5 Best Bargains for Dividend Investors (including Retirees)

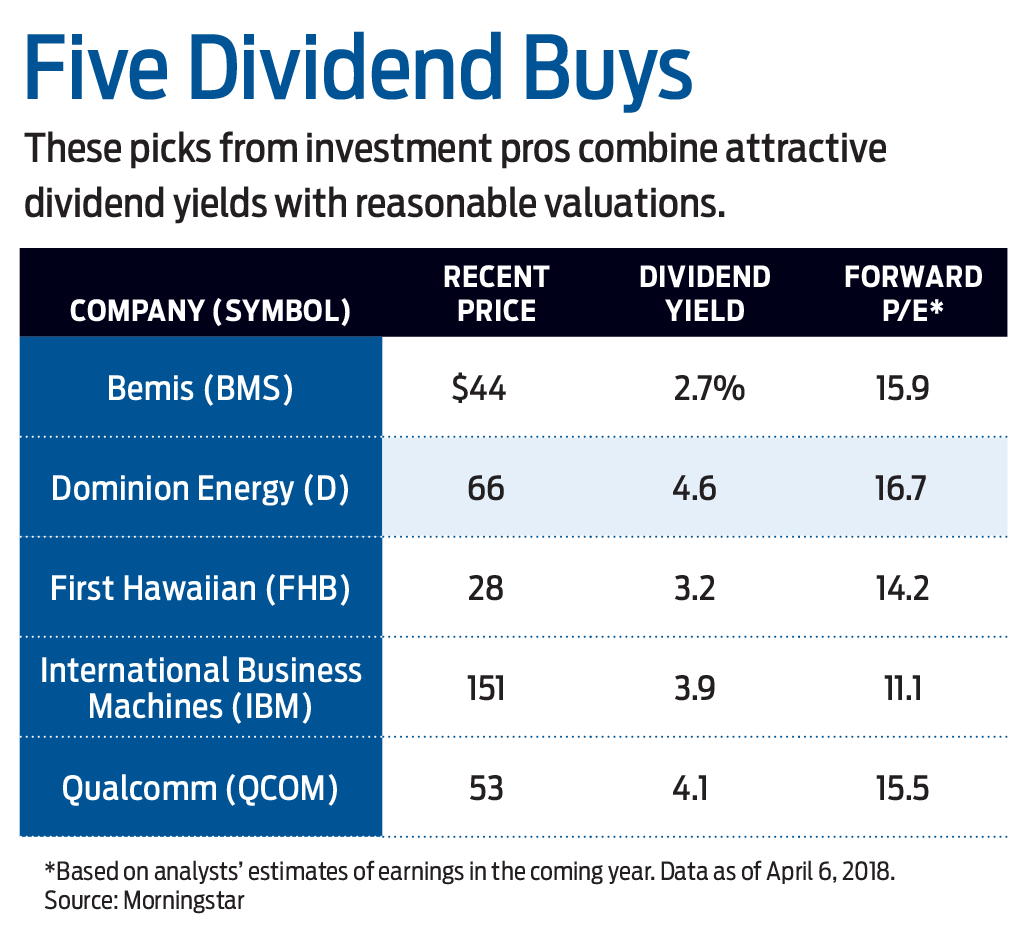

These stock picks from investment pros offer attractive yields with reasonable valuations -- a good combination for income and retirement portfolios.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

What do tax reform, rising interest rates and market volatility have in common? They’re all reasons to take a fresh look at dividend stocks.

The new tax law should benefit dividend investors, money managers say, as a lower corporate tax rate boosts profitability and spurs companies to return more cash to shareholders. Recent market swings are another argument for dividend stocks: Historically, stocks paying generous dividends have outperformed non-dividend payers, with less volatility.

Rising rates, however, are often considered a strike against dividend stocks—why would you take the risk of investing in stocks when you can get decent yields in bonds? But historically, dividend payers have significantly outperformed non-dividend payers in the years after the Federal Reserve initiates a rate-hiking cycle, says John Buckingham, chief investment officer at AFAM Capital, in Aliso Viejo, Cal.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

Though rates have started to rise, they remain relatively low, and dividend income “is still very attractive relative to other investment choices,” Buckingham says. The yield on the 10-year U.S. Treasury hit 3% in late April, the first time it's been that high in about four years, while many dividend stocks offer similar or higher yields along with potential price appreciation and dividend growth.

That said, some dividend payers have become overvalued as income-hungry investors snapped up traditional bond substitutes, such as utility stocks, during the long stretch of low rates. Here’s where some value-minded money managers and analysts are finding the best bargains today.

Where to Look for Good Dividend Stocks

Banks tend to be beneficiaries of rising interest rates, as they profit from a widening gap between the rates they charge borrowers and the yield they pay depositors. Jeff John and Miles Lewis, co-managers of the American Century Small Cap Value Fund, like First Hawaiian (FHB), which has strong market share in the Aloha state. The bank has a solid balance sheet and room to boost its dividend 9% or 10% this year, Lewis says.

Lewis and John also like Bemis (BMS), which makes packaging for food and other products. There is stable demand for such packaging, and the company generates a lot of free cash flow and pays a “very safe dividend,” Lewis says. Bemis has paid a dividend since 1922 and has boosted its cash payout for 35 years in a row.

Buckingham is finding some bargains in the technology sector, which has taken some hits this year after a strong 2017. He likes Qualcomm (QCOM), maker of wireless communications equipment and developer of the widely used CDMA technology, which allows mobile devices to send and receive data and voice signals. The company recently raised its quarterly cash dividend about 9%, to 62 cents per share.

IBM (IBM), the information-technology giant, is another Buckingham favorite. Big Blue stock was left out of last year’s tech-sector surge as investors questioned its growth potential. But the company is focused on expanding its “Strategic Imperatives,” including mobile, cloud and security technologies, and the growth in those areas is starting to outweigh the stagnation in other businesses, analysts say.

Even the utilities sector, widely seen as overvalued, holds some bargains for choosy dividend investors, says Travis Miller, equity strategist at investment-research firm Morningstar. Among Morningstar’s favorites is Dominion Energy (D), one of the largest energy producers and transporters in the U.S. Dominion is a partner in the Atlantic Coast Pipeline, which will transport natural gas from West Virginia to Virginia and North Carolina utilities. Over the next decade, Miller says, Dominion will be “a big winner from the U.S. energy shift toward gas and renewable energy and away from coal.”

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

-

Over 65? Here's What the New $6K 'Senior Deduction' Means for Medicare IRMAA Costs

Over 65? Here's What the New $6K 'Senior Deduction' Means for Medicare IRMAA CostsTax Breaks A new deduction for people over age 65 has some thinking about Medicare premiums and MAGI strategy.

-

U.S. Congress to End Emergency Tax Bill Over $6,000 Senior Deduction and Tip, Overtime Tax Breaks in D.C.

U.S. Congress to End Emergency Tax Bill Over $6,000 Senior Deduction and Tip, Overtime Tax Breaks in D.C.Tax Law Here's how taxpayers can amend their already-filed income tax returns amid a potentially looming legal battle on Capitol Hill.

-

5 Investing Rules You Can Steal From Millennials

5 Investing Rules You Can Steal From MillennialsMillennials are reshaping the investing landscape. See how the tech-savvy generation is approaching capital markets – and the strategies you can take from them.

-

What Fed Rate Cuts Mean For Fixed-Income Investors

What Fed Rate Cuts Mean For Fixed-Income InvestorsThe Fed's rate-cutting campaign has the fixed-income market set for an encore of Q4 2024.

-

Another State Bans Capital Gains Taxes: Will More Follow in 2026?

Another State Bans Capital Gains Taxes: Will More Follow in 2026?Capital Gains A constitutional amendment blocking future taxes on realized and unrealized capital could raise interesting questions for other states.

-

IRS Updates Capital Gains Tax Thresholds for 2026: Here’s What’s New

IRS Updates Capital Gains Tax Thresholds for 2026: Here’s What’s NewCapital Gains The IRS has increased the capital gains tax income thresholds for 2026. You'll need this information to help minimize your tax burden.

-

The Most Tax-Friendly States for Investing in 2025 (Hint: There Are Two)

The Most Tax-Friendly States for Investing in 2025 (Hint: There Are Two)State Taxes Living in one of these places could lower your 2025 investment taxes — especially if you invest in real estate.

-

The Final Countdown for Retirees with Investment Income

The Final Countdown for Retirees with Investment IncomeRetirement Tax Don’t assume Social Security withholding is enough. Some retirement income may require a quarterly estimated tax payment by the September 15 deadline.

-

Washington Approves Capital Gains Tax Increase for 2025: Who Pays?

Washington Approves Capital Gains Tax Increase for 2025: Who Pays?State Tax Here's what high-income filers need to know about Washington's latest tax hike.

-

457 Plan Contribution Limits for 2026

457 Plan Contribution Limits for 2026Retirement plans There are higher 457 plan contribution limits in 2026. That's good news for state and local government employees.

-

Medicare Basics: 12 Things You Need to Know

Medicare Basics: 12 Things You Need to KnowMedicare There's Medicare Part A, Part B, Part D, Medigap plans, Medicare Advantage plans and so on. We sort out the confusion about signing up for Medicare — and much more.