5 Ways to Increase Your After-Tax Spendable Income - and Legacy

Did you enjoy writing a check to Uncle Sam on April 15? No? Well, then try these strategies to increase your spendable after-tax income (and leave more to your heirs) over the long term.

Over dinner with friends a few nights back, they expressed concern about how the recent tax law changes increased their federal income taxes. New rules limit the amount of property and state income taxes that can be deducted — and they live in a high-tax state. Other than moving, there’s not a lot they can do — or so they thought.

Like most taxpayers, I am a fan of legally minimizing your income taxes. But I think — if you are retired or about to retire — you should concentrate less on minimizing taxes and more about increasing after-tax spendable income and your financial legacy to heirs. Sounds like a non-sequitur, but it isn’t.

As an example, you could invest your entire savings in high-quality intermediate-term municipal bonds and pay no taxes on interest earnings. But you would earn something like 2.5% (or $25,000 on $1 million in bonds) in annual income. Wouldn’t it be an improvement if you paid some taxes and generated an income stream equal to, say, 6% after taxes?

Sign up for Kiplinger’s Free E-Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

Where do you learn about tax strategies?

Most people either rely on their accountant or tax reporting service to prepare their taxes. Very few have looked at individual schedules, such as the schedule used for calculating your tax shown in line 11a of IRS Form 1040. This schedule has 27 (count ’em) steps in the worksheet, addressing in particular qualified dividends and realized capital gains.

Some taxpayers get their information about taxation from news reports that often focus on the tax breaks for corporations or, as is the case for our friends, the limitation on the deductibility of property taxes. Investment advisers shy away from giving tax advice, and thus leave tax strategies to your tax preparers, who are not typically in the business of giving financial advice. Finally, financial publications can’t do one-on-one counseling.

As an adviser who’s looking to create the highest amount of dependable and spendable (after-tax) income for my firm’s boomer clients, it’s incumbent upon me to provide actionable ways to achieve that result. So here are five strategies that you can follow (and I have) to increase your spendable income — and legacy. The couple in the example at the end of this article increased their spendable income by over $15,000 per year.

What are the 5 strategies?

As you will see, I am mindful of the tax bill, even while I concentrate on boosting spendable income and our clients’ legacy.

1. Use qualified dividends from personal savings to generate preferred income

Personal savings are those that have already been taxed, and the income on these savings enjoys some tax benefits. Qualified dividends, together with long-term realized capital gains on stocks or from mutual funds/ETFs, are considered as “preferred income” (per my accountant) and are taxed at a lower rate than ordinary income. In fact, at reasonable levels of income they escape tax completely. The actual tax rate is determined in that 27-step worksheet described above.

2. Use muni bonds from personal savings to generate tax-free income

Interest payments on municipal bonds can also avoid taxes entirely, so if half of a fixed-income portfolio is in muni bonds our investor-client is taxed on only half the interest. The muni portion also may keep you in a lower tax bracket. However, if you’re in a low tax bracket without muni’s you may consider lowering your allocation to them. While it would be nice to have simple rules of thumb to figure out strategies, you almost need to fill in a tax return to create the best strategy. The point here is to be aware of — and then evaluate — the preferred treatment.

3. Include tax-advantaged annuity payments from personal savings

Payments from an income annuity purchased with personal savings receive a break because a portion of each annuity payment is considered a return of previously taxed principal, until the principal has been paid out. Looking at an immediate annuity quote as of May 2, a couple both aged 70 (see example below) can generate 6.32% in annuity payments as long one or both are alive, and be taxed on only 1.35% until age 90. After age 90 when payments become fully taxable, one or both are more likely to have larger tax deductions from unreimbursed medical and caregiver costs.

Another benefit of an income annuity: If you own a deferred annuity (fixed, indexed or variable), then these savings can be converted into annuity payments and any tax-deferred gain in the deferred annuity will be spread and taxed as part of the annuity payments.

4. Reduce taxable distributions from a traditional IRA

Withdrawals from a traditional IRA are taxed as ordinary income, whatever the type of investment earnings. On top of that, the IRS requires that you start taking withdrawals when you turn 70½ years old whether you need the money or not. One idea virtually every IRA holder ought to consider is to allocate a portion of the account to a Qualifying Longevity Annuity Contract (QLAC for short). With a QLAC, you can defer up to 25% of required withdrawals. You won’t pay taxes on that money until the QLAC starts generating annuity payments. Those payments could cover late-in-retirement expenses.

5. For legacy planning, “die rich” with your personal savings and “die poor” with your traditional IRA savings

While every retiree’s split between personal and traditional IRA savings is different, you should consider that (1) all growth (unrealized capital gains) in personal savings is passed to heirs income tax free, and (2) similar growth is taxed as ordinary income if from a traditional IRA. One way to change that “split” is to gradually convert a part of the traditional IRA into a Roth IRA, which is passed on income tax free. Another approach is to use annuity payments to generate more cash flow in the traditional IRA to enable more growth in your personal assets. My own personal retirement plan is to have little or no traditional IRA assets at my passing, having converted most to annuity payments, and the balance to a Roth IRA. On the personal savings side, when it makes sense investment-wise, defer realization of capital gains.

Bring these ideas to meetings with your adviser

Retirement planning alone can be complicated and is made more so when taxation is considered. Further, it must be personalized to the individual. However, by taking advantage of these tax-break opportunities you may earn attractive income from your hard-earned savings, both before and after taxes, and leave a larger legacy. You will likely need a financial adviser in these areas but be sure to challenge the adviser with these tax breaks.

Maybe next April 15, whether your tax bill is up or down, you’ll feel more secure about your future.

Example: Couple both aged 70 with $2 million in financial assets, $36,000 per year in Social Security payments, and $26,600 in standard deductions. 50% of the savings is invested in a traditional IRA, with the rest in in personal (after-tax) savings. Couple is considering two retirement income plans — one with annuity payments (Plan A) and one without annuity payments (Plan B). Plan A uses the Income Allocation planning method; Plan B replaces the annuity payments in Plan A with interest on corporate bonds. Here are the results in the first year:

- Spendable Income. Plan A delivers $119,000; Plan B delivers $103,000 — a difference of $16,000 in after-tax income.

- Federal income taxes. Plan A generates $6,000 in taxes; Plan B generates $7,900. So despite more spendable income, Plan A generates $1,900 less in taxes.

With this additional $16,000 in spendable income, our couple can spend it on travel, reinvest it, purchase life or long-term care insurance, or give to kids or grandkids.

To create your own retirement income plan, go to the income allocation page at Go2income.com. Once you get your Income Allocation report, request an appointment so we can discuss these tax strategies. We are not intending the above as tax advice and suggest you discuss all ideas with your accountant or tax adviser.

Note: Annuity payment amounts above are based on quotes from the Go2Income Annuity Shopping Service. To find out how much of the annuity payments are taxable, go to Income Annuity Shortcuts on the Go2Income site. If you have other questions about retirement, simply post at Ask Jerry.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Jerry Golden is the founder and CEO of Golden Retirement Advisors Inc. He specializes in helping consumers create retirement plans that provide income that cannot be outlived. Find out more at Go2income.com, where consumers can explore all types of income annuity options, anonymously and at no cost.

-

I'm a Financial Planner: Here Are Five Smart Moves for DIY Investors

I'm a Financial Planner: Here Are Five Smart Moves for DIY InvestorsYou'll go further as a DIY investor with a solid game plan. Here are five tips to help you put together a strategy you can rely on over the years to come.

-

Neglecting Car Maintenance Could Cost You More Than a Repair, Especially in the Summer

Neglecting Car Maintenance Could Cost You More Than a Repair, Especially in the SummerWorn, underinflated tires and other degraded car parts can fail in extreme heat, causing accidents. If your employer is ignoring needed repairs on company cars, there's something employees can do.

-

'Drivers License': A Wealth Strategist Helps Gen Z Hit the Road

'Drivers License': A Wealth Strategist Helps Gen Z Hit the RoadFrom student loan debt to a changing job market, this generation has some potholes to navigate. But with those challenges come opportunities.

-

Financial Pros Provide a Beginner's Guide to Building Wealth in 10 Years

Financial Pros Provide a Beginner's Guide to Building Wealth in 10 YearsBuilding wealth over 10 years requires understanding your current financial situation, budgeting effectively, eliminating high-interest debt and increasing both your income and financial literacy.

-

Five Mistakes to Avoid in Your First Year of Retirement

Five Mistakes to Avoid in Your First Year of RetirementRetirement brings the freedom to choose how to spend your money and time. But choices made in the initial rush of excitement could create problems in the future.

-

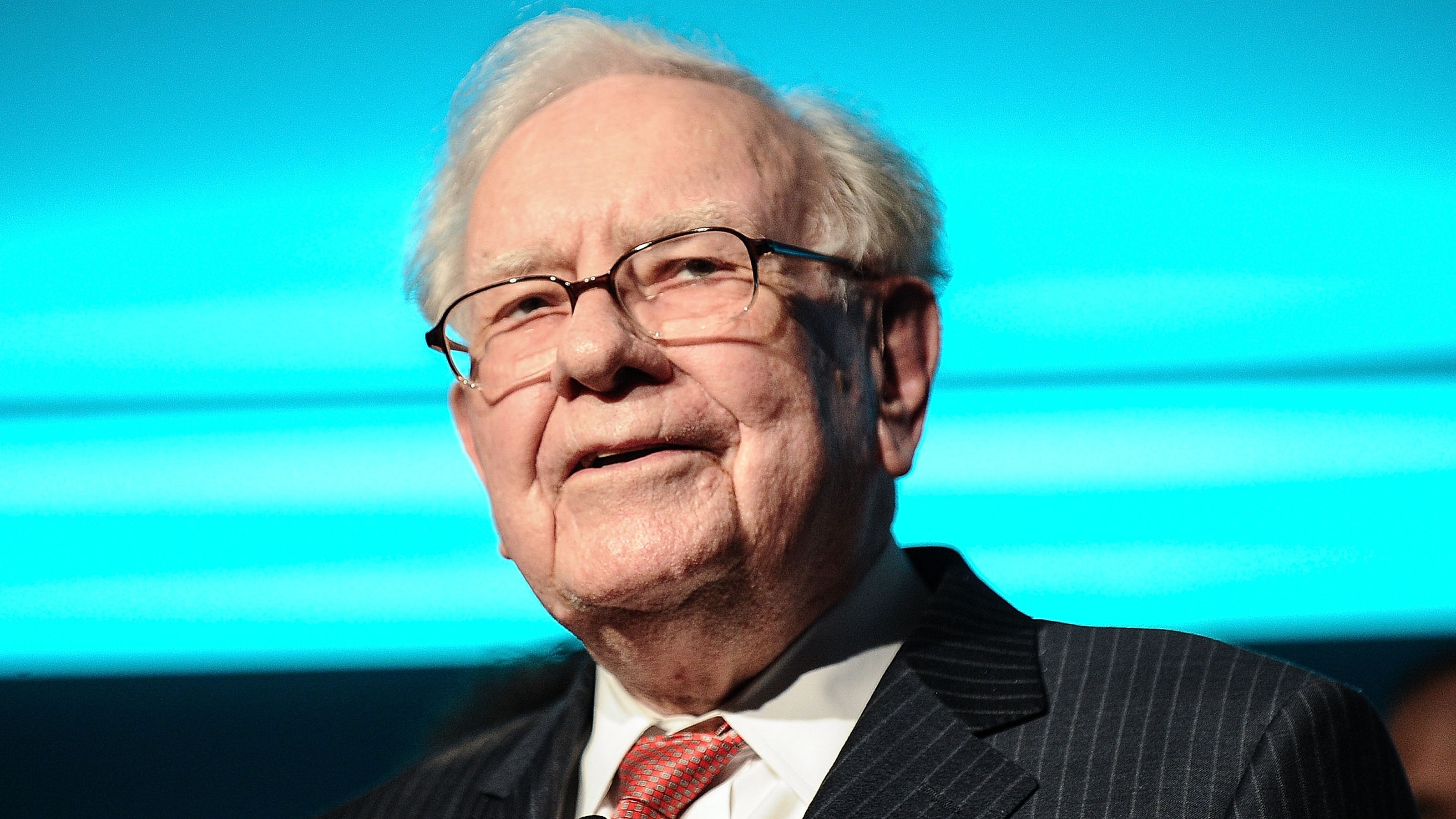

I'm an Investing Expert: This Is How You Can Invest Like Warren Buffett

I'm an Investing Expert: This Is How You Can Invest Like Warren BuffettBuffett just invested $15 billion in oil and gas, and you can leverage the same strategy in your IRA to potentially generate 8% to 12% quarterly cash flow while taking advantage of tax benefits that are unavailable in any other investment class.

-

Integrity, Generosity and Wealth: A Faith-Based Approach to Business

Integrity, Generosity and Wealth: A Faith-Based Approach to BusinessEntrepreneurs who align their business and financial decisions with the biblical principles of integrity, generosity and helping others can realize impactful and fulfilling success.

-

How Much Income Can You Get From an Annuity? An Annuities Expert Gets Specific

How Much Income Can You Get From an Annuity? An Annuities Expert Gets SpecificHere's a detailed look at income annuities and the factors that determine your payout now and in the future.