2016: A Second Good Year for Housing

The housing market picked up last year in many areas of the U.S. Look for it to grow as well or better this year.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

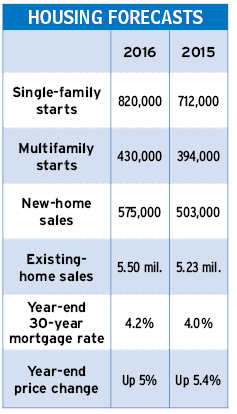

The housing market is poised for a solid year. In fact, it’s shaping up to be slightly better than 2015, when many parts of the U.S. saw housing perk up.

More potential buyers are seeking mortgages this year as they see their paychecks swell a bit in a strengthening job market that’s forcing up wages. Stronger household formation and continuing low mortgage rates will also spur buyers. Growth in households, moreover, is fueling a clamor for apartments in metro areas, and vacancy rates have fallen to 22-year lows.

Builders will scramble to keep up with demand for housing of all types. Inventories of new homes are especially tight. Construction is constrained by, among other things, a big shortage of skilled home construction workers. The need for new homes will increase as sales of existing homes rise — homes sold by downsizing baby boomers as well as by buyers looking to move up. But some builders will continue to focus on putting up multifamily homes — the quickest way to expand inventory and make more efficient use of workers.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

Housing markets overall will be strongest in the West and in the South, where they are boosted by strong population growth stemming in part from strong in-migration from the Northeast and Midwest. Note that home prices are rising at near-double-digit rates in San Francisco, Denver, Portland, Ore., Seattle and Dallas. Price growth is strong in smaller metros as well — places such as Salt Lake City, Boise, Idaho, Reno, Nevada and much of the Florida peninsula. Phoenix and Las Vegas have improved greatly since their “bust” days, though they still retain some of the highest shares of underwater mortgages in the country.

More-modest growth will pace much of the Northeast and the Midwest. Boston is a bright spot in the Northeast, while Minneapolis, Columbus, Ohio, Des Moines, Iowa, and Indianapolis will be among the top gainers in the Midwest. The Detroit area is also showing improvement.

But states and cities that largely rely on strong oil prices will lag the field. Houston’s market is softening, and home prices are falling in Oklahoma City and Tulsa, Okla., Baton Rouge, La., and near fracking hot spots in North Dakota, Wyoming, Ohio and Pennsylvania.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

David is both staff economist and reporter for The Kiplinger Letter, overseeing Kiplinger forecasts for the U.S. and world economies. Previously, he was senior principal economist in the Center for Forecasting and Modeling at IHS/GlobalInsight, and an economist in the Chief Economist's Office of the U.S. Department of Commerce. David has co-written weekly reports on economic conditions since 1992, and has forecasted GDP and its components since 1995, beating the Blue Chip Indicators forecasts two-thirds of the time. David is a Certified Business Economist as recognized by the National Association for Business Economics. He has two master's degrees and is ABD in economics from the University of North Carolina at Chapel Hill.

-

Over 65? Here's What the New $6K 'Senior Deduction' Means for Medicare IRMAA Costs

Over 65? Here's What the New $6K 'Senior Deduction' Means for Medicare IRMAA CostsTax Breaks A new deduction for people over age 65 has some thinking about Medicare premiums and MAGI strategy.

-

U.S. Congress to End Emergency Tax Bill Over $6,000 Senior Deduction and Tip, Overtime Tax Breaks in D.C.

U.S. Congress to End Emergency Tax Bill Over $6,000 Senior Deduction and Tip, Overtime Tax Breaks in D.C.Tax Law Here's how taxpayers can amend their already-filed income tax returns amid a potentially looming legal battle on Capitol Hill.

-

5 Investing Rules You Can Steal From Millennials

5 Investing Rules You Can Steal From MillennialsMillennials are reshaping the investing landscape. See how the tech-savvy generation is approaching capital markets – and the strategies you can take from them.

-

Federal Debt: A Heavy Load

Federal Debt: A Heavy LoadEconomic Forecasts The debt continues to grow, but record-low interest rates could ease the long-term damage.

-

How the Fed's Moves Affect You

How the Fed's Moves Affect YouEconomic Forecasts It’s pumping trillions of dollars into the economy and keeping rates near zero. Savers are sunk, but borrowers get a boost.

-

U.S. Manufacturing Is Already Ailing from Coronavirus

U.S. Manufacturing Is Already Ailing from CoronavirusEconomic Forecasts Supplies are hard to come by, and in the longer-term demand may be at risk.

-

Consumers Will Feel Impact of Rapidly Falling Interest Rates

Consumers Will Feel Impact of Rapidly Falling Interest RatesEconomic Forecasts Mortgage and car loans will experience the most significant dips, while some holders of Treasuries may get a slight boost.

-

Will You Have to Pay More Sales Taxes on Your Online Purchases?

Will You Have to Pay More Sales Taxes on Your Online Purchases?business One thing’s for sure: Consumers who live in one of the five states without a sales tax won’t be affected by the Supreme Court’s ruling.

-

What to Expect From the New Fed Chief

What to Expect From the New Fed ChiefEconomic Forecasts By and large, Jerome Powell will move along the path set by his predecessor.

-

How a Border Tax Would Affect You

How a Border Tax Would Affect YouBusiness Costs & Regulation A plan to limit imports could raise prices but also create more jobs.

-

A Housing Shortage Looms: Builders Can’t Keep Up

A Housing Shortage Looms: Builders Can’t Keep Upbusiness Starter homes especially are becoming scarce.