James K. Glassman’s 10 Stock Picks for 2014

2013 was a very good year for the stocks I recommended. Let's see how I can follow up.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

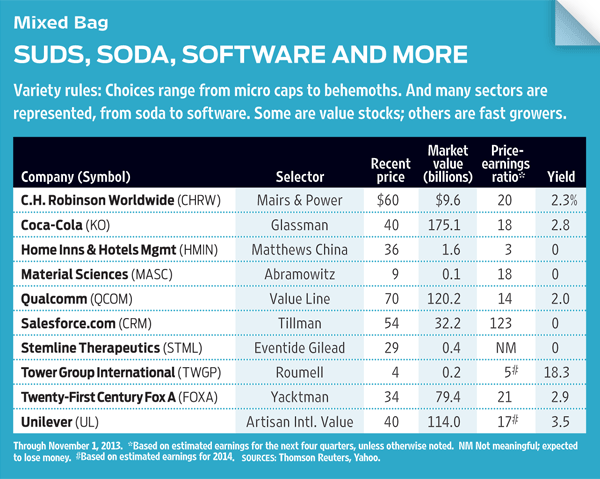

After trailing Standard & Poor’s 500-stock index for two straight years, I hit a home run with my 2013 stock recommendations. My ten picks—nine from the choices of experts I admire—scored positive returns. The average return, including dividends, from the time my January 2013 story was published was a whopping 42%, 16 percentage points better than the S&P 500. It was my best year, both absolutely and relative to the index, since I started this exercise in 1993. Here are my picks for the coming year:

The biggest winner of 2013 was my selection of one of the holdings of the superb Matthews China Fund (symbol MCHFX). New Oriental Education & Technology Group (EDU), which dominates the market for private educational services in China, jumped 62% in a year when Chinese stocks as a whole rose only about 10%. Because I expect China’s economy to bounce back from a recent slowdown in growth, I prefer companies that focus on the domestic Chinese market. I’m particularly fond of Home Inns & Hotels Management (HMIN), a Matthews holding that runs about 1,700 economy-priced hotels on the mainland. (All results and prices are through November 1.)

Another big winner came from Terry Tillman, who analyzes software stocks for the Raymond James investment firm. Tangoe (TNGO), a firm that helps big businesses manage their telecom services, climbed 43%. (Tillman had the second-best stock in 2012: SuccessFactors, which was acquired by SAP for a 48% gain.) For 2014, he likes yet another software firm: Salesforce.com (CRM), which helps its clients use remote computing—the “cloud”—to conduct business. Tillman is not put off by the stock’s tenfold increase since 2008. He predicts that revenues will rise 32% in the fiscal year that ends in January 2014 and 31% in the year that ends in January 2015.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

Another regular on my list with a record of success is James Roumell, a money manager who launched Roumell Opportunistic Value Fund (RAMVX) three years ago. Roumell is a super-contrarian. Last year, he chose Dell (DELL), which gained 55%. For 2014, he offers Tower Group International (TWGP) as a potentially rewarding stock, albeit a risky one. Its 18% dividend yield attests to that. Growing doubts about the adequacy of the property-and-casualty insurer’s loss reserves caused the stock to fall from more than $22 in August to less than $4 in October. Roumell thinks investors have overreacted.

My maven for micro-cap stocks is Daniel Abramowitz, of Hillson Financial Management, in Rockville, Md. He made his debut in 2013 with a winner, Cenveo (CVO), up 45%. For 2014, he likes Material Sciences (MASC), a tiny (market capitalization: $97 million) maker of lightweight alternatives to stainless steel. He thinks that, considering Material Sciences’ earnings potential and $9 share price, the stock is a bargain. “The company has $3.73 per share in cash, is debt-free and sells at a discount to book value” (assets minus liabilities).

One of the fund industry’s best five-year records belongs to little-known Eventide Gilead (ETGLX). Its investment philosophy, according to its Web site, is “rooted in the biblical understanding that God’s great intent for business is that it serve and, in turn, bless humankind.” Eventide Gilead’s investors have certainly been blessed: The fund’s five-year annualized return through November 1 is 24.3%. Although expenses, at 1.62% annually, are high, we can glean some good advice from the fund, which lately has loaded up on Stemline Therapeutics (STML), a small, early-stage biotech firm that focuses on developing drugs that target cancer stem cells. It’s a seeming bargain after its price recently fell by one-fourth.

Also invited back this year for another selection are N. David Samra and Daniel O’Keefe, managers of Artisan International Value (ARTKX), my favorite foreign stock fund. Artisan has whipped its benchmark by an average of 7.6 percentage points per year over the past five years. Artisan’s 2013 pick, Reed Elsevier (RUK), returned 44% and remains one of the fund’s ten biggest holdings. For 2014, I like Unilever (UL), another multinational giant among the fund’s top ten. The Netherlands-based consumer-products company has a major presence in burgeoning markets in Asia, Africa and the Middle East. So far in 2013, Unilever shares have trailed the S&P by 20 percentage points, but they are likely to rebound.

Donald Yacktman, one of my favorite managers, is stepping down from the helm of his eponymous funds in favor of his son Stephen, who has co-managed the funds for 12 years. No worries. Yacktman Fund (YACKX) holds only 45 stocks, and, with 7% turnover, they rarely change. But the fund’s September 30 update revealed that its largest holding (at 8% of assets) is now Twenty-First Century Fox (FOXA). That’s quite an endorsement. Fox is the new movie-and-TV company that resulted from the split-up of Rupert Murdoch’s News Corp. (NWS), which retained the newspaper and other media properties.

A fund with an investment philosophy and record similar to Yacktman’s is Mairs & Power Growth (MPGFX). A member of the Kiplinger 25, the fund has been in the top one-third of its category four years in a row, so it has to be doing something right. As of November 1, only one of the portfolio’s 25 biggest holdings, C.H. Robinson Worldwide (CHRW), didn’t increase in value during 2013. As a contrarian, I’m choosing that one for 2014 because it’s bargain priced. Robinson is a Minnesota-based logistics company that offers global transportation services. Its business will only improve as global trade increases, as I expect it will.

The Value Line Investment Survey, my secular bible, offers four recommended portfolios of 20 stocks each. Only one of the stocks carries the research service’s top ratings for both timeliness and safety. That’s Qualcomm (QCOM), maker of popular chips that serve as the modems and brains of wireless phones. Qualcomm is attractively priced. The stock sells for 14 times estimated year-ahead earnings, a figure that compares favorably with analysts’ estimates of 17% yearly earnings gains over the next three to five years.

Now it’s time for my own pick. I’m happy to say that my choice of Ford Motor (F) last year ranked third among the gainers, with a return of 54%. I’m going with another household name that has disappointed lately: Coca-Cola (KO), which has trailed the market significantly for the past two years. Coke is a classic “faith-based” stock—that is, a great company that, by means that can’t be predicted, always seems to bounce back. The company has been under fire from competitors as well as from policymakers who want citizens to slim down, and it’s been hurt by the sluggish global economy. But, one way or another, I have faith it will solve its problem. And the 2.8% yield will quench your thirst while you wait for the price to rise.

Final words. I’ll end with my usual warnings. I expect these stocks to beat the market over the next year, but I don’t believe in short-term investing (holding a stock for less than five years), so consider them long-term holdings. These are just suggestions—ultimately, the decisions are yours. And, oh, yes, don’t expect another 42% gain.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

-

8 Boring Habits That Will Make You Rich in Retirement

8 Boring Habits That Will Make You Rich in RetirementThese mundane activities won't make you the life of the party, but they will set you up for a rich retirement. Discover the 8 boring habits that build real wealth.

-

QUIZ: Are You Ready To Retire At 55?

QUIZ: Are You Ready To Retire At 55?Quiz Are you in a good position to retire at 55? Find out with this quick quiz.

-

10 Decluttering Books That Can Help You Downsize Without Regret

10 Decluttering Books That Can Help You Downsize Without RegretFrom managing a lifetime of belongings to navigating family dynamics, these expert-backed books offer practical guidance for anyone preparing to downsize.

-

5 Big Tech Stocks That Are Bargains Now

5 Big Tech Stocks That Are Bargains Nowtech stocks Few corners of Wall Street have been spared from this year's selloff, creating a buying opportunity in some of the most sought-after tech stocks.

-

How to Invest for a Recession

How to Invest for a Recessioninvesting During a recession, dividends are especially important because they give you a cushion even if the stock price falls.

-

10 Stocks to Buy When They're Down

10 Stocks to Buy When They're Downstocks When the market drops sharply, it creates an opportunity to buy quality stocks at a bargain.

-

How Many Stocks Should You Have in Your Portfolio?

How Many Stocks Should You Have in Your Portfolio?stocks It’s been a volatile year for equities. One of the best ways for investors to smooth the ride is with a diverse selection of stocks and stock funds. But diversification can have its own perils.

-

An Urgent Need for Cybersecurity Stocks

An Urgent Need for Cybersecurity Stocksstocks Many cybersecurity stocks are still unprofitable, but what they're selling is an absolute necessity going forward.

-

Why Bonds Belong in Your Portfolio

Why Bonds Belong in Your Portfoliobonds Intermediate rates will probably rise another two or three points in the next few years, making bond yields more attractive.

-

140 Companies That Have Pulled Out of Russia

140 Companies That Have Pulled Out of Russiastocks The list of private businesses announcing partial or full halts to operations in Russia is ballooning, increasing economic pressure on the country.

-

How to Win With Game Stocks

How to Win With Game Stocksstocks Game stocks are the backbone of the metaverse, the "next big thing" in consumer technology.