The Benefits of Being FIRE-ish

You can adapt the Financial Independence, Retire Early movement to fit your lifestyle.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

It’s easy to dismiss the super savers who embrace the FIRE movement as starry-eyed dreamers or cultish extremists. Financial Independence, Retire Early followers—many of whom are millennials who consider working 9 to 5 to be drudgery—often save 50% to 70% of their annual income with the goal of retiring in 10 to 15 years. The aggressive “Lean FIRE” savers share tips online on how they manage on less than $40,000 a year—for example, by Dumpster diving, living in a van, not having children or living on a diet of rice and beans.

But FIRE is much more than that. FIRE followers track their money, invest in low-cost funds, avoid high-interest debt and focus their spending on what’s important to them, rather than buying things because they can afford them. Adapting some of these FIRE principles to fit your less-austere lifestyle can go a long way toward helping you achieve your retirement goals.

If you’re not ready to go full-blown FIRE, here’s how to be FIRE-ish.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

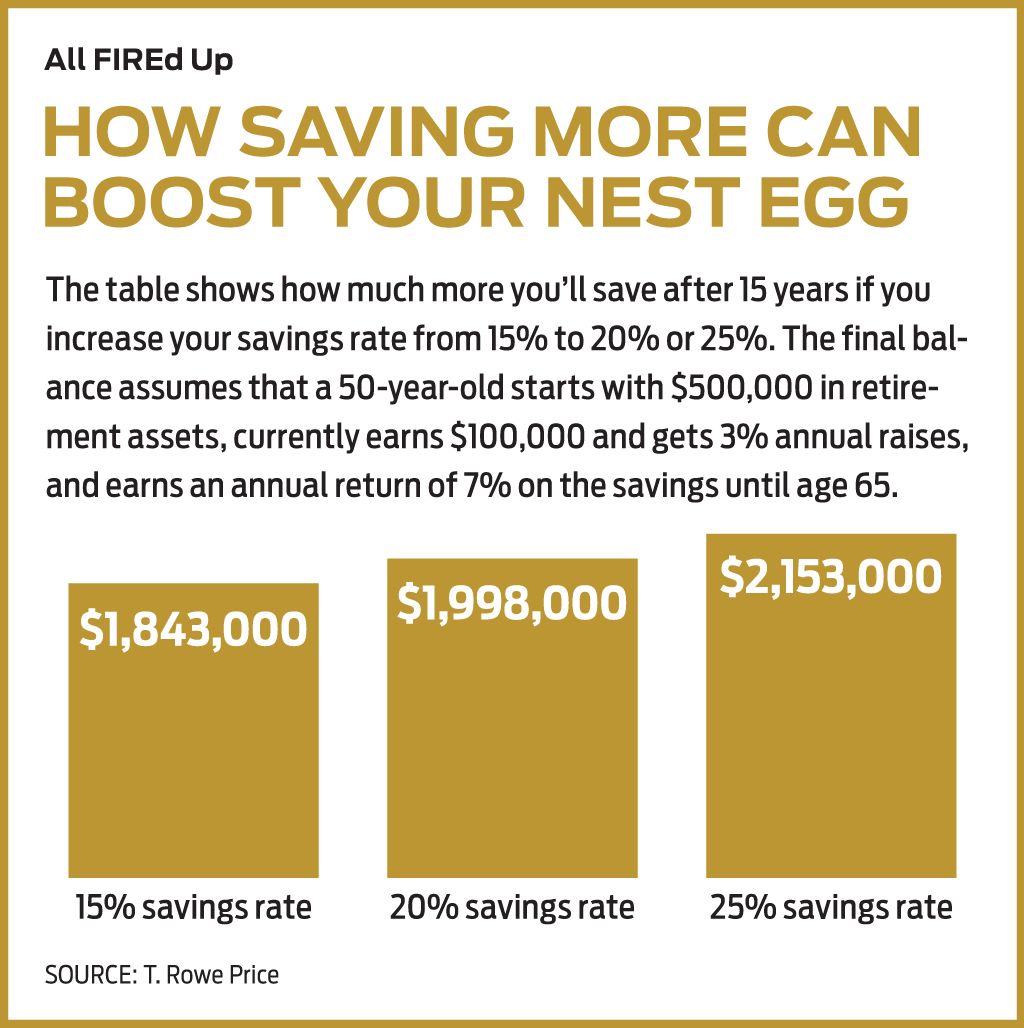

Supercharge your savings. Boosting savings gives you more money to invest. But more important, “every time you increase your savings rate, you are decreasing your lifestyle,” says Whitney Morrison, principal financial planner with LegalZoom. That means you won’t need to accumulate as much to maintain your lifestyle in retirement.

FIRE folks typically watch every penny. You don’t have to be that precise, but you should have an idea of your cash flow so you can find extra dollars to put toward savings. Some expenses, such as a car loan or kids’ extracurricular activities, disappear over time, freeing up money that you can redirect into investments, says Melissa Sotudeh, a certified financial planner in Rockville, Md. “If you’re at the point that you’ve got the kids launched, that’s a big pay raise there,” she says.

Or boost savings by cutting expenses. “There is a lot of low-hanging fruit that won’t force you into depriving yourself,” says Brad Barrett, cofounder of the ChooseFI website. You don’t have to give up your lattes. Look to housing and transportation, the largest expenses for consumers. If the kids are grown and you no longer need a four-bedroom house, consider downsizing.

Many FIRE folks also move to areas with a lower cost of living. Barrett moved from a one-bedroom co-op in East Northport, N.Y., to a four-bedroom home in Richmond, Va., and slashed his housing expenses in half.

Some FIRE advocates also ditch cars in favor of bikes, or they move closer to work so they can walk to their jobs. Barrett says he and his wife each have a car for convenience, but they drive older vehicles (his is a 2003 model; hers is a 2013).

Also look for ways to increase income. FIRE practitioners often find creative ways to generate income, such as blogging about their path to financial independence. Sotudeh says a pair of her clients pull in $30,000 a year by leasing their basement through Airbnb. Consider consulting on the side or finding ways to turn hobbies into cash, such as selling your crafts. “It can potentially help you retire earlier, but it can also help you create more income in retirement,” says Katrina Soelter, a CFP in Los Angeles.

Review the investment fees you pay, which can significantly erode your returns over time. FIRE acolytes favor low-cost index funds, such as those offered by Vanguard, Schwab and Fidelity.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

-

Timeless Trips for Solo Travelers

Timeless Trips for Solo TravelersHow to find a getaway that suits your style.

-

A Top Vanguard ETF Pick Outperforms on International Strength

A Top Vanguard ETF Pick Outperforms on International StrengthA weakening dollar and lower interest rates lifted international stocks, which was good news for one of our favorite exchange-traded funds.

-

Is There Such a Thing As a Safe Stock? 17 Safe-Enough Ideas

Is There Such a Thing As a Safe Stock? 17 Safe-Enough IdeasNo stock is completely safe, but we can make educated guesses about which ones are likely to provide smooth sailing.

-

3 Retirement Changes to Watch in 2026: Tax Edition

3 Retirement Changes to Watch in 2026: Tax EditionRetirement Taxes Between the Social Security "senior bonus" phaseout and changes to Roth tax rules, your 2026 retirement plan may need an update. Here's what to know.

-

States That Tax Social Security Benefits in 2026

States That Tax Social Security Benefits in 2026Retirement Tax Not all retirees who live in states that tax Social Security benefits have to pay state income taxes. Will your benefits be taxed?

-

Retirees in These 7 States Could Pay Less Property Taxes Next Year

Retirees in These 7 States Could Pay Less Property Taxes Next YearState Taxes Retirement property tax bills could be up to 65% cheaper for some older adults in 2026. Do you qualify?

-

6 Tax Reasons to Convert Your IRA to a Roth (and When You Shouldn't)

6 Tax Reasons to Convert Your IRA to a Roth (and When You Shouldn't)Retirement Taxes Here’s how converting your traditional retirement account to a Roth IRA can boost your nest egg — but avoid these costly scenarios.

-

10 Retirement Tax Plan Moves to Make Before December 31

10 Retirement Tax Plan Moves to Make Before December 31Retirement Taxes Proactively reviewing your health coverage, RMDs and IRAs can lower retirement taxes in 2025 and 2026. Here’s how.

-

The Rubber Duck Rule of Retirement Tax Planning

The Rubber Duck Rule of Retirement Tax PlanningRetirement Taxes How can you identify gaps and hidden assumptions in your tax plan for retirement? The solution may be stranger than you think.

-

The Most Tax-Friendly State for Retirement in 2025: Here It Is

The Most Tax-Friendly State for Retirement in 2025: Here It IsRetirement Tax How do you retire ‘tax-free’? This state doesn’t tax retirement income, has a low median property tax bill, and even offers savings on gas. Are you ready for a move?

-

‘I Play Pickleball in Retirement.’ Is It HSA-Eligible?

‘I Play Pickleball in Retirement.’ Is It HSA-Eligible?Retirement Tax Staying active after you retire may be easier with these HSA expenses. But there’s a big catch.