3 Great Reasons Why You Should Start Saving Early

Once you see what you could gain by stuffing your piggy bank now (and the potential riches you’re giving up by waiting), you'll see why there really is no time like the present.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

Our clients often ask “How much do I need to save this year to be on track for retirement?” Obviously, there are a lot of variables that go into answering that question: retirement spending, assumed rate of return, pensions and Social Security to name a few. But perhaps the most important variable is the one that’s priceless: time.

People with the most time on their side are those most likely to achieve their retirement goals. Those who save early end up way ahead of their procrastinating peers.

You may have heard the wise Chinese proverb that says "The best time to plant a tree was 20 years ago. The second-best time is now." The same is true for saving. While the best time to start saving may have been 20 years ago, don't fret, there are ample benefits to starting to save today.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

Let's look at a few of the most important reasons.

Time is Money

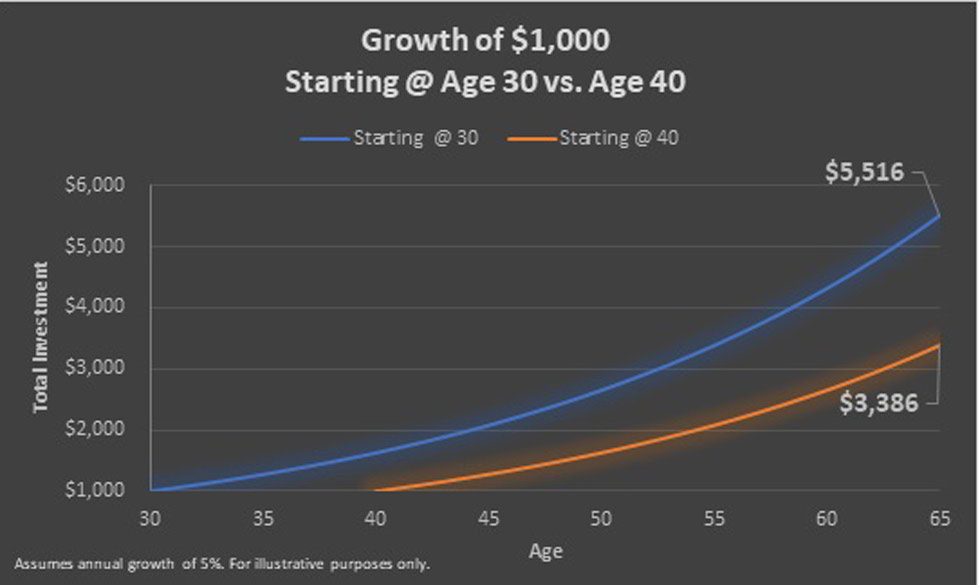

There are few forces as impressive and powerful as compound interest. The real secret to compound interest is less about the amount that is saved, and more about the amount of time it is invested. Let's compare saving $1,000 at age 40 versus age 30 with a hypothetical 5% compound annual return to age 65.

The 30-year-old saver ends up with over 60% more money simply because she saved 10 years earlier.

Instead of just investing $1,000 one time, what if you saved $1,000 per year from 40 to 65 versus starting at age 30?

In this example by starting 10 years earlier you have almost double the final amount at age 65!

The earlier you start the more magical compound interest is.

Opportunity Lost

What if you don't save for the first several years or decades of your career but save massive amounts of money later in retirement? Will that balance things out? Maybe, but there are some opportunities lost.

First, if you have an employer-sponsored retirement plan like a 401(k) that offers an employer match, those dollars are forever lost each year that you don't contribute. If you start saving later, you can't go back to your employer and ask that they give you the lost matching dollars from earlier in your career. Employer matches are free money: Never leave that on the table.

Another consideration is IRS maximum contribution amounts. All tax-advantaged retirement vehicles like 401(k)s, IRAs, etc. have maximum contribution limits each year. For example, in 2019 you can contribute $6,000 into a traditional IRA or a Roth IRA. If you don't make that contribution by the tax-filing deadline next year, that's a lost opportunity and no matter how much money you want to save in the future, you can't get that IRA contribution opportunity back. Yes, you can still save, but you'll have to choose less tax-efficient vehicles and that will impact your return and ending value.

We advise our clients to max out their retirement accounts every single year to take advantage of these tax-saving opportunities from Uncle Sam!

Market Trends

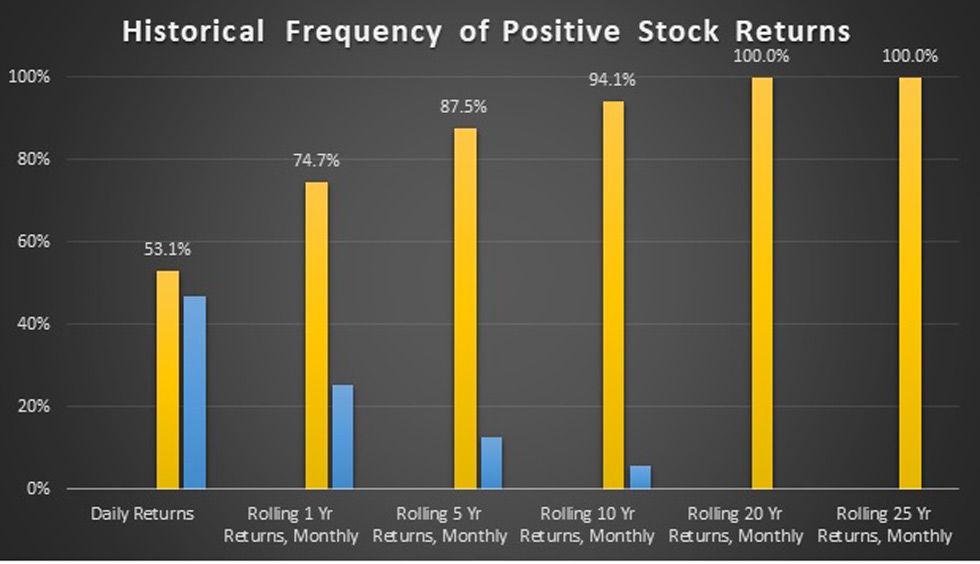

One final advantage I'll point out to saving and investing earlier rather than later is that the stock market presents a much better opportunity for long-term investors than it does for short-term investors. People who invest in the stock market with a short time horizon often get burned and have negative returns. So why then do we invest money for retirement in the stock market? Well, consider the following data.

Between 1928 and 2017, if you had invested in the market any given day, your chances of a positive return were 53.1%; about as good as flipping a coin. As you increase your investment period, your likelihood of a positive return significantly increases. Rolling one-year calendar returns had a 74.7% occurrence of positive returns, and rolling 10-year periods were positive 94.1% of the time! Once you increase the time period to 20 years, there were no negative return periods!

Source: Global Finance Data Inc. as of 12/31/2017. Based on historical S&P 500 returns over various periods. Daily return data begins on 01/31/1928, and based on price appreciation only.

Although nothing is ever guaranteed when it comes to investing, history shows that the longer you are invested, the greater your chance for favorable returns. I've heard it said that what truly matters in investing is not timing the market but time in the market. Get money invested early so your time horizon is long enough to ride out short-term volatility in pursuit of long-term gains. You can sum it all up like this:

- The longer your money is invested, the more compounding you experience.

- There are specific retirement savings opportunities offered each year that may be forfeited if not acted on.

- And the stock market should be viewed as a long game, not a quick turnaround.

Because of these reasons, you should start saving today. Even if you can't save as much as you need to right now, start with something. Get some money working for you and get time on your side. Don't let another year go by lamenting that you haven't started planting financial trees. Besides, today is the second-best time to start!

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Josh Monroe is a CERTIFIED FINANCIAL PLANNER™ practitioner and a Chartered Financial Consultant designee who listens actively and plans thoughtfully to help clients achieve their goals. He joined the CI Brightworth team in 2019 as a Financial Planner. Before CI Brightworth, Josh spent eight years at a leading insurance and investment firm in a variety of roles, including compliance and supervision. Josh is passionate about financial planning and making complex concepts easy to understand.

-

Nasdaq Leads a Rocky Risk-On Rally: Stock Market Today

Nasdaq Leads a Rocky Risk-On Rally: Stock Market TodayAnother worrying bout of late-session weakness couldn't take down the main equity indexes on Wednesday.

-

Quiz: Do You Know How to Avoid the "Medigap Trap?"

Quiz: Do You Know How to Avoid the "Medigap Trap?"Quiz Test your basic knowledge of the "Medigap Trap" in our quick quiz.

-

5 Top Tax-Efficient Mutual Funds for Smarter Investing

5 Top Tax-Efficient Mutual Funds for Smarter InvestingMutual funds are many things, but "tax-friendly" usually isn't one of them. These are the exceptions.

-

Social Security Break-Even Math Is Helpful, But Don't Let It Dictate When You'll File

Social Security Break-Even Math Is Helpful, But Don't Let It Dictate When You'll FileYour Social Security break-even age tells you how long you'd need to live for delaying to pay off, but shouldn't be the sole basis for deciding when to claim.

-

I'm an Opportunity Zone Pro: This Is How to Deliver Roth-Like Tax-Free Growth (Without Contribution Limits)

I'm an Opportunity Zone Pro: This Is How to Deliver Roth-Like Tax-Free Growth (Without Contribution Limits)Investors who combine Roth IRAs, the gold standard of tax-free savings, with qualified opportunity funds could enjoy decades of tax-free growth.

-

One of the Most Powerful Wealth-Building Moves a Woman Can Make: A Midcareer Pivot

One of the Most Powerful Wealth-Building Moves a Woman Can Make: A Midcareer PivotIf it feels like you can't sustain what you're doing for the next 20 years, it's time for an honest look at what's draining you and what energizes you.

-

I'm a Wealth Adviser Obsessed With Mahjong: Here Are 8 Ways It Can Teach Us How to Manage Our Money

I'm a Wealth Adviser Obsessed With Mahjong: Here Are 8 Ways It Can Teach Us How to Manage Our MoneyThis increasingly popular Chinese game can teach us not only how to help manage our money but also how important it is to connect with other people.

-

Looking for a Financial Book That Won't Put Your Young Adult to Sleep? This One Makes 'Cents'

Looking for a Financial Book That Won't Put Your Young Adult to Sleep? This One Makes 'Cents'"Wealth Your Way" by Cosmo DeStefano offers a highly accessible guide for young adults and their parents on building wealth through simple, consistent habits.

-

Global Uncertainty Has Investors Running Scared: This Is How Advisers Can Reassure Them

Global Uncertainty Has Investors Running Scared: This Is How Advisers Can Reassure ThemHow can advisers reassure clients nervous about their plans in an increasingly complex and rapidly changing world? This conversational framework provides the key.

-

I'm a Real Estate Investing Pro: This Is How to Use 1031 Exchanges to Scale Up Your Real Estate Empire

I'm a Real Estate Investing Pro: This Is How to Use 1031 Exchanges to Scale Up Your Real Estate EmpireSmall rental properties can be excellent investments, but you can use 1031 exchanges to transition to commercial real estate for bigger wealth-building.

-

The 8 Stages of Retirement: An Expert Guide to Confidence, Flexibility and Fulfillment, From a Financial Planner

The 8 Stages of Retirement: An Expert Guide to Confidence, Flexibility and Fulfillment, From a Financial PlannerRetirement planning is less about hitting a "magic number" and more about an intentional journey — from understanding your relationship with money to preparing for your final legacy.