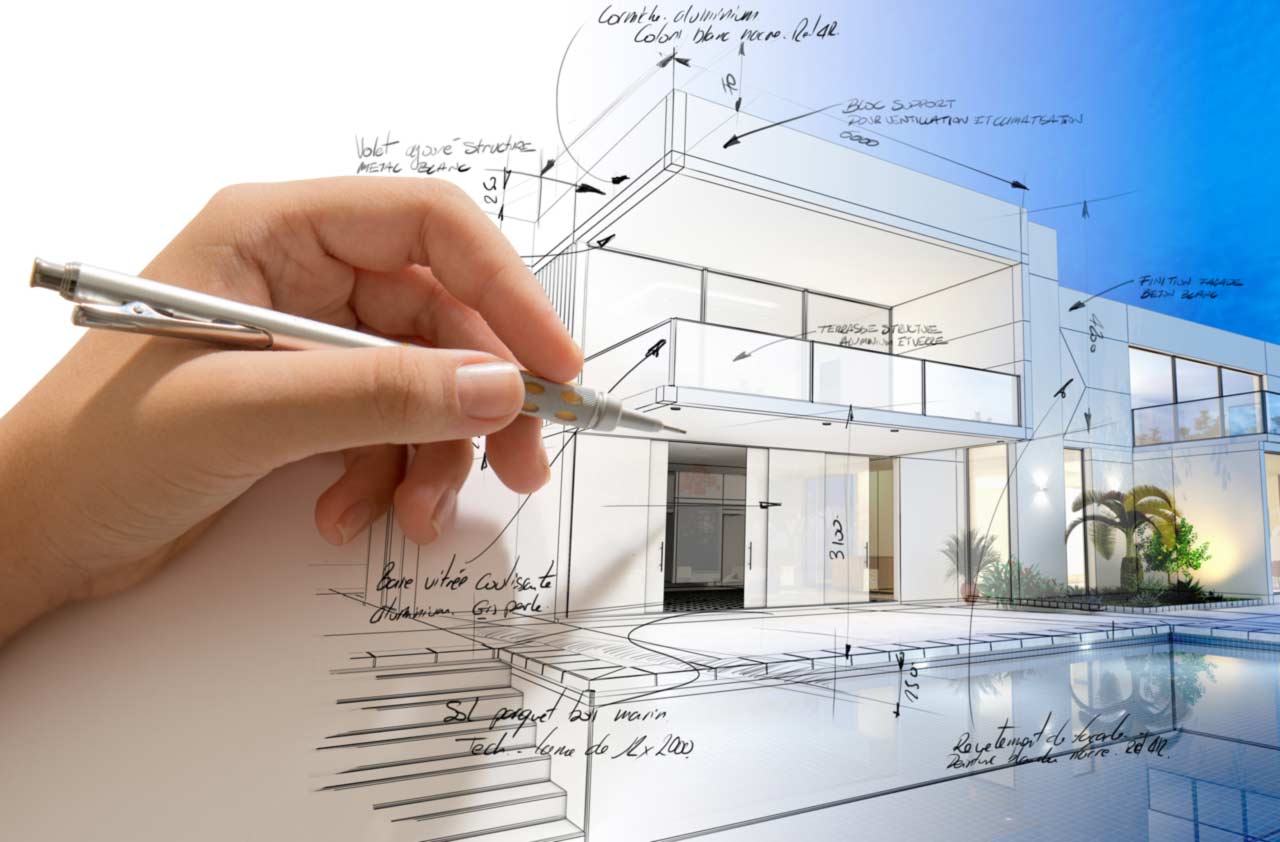

To Build a Sturdy Financial House, You’ll Need a Well-Designed Plan

You wouldn't build a house without a blueprint, but that's what too many people do with their finances, and it can easily turn out very wrong.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

Is it possible, do you think, to accidentally build a house upside down?

It could happen, I guess. If you didn’t know what you were doing. If you got bad advice. Or if you didn’t have a set of blueprints to work from.

Obviously, at some point, though, you’d notice something was terribly wrong.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

When you’re building your financial house, the mistakes you make can be a lot harder to spot. But the idea is the same: It’s always best to work with a plan.

Lay the foundation

It’s important to start with a solid foundation built with “safe money,” such as Social Security and a pension, which can provide a steady and reliable source of income. And if those two income streams aren’t large enough when combined, you may decide to shore things up with an annuity. Think of the foundation as mostly — but not completely — replacing your salary, the income you’ve had all your life. It should be stable and dependable.

Build the walls and roof

Next are your walls, made up of conservative investments. They might be subject to some volatility, but they’ll stand up to most storms. Sometimes they’ll bend and sometimes they’ll break, but most of the time, they’ll help keep you protected.

And then, of course, comes the roof, which is made up of your more moderate- and high-risk investments. The more effort you put into care and maintenance, the better off your financial house can be. Still, this part of your financial portfolio may be the first to go when things get turbulent.

Unfortunately, I see upside-down financial houses all the time, and often the people who own them have no idea the precarious state they’re in. Because the marketplace puts a priority on equities and people are taught to chase returns, all the money goes there, instead of into a well-laid-out portfolio.

Go back to the blueprint

How can you fix an upside-down house?

Diversification is the key.

There are 13 asset classes, and an investment that does the best in one year typically won’t repeat that performance in the next. That’s why it’s important to own a mix of stocks, bonds and cash, diversified across different market caps and styles. This can help spread your risk, because you’ll own a variety of asset types that may perform differently from one another in any given time period.

If you’re looking at the periodic table of asset classes, which ranks asset returns as measured by global market indices, I recommend that clients stay in the middle range, with investments that have been ranked No. 5, 6 or 7 over the last 20 years. Not No. 1, but not 13, either.

Now, this isn’t to say that you won’t ever lose money — remember, your walls may bend or even break. But you may experience less loss of your investment if you go with this approach. And I have been telling my clients for years that when it comes to investing, you win by not losing big.

If you want to have a good, upstanding house with a strong foundation, sturdy walls and an adequate roof, you need financial advice and strategies that utilize a diversified portfolio. A financial professional who is held to the fiduciary standard can furnish you with a personalized detailed blueprint to get you started — or help you out if you’re standing in the middle of a leaky fixer-upper.

Kim Franke-Folstad contributed to this article.

Investment advisory services offered only by duly registered individuals through AE Wealth Management, LLC (AEWM). AEWM and Roberts Wealth Management are not affiliated companies. Investing involves risk, including the potential loss of principal. Insurance and annuity product guarantees are backed by the financial strength and claims-paying ability of the issuing insurance company.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Paul E. Roberts Jr. is the founder and chief investment officer of Roberts Wealth Management. He has passed the Series 65 exam and has insurance licenses in Texas, Louisiana, Mississippi and Alabama. He spent 22 years as a practicing CPA, then founded Roberts Wealth Management, a firm that focuses on estate preservation and retirement planning. His primary areas of focus are retirement income planning, investment management, 401(k)/individual retirement account (IRA) guidance and asset protection.

-

Over 65? Here's What the New $6K 'Senior Deduction' Means for Medicare IRMAA Costs

Over 65? Here's What the New $6K 'Senior Deduction' Means for Medicare IRMAA CostsTax Breaks A new deduction for people over age 65 has some thinking about Medicare premiums and MAGI strategy.

-

U.S. Congress to End Emergency Tax Bill Over $6,000 Senior Deduction and Tip, Overtime Tax Breaks in D.C.

U.S. Congress to End Emergency Tax Bill Over $6,000 Senior Deduction and Tip, Overtime Tax Breaks in D.C.Tax Law Here's how taxpayers can amend their already-filed income tax returns amid a potentially looming legal battle on Capitol Hill.

-

5 Investing Rules You Can Steal From Millennials

5 Investing Rules You Can Steal From MillennialsMillennials are reshaping the investing landscape. See how the tech-savvy generation is approaching capital markets – and the strategies you can take from them.

-

When Estate Plans Don't Include Tax Plans, All Bets Are Off: 2 Financial Advisers Explain Why

When Estate Plans Don't Include Tax Plans, All Bets Are Off: 2 Financial Advisers Explain WhyEstate plans aren't as effective as they can be if tax plans are considered separately. Here's what you stand to gain when the two strategies are aligned.

-

Counting on Real Estate to Fund Your Retirement? Avoid These 3 Costly Mistakes

Counting on Real Estate to Fund Your Retirement? Avoid These 3 Costly MistakesThe keys to successful real estate planning for retirees: Stop thinking of property income as a reliable paycheck, start planning for tax consequences and structure your assets early to maintain flexibility.

-

I'm a Financial Planner: These Small Money Habits Stick (and Now Is the Perfect Time to Adopt Them)

I'm a Financial Planner: These Small Money Habits Stick (and Now Is the Perfect Time to Adopt Them)February gets a bad rap for being the month when resolutions fade — in fact, it's the perfect time to reset and focus on small changes that actually pay off.

-

Social Security Break-Even Math Is Helpful, But Don't Let It Dictate When You'll File

Social Security Break-Even Math Is Helpful, But Don't Let It Dictate When You'll FileYour Social Security break-even age tells you how long you'd need to live for delaying to pay off, but shouldn't be the sole basis for deciding when to claim.

-

I'm an Opportunity Zone Pro: This Is How to Deliver Roth-Like Tax-Free Growth (Without Contribution Limits)

I'm an Opportunity Zone Pro: This Is How to Deliver Roth-Like Tax-Free Growth (Without Contribution Limits)Investors who combine Roth IRAs, the gold standard of tax-free savings, with qualified opportunity funds could enjoy decades of tax-free growth.

-

One of the Most Powerful Wealth-Building Moves a Woman Can Make: A Midcareer Pivot

One of the Most Powerful Wealth-Building Moves a Woman Can Make: A Midcareer PivotIf it feels like you can't sustain what you're doing for the next 20 years, it's time for an honest look at what's draining you and what energizes you.

-

I'm a Wealth Adviser Obsessed With Mahjong: Here Are 8 Ways It Can Teach Us How to Manage Our Money

I'm a Wealth Adviser Obsessed With Mahjong: Here Are 8 Ways It Can Teach Us How to Manage Our MoneyThis increasingly popular Chinese game can teach us not only how to help manage our money but also how important it is to connect with other people.

-

Looking for a Financial Book That Won't Put Your Young Adult to Sleep? This One Makes 'Cents'

Looking for a Financial Book That Won't Put Your Young Adult to Sleep? This One Makes 'Cents'"Wealth Your Way" by Cosmo DeStefano offers a highly accessible guide for young adults and their parents on building wealth through simple, consistent habits.