Fidelity Challenges Vanguard on Mutual-Fund Fees

Better known for its actively managed funds, Fidelity wants to be known as the low-cost provider of index funds.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

When it comes to index funds, Fidelity doesn’t want to play second fiddle to Vanguard anymore. The Boston-based fund firm, which is better known for its actively managed funds, recently cut fees on 27 of its index mutual funds and exchange-traded funds. Now, Fidelity charges less for some of its index funds than Vanguard, the de facto king of indexing, does for its products. “Fidelity wants to be known as the low-cost provider,” says Katie Rushkewicz Reichart, a Morningstar analyst.

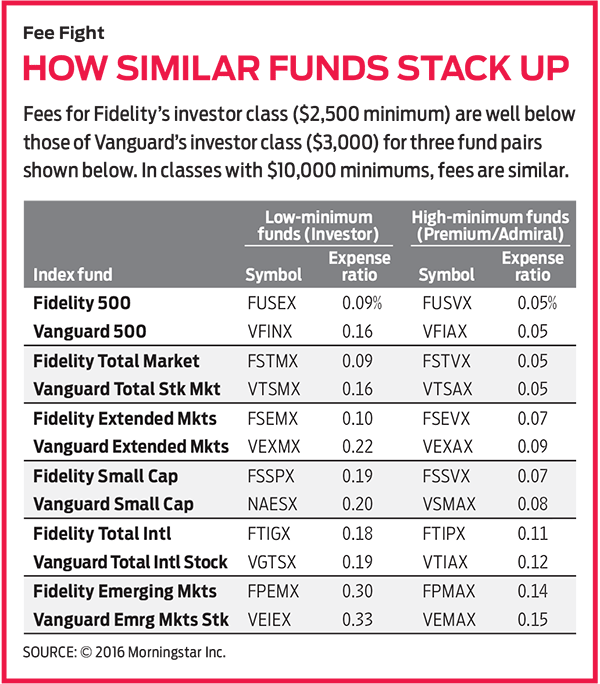

Among funds designed for investors of modest means, Fidelity now has a noticeable edge in two of the most popular areas for indexing: funds that track Standard & Poor’s 500-stock index and those that track total stock market indexes. For the “investor” share class, Fidelity 500 Index (symbol FUSEX) now charges 0.09% in annual fees, while Vanguard 500 Index (VFINX) charges 0.16%. Investor-share fees for Fidelity Total Market Index (FSTMX) are 0.09%, compared with 0.16% for Vanguard Total Stock Market Index (VTSMX). And Fidelity’s investor shares require slightly less to start—$2,500, compared with $3,000 for Vanguard’s investor funds. But Fidelity’s expense advantage all but disappears for the share classes that require $10,000 minimum investments.

If you’re thinking about switching from Vanguard’s index funds to Fidelity’s, it’s important to realize that saving, say, 0.06 percentage point won’t dramatically affect your lifestyle. Suppose that over the next 10 years the S&P 500 returns 8% annualized. If you invest $5,000 in the Fidelity S&P 500 fund, you’ll have $10,599 at the end of the period. If you put $5,000 in the Vanguard fund, you’ll wind up with $10,525. (This assumes, of course, that both firms are equally adept at running S&P 500 index funds). “Some people say every penny makes a difference,” says Daniel Wiener, editor of the Independent Adviser for Vanguard Investors newsletter. In this particular case, you’d have to determine how much of a difference 7,400 pennies would make.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

If you’re already a Vanguard customer, we don’t see much point in switching to Fidelity—the fee differential isn’t big enough. But if you’re just starting out and are interested in indexing, you might want to consider Fidelity. Not only are its index funds cheaper, says Wiener, but “Fidelity has a much better website, with better technology, and that’s probably more important to a millennial than even the savings in annual fees.” (Fidelity won top marks in our latest survey of discount brokers, and Vanguard came in last.)

But Vanguard has some important advantages, too. It has a deeper, more diverse bench of index mutual funds and ETFs: 79, with $2.3 trillion in assets, compared with Fidelity’s 44, with $220 billion in assets. And with ETFs specifically, size matters. The bigger a fund, the greater the typical trading volume, and that can mean lower trading costs, says Max Chen, an analyst with ETFTrends.com. Many of Vanguard’s sector ETFs have more than $1 billion in assets. The biggest Fidelity sector ETF—Fidelity MSCI Health Care (FHLC)—has a bit more than $600 million. Vanguard Total Stock Market ETF (VTI) is the third-largest exchange-traded fund in the country, with $63 billion in assets. (Fidelity doesn’t offer an ETF version of its Total Market Index fund.)

Low fees are a good thing. But fees should not be the only consideration when you pick a fund. “People get so caught up with the issue of expenses that they lose sight of the bigger picture, which is, should you be in an index fund in the first place?” says Wiener.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Nellie joined Kiplinger in August 2011 after a seven-year stint in Hong Kong. There, she worked for the Wall Street Journal Asia, where as lifestyle editor, she launched and edited Scene Asia, an online guide to food, wine, entertainment and the arts in Asia. Prior to that, she was an editor at Weekend Journal, the Friday lifestyle section of the Wall Street Journal Asia. Kiplinger isn't Nellie's first foray into personal finance: She has also worked at SmartMoney (rising from fact-checker to senior writer), and she was a senior editor at Money.

-

Nasdaq Leads a Rocky Risk-On Rally: Stock Market Today

Nasdaq Leads a Rocky Risk-On Rally: Stock Market TodayAnother worrying bout of late-session weakness couldn't take down the main equity indexes on Wednesday.

-

Quiz: Do You Know How to Avoid the "Medigap Trap?"

Quiz: Do You Know How to Avoid the "Medigap Trap?"Quiz Test your basic knowledge of the "Medigap Trap" in our quick quiz.

-

5 Top Tax-Efficient Mutual Funds for Smarter Investing

5 Top Tax-Efficient Mutual Funds for Smarter InvestingMutual funds are many things, but "tax-friendly" usually isn't one of them. These are the exceptions.

-

Nasdaq Leads a Rocky Risk-On Rally: Stock Market Today

Nasdaq Leads a Rocky Risk-On Rally: Stock Market TodayAnother worrying bout of late-session weakness couldn't take down the main equity indexes on Wednesday.

-

Stocks Make More Big Up and Down Moves: Stock Market Today

Stocks Make More Big Up and Down Moves: Stock Market TodayThe impact of revolutionary technology has replaced world-changing trade policy as the major variable for markets, with mixed results for sectors and stocks.

-

Small Caps Step Up, Tech Is Still a Drag: Stock Market Today

Small Caps Step Up, Tech Is Still a Drag: Stock Market TodayEarly strength gave way to AI skepticism again as a volatile trading week ended on another mixed note.

-

AI Unwind Takes 2% Off the Nasdaq: Stock Market Today

AI Unwind Takes 2% Off the Nasdaq: Stock Market TodayMarkets are paying more and more attention to hyperscalers' plans to spend more and more money on artificial intelligence.

-

Strong Jobs Report Leaves Markets Flat: Stock Market Today

Strong Jobs Report Leaves Markets Flat: Stock Market TodayInvestors, traders and speculators are taking time to weigh the latest labor market data against their hopes for lower interest rates.

-

Dow Hits New High Ahead of January Jobs Report: Stock Market Today

Dow Hits New High Ahead of January Jobs Report: Stock Market TodayA weak reading on December retail sales was in focus ahead of Wednesday's delayed labor market data.

-

Tech Stocks Fuel Strong Start to the Week: Stock Market Today

Tech Stocks Fuel Strong Start to the Week: Stock Market TodayThe blue-chip Dow Jones Industrial Average extended its run above 50,000 on Monday and there are plenty of catalysts to keep the 30-stock index climbing.

-

Dow Adds 1,206 Points to Top 50,000: Stock Market Today

Dow Adds 1,206 Points to Top 50,000: Stock Market TodayThe S&P 500 and Nasdaq also had strong finishes to a volatile week, with beaten-down tech stocks outperforming.