8 Steps to Be a Better Investor

Building a successful investing plan is like building a hero sandwich: Stick with basic ingredients and don’t get too fancy.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

Investors sometimes think they need a secret recipe to succeed. But for most people, there’s no big secret: Adhering to a few basic principles will serve you well regardless of where the markets are headed next week or next year, or whether or not you suss out Silicon Valley’s next big thing.

When it comes to finding the best ingredients for healthy gains over the long haul, selecting the right mix of assets, for example, trumps choosing a particular stock or mutual fund. You’ll do better by keeping your investments simple and your costs low than by dabbling in more-exotic fare or chasing after the hot fund manager du jour. If you can start setting aside money when you’re young, you’ll have enough to accommodate a more sophisticated palate later. And for gosh sakes, don’t let Uncle Sam take too big a bite out of your profits.

Spread your investments

Diversifying your holdings increases the chances that when one or more of your investments are struggling, others will be performing well. “If you could time markets perfectly, that would be best,” says Maria Bruno, a strategist at the Vanguard Group. “But that’s hard to do, so diversification comes into play.”

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

Think of your investments as a smorgasbord. You’ll want to spread your wealth among stocks, bonds and other assets, a process known as asset allocation. Although investors tend to hem and haw about whether to buy this stock or sell that fund, research shows that 88% of a portfolio’s ups and downs over time are explained by its asset allocation; only 12% have to do with security selection or market timing. With stocks, you’ll want to consider different investment styles, company sizes, industries and countries. With bonds, go for varying maturities and levels of credit risk.

A look at annual returns for 10 key indexes over the past 20 years illustrates the difficulty of pinpointing the zigs and zags of the investment universe. From 1996 through 2015, emerging-markets stocks were the top performers in eight years, including five years in a row starting in 2003. But they were the worst performers in seven of the 20 years, plunging from first place in 2007, with a gain of 40%, to last place, with a loss of 53%, in 2008. Over that 20-year period, stocks of large U.S. companies with above-average earnings growth beat bargain-priced large-capitalization stocks 55% of the time—but not from 2000 to 2006, when large-cap value stocks led. And large-cap value stocks ran ahead of growth stocks in the first eight months of 2016, after trailing in eight of the past 10 calendar years.

Without knowing which investment category will be on top, or when, diversification is your best shot at owning enough of the winners to offset the losers. The catch is that you’ll lag in bull markets. As David Lebovitz, a market strategist at J.P. Morgan Asset Management, puts it, “Diversification means having to say you’re sorry.” But diversification can be especially helpful in bear markets. A portfolio invested in large-cap U.S. stocks lost more than half of its value during the 2007–09 collapse; a package split 60-40 between stocks and high-grade U.S. bonds lost one-third of its value. The diversified portfolio recouped its losses in 19 months; it took the all-stock version three years to recover.

Spreading assets beyond U.S. shores is particularly challenging because of investors’ tendency to favor their home country, a bias that has been reinforced in recent years as U.S. stocks have regularly outpaced their foreign counterparts. The U.S. accounts for a bit more than half of global stock market capitalization, but it claims nearly 80% of U.S. investors’ stock holdings. “Portfolios should represent the world we live in,” says Lebovitz. That said, you don’t need to mirror global stock market weightings exactly; Vanguard, for example, recommends putting 20% to 40% of your stock allocation in foreign stocks.

The precise formula you use for divvying up your investment dollars will depend on your age, goals and risk tolerance. Target-date funds take those factors into account and deliver a portfolio mix that’s adjusted over time. Investors who prefer individual stocks should aim to hold more than 10 but fewer than 30, says Charles Rotblut, vice president of the American Association of Individual Investors. He adds that no individual issue should count for more than 2.5 times the weighting of your average holding.

With bonds, diversify by degree of credit risk. Investors holding bonds backed by Uncle Sam need only stagger maturities. If you hold mostly investment-grade municipal bonds or corporate debt, you should spread your money among at least 10 issuers. If you invest in junk bonds or emerging-markets debt, use a mutual fund or exchange-traded fund.

Keep your balance

You wouldn’t think of arranging a sumptuous buffet without continuing to freshen and replenish the menu. Yet evidence shows that investors let their portfolios suffer from benign neglect. But regular portfolio maintenance that reshuffles assets to make sure they reflect the division you’ve chosen—a process known as rebalancing—can minimize risk and keep you on track with an allocation appropriate to your goals.

Rebalancing works by trimming asset groups that have performed relatively well and adding to holdings that have been relative laggards. For example, a stock portfolio that started 2016 with 60% in shares of U.S. companies, 30% in stocks from developed foreign markets and 10% in emerging-markets stocks now has 61%, 28% and 11% in those groups, respectively. A $100,000 portfolio that began 1996 invested 60% in stocks and 40% in high-quality U.S. bonds would have been 83% invested in stocks by the end of 2015.

Rebalancing may seem like a ho-hum administrative chore, but in reality the process is fraught with emotion. It can be especially hard to cut back on your biggest winners. But if you don’t, you increase the risk that drops in those holdings will wreak more havoc than you can stand, causing you to abandon your investment plan and jeopardize long-term goals.Compare the path of two hypothetical portfolios constructed by T. Rowe Price. Each portfolio starts with $100,000, with 60% in a mix of stocks—including shares of large and small companies, U.S. and foreign firms—and 40% in high-quality U.S. bonds. One portfolio is rebalanced annually over the 20-year period through 2015; the other is left alone. Both portfolios deliver the same returns, with annualized gains of just a bit more than 7%. But the risk of the non-rebalanced portfolio, measured in terms of the volatility of returns, is 24% greater than that of the rebalanced package.

The difference becomes stark when you zero in on turbulent market periods. During the powerful, technology-driven bull market of the late 1990s, stock holdings racked up monster gains, accounting for a growing proportion of assets in the non-rebalanced portfolio. But from the market’s peak in 2000 to the bear-market trough in late 2002, the portfolio lost 32%, compared with 19% for the rebalanced version. During the 2007–09 bear market, the non-rebalanced portfolio lost 42%; the rebalanced portfolio, 32%. “When you have a smoother ride, you’re more likely to stay the course,” says T. Rowe Price planner Judith Ward. “Investors whose portfolios encounter extreme volatility tend to buy and sell at the wrong time.” Take your pick from a number of rebalancing strategies. You can rebalance at set times or when your holdings reach a certain level over your target. Or you can use a combination of those strategies, checking the portfolio at set times but rebalancing only when a threshold is reached. But don’t forget costs. You’ll pay brokerage fees to buy and sell stocks, and you may pay commissions to trade ETFs. If your money is in a taxable account, you may have to pay taxes on capital gains.

Invest like clockwork

Deciding what to invest in is daunting. But adopting a practice known as dollar-cost averaging makes how to invest a no-brainer. Dollar-cost averaging, a strategy that involves investing a set amount periodically, usually monthly or quarterly, helps combat harmful behavioral inclinations. If you’re apprehensive about committing cash to stocks—a common concern in an aging bull market such as this one but also a typical investor reaction to tumbling share prices—averaging makes taking the plunge easier by spreading out your risk over an extended period (averaging works best with volatile asset classes, such as stocks). “If you’re always waiting on the sidelines for the right time to invest, you’ll easily get left behind,” says Tyler Landes, a certified financial planner at Tandem Financial Guidance, in Kansas City, Mo.

Once you’re in the market, averaging helps you stick to your plan. Putting everything into the market at once guarantees that you’ll know all too well how much you’ve lost if you happen to invest at the wrong time. Investing at intervals erases that fixed reference point, which keeps you from being paralyzed by the aversion we all have to losing money. “The beauty of dollar-cost averaging is that you don’t second-guess yourself,” says Myhanh Hoskin, a CFP at brokerage Charles Schwab. Averaging also lowers the average per-share cost of your stock holdings by ensuring that you buy more shares when prices are down and fewer when shares are richly priced.

The strategy works well as part of a regular savings plan—you may already be dollar-cost averaging if you invest in a 401(k) savings plan—and also as a way to deploy a windfall from, say, the sale of a business, or from an inheritance. You might invest one-sixth of the cash every month over a six-month period, for example, or one-twelfth each month over a year. Or try a souped-up dollar-cost-averaging strategy favored by Jake Altendorf, an analyst at Accredited Investors Wealth Management, an investment firm in Edina, Minn. Altendorf follows the familiar pattern of investing a preset portion of a client’s assets at regular intervals; but if the stock market falls 3% from its level at the time of the most recent investment, Altendorf will invest the next portion immediately, accelerating the plan. “It can be nerve-racking for a client to accelerate investment into a downturn,” says Altendorf, “but we’ve seen some great results from January and February of this year, as well as from dips that triggered purchases around Brexit, in July.”

Cut your costs

Investment statements disclose such things as capital gains and dividends. What you won’t find on them is a tidy sum of all the fees you’re paying. That’s important information because with a little digging you can predict and manage expenses, but you have relatively little control over returns. And the less you spend on fees, the more of your returns you get to keep.

Start by trimming the fat off fund fees you’re paying. Investment firms slice a bit off the top behind the scenes by periodically deducting management fees and most other costs of doing business from a fund’s assets. A fund’s annual expense ratio reveals how much a fund charges in total.

The longer you hold a fund, the more those fees can sting. Suppose the market returns 8% a year. If you invest $10,000 and earn the market returns, you’ll have $58,485 after 25 years. But if you invest in a fund with average expenses of 1.20% a year, you’ll have $17,659 less. Fees, in other words, would erase about 30% of your gains.

To see what you may be losing to fees, visit Vanguard’s website and use its free Principles for Investing Success tool, which shows how fund fees can add up over different time frames.

If you’re paying for high-cost funds with subpar records, consider investing in exchange-traded funds or mutual funds with lower fees that hold similar kinds of stocks or bonds. Among actively managed mutual funds, one of our favorites is Kiplinger 25 member Dodge & Cox Stock (DODGX), which tilts toward large-cap value stocks and charges just 0.52% per year. For low-cost exposure to the entire U.S. stock market, consider Vanguard Total Stock Market ETF (VTI), a member of the Kiplinger ETF 20; it charges just 0.05% annually. In the bond world, our favorites include Kip 25 members Fidelity Intermediate Muni (FLTMX), with annual fees of 0.36%, and Vanguard Short-Term Investment Grade (VFSTX), which charges just 0.20%.

Trading commissions can also erode your returns. Fidelity, our top-rated discount broker., charges a reasonable $7.95 per stock trade. But you can fare even better with Scottrade ($7) or Merrill Edge ($6.95), which offers 100 free trades a month for accounts with at least $100,000.

If you get help from an adviser, make sure he is earning his keep. Advisers who manage your investments charge a percentage of a portfolio’s value, typically starting at 1% of assets per year. That’s well worth it if your investments outpace the market averages or other appropriate benchmarks. But an adviser’s value becomes more dubious if your returns are falling short. And the chances of your results falling short increase if your adviser is investing your money in high-fee funds, which could result in your total costs exceeding 2% a year.

Many advisers provide more than investment advice, helping with tasks such as retirement planning and budgeting. But if an investment road map is all you need, consider switching to an online, “robo” adviser. These services use algorithms to create a basket of stock and bond funds (typically ETFs) tailored to your needs, and they automatically adjust it to maintain a steady mix. Betterment, one of the original robos, charges 0.25% to 0.35% annually for monitoring accounts of up to $100,000, and 0.15% above that amount, making it one of the better deals. Schwab offers a free robo service, but it forces customers to hold at least 6% of their portfolio in cash (which can drag down long-term returns). Robos can also take the emotion out of investing, keeping you on the right path through the market’s bumps in the road.

Match the market

No one likes the idea of being average, whether it’s in school, sports or spousal selection. Yet achieving average investment returns may actually be an improvement, especially if you own high-fee mutual funds that have fallen behind the market.

Despite some drawbacks, index funds can get you to within a whisker of market-rate returns. Many track traditional benchmarks, such as Standard & Poor’s 500-stock index. Others follow various segments of the stock and bond markets, emphasizing dividends or value stocks, for instance, or high-yield bonds.

By design, index funds can’t beat the markets, which may sound dispiriting. But many investors don’t even approach market returns, and poorly performing, high-cost, actively managed funds are often the culprits. Piling into funds after a period of scintillating performance can also harm long-term results because such streaks usually don’t persist. In fact, largely because of poor timing of purchases and sales, the average stock mutual fund investor trailed the S&P 500 by 3.7 percentage points in 2015, according to research firm Dalbar. Bond fund investors trailed the Barclays Aggregate U.S. Bond index by the same margin. And these aren’t anomalies. Over the 20-year period through 2015, annualized returns for stock fund investors averaged 4.7%, compared with 8.2% for the S&P 500.

Of course, index funds will only get you market returns if you don’t try to time your purchases and if you stick with them through both ups and downs. It’s also important not to overpay. ETFs that track broad indexes such as the S&P 500 now cost as little as 0.03% a year in fees, or just 30 cents per $1,000 invested. But fees can be much higher for funds with a narrow focus, such as those that track commodity prices or stock sectors, such as technology or health care. Annual costs of 0.6% and up can sweep away much of the advantage of indexing. Another drawback is that index funds won’t protect you from market manias. Most major indexes weight stocks by market value, which can cause some wild distortions if investors pile into certain sectors, as they did with tech stocks in the late 1990s and financial firms from 2004 to 2007.

Even if you stick with broad-based index funds, it can still pay to be opportunistic, homing in on parts of the market that look attractive and avoiding others. Some ETFs pay more dividend income than the S&P 500, for example. Others emphasize value stocks, which are cheap in relation to such basic measures as profits and assets and may fare better than the broad market.

Whether you prefer mutual funds or ETFs, you can choose one that matches just the S&P 500 or one that seeks to copy a “total market” index, which has more exposure to small and midsize companies. Fidelity and Vanguard offer mutual funds with rock-bottom fees. If you prefer ETFs, invest in iShares Core S&P 500 (IVV), then consider supplementing it with PowerShares Dynamic Large-Cap Value (PWV) and Schwab U.S. Dividend Equity (SCHD). All three are members of the Kip ETF 20.

In the bond world, we suggest emphasizing areas that should fare relatively well once interest rates start to rise (bond prices generally move in the opposite direction of rates). Funds in the Kiplinger ETF 20 that we expect to hold up in a rising-rate environment include PowerShares Senior Loan Portfolio (BKLN) and iShares iBonds 2021 December Term Corporate (IBDM). The latter holds hundreds of high-quality corporate bonds that all mature by December 2021 and charges just 0.10% annually.

Trim your tax bill

It feels good to pocket profits on your investments. But your haul can take a mighty hit from the tax man, based on your federal and state tax brackets. You can trim your bill, though, if you follow a few basic planning rules.

For starters, make the most of tax breaks offered by Uncle Sam by investing in a tax-deferred account, such as an IRA or an employer-sponsored 401(k) plan. Interest income, capital gains and dividends all accumulate in these accounts without any immediate tax consequences, making them ideal vehicles to boost your assets without the drag of taxes. Put investments that are taxed at high rates, including high-yield bond funds and real estate investment trusts, in a retirement account. Conversely, place tax-efficient investments, such as broad stock market index funds, municipal bonds and growth stocks that pay minimal, if any, dividends, in taxable accounts.

Such strategies can work even better if you rank your investments by both their returns and tax efficiency. A bond fund yielding 2% probably won’t result in much income tax savings if you stash it in a retirement account, says Michael Kitces, director of wealth management at Pinnacle Advisory Group in Columbia, Md. But shielding a stock or fund with the potential of delivering large gains would boost your after-tax returns quite a bit over the long run. Ideally, he says, put your least tax-efficient, highest-returning investments in an IRA.

Actively managed funds should generally go in a retirement account, too. Mutual funds must distribute all capital gains (net of any losses) to shareholders every year. Those distributions can be costly from a tax vantage point, particularly if they consist mainly of short-term capital gains, which are taxed at ordinary income-tax rates—as high as 43.4% at the federal level. Stock funds that trade heavily, swapping out more than 75% of their holdings over the course of a year, are more likely to distribute capital gains than buy-and-hold funds, making them less tax-efficient, according to Morningstar.

Granted, high-turnover funds can be superb performers. But if you own one in a taxable account and it has been a disappointment, consider swapping it for a fund that historically hasn’t distributed a lot of capital gains, a good indicator that it will continue to be tax-efficient. Dodge & Cox Stock and T. Rowe Price Dividend Growth (PRDGX), just added to the Kiplinger 25, both earn high marks for their tax efficiency and long-term performance, according to Morningstar. Also compelling is Vanguard Tax-Managed Capital Appreciation Admiral (VTCLX), a large-company index fund that is managed to hold down distributions of both capital gains and dividends.

Selling unprofitable investments in your portfolio can also trim your tax bill. The Internal Revenue Service lets you offset capital gains with losses. If you don’t have capital gains, you can still deduct up to $3,000 in losses against ordinary income every year (carrying forward additional losses to future years).

Of course, you may not want to sell an underwater investment if you expect it to rebound. But in many cases, you can replace it with a similar one. If you lost money in an energy stock such as ConocoPhillips (COP), for instance, you could sell it and immediately buy a stock such as Chevron (CVX). Although they aren’t precisely the same, their stocks tend to move in tandem, keeping your exposure to the energy industry intact. Replacing an ETF with a similar mutual fund would work, too. Just don’t buy the same stock, bond or fund until more than 30 days after the sale. Doing so would violate the IRS’s “wash sale” rule, which requires a 30-day wait if you want to buy a “substantially identical” security and still claim the loss on your tax return.

Focus on dividends

With income investors desperate for cash, Dividends are the darlings of Wall Street these days. But dividend-paying stocks deserve a place in your portfolio regardless of the level of rates or the market’s day-to-day movements. Over the long haul, dividend stocks have paid off in all kinds of market environments.

In fact, since 1930, dividends have accounted for more than 40% of the average annual return of Standard & Poor’s 500-stock index.Companies that increase their payouts consistently deserve special attention. According to Reality Shares, which sponsors exchange-traded funds, stocks in the S&P 500 with rising dividends earned 9.8% annualized from 1972 through 2015, compared with 7.2% a year for companies with static dividends and 2.5% for companies that paid out nothing.

Automatically reinvesting dividends is a form of dollar-cost averaging, allowing you to boost your holdings at regular intervals. Distributions can also serve as a source of funds for boosting lagging investments in order to rebalance your portfolio holdings mix. Financial adviser Michael Angelucci, in Buffalo, N.Y., often directs dividends into a money market account for rebalancing purposes and to “provide clients a mental reminder that they’re earning a return,” even when the underlying investment is losing ground.

You’ll find plenty of attractive payers in T. Rowe Price Dividend Growth ( PRDGX), a member of the Kiplinger 25 that counts Pfizer, General Electric and Danaher among its top holdings. If you favor exchange-traded funds, consider Schwab U.S. Dividend Equity (SCHD), a member of the Kiplinger ETF 20 that targets high-quality companies that have paid dividends at least 10 years in a row. The ETF charges a minuscule 0.07% expense ratio.

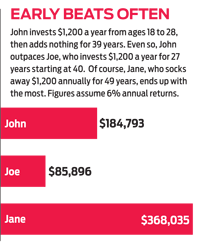

It Pays to Start Young

Albert Einstein is said to have once called compound interest the eighth wonder of the world. Warren Buffett has attributed his success as an investor to three things: living in America, having good genes and compound interest. The magic of compounding, if you recognize it early enough, can make you far richer than someone who earns a larger salary than you or who puts away more money over a longer period but doesn’t seize compounding’s potential soon enough.

Source: Charles Schwab & Co.

Compound interest is the money you make not only on your initial investment, but on the earnings it accumulates over time. The math is clearly on the side of the younger investor. Consider someone who invests $1,200 a year for 10 years, from ages 18 to 28, then adds nothing for the next 39 years. Assuming returns of 6% a year throughout the period, by the time that person reaches age 67 (full retirement age for those born after 1959), he or she will have accumulated $184,793. But someone who invests $1,200 a year from ages 40 to 67—investing $20,400 more over 17 additional years—and earns the same 6% return will accumulate just $85,896. “It’s easy to fret about how the markets are performing, but assuming that your portfolio is reasonably invested, the number-one thing you can do to improve your chances of meeting your goals is to save early and save often,” says certified financial planner Tyler Landes, in Kansas City, Mo.

Another way to measure the magic of compounding is with the Rule of 72. To find the number of years needed to double your money at a given interest rate, divide the interest rate into 72. For example, at an annual 8% growth rate, you’ll double your money in roughly nine years. A person who invests $20,000 at age 21, with an 8% annual growth rate, would have $640,000 at age 66, compared with $320,000 for someone who invests $20,000 at age 30. At age 84, the early bird would have $2.56 million, compared with the late starter’s $1.28 million. You can play around with compounding and Rule of 72 calculators at www.moneychimp.com.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Anne Kates Smith brings Wall Street to Main Street, with decades of experience covering investments and personal finance for real people trying to navigate fast-changing markets, preserve financial security or plan for the future. She oversees the magazine's investing coverage, authors Kiplinger’s biannual stock-market outlooks and writes the "Your Mind and Your Money" column, a take on behavioral finance and how investors can get out of their own way. Smith began her journalism career as a writer and columnist for USA Today. Prior to joining Kiplinger, she was a senior editor at U.S. News & World Report and a contributing columnist for TheStreet. Smith is a graduate of St. John's College in Annapolis, Md., the third-oldest college in America.

-

Over 65? Here's What the New $6K 'Senior Deduction' Means for Medicare IRMAA Costs

Over 65? Here's What the New $6K 'Senior Deduction' Means for Medicare IRMAA CostsTax Breaks A new deduction for people over age 65 has some thinking about Medicare premiums and MAGI strategy.

-

U.S. Congress to End Emergency Tax Bill Over $6,000 Senior Deduction and Tip, Overtime Tax Breaks in D.C.

U.S. Congress to End Emergency Tax Bill Over $6,000 Senior Deduction and Tip, Overtime Tax Breaks in D.C.Tax Law Here's how taxpayers can amend their already-filed income tax returns amid a potentially looming legal battle on Capitol Hill.

-

5 Investing Rules You Can Steal From Millennials

5 Investing Rules You Can Steal From MillennialsMillennials are reshaping the investing landscape. See how the tech-savvy generation is approaching capital markets – and the strategies you can take from them.

-

Best Mutual Funds to Invest In for 2026

Best Mutual Funds to Invest In for 2026The best mutual funds will capitalize on new trends expected to emerge in the new year, all while offering low costs and solid management.

-

What Fed Rate Cuts Mean For Fixed-Income Investors

What Fed Rate Cuts Mean For Fixed-Income InvestorsThe Fed's rate-cutting campaign has the fixed-income market set for an encore of Q4 2024.

-

The Most Tax-Friendly States for Investing in 2025 (Hint: There Are Two)

The Most Tax-Friendly States for Investing in 2025 (Hint: There Are Two)State Taxes Living in one of these places could lower your 2025 investment taxes — especially if you invest in real estate.

-

The Final Countdown for Retirees with Investment Income

The Final Countdown for Retirees with Investment IncomeRetirement Tax Don’t assume Social Security withholding is enough. Some retirement income may require a quarterly estimated tax payment by the September 15 deadline.

-

How Inflation, Deflation and Other 'Flations' Impact Your Stock Portfolio

How Inflation, Deflation and Other 'Flations' Impact Your Stock PortfolioThere are five different types of "flations" that not only impact the economy, but also your investment returns. Here's how to adjust your portfolio for each one.

-

Why I Still Won't Buy Gold: Glassman

Why I Still Won't Buy Gold: GlassmanOne reason I won't buy gold is because while stocks rise briskly over time – not every month or year, but certainly every decade – gold does not.

-

Should You Use a 25x4 Portfolio Allocation?

Should You Use a 25x4 Portfolio Allocation?The 25x4 portfolio is supposed to be the new 60/40. Should you bite?

-

Retirement Income Funds to Keep Cash Flowing In Your Golden Years

Retirement Income Funds to Keep Cash Flowing In Your Golden YearsRetirement income funds are designed to generate a reliable cash payout for retirees. Here are a few we like.