Build a Bond Ladder for More Income

Our four portfolios will help you harness higher interest rates.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

It's a sure bet that interest rates have settled into a higher range and are poised to rise further. But don't let that scare you away from bonds (when rates are rising, bond prices tend to fall, and vice versa) or from certificates of deposit. If anything, the volatile stock market should be nudging you toward more bonds and CDs, not fewer.

Still, the rate outlook demands some caution in your fixed-income strategy. The market value of long-term Treasuries and other bonds is apt to shrink more, especially if inflation rises enough to shock bond traders into demanding higher yields on new investments.

But it's worth remembering that when a bond matures, the issuer returns the entire face amount. So a bond whose price falls to 95 cents on the dollar will eventually pay you back 100 cents, unless the borrower defaults or you sell in the interim. Income-seeking investors can stick to a simple plan to protect bond principal from getting nicked by rising rates, while collecting a decent income and reinvesting returned capital for a higher yield as rates continue to climb. You can accomplish this with an old-school technique called laddering. It works well with certificates of deposit and with individual bonds.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

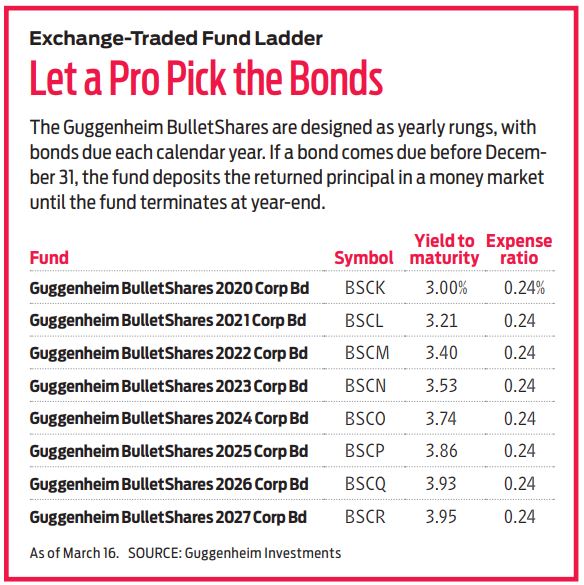

Bond funds don't work for ladders because the bonds in them are rarely held to maturity. But some exchange-traded funds have found a work-around, holding portfolios of bonds that all mature in a target year, and such ETFs can be a low-cost way to build a laddered income stream.

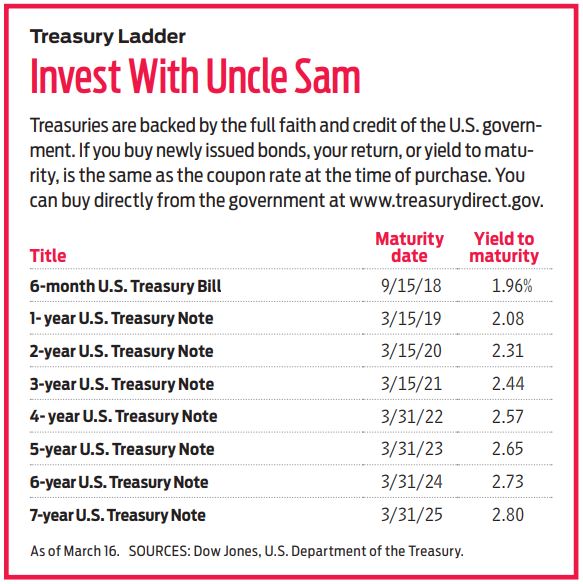

The analogy to a ladder is straightforward. You own a series of bonds that represent the rungs, with the bottom ones paying the lowest interest rates and maturing soonest, and the yields and terms climbing as you go higher. Recently, a six-month Treasury bill paid 1.96%, a one-year note paid 2.08%, a two-year issue paid 2.31% and so on, until you hit 2.85% for a 10-year bond and 3.08% for a 30-year. (Rates and prices are as of March 16.)

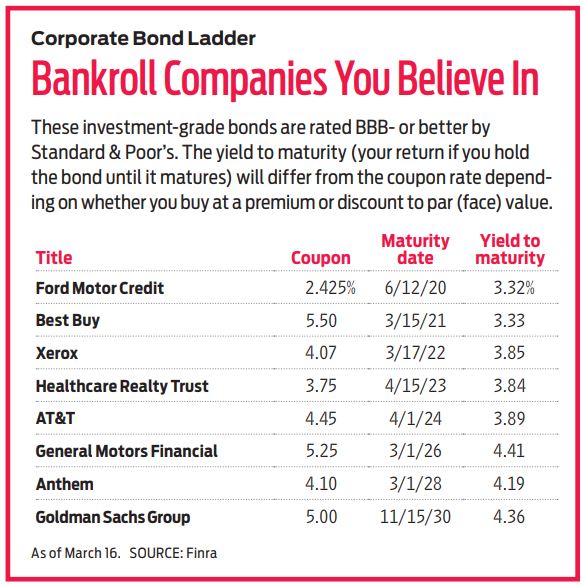

A survey of corporate bonds rated A to AAA shows coupon rates starting at 1.97% for six months and rising to 2.12% for one year, 2.38% for two, 2.88% for five and then to 3.54% for 10 years and 4.11% for 30.

An ideal government-bond ladder might start at six months and step up to a one-year note, then one rung at a time to seven-year T-notes, each yielding a little more than the previous one. If you invest the same amount at each maturity, the average yield currently is 2.35%. That's reasonable, considering you get the full faith and credit of the U.S. Treasury. When the six-month bill matures, simply buy a new one. As the note on the next-lowest rung on the ladder matures each year, reinvest the proceeds in the longest maturity on the ladder, in this case a seven-year note. (With other bonds, yields on the ladder might not always rise rung-by-rung, but in a rising-rate environment, you will be replacing maturing bonds with higher-yielding ones.)

How much you'll need. The amount of money you need to build a ladder of individual bonds varies. Treasury Direct (www.treasurydirect.gov) fills orders as small as $100. Consider any dollar amount in government bonds safe, in the sense that there's virtually no risk of default.

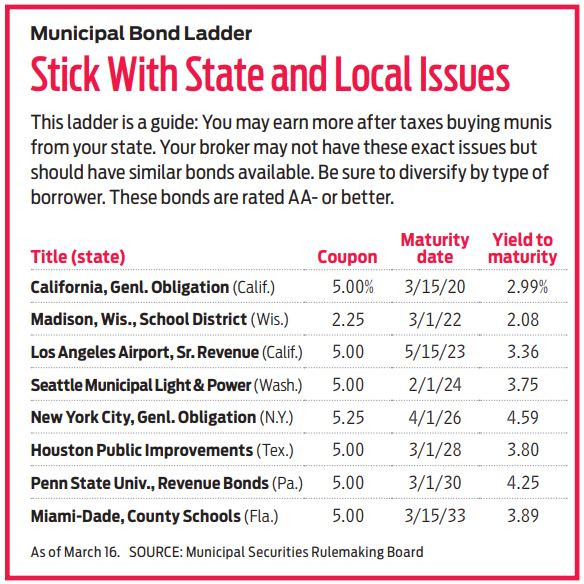

With corporates and municipals, advisers typically recommend that you invest at least $100,000 to adequately diversify and protect against defaults or bond downgrades from rating agencies that weigh in on companies' creditworthiness. But most tax-exempt issuers and investment-grade corporate borrowers are healthy and as likely to win higher credit ratings as to be downgraded to so-called junk status. So $50,000 to set up a 10-rung muni or corporate ladder is probably enough. Even $25,000 may be adequate if a broker fills small-enough orders across a wide spectrum of issuers.

Assemble a CD ladder by splitting your money among certificates with one- to five-year terms, rolling the one that matures each year into a new five-year CD. Nationwide, current rates range from 0.75% on a one-year CD to 1.69% on a five-year. Bank or credit union CDs are insured, up to $250,000 per depositor, at each institution.

For a bond ladder, consider the following portfolios as a guide. You may not be able to replicate them exactly, but you should be able to get close.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Kosnett is the editor of Kiplinger Investing for Income and writes the "Cash in Hand" column for Kiplinger Personal Finance. He is an income-investing expert who covers bonds, real estate investment trusts, oil and gas income deals, dividend stocks and anything else that pays interest and dividends. He joined Kiplinger in 1981 after six years in newspapers, including the Baltimore Sun. He is a 1976 journalism graduate from the Medill School at Northwestern University and completed an executive program at the Carnegie-Mellon University business school in 1978.

-

Nasdaq Leads a Rocky Risk-On Rally: Stock Market Today

Nasdaq Leads a Rocky Risk-On Rally: Stock Market TodayAnother worrying bout of late-session weakness couldn't take down the main equity indexes on Wednesday.

-

Quiz: Do You Know How to Avoid the "Medigap Trap?"

Quiz: Do You Know How to Avoid the "Medigap Trap?"Quiz Test your basic knowledge of the "Medigap Trap" in our quick quiz.

-

5 Top Tax-Efficient Mutual Funds for Smarter Investing

5 Top Tax-Efficient Mutual Funds for Smarter InvestingMutual funds are many things, but "tax-friendly" usually isn't one of them. These are the exceptions.

-

Big Change Coming to the Federal Reserve

Big Change Coming to the Federal ReserveThe Lette A new chairman of the Federal Reserve has been named. What will this mean for the economy?

-

The Most Tax-Friendly States for Investing in 2025 (Hint: There Are Two)

The Most Tax-Friendly States for Investing in 2025 (Hint: There Are Two)State Taxes Living in one of these places could lower your 2025 investment taxes — especially if you invest in real estate.

-

The Final Countdown for Retirees with Investment Income

The Final Countdown for Retirees with Investment IncomeRetirement Tax Don’t assume Social Security withholding is enough. Some retirement income may require a quarterly estimated tax payment by the September 15 deadline.

-

Why Investors Needn't Worry About U.S. Credit Downgrade

Why Investors Needn't Worry About U.S. Credit DowngradeFitch Ratings The United States saw its credit rating downgraded for just the second time in history, but experts aren't worried about the long-term damage to stocks.

-

Bond Ratings and What They Mean

Bond Ratings and What They Meaninvesting Bond ratings measure the creditworthiness of your bond issuer. Understanding bond ratings can help you limit your risk and maximize your yield.

-

Bond Basics: Treasuries

Bond Basics: Treasuriesinvesting Understand the different types of U.S. treasuries and how they work.

-

Bond Basics: Ownership

Bond Basics: Ownershipinvesting Bonds come in a variety of forms, but they all share these basic traits.

-

Bond Basics: Pick Your Type

Bond Basics: Pick Your Typeinvesting Bonds offer a variety of ways to grow wealth and fortify your portfolio. Learn about the types of bonds and how they work.