on building wealth through simple, consistent habits.

-

To Love, Honor and Make Financial Decisions as Equal Partners

To Love, Honor and Make Financial Decisions as Equal PartnersEnsuring both partners are engaged in financial decisions isn't just about fairness — it's a risk-management strategy that protects against costly crises.

-

For More Flexible Giving, Consider Combining a Charitable Remainder Trust With a Donor-Advised Fund

For More Flexible Giving, Consider Combining a Charitable Remainder Trust With a Donor-Advised FundIf a charitable remainder trust puts too many constraints on your family's charitable giving, consider combining it with a donor-advised fund for more control.

-

These Thoughtful Retirement Planning Steps Help Protect the Life You Want in Retirement

These Thoughtful Retirement Planning Steps Help Protect the Life You Want in RetirementThis kind of planning focuses on the intentional design of your estate, philanthropy and long-term care protection.

-

A Wake-Up Call and a Healthy Dose of Terror: How to Survive Your First Days in Prison

A Wake-Up Call and a Healthy Dose of Terror: How to Survive Your First Days in PrisonThis young man needed to be scared straight after his mother expressed her fear that he was on a path to prison. Hearing these eight do's and don'ts worked.