How to Reduce Taxable RMDs and Improve Your Retirement Income Plan at the Same Time

Adding annuity payments to your IRA withdrawals could save on taxes and help ensure a stable cash flow throughout your retirement. With that in mind, here's a QLAC strategy to consider.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

A reporter called me to ask whether investing in a QLAC would reduce a retiree’s RMDs and the tax that must be paid on them. (Regulations demand that you begin taking these required minimum distributions — and pay taxes on them — from your 401(k) or IRA beginning at age 70½.)

The short answer is yes.

The complete answer is, think about the QLAC decision as part of a broader consideration of your retirement finances. Management of taxes is important, but so is structuring your savings to provide income that lasts your entire life. Properly combined with your IRA investments, a QLAC can provide steady, lifetime income and may help you to fund a legacy to your heirs.

Article continues belowFrom just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

As I have said previously, consider using 25% of your 401(k) or traditional IRA — up to $130,000 — to purchase a qualifying longevity annuity contract, or QLAC. This is a form of deferred income annuity that starts paying you at an age you set, usually 80 or 85, in anticipation of late-in-retirement expenses. It also defers taxes until you start receiving QLAC payments. Once a QLAC is in place, consider a strategy that generates the highest income until the QLAC kicks in.

Let’s examine how you might create a retirement income plan that balances various investment opportunities.

A revealing case study

We’ll start by looking at a retiree with $1 million in savings. She is 70, and 100% of her savings are in a rollover IRA. Her family history indicates she has a good chance of living into her 90s. She is interested in investing some of her IRA into a QLAC that would start paying her income when she reaches 85 — primarily in order to reduce taxable required minimum distributions.

She may also be interested in an immediate income annuity that would provide annuity payments now to provide a secure source of income in these volatile markets. She is single and her children are self-supporting, so she is considering a life-only annuity for maximum income.

Our investor can shop the QLAC and immediate annuity market for the best rates for each purchase. Different companies will offer better rates at varying ages. Or she can use this opportunity to create a retirement income plan for herself.

She is a good example for our purposes because she faces an impending decision regarding RMDs, which kick in at age 70½; however, the planning exercise and the conclusions will be generally consistent for many other situations, as well. We will use graphics to show our retiree’s results in various financial circumstances.

What happens when you rely on investments alone?

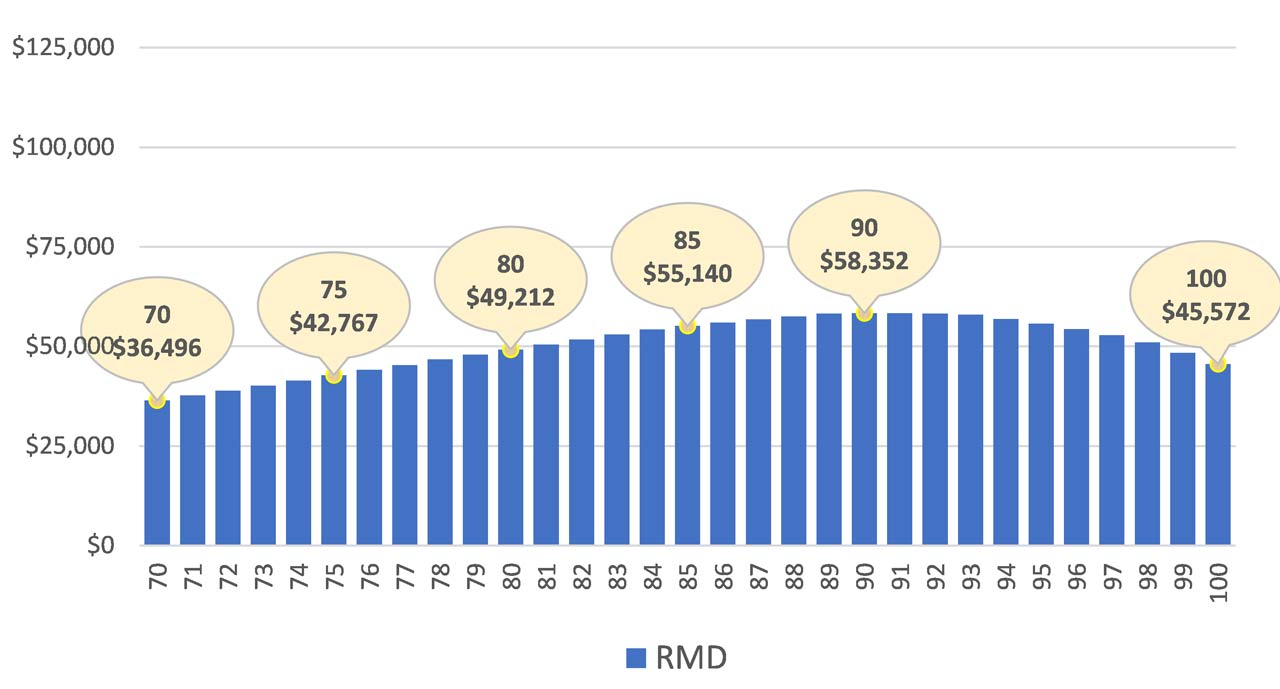

Chart 1 below shows what our retiree’s income would look like if she relies solely on investments in her IRA, including stocks and bonds, based on an average annual return after fees of 4% in the stock market. That rate would rank among the 10% worst prolonged markets. A market return closer to the long-term average of 8% would increase her income, but the downward income curve would stay the same as she ages. (We use the 4% return in all of the charts you will see.)

Note that her RMD in the first year is $36,496, which of course is fully taxable.

Chart 1 – RMD only

Investment plus QLAC at 85

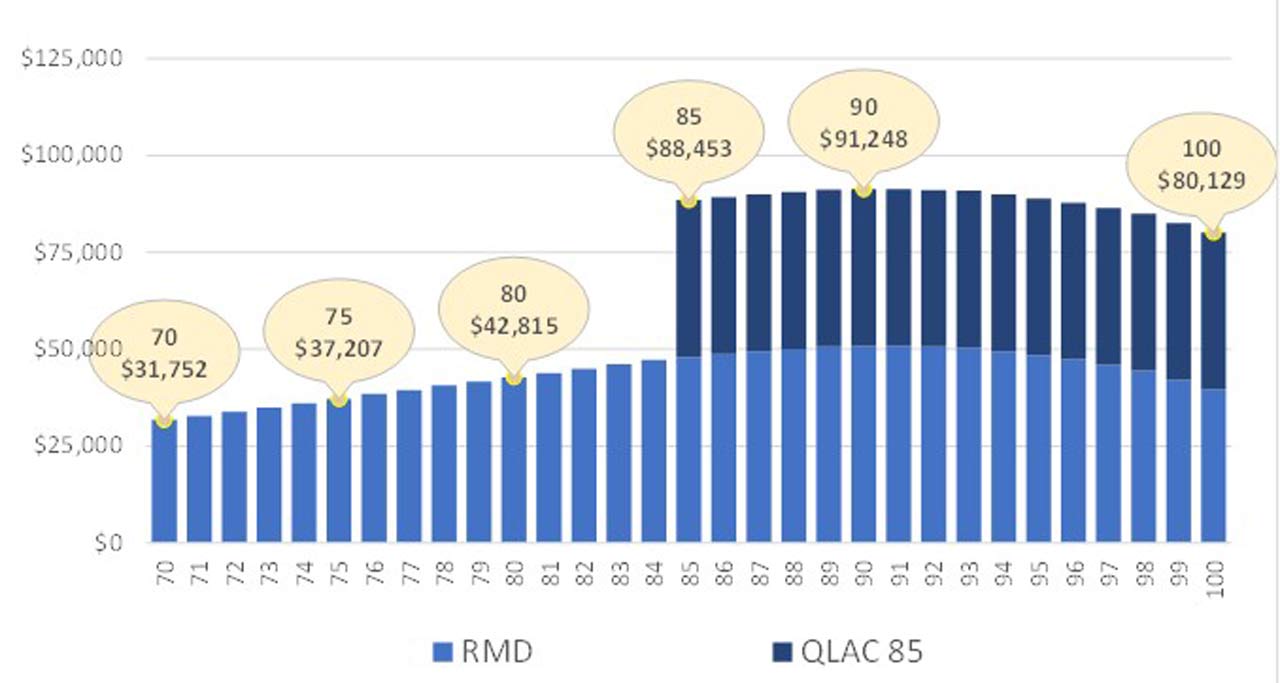

Chart 2 below demonstrates the answer to the reporter’s question. Our 70-year-old retiree can take up to $130,000 of her IRA and buy a QLAC that begins to pay out at age 85. Not only will the payments help her cover medical and other costs that may be higher at that age, but also reducing her IRA by the $130,000 purchase price will lower her RMDs — and the taxes she must pay on them — from age 70 until she reaches 85.

Note that her RMD is reduced by nearly $5,000 to $31,752 in the first year. While the taxable income is reduced initially, it does rise after age 85, and unless there is a specific need for the late-in-retirement income, taxes could again become an issue. Of course, some of those late-in-retirement expenses could be tax-deductible.

Chart 2 – Adding QLAC

But our investor can also design alternative plans with more logical income

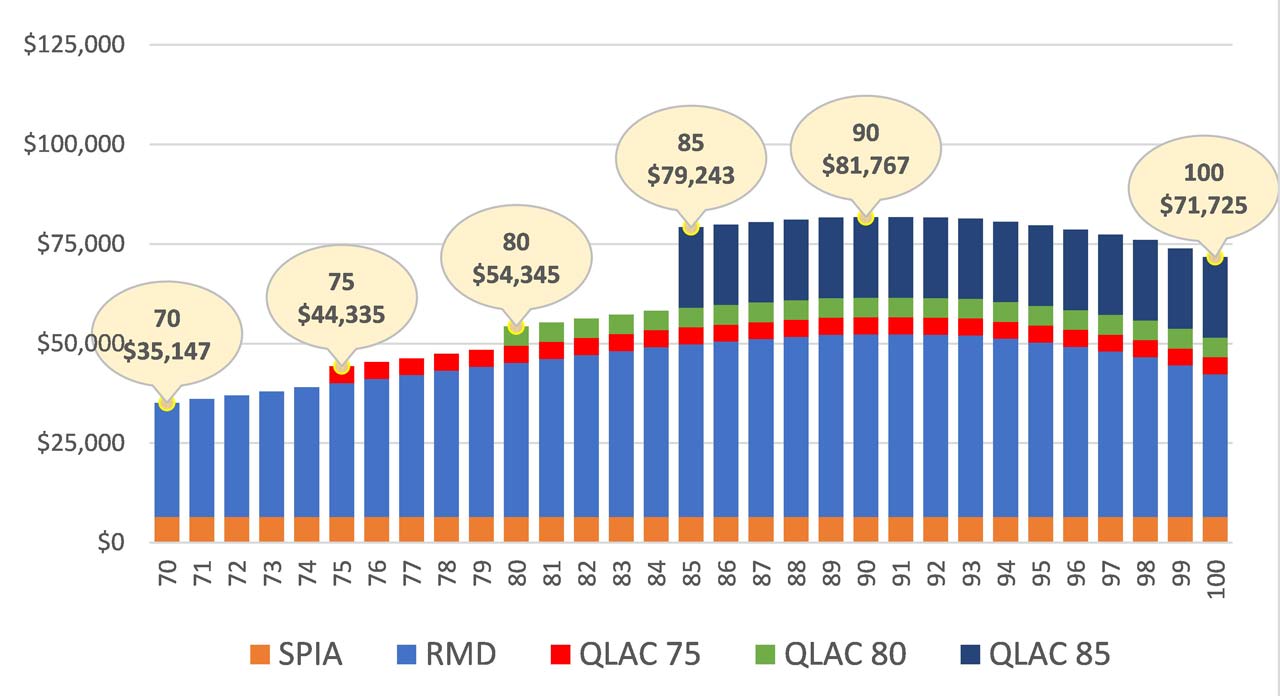

Chart 3 shows that when she adds an income annuity that begins payments immediately (otherwise called a single premium immediate annuity, or SPIA), she will obtain an additional source of guaranteed income today — and still maintain lower taxable income than the investment-only plan ($35,147 vs $36,496).

Chart 3 below also demonstrates how to “ladder” QLAC income, an approach that provides increasing income starting in stages at 75, 80 and 85. Again, we show the results with a 4% annual rate of return for stock market investments.

As you see, even with a poor market, a combination of an immediate income annuity and laddered QLAC provides much more income — and peace of mind — than a retirement plan invested solely in stocks and bonds.

Chart 3 — Laddered QLAC and SPIA

Income Allocation and managed withdrawals from a traditional IRA

Managing your IRA withdrawals is a relatively simple way to keep your total income steadily increasing for your early retirement years. As we discussed above, RMDs are only managed by the IRS to collect taxes, not to provide a logical pattern of income.

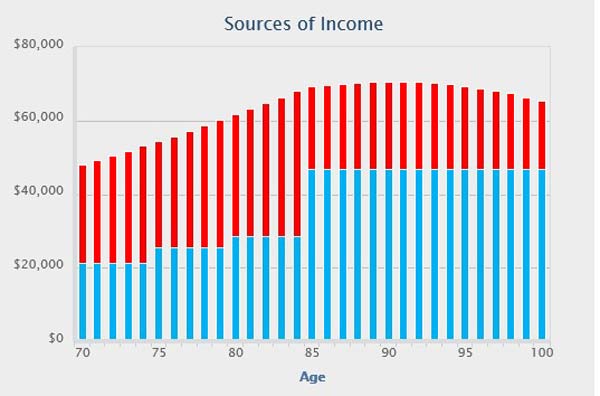

Set out in Chart 4 below is an excerpt from an Income Allocation report generated from Go2Income.com for our investor. While this plan generates more taxable income in early years, the retiree does not sacrifice income in later years.

Chart 4 – Income Allocation Plan

Income Allocation is a retirement planning method that emphasizes creating income to last for the rest of your life. The income under an Income Allocation plan increases on a regular basis until age 85. Income Allocation uses the same income sources as the DIY plan shown in Chart 3 above but manages the withdrawals, rather than setting them at the RMD level.

Visit Go2Income and plug in your own numbers on the Income Allocation tool. If you like what you see, you can talk — with no commitment — to a Go2specialist who will help you determine all the ways you can improve your retirement.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Jerry Golden is the founder and CEO of Golden Retirement Advisors Inc. He specializes in helping consumers create retirement plans that provide income that cannot be outlived. Find out more at Go2income.com, where consumers can explore all types of income annuity options, anonymously and at no cost.