Small-Cap Value Stocks: This Time, Things Are Not Different

History repeatedly shows us a pattern with small-cap value that's being repeated yet again today.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

Investors wondering about ways to re-risk portfolios after the COVID-19 pandemic should consider increasing allocations to U.S. small-cap value stocks. Following years of underperformance and a collapse in valuations in March, these equities appear poised for a long-awaited, sustained rebound.

Proponents of value investing have been predicting a great rotation from growth to value stocks for years. So, why should investors believe it now?

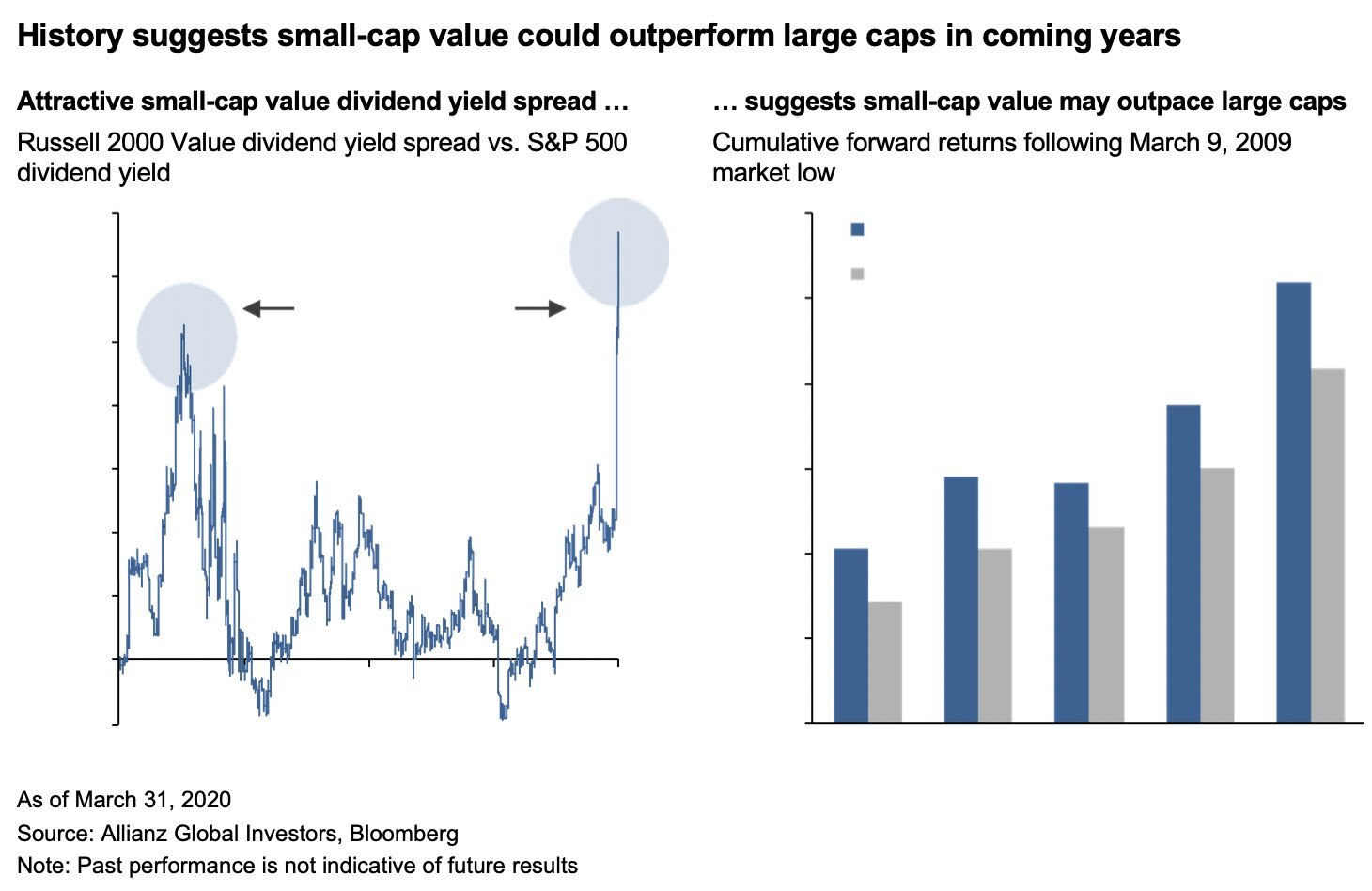

Because this is not my personal opinion, but rather a conclusion drawn from a thorough analysis of prior disruptions dating back to 1937 in which the spread between dividend yields on small-cap value (as measured by the Russell 2000 Value Index) and large-cap stocks (as measured by the S&P 500 Index) widened significantly.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

Small-Cap Value: A Look Back

In each prior case, small-cap value subsequently outperformed large caps, often for several years and by a wide margin. In mid-March, the spread between the Russell 2000 Value Index and the S&P 500 Index was the widest it had been since the 2008 Global Financial Crisis (GFC). Historically, this has suggested an attractive entry point into small-cap value.

In "normal" times, small- and large-cap stocks tend to perform similarly, with a relatively high correlation (0.8 on average) between the Russell 2000 and the S&P 500 indices. However, at critical moments in market history, those indexes have diverged, with the underperformance of small caps creating a significant gap between them. Often during selloffs, small-cap value stocks are hit hardest, creating an even wider dividend-yield spread over large caps.

The most recent such event was the GFC.

During the market selloff in January 2008, the dividend-yield spread between the Russell 2000 Value Index and the S&P 500, which has historically averaged about 0.19%, spiked to 1.05%. Over the next five years, Russell 2000 Value outperformed the S&P 500 by a cumulative 50.4%.

That pattern of small-cap value being hardest hit is repeating itself today.

Thanks to a large portion of Americans going into lockdown, small businesses are suffering much worse than larger firms that have more resources to endure revenue losses and adjust to the dislocation. As a result, in March 2020, the spread between the Russell 2000 Value dividend yield and the S&P 500 dividend yield soared to a new high of 1.34%.

Based on the experience of 2008 and other historic market events, spreads of this magnitude represent a powerful signal that small-cap value stocks have the ability to outperform during the coming recovery.

The Current Opportunity

Of course, it's always possible that things are different this time.

There are certainly important differences between the markets' reactions to the COVID-19 pandemic and the GFC. Most notably, the 2008 equity selloff struck indiscriminately across industries. In the current crisis, the impact has been uneven. In large-cap stocks, for example, some industries such as airlines, entertainment and leisure are bearing the brunt, while industries such as technology are maintaining and even seeing higher valuations.

Given these differences, it makes sense that the subsequent recoveries could diverge as well, at least for large caps.

In small-cap value stocks, however, the COVID-19 selloff has been violent and across the board, with virtually no differentiation across sectors. In this way, the situation today mirrors that of the GFC almost perfectly. As a result, it's reasonable to conclude that the recovery will also resemble that of the prior crisis and small-cap value could again outperform.

The opportunity in small-cap value stocks relative to large caps comes as investors have flocked to large-cap growth stocks, largely as a flight to safety in the aftermath of the COVID-19 selloff. Now, after the recent stock market rally, many market observers see large caps as having little room to appreciate. In contrast, betting against significant appreciation in small-cap value would require believing that the spread between small-cap value and other assets will not revert to historic means and small businesses will continue lagging the broader economy throughout the recovery.

There is one factor working against small-cap value: falling dividends. Dividends are a crucial component of small-cap value returns – up to 40% on average – and there is little doubt that small businesses will be forced to continue reducing or eliminating dividends. However, the same phenomenon occurred during the GFC, and it in no way disrupted the outperformance trend during the subsequent recovery.

Having said that, given how the current crisis is reshaping the economy, investors considering tilting toward small-cap value today might benefit by avoiding broad index strategies in favor of actively managed approaches that can better navigate the shifting economic sands to focus on companies with the strongest fundamentals while minimizing the drag of dividend cuts on potential returns.

Even taking lower dividends into account, the market is sending clear signals that small-cap value appears potentially poised to outperform large-cap equities. Investors who remain unconvinced by the historic data and fear a continuation of small-cap value's extended run of underperformance should remember that Washington has made clear that the federal government will support small businesses throughout the crisis – potentially to an even greater extent than in any previous crisis.

That commitment should bolster investors' confidence in the historic trend.

The Bottom Line on Small-Cap Value Stocks

History teaches us that the time to act on these signals is now. Investors who are still doubtful about "the return of value" leave themselves at risk of missing out on the potentially significant outperformance of small-cap value during the initial stages of the coming recovery from the Covid-19 pandemic.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

-

Nasdaq Leads a Rocky Risk-On Rally: Stock Market Today

Nasdaq Leads a Rocky Risk-On Rally: Stock Market TodayAnother worrying bout of late-session weakness couldn't take down the main equity indexes on Wednesday.

-

Quiz: Do You Know How to Avoid the "Medigap Trap?"

Quiz: Do You Know How to Avoid the "Medigap Trap?"Quiz Test your basic knowledge of the "Medigap Trap" in our quick quiz.

-

5 Top Tax-Efficient Mutual Funds for Smarter Investing

5 Top Tax-Efficient Mutual Funds for Smarter InvestingMutual funds are many things, but "tax-friendly" usually isn't one of them. These are the exceptions.

-

Nasdaq Leads a Rocky Risk-On Rally: Stock Market Today

Nasdaq Leads a Rocky Risk-On Rally: Stock Market TodayAnother worrying bout of late-session weakness couldn't take down the main equity indexes on Wednesday.

-

Stocks Make More Big Up and Down Moves: Stock Market Today

Stocks Make More Big Up and Down Moves: Stock Market TodayThe impact of revolutionary technology has replaced world-changing trade policy as the major variable for markets, with mixed results for sectors and stocks.

-

Small Caps Step Up, Tech Is Still a Drag: Stock Market Today

Small Caps Step Up, Tech Is Still a Drag: Stock Market TodayEarly strength gave way to AI skepticism again as a volatile trading week ended on another mixed note.

-

AI Unwind Takes 2% Off the Nasdaq: Stock Market Today

AI Unwind Takes 2% Off the Nasdaq: Stock Market TodayMarkets are paying more and more attention to hyperscalers' plans to spend more and more money on artificial intelligence.

-

Strong Jobs Report Leaves Markets Flat: Stock Market Today

Strong Jobs Report Leaves Markets Flat: Stock Market TodayInvestors, traders and speculators are taking time to weigh the latest labor market data against their hopes for lower interest rates.

-

Dow Hits New High Ahead of January Jobs Report: Stock Market Today

Dow Hits New High Ahead of January Jobs Report: Stock Market TodayA weak reading on December retail sales was in focus ahead of Wednesday's delayed labor market data.

-

Tech Stocks Fuel Strong Start to the Week: Stock Market Today

Tech Stocks Fuel Strong Start to the Week: Stock Market TodayThe blue-chip Dow Jones Industrial Average extended its run above 50,000 on Monday and there are plenty of catalysts to keep the 30-stock index climbing.

-

Dow Adds 1,206 Points to Top 50,000: Stock Market Today

Dow Adds 1,206 Points to Top 50,000: Stock Market TodayThe S&P 500 and Nasdaq also had strong finishes to a volatile week, with beaten-down tech stocks outperforming.