Housing Will Add to the Economy's Growth This Year

The sector’s collapse is just about over, but don’t look for the typical boomy recovery.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

It’s another small sign that the economy is improving: Flickers of life in the housing industry. True, it’s nowhere near the usual pattern, in which housing soars as a recession ends. But look for the industry to make a small contribution to GDP growth this year instead of subtracting from it, as it has in 17 of the past 20 quarters.

The industry will also add jobs this year -- a small gain of about 125,000, after shedding 1.44 million since 2006. Housing starts are slowly inching up, getting a big boost from apartment construction in January (although this volatile segment did take a dive in February). Still, with mortgages tougher to get and with would-be buyers spooked by a three-year decline in home prices, rental demand is strong. That’s shown by the homeownership rate, which is down to 66.5% from a peak of 68% and on its way back to its historical norm of 64%. Each percentage point equals about 1 million households.

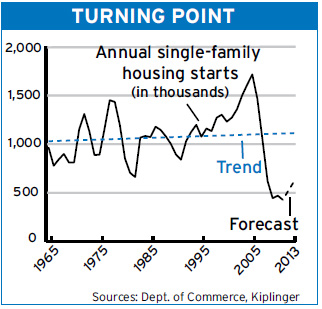

Starts of single-family houses will be up a smidge this year, climbing to about 650,000 from about 590,000 last year. That’s about one-third of the total racked up each year from 2004 to 2006. They remain in the dumps after the two lowest years on record in 2009 and 2010. As an executive with a major builder says, “It feels as if we’re not falling as fast as we were. But it’ll be a long claw back.”

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

There’s also a lift from remodeling -- some from buyers of empty, foreclosed homes and some from owners opting to stay put and spruce up their houses rather than trying to trade up and go through the hassle of selling and buying.

New-home sales will linger near historical lows, around 350,000 this year. Traffic at model homes is on the rise, but sales will take a while to materialize. Thomas Lawler, a Virginia housing consultant, says it’s good that construction remains so low, adding that “as demand increases and supply remains subdued, prices will level off.”

Sales of existing homes will creep higher, to just over 5 million this year from just under that mark last year. Mortgage rates remain attractive, with the 30-year fixed rate loan near 5%, about where it was one year ago. The rate is likely to creep toward 5.5% this year, but any dampening effect will be offset by the positive impact of additional jobs in a growing economy. A bigger impediment to sales is that tight lending standards -- more money down, a higher cutoff in credit scores -- limit potential buyers.

Another good sign: Fresh loan delinquencies are waning. These track the job market -- specifically, the filing of initial claims for unemployment benefits. But foreclosures won’t show a letup. The probe into shoddy paperwork by banks on mortgages delayed the process, so we expect foreclosures to climb from 1.8 million last year to 2 million in 2011. One in four mortgages remain underwater, but fewer of these homeowners will go into default as layoffs continue to ease and hiring shows modest gains.

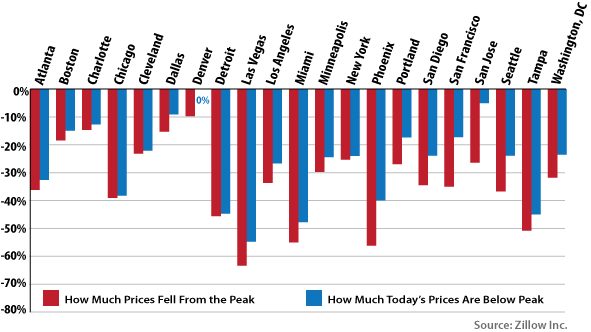

Prices will continue to slide lower through midyear or so -- an additional 4% on average, a bit more in once-hot markets, including Tampa, Las Vegas and Phoenix. Prices will be stable in many cities that dodged the boom-bust cycle -- for instance the wide area between the Mississippi River and the Great Smoky Mountains.

Signs of improvement, then, indicate that the depression in housing is nearly over. But major gains remain in the distance. Supply and demand are still out of whack, and balance will come only with substantial job creation and a renewed appetite among consumers.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

-

Americans, Even With Higher Incomes, Are Feeling the Squeeze

Americans, Even With Higher Incomes, Are Feeling the SqueezeA 50-year mortgage probably isn’t the answer, but there are other ways to alleviate the continuing sting of high prices

-

Hiding the Truth From Your Financial Adviser Can Cost You

Hiding the Truth From Your Financial Adviser Can Cost YouHiding assets or debt from a financial adviser damages the relationship as well as your finances. If you're not being fully transparent, it's time to ask why.

-

How to Manage a Disagreement With Your Financial Adviser

How to Manage a Disagreement With Your Financial AdviserKnowing how to deal with a disagreement can improve both your finances and your relationship with your planner.

-

A Housing Shortage Looms: Builders Can’t Keep Up

A Housing Shortage Looms: Builders Can’t Keep Upbusiness Starter homes especially are becoming scarce.

-

2016: A Second Good Year for Housing

2016: A Second Good Year for Housingbusiness The housing market picked up last year in many areas of the U.S. Look for it to grow as well or better this year.

-

Where the Housing Market Is Headed in Late 2015

Where the Housing Market Is Headed in Late 2015business First-time home buyers will be a big driver of this market's recovery.

-

Housing Market Will Improve in 2015

Housing Market Will Improve in 2015Economic Forecasts The lagging sector is new single family homes, where a shortage of skilled labor and buildable lots is holding back construction.

-

No Reason to Fear a Housing Bubble

No Reason to Fear a Housing Bubblebusiness Look for recent price spikes to ease as new construction picks up and more homes come on the market.

-

Housing Recovery Firmly Under Way

real estate Gains among states will be uneven, but progress will continue through 2014

-

Office, Other Commercial Property Rents to Rise in 2013

Business Costs & Regulation Like the economy as a whole, the commercial real estate market will strengthen over the coming year.

-

3 Signs the Housing Recovery Has Arrived

3 Signs the Housing Recovery Has ArrivedEconomic Forecasts Buyers are back, building is up -- and housing is poised to add to the economy instead of pulling it down.