FAANGs + 1: Higher Tech, Lower Risk

These stocks can withstand the shocks that are becoming more common in our interconnected world.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

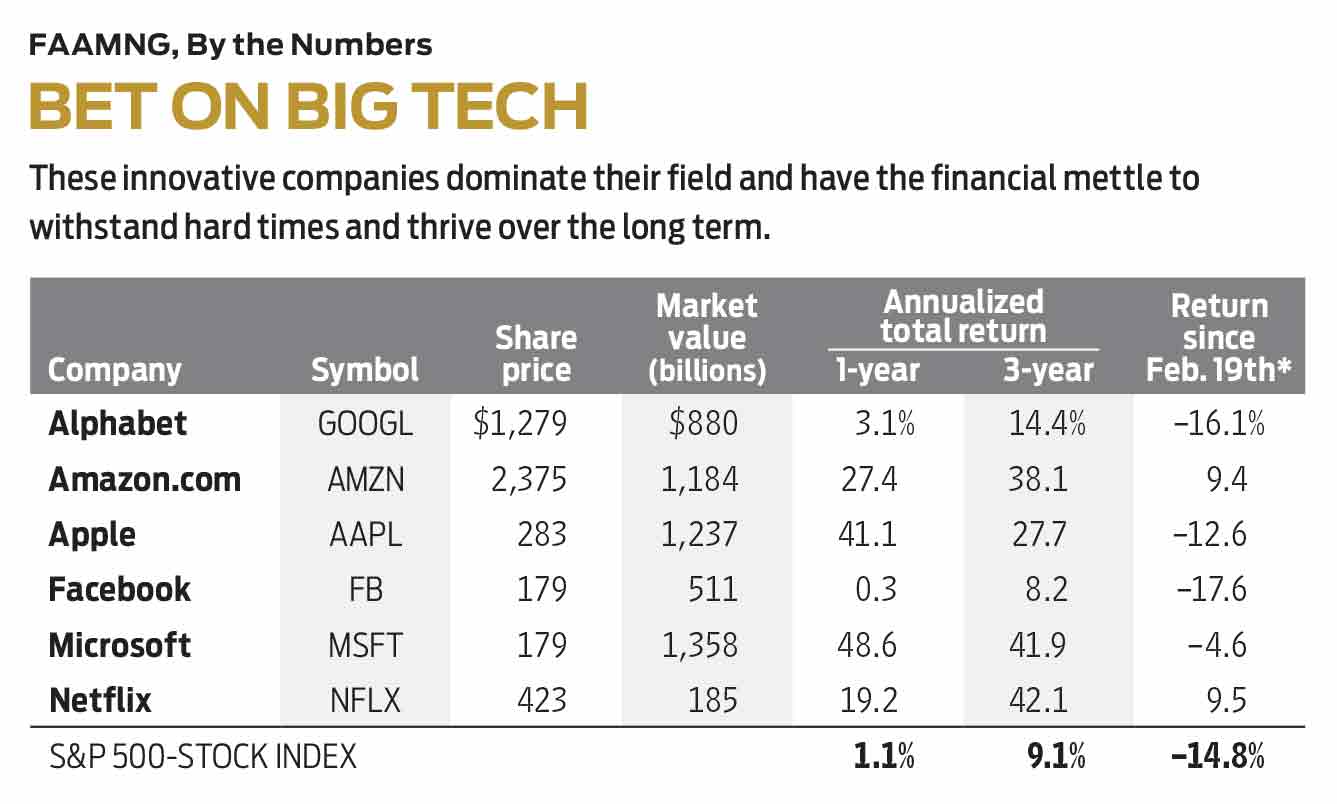

The acronym FAANG was coined a few years ago by CNBC host Jim Cramer to denote five tech firms that are “totally dominant in their markets”: Facebook (symbol FB), Apple (AAPL), Amazon.com (AMZN), Netflix (NFLX) and Google parent Alphabet (GOOGL). I think he made a mistake in leaving out Microsoft (MSFT), so let’s expand the group to six and call them FAAMNG (pronounced “faming”).

FAAMNG firms have been hurt by the COVID-19 pandemic and the crash in energy prices, but not as much as the market as a whole. Since the bear market began, Standard & Poor’s 500-stock index, the U.S. benchmark, has lost 14.8%, while the FAAMNG stocks, on average, lost 5.3%. For the year ending April 17, the S&P is up 1.1% but the FAAMNG six are up an average of 23.3%.

One reason the companies performed relatively well is that they conduct nearly all their activities online, so social distancing harmed them less than, say, brick-and-mortar retailers or the travel industry. But there’s much more to the story. FAAMNG firms provide longer-term lessons for investors seeking stocks that can withstand the shocks that are becoming more common in our interconnected world.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

Size matters. The first lesson is that, like a giant ship, a giant company is better equipped to ride out the worst storms. On August 2, 2018, Apple became the first U.S. stock with a market capitalization (stock price times shares outstanding) of $1 trillion. Three other FAAMNG companies followed. Microsoft, Apple and Amazon retain their 13-figure status; Alphabet has dropped to just under $900 billion. Those four are the largest U.S. firms by market cap, with Facebook in fifth place. Netflix ranks 24th, but it’s still larger than such behemoths as Chevron (CVX), Comcast (CMCSA) and McDonald’s (MCD).

Bigger is no guarantee of better. In October 2007, the two largest stocks were ExxonMobil (XOM), at about $500 billion, and General Electric (GE), at $400 billion. Today, their combined market cap is less than $250 billion. The reasons for the fall are instructive. Exxon’s profits are highly dependent on the price of a single commodity; GE became an unmanageable leviathan with too many businesses.

By contrast, the FAAMNG stocks have firm control of their primary markets. Google and Facebook together split about half of global digital advertising revenues, which currently represent more than half of all ad sales in the U.S., China and most other large countries. Google’s search engine has an 87% market share. Facebook has 2.4 billion monthly users (it’s the most popular social media site in the world), and it owns Whats-App and Instagram, too, which have another 2.6 billion users between them. Amazon accounts for half of U.S. online retail spending. Seven out of eight U.S. streaming subscribers have a subscription to Netflix; Apple’s global smartphone market share exceeds 50%; and Microsoft’s Windows operating system runs on 77% of desktop computers.

FAAMNG stocks have room to grow, as well. Digital advertising and streaming video are still young markets, and Amazon’s overall share of U.S. retail is still just 5%. Smartphones still have not been adopted by three-fifths of the world’s population, and Microsoft keeps bringing out new variations of software and cloud products, lifting revenues by a cumulative 30% over the past two years.

FAAMNG companies are seen as growth stocks; in normal times, their earnings increase at a faster clip than the rest of the market. They also have excellent balance sheets. Four of the six have a top rating of A++ for financial strength from Value Line Investment Survey. Amazon is rated A+; Netflix, a very solid A.

“Downturns are capitalism’s sorting mechanism,” said a recent article in The Economist. Or, as Warren Buffett said, more colorfully, “Only when the tide goes out do you discover who’s been swimming naked.” In the past three recessions, companies whose share-price returns landed in the top fourth of each sector rose by an average of 6%; stocks in the bottom fourth fell by 44%. Firms that survive and even thrive have a surfeit of assets that are easy to liquidate, plus modest liabilities. That gives them the cash to stay afloat, the credit to borrow (if necessary) and the ability to buy smaller firms at bargain prices.

Cash rich. FAAMNG companies are loaded with cash and short-term securities—a total of $476 billion among the six of them at the end of 2019, with light, low-interest debt. Alphabet, for example, had $120 billion in cash and short-term investments and $15 billion in long-term debt; Facebook, $55 billion at hand and $11 billion in debt.

Netflix has more debt than cash, but it also has soaring revenues that will likely be undented by the pandemic—and in a pinch, the company can temporarily trim its heavy costs for developing new programming. Alphabet and Facebook, by contrast, are expected to suffer revenue declines of about 18% this year, but they easily have enough cash to handle any losses. All six companies have grown rapidly in the past and will resume growing when the crisis ends. Don’t forget that stock prices are determined by expected future earnings, not those that are current or past.

By definition, these tech companies are innovators. They don’t stand pat. While preserving domination in their primary markets, they constantly look to expand. Amazon, for example, has developed the largest cloud-computing infrastructure business in the world, with a 33% share of a $100 billion market. Apple has moved aggressively into video, and Alphabet has reorganized into two divisions: Google and Other Bets, including a “moonshot” research-and-development unit.

No company is dominant forever. With the booting of GE in 2018, not a single component of the original 1896 Dow Jones industrial average—a group of stocks generally considered both financially strong and consistently profitable—remains in the index. And certainly, the FAAMNG stocks have had their own ups and downs. In 1997, Apple had to cut one-third of its workforce and was within 90 days of going broke. Amazon lost more than 90% of its stock value when the tech bubble burst in 2000–01. Both Facebook and Google shares have declined with the companies’ struggles to address public concerns about privacy and hate speech. But my guess is that any government policy changes will only enhance their market positions because complying with new regulations will strain smaller competitors’ resources.

So, although I recommend the stocks currently, can I commit to FAAMNG forever? Not quite. Things change. One flexible approach is to buy Invesco QQQ Trust (QQQ), an exchange-traded fund with a 0.2% expense ratio. QQQ owns the stocks of the Nasdaq 100 index, and FAAMNG companies currently make up half of its assets. It’s not a pure play, but it’s easy, and it lets you own other companies with the potential to become the next great FAAMNG-style stock.

Or consider a portfolio technique devised by the late Leslie Douglas, a Washington, D.C., investment adviser. To apply the Douglas Theory, which has been highly profitable, you buy equal dollar amounts of the five largest Nasdaq stocks at the start of each year. Right now, those five are all FAAMNG companies. (Netflix is the eighth-largest Nasdaq stock.) I once called the Douglas Theory “a low-risk system for high-tech stocks.” That sums up the case for FAAMNG firms in a time of troubles—and beyond.

James K. Glassman chairs Glassman Advisory, a public-affairs consulting firm. He does not write about his clients. Of the investments mentioned in this column, he owns Amazon, Microsoft and QQQ. His most recent book is Safety Net: The Strategy for De-Risking Your Investments in a Time of Turbulence.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

-

Over 65? Here's What the New $6K 'Senior Deduction' Means for Medicare IRMAA Costs

Over 65? Here's What the New $6K 'Senior Deduction' Means for Medicare IRMAA CostsTax Breaks A new deduction for people over age 65 has some thinking about Medicare premiums and MAGI strategy.

-

U.S. Congress to End Emergency Tax Bill Over $6,000 Senior Deduction and Tip, Overtime Tax Breaks in D.C.

U.S. Congress to End Emergency Tax Bill Over $6,000 Senior Deduction and Tip, Overtime Tax Breaks in D.C.Tax Law Here's how taxpayers can amend their already-filed income tax returns amid a potentially looming legal battle on Capitol Hill.

-

5 Investing Rules You Can Steal From Millennials

5 Investing Rules You Can Steal From MillennialsMillennials are reshaping the investing landscape. See how the tech-savvy generation is approaching capital markets – and the strategies you can take from them.

-

Dow Rises 313 Points to Begin a Big Week: Stock Market Today

Dow Rises 313 Points to Begin a Big Week: Stock Market TodayThe S&P 500 is within 50 points of crossing 7,000 for the first time, and Papa Dow is lurking just below its own new all-time high.

-

Dow, S&P 500 Rise to New Closing Highs: Stock Market Today

Dow, S&P 500 Rise to New Closing Highs: Stock Market TodayWill President Donald Trump match his Monroe Doctrine gambit with a new Marshall Plan for Venezuela?

-

'Donroe Doctrine' Pumps Dow 594 Points: Stock Market Today

'Donroe Doctrine' Pumps Dow 594 Points: Stock Market TodayThe S&P 500 rallied but failed to turn the "Santa Claus Rally" indicator positive for 2026.

-

Stocks Chop as the Unemployment Rate Jumps: Stock Market Today

Stocks Chop as the Unemployment Rate Jumps: Stock Market TodayNovember job growth was stronger than expected, but sharp losses in October and a rising unemployment rate are worrying market participants.

-

Risk Is Off Again, Dow Falls 397 Points: Stock Market Today

Risk Is Off Again, Dow Falls 397 Points: Stock Market TodayMarket participants are weighing still-solid earnings against both expectations and an increasingly opaque economic picture.

-

Honeywell Leads Dow Higher: Stock Market Today

Honeywell Leads Dow Higher: Stock Market TodayOil prices got a lift after the Treasury Department announced new sanctions on Russia's two largest oil companies.

-

Investors Take Stock of Shutdown Talk: Stock Market Today

Investors Take Stock of Shutdown Talk: Stock Market TodayWhether we'll have a Jobs Friday this week depends on if we have a government shutdown in Washington.

-

How to Invest for Rising Data Integrity Risk

How to Invest for Rising Data Integrity RiskAmid a broad assault on venerable institutions, President Trump has targeted agencies responsible for data critical to markets. How should investors respond?