Kiplinger’s 2014 Stock Picks: Readers Weigh In

We asked individual investors on Kiplinger.com to forecast the best-performing stock from our list of recommendations for 2014. The runaway favorite may surprise you.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

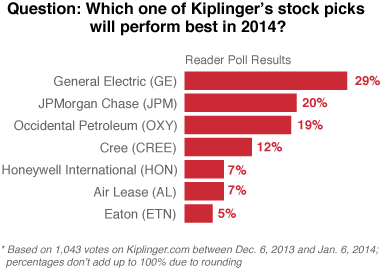

What's old is seemingly new again. Of the top two finishers in our online poll assessing the potential of seven stocks featured in the January 2014 issue of Kiplinger’s Personal Finance, one company boasts ties to Thomas Edison and the other traces its roots to Aaron Burr. Both stocks would’ve looked equally at home in your grandfather’s portfolio as they would in yours today.

The two venerable stocks that proved most appealing to our readers are General Electric (GE) and JPMorgan Chase (JPM). GE, founded in 1892 through the merger of electric-light manufacturers Edison General Electric and Thomson-Houston, garnered a decisive 29% of the 1,043 votes cast. In 2014, the global conglomerate should benefit from an improving world economy, we wrote in the January issue. GE investors, in turn, should benefit from dividend hikes, share buybacks and an above-average stock yield.

Twenty percent of readers think runner-up JPMorgan will be the best-performing stock among the seven choices in 2014. Despite being mired in controversies over the past two years, it’s “one of the best-run banks, with a strong balance sheet and a compelling international investment-banking operation,” we wrote. Its legal and regulatory woes have suppressed the stock, so its valuation remains attractive. Incidentally, JPMorgan is no stranger to controversy. It began as the Bank of the Manhattan Co., established in 1799 by Burr, who gained notoriety for killing Alexander Hamilton in a duel in 1804.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

The next two stocks favored by readers are those of energy companies, albeit from different ends of the energy spectrum. In third place, with 19% of the votes, is Occidental Petroleum (OXY), an oil-and-gas firm that also has operations in chemical manufacturing. We like the fact that it derives the bulk of its energy from North America rather than from unstable regions of the world, plus Occidental “boasts a superb balance sheet, with plenty of cash for dividends and share buybacks.”

Coming in fourth is Cree (CREE). It’s not a household name—at least not yet—but 12% of voters think highly of the company’s status as a leader in the manufacture of energy-efficient light-emitting diodes, or LEDs. The U.S. and other nations are phasing out traditional incandescent bulbs, which paves the way for sales of LED bulbs as replacements. Cree is also dipping its toes in the solar-power industry.

The next two stocks on the list earned just 7% of the votes apiece. Honeywell International (HON), an industrial giant that makes everything from jet engines to smoke detectors, “has turned skeptics into believers,” we wrote in the January issue, as a result of management meeting the ambitious goals laid out in a five-year plan unveiled in 2010. Air Lease (AL), as the name implies, leases planes to more than 75 airlines. The stock has had a bumpy ride since its market debut in 2011, but the share price should take off in 2014 if profits climb, as analysts expect.

In last place, with just 5% of the votes, is Eaton Corp. (ETN). The company, based in Ireland, manufactures all manner of power-management components and systems for cars, trucks, heavy equipment, planes and more. Eaton has the potential to “fire on all cylinders” in 2014, we wrote, as long as the commercial-construction market rebounds.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

-

Quiz: Do You Know How to Avoid the "Medigap Trap?"

Quiz: Do You Know How to Avoid the "Medigap Trap?"Quiz Test your basic knowledge of the "Medigap Trap" in our quick quiz.

-

5 Top Tax-Efficient Mutual Funds for Smarter Investing

5 Top Tax-Efficient Mutual Funds for Smarter InvestingMutual funds are many things, but "tax-friendly" usually isn't one of them. These are the exceptions.

-

AI Sparks Existential Crisis for Software Stocks

AI Sparks Existential Crisis for Software StocksThe Kiplinger Letter Fears that SaaS subscription software could be rendered obsolete by artificial intelligence make investors jittery.

-

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have TodayAdvanced Micro Devices stock is soaring thanks to AI, but as a buy-and-hold bet, it's been a market laggard.

-

If You'd Put $1,000 Into UPS Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into UPS Stock 20 Years Ago, Here's What You'd Have TodayUnited Parcel Service stock has been a massive long-term laggard.

-

If You'd Put $1,000 Into Lowe's Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into Lowe's Stock 20 Years Ago, Here's What You'd Have TodayLowe's stock has delivered disappointing returns recently, but it's been a great holding for truly patient investors.

-

If You'd Put $1,000 Into 3M Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into 3M Stock 20 Years Ago, Here's What You'd Have TodayMMM stock has been a pit of despair for truly long-term shareholders.

-

If You'd Put $1,000 Into Coca-Cola Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into Coca-Cola Stock 20 Years Ago, Here's What You'd Have TodayEven with its reliable dividend growth and generous stock buybacks, Coca-Cola has underperformed the broad market in the long term.

-

If You Put $1,000 into Qualcomm Stock 20 Years Ago, Here's What You Would Have Today

If You Put $1,000 into Qualcomm Stock 20 Years Ago, Here's What You Would Have TodayQualcomm stock has been a big disappointment for truly long-term investors.

-

If You'd Put $1,000 Into Home Depot Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into Home Depot Stock 20 Years Ago, Here's What You'd Have TodayHome Depot stock has been a buy-and-hold banger for truly long-term investors.

-

If You'd Put $1,000 Into Bank of America Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into Bank of America Stock 20 Years Ago, Here's What You'd Have TodayBank of America stock has been a massive buy-and-hold bust.