I Wish I Had Done This Years Ago: All Too Common Financial Regrets

Some of the most valuable financial lessons are learned in hindsight. Live a happier, more secure life by avoiding these familiar financial foibles.

I was recently enjoying dinner with my husband and our three children at our local country club. It was a relaxed and comfortable setting, the perfect place to spend a weekend with the people I love after a long workweek. As I sat across the table from my family, enjoying this special time, I thought, “I wish I had done this years ago.”

I was raised in a small community in upstate New York and my parents were both teachers, so joining a private club wasn’t ever a remote consideration growing up. When my husband suggested the idea, I wasn’t in favor of spending the money — thousands of dollars for annual membership fees. But after considering it for several weeks and making certain we could I afford it, I relented.

Now, years later, I clearly owe him an enormous apology. For starters, the amount of personal joy we’ve experienced, the new friendships we’ve made, and the memories we’re creating have more than paid for any membership. On top of that, I’ve been able to entertain potential clients in an informal environment close to home.

Sign up for Kiplinger’s Free E-Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

But the phrase “I wish I had done this years ago,” is the same one I hear most often from new clients once we’ve had an initial meeting and developed a long-term plan to grow their wealth. It’s not a surprise. Afterall, once a person or couple has a clear plan to help them achieve financial independence, their relief is palpable. The benefits of their decision are so clear they only wish they had put a plan together years ago.

Here are the other financial items that commonly lead someone to say, “I wish I had done this years ago.” If one or more of these items are on your list, I encourage you to take action:

Know the Amount of Money Needed for Financial Independence

Most people save and save and save some more — but they don’t really know if they have enough socked away. They need to understand “how much is enough,” whether it’s for their own retirement or their children’s college education. Once this question is answered, the person or couple has the freedom to spend the rest of their paychecks or not feel guilty about spending money on the “extras.”

Don’t Work Too Hard

Many parents miss their children’s ballgames, dance recitals and other important events fearing that less work will put their financial future at risk. Some people don’t believe they will be as successful in business or get the next promotion if they work fewer hours.

I’ve seen clients with solid financial plans delay retirement for years because they’re scared to get off the hamster wheel. When they finally do retire, they’re burned out, have health issues, their kids are off living their own lives, and there’s regret. If you have a financial plan, it can give you the freedom to balance work and life better while still achieving your goals.

Get a Will Done

My clients are well-educated, well-read and travel around the world. But I’m never surprised to hear that a new client doesn’t have a will — or it hasn’t been updated in a decade or more. More than any other financial issue, this is one that creates the most guilt and embarrassment, until it’s done. Once the process is complete, clients are so relieved to know their estate plan is buttoned up.

Discuss Money with Your Parents

I’ve watched several of my clients agonize for months, even years, as their aging parents get sick or pass away. By speaking to their parents before their health deteriorates, a person can understand if Mom and Dad can pay their own bills, especially if long-term or professional care is needed, or whether they need to help.

Even if parents aren’t in poor health, ask about their financial condition and make sure their finances are in order. If not, after the death of a mother or father, the client is often left with a scattered list of savings, investments, insurance plans and other assets that can take months to track down.

Talk to Your Adult Children About Money, Too

Once your children get married and start their own families, it can be easy to consider that your job is complete. But remember that they are now awash in all of the same financial issues that you faced 30 years before. Yes, their money is going to pay for diapers and mortgage payments, but help them understand the importance of saving and investing at an early age. The typical comment I hear from Baby Boomer parents is “Do what I should have done — start saving early!”

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Lisa Brown, CFP®, CIMA®, is author of "Girl Talk, Money Talk, The Smart Girl's Guide to Money After College” and “Girl Talk, Money Talk II, Financially Fit and Fabulous in Your 40s and 50s". She is the Practice Area Leader for corporate professionals and executives at wealth management firm CI Brightworth in Atlanta. Advising busy corporate executives on their finances for nearly 20 years has been her passion inside the office. Outside the office she's an avid runner, cyclist and supporter of charitable causes focused on homeless children and their families.

-

‘I Play Pickleball in Retirement.’ Is It HSA-Eligible?

‘I Play Pickleball in Retirement.’ Is It HSA-Eligible?Retirement Tax Staying active after you retire may be easier with these HSA expenses. But there’s a big catch.

-

What New Tariffs Mean for Car Shoppers

What New Tariffs Mean for Car ShoppersThe Kiplinger Letter Car deals are growing scarcer. Meanwhile, tax credits for EVs are on the way out, but tax breaks for car loans are coming.

-

Five Mistakes to Avoid in Your First Year of Retirement

Five Mistakes to Avoid in Your First Year of RetirementRetirement brings the freedom to choose how to spend your money and time. But choices made in the initial rush of excitement could create problems in future.

-

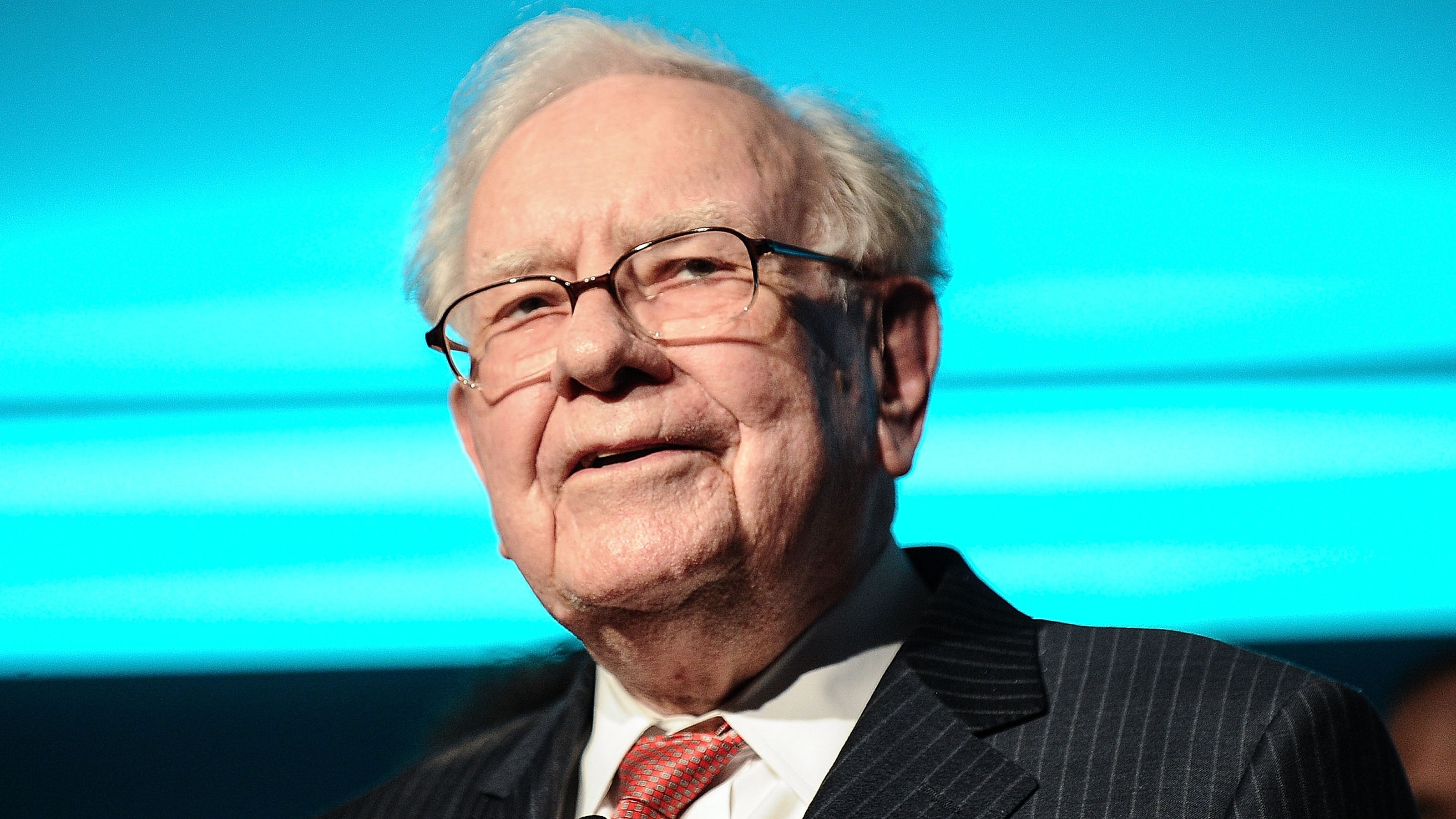

I'm an Investing Expert: This Is How You Can Invest Like Warren Buffett

I'm an Investing Expert: This Is How You Can Invest Like Warren BuffettBuffett just invested $15 billion in oil and gas, and you can leverage the same strategy in your IRA to potentially generate 8% to 12% quarterly cash flow while taking advantage of tax benefits that are unavailable in any other investment class.

-

Integrity, Generosity and Wealth: A Faith-Based Approach to Business

Integrity, Generosity and Wealth: A Faith-Based Approach to BusinessEntrepreneurs who align their business and financial decisions with the biblical principles of integrity, generosity and helping others can realize impactful and fulfilling success.

-

How Much Income Can You Get From an Annuity? An Annuities Expert Gets Specific

How Much Income Can You Get From an Annuity? An Annuities Expert Gets SpecificHere's a detailed look at income annuities and the factors that determine your payout now and in the future.

-

Your Paycheck Stops in Retirement, But Your Life Doesn't: An Expert Guide to Planning for a Confident Future

Your Paycheck Stops in Retirement, But Your Life Doesn't: An Expert Guide to Planning for a Confident FutureSocial Security will replace only about 40% of your salary, on average. A solid financial plan will help you plug the gap so you can rest easy in retirement.

-

Are You Jeopardizing Your Future to Help Your Adult Kids? An Expert Guide for How to Not Do That

Are You Jeopardizing Your Future to Help Your Adult Kids? An Expert Guide for How to Not Do ThatIf your adult child needs financial help, of course you want to provide it, but crafting a plan that also protects your financial and emotional well-being is vital.

-

I'm a Financial Planner: Here Are Some Long-Term Care Insurance Tips for Every Age

I'm a Financial Planner: Here Are Some Long-Term Care Insurance Tips for Every AgeStrategies include adding riders to life insurance for younger individuals and considering hybrid or traditional long-term care policies for those in their mid-50s and 60s.

-

Engineering Reliable Retirement Income in 2025: An Expert Guide

Engineering Reliable Retirement Income in 2025: An Expert GuideFor dependable income, consider using a bucket strategy and annuities in tandem to promote structure, flexibility and peace of mind.