Home Prices on the Rise

A tight supply of homes for sale and lower mortgage rates are pushing up home values. Sellers and homeowners are reaping the rewards.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

Kaushik Mukerjee and Preeti Vasishtha faced stiff competition when they set out to buy a home last spring. The couple, who live in Northern Virginia and have an 8-year-old son, were looking for a home in a good school district, but they lost out to other bidders on two houses before their offer on a townhouse stuck. "In one case we competed against 10 other offers, and the home sold for $20,000 above list price," Mukerjee says. Ultimately, the couple paid $502,000—slightly above list price—for a 2,000-square-foot, three-bedroom townhouse in Burke, Va.

Kody Henderson, a 26-year-old first-time home buyer, also grappled with a hyperactive market when he looked for a home in the Seattle area. He struck out on three before he snagged a three-bedroom single-family house for $465,000 in Burien, Wash., last November. "I kept getting beat by cash offers that were usually above list price," says Henderson. "It was frustrating."

More buyers are looking for a home than at any time since 2013. Skylar Olsen, Zillow's director of economic research, says demand for homes has increased over the past five years as a result of strong economic growth as well as low mortgage rates and more millennials entering their thirties and "approaching peak home buying ages." (According to a recent report from the National Association of Realtors, the median age of first-time home buyers is 33.)

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

Furthermore, a large cohort of baby boomers are buying and selling, as many boomers downsize for retirement. Adding to the big squeeze on buyers is a huge housing shortage: The number of homes in the U.S. listed for sale on Zillow in December was down 7.5% from the previous year and is at the lowest level ever recorded by the company. The U.S. housing market is facing an undersupply of homes for sale of 3.8 million, which is driving up home prices and putting pressure on housing affordability, says George Ratiu, Realtor.com's senior economist.

For about one in four home buyers in 2019, the home-search process took more than a year, Realtor.com found. "The housing shortage is brutal," says Matt Parker, a Seattle real estate agent and author of Real Estate Smart: The New Home Buying Guide. "Buyers can go months without looking at any new properties."

High Demand, Higher Prices

While buyers are dealing with limited supply, home sellers—and homeowners with no plans to move anytime soon—are reaping the rewards. Home values climbed in 2018 before hitting the pause button starting in spring 2018 because of higher mortgage rates. But home price gains picked up in the second half of 2019 as mortgage rates retreated again. The median price of existing homes depends on who’s calculating it. According to Attom Data Solutions, a property database provider, the median home price increased 6.2% in 2019, hitting an all-time high of $258,000. According to Clear Capital, which supplies average home prices for metro areas across the U.S., home prices rose 5.7% in 2019, compared with an increase of 7.4% in 2018. Clear Capital says the median sales price of a residential property was $253,000 in December 2019.

How high will home prices go this year? Kiplinger expects a 3.6% rise in 2020. December marked the sixth consecutive month of year-over-year increases, reversing the trend of decelerating price growth that began in March 2018 and ended in July 2019. Home prices are nearly 60% above the bottom they hit in February 2012 and are now 15% above their pre-crisis peak, on average.

Frank Nothaft, chief economist at financial data and analytics firm CoreLogic, is more optimistic, with a price-increase forecast of 4.6% for 2020. "We're predicting 2% economic growth this year, which is slightly slower than the past couple of years but still sufficient to create enough jobs to stimulate the housing market," Nothaft says.

Assuming that mortgage rates stay below 4%—the 30-year fixed-rate mortgage was recently about 3.5%, according to Freddie Mac—lower-priced homes will continue to appreciate faster than higher-priced homes, says Mike Fratantoni, chief economist at the Mortgage Bankers Association.

After years of sluggish growth, the supply of newly built homes is picking up. Robert Dietz, chief economist at the National Association of Home Builders (NAHB), says that builders have been grappling with rising costs of land, labor and building materials, plus a labor shortage of about 300,000 skilled workers. But the NAHB projects that 920,000 single-family houses will be built this year—close to the 1 million homes that will have to be constructed annually to pull the nation out of its housing shortage, Dietz says.

The median price tag of newly built homes climbed to $331,400 in December, less than a 1% year-over-year bump, according to data from the Department of Housing and Urban Development and the U.S. Census Bureau. Most new homes being built are for move-up home buyers, Dietz says, but a growing number of homebuilders are beginning to focus on building houses for first-time buyers.

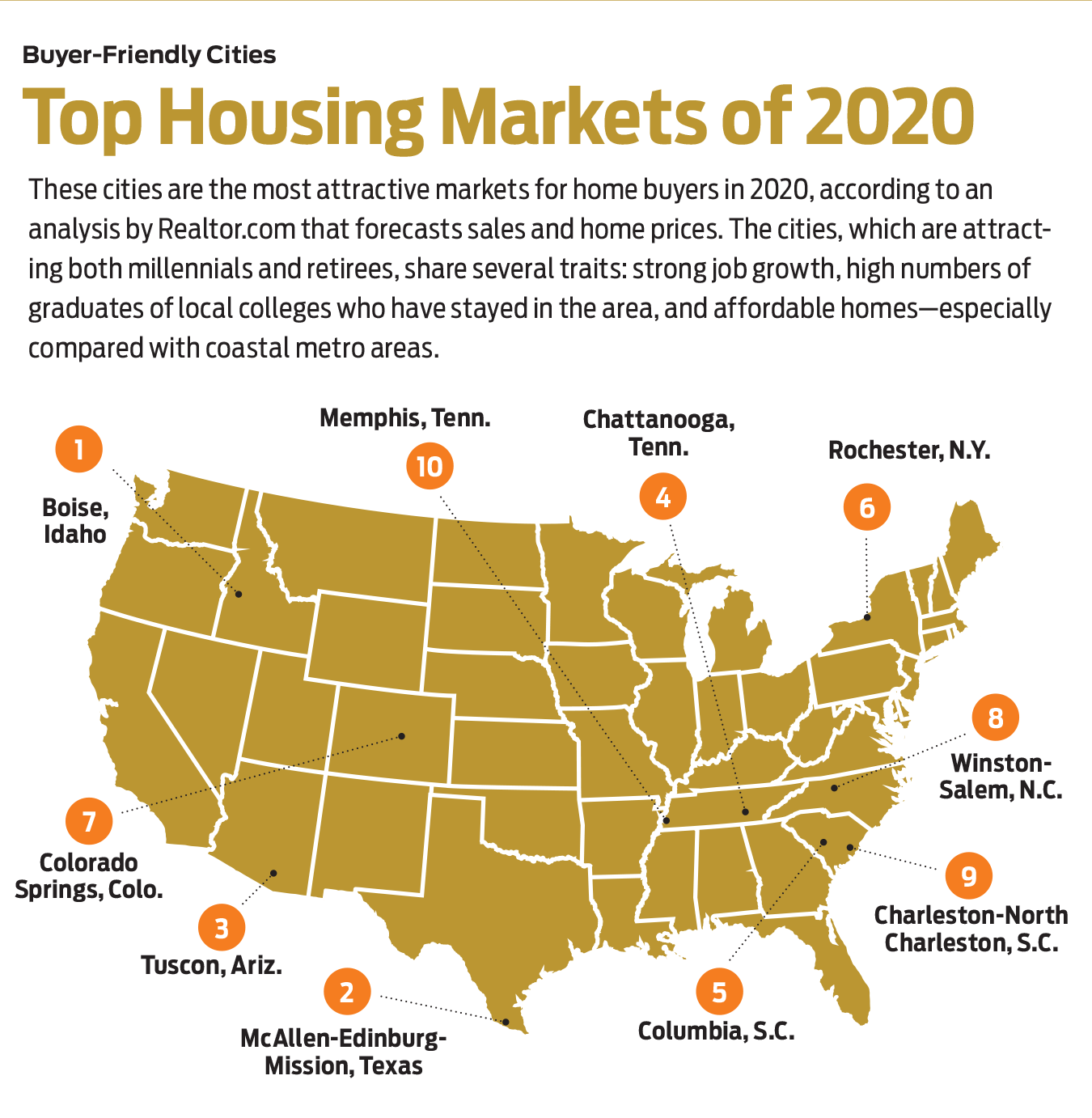

Hot Markets

Of course, some housing markets are seeing bigger price gains than others. Salt Lake City, New Orleans and Knoxville, Tenn., had the highest home-price appreciation. Boise, Idaho, also had a double-digit jump. “Our inventory is the lowest it has been in 19 years,” says Boise real estate agent Sheila Smith. "We've been seeing a huge exodus from [the West Coast] to Boise, largely because the cost of living here is so much more affordable." Denver's price increases slowed in 2019, but—from January 2010 to December 2019, the city's median home price swelled from $202,896 to $424,051, a price increase of 11.2% per year, according to a December report from Redfin.

The downside? Tight supply coupled with rising living costs has eroded affordability in some areas, particularly in California. Nationally, home buyers need 7.2 years to save for a 20% down payment on the median-priced home, but home buyers in Los Angeles need 18.4 years, a recent Zillow report found. “Homes on the West Coast just aren’t affordable anymore,” says Lawrence Yun, the NAR's chief economist.

Tips for Buyers and Sellers

Although it's a seller's market in most cities, now is still a great time to buy a house if you're looking to snag a low mortgage rate. But home buyers should be prepared to deal with competing offers, says Chris Dossman, a real estate agent in Indianapolis. And getting preapproved for a mortgage before you make an offer is a must.

If a house is priced fairly, you'll need to be willing to make a full-price offer—or even above list price for a property in a hot neighborhood. You will want to make your strongest offer from the outset—your highest bid, with as few contingencies as possible. Home sellers have been shying away from bidding wars; just 9% of offers written by Redfin agents faced a bidding war in December, a 10-year low. "Talk [with your agent] in advance about what an aggressive offer looks like so that you'll be prepared in a multiple-offer situation," advises Peggy Yee, a real estate broker in Vienna, Va.

Partnering with a real estate agent who's an expert in the neighborhoods where you're shopping is key, because a plugged-in agent can hear about new listings before they hit the market and set up early showings for you. Also, sign up for real-time alerts of price reductions and new listings from websites such as Zillow and Realtor.com.

Flexibility is crucial, says Julie McDonough, a real estate agent in Southern California. You may have to expand your home search to other neighborhoods or towns if no homes are for sale in your desired area or you can’t afford to buy a home there. This is a common challenge: 22% of millennials who are planning to buy their first home this year said they’ve been priced out of their desired neighborhoods, TD Bank's 2020 First-Time Homebuyer Pulse survey found.

Home sellers have the upper hand in most markets. But even though it may be tempting, don’t list your home above its market value. Today's home buyers have access to a surplus of housing information online—meaning they know what properties are worth and when a house is overpriced.

"Some home sellers think that they can ratchet up home prices and find buyers. But if your house stays on the market for more than 30 days, it becomes stale, and buyers will believe that there is something wrong with your house," the NAR's Yun says.

Home buyers expect Instagram-worthy, move-in-ready homes, so staging is more important than ever, says Philadelphia-based real estate agent Patrick Conway. If you’re on a budget, focus on staging the living room, master bedroom and kitchen—the three most important staged rooms for home buyers, an NAR survey found.

The supply of homes for sale in your area is a good indicator of how much leverage you have. Six months' supply is considered a balanced market between buyers and sellers; in markets with less than six months' supply, home sellers have the upper hand. (You can find this information and other home-sale market statistics on the website of your local association of Realtors.) Devise a plan for how you'd handle multiple offers. Instead of reviewing offers as they come in—or simply accepting the first offer you get—Yee recommends setting a deadline for all offers, so that every buyer who comes to your open house gets a chance to submit an offer.

If you’re buying another home after you sell, you’ll be competing with other buyers. Move-up buyers have less to worry about, but if you plan to downsize, you may be targeting the same homes as first-time buyers.

Should You Refinance?

Mortgage rates are at three-year lows. The average rate for a 30-year fixed-rate mortgage was recently about 3.5%, according to Freddie Mac—down about one percentage point from the year before. The average rate for a 15-year fixed-rate mortgage was recently 3%. Is now the right time for you to refinance?

In 2019, buyers and refinancers took out more home loans than in any year since 2006, according to industry research group Inside Mortgage Finance. The reduced rates widen the pool of homeowners who could lower their monthly payments. Mortgage-data firm Black Knight Inc. estimates that 11.3 million U.S. homeowners would qualify for and benefit from a refinancing, the second-most on record. Average monthly savings would be $268.

If it has been several years or more since you bought your home or since you last refinanced, there’s a good chance your mortgage rate is more than one percentage point above current rates, which is usually a sign that it makes sense to refinance. But you may benefit from a refi even if your new rate would be less than a full point lower. It depends partly on how long you plan to stay in your home and how long it would take to recoup closing costs.

Keep in mind that closing costs for refinancing will typically run between 3% and 6% of your new loan amount, so knowing when you plan to sell your home is essential. Say you have a $300,000, 30-year, fixed-rate loan at an interest rate of 4.4% that you took out in 2014, and you’re making a monthly payment of $1,688 a month in principal and interest. If you refinance to a 30-year loan with an interest rate of 3.0% and closing costs of 3% and finance the closing costs, you would lower your mortgage payment to $1,303, saving you $385 per month. You could break even and begin saving after a bit more than three years. If you sold your home in 10 years, you would save a total of $17,457.

If you have a 30-year loan but plan to sell your house in a few years, refinancing to a five- or seven-year adjustable-rate mortgage (ARM) could enable you to save even more money. You could also choose a no-cost refinance, in which your mortgage lender pays the closing fees, but that would require you to pay a higher interest rate.

Need help crunching the numbers? Use The Mortgage Professor's refinance calculator to enter the details of both your current mortgage and your new loan to see how long you'd have to stay in your home to start saving money on a refi.

Find Out What Your Home Is Worth

All real estate is local, so the median home price in your metro area is only a broad indicator of overall trends.

Unfortunately, many homeowners misjudge the value of their home, laments Indianapolis real estate agent Chris Dossman. "You can't just look at what your neighbor's house sold for and assume that your home is the same value as theirs,” Dossman says. "For example, how old is your neighbor's roof compared to yours? How old are their appliances? You can look at pictures, but pictures don’t tell the whole story."

There's no shortage of online home-value estimators—and they can be a good starting point—but their estimates can vary significantly depending on their methodology. For example, Zillow estimates that its error rate for homes not currently on the market is about 7.5%.

Your best approach when assessing your home's value? Look at homes within a one-mile radius that sold within the past 30 to 60 days that are similar to yours in terms of square footage, the number of bedrooms and bathrooms, and home improvements. (You can search for recently sold houses at sites such as Zillow, Realtor.com and Redfin.) Take the average sales price of three or four homes to gauge your home's value.

Essentially, you're doing a comparative market analysis, or "CMA," in which you’re looking at comparable properties ("comps" in industry lingo)—which is how real estate agents recommend listing prices to home sellers.

Want an expert's opinion of how much your house is worth? Consult a real estate agent—many offer complimentary home appraisals—or consider hiring a professional appraiser to assess the value of your home. A typical home appraisal costs between $300 and $400, according to HomeAdvisor.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Daniel Bortz is the Personal Finance Editor at AARP and is based in Arlington, Va. His freelance work has been published by The New York Times, The Washington Post, Consumer Reports, Newsweek, and Money magazine, among others.

-

Nasdaq Leads a Rocky Risk-On Rally: Stock Market Today

Nasdaq Leads a Rocky Risk-On Rally: Stock Market TodayAnother worrying bout of late-session weakness couldn't take down the main equity indexes on Wednesday.

-

Quiz: Do You Know How to Avoid the "Medigap Trap?"

Quiz: Do You Know How to Avoid the "Medigap Trap?"Quiz Test your basic knowledge of the "Medigap Trap" in our quick quiz.

-

5 Top Tax-Efficient Mutual Funds for Smarter Investing

5 Top Tax-Efficient Mutual Funds for Smarter InvestingMutual funds are many things, but "tax-friendly" usually isn't one of them. These are the exceptions.

-

How to Search For Foreclosures Near You: Best Websites for Listings

How to Search For Foreclosures Near You: Best Websites for ListingsMaking Your Money Last Searching for a foreclosed home? These top-rated foreclosure websites — including free, paid and government options — can help you find listings near you.

-

Luxury Home Prices Rise as the Rich Dodge High Mortgage Rates

Luxury Home Prices Rise as the Rich Dodge High Mortgage RatesLuxury home prices rose 9% to the highest third-quarter level on record, Redfin reports, growing nearly three times faster than non-luxury prices.

-

Four Tips for Renting Out Your Home on Airbnb

Four Tips for Renting Out Your Home on Airbnbreal estate Here's what you should know before listing your home on Airbnb.

-

5 Ways to Shop for a Low Mortgage Rate

5 Ways to Shop for a Low Mortgage RateBecoming a Homeowner Mortgage rates are high this year, but you can still find an affordable loan with these tips.

-

Looking to Relocate? Plan for Climate Change

Looking to Relocate? Plan for Climate Changebuying a home Extreme weather events are on the rise. If you’re moving, make sure your new home is protected from climate change disasters.

-

Retirees, A Healthy Condo Has a Flush Reserve Fund

Retirees, A Healthy Condo Has a Flush Reserve FundSmart Buying Reserve funds for a third of homeowner and condo associations have insufficient cash, experts say. Here are some cautionary steps you should take.

-

Cash Home Buyers: New Services Offer Help Making All-Cash Offers

Cash Home Buyers: New Services Offer Help Making All-Cash OffersBecoming a Homeowner Some firms help home buyers make all-cash offers on homes. Weigh the fees before you sign on.

-

Home Sale Prices in the 50 Largest Metro Areas

Home Sale Prices in the 50 Largest Metro AreasBecoming a Homeowner What’s happening in the market where you live?