What Trump and the Other Presidential Candidates Are Not Talking About

While our politicians ignore our huge economic problems, investors should brace themselves for the fallout.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

Remember the fiscal crisis? It never went away; it just got boring. While many Americans took a "what I can't see won't hurt me" attitude, this Washington monster kept getting bigger and bigger.

Not that you would know anything about it from the candidates. They are too busy running around declaring that they will make America great again or that everybody should get free college or that they are still relevant. Whatever they're saying, none of them are dealing with the real issues. That would require strength, leadership and fearlessness in the face of political suicide.

What are the real issues that you need to be concerned about even when our politicians ignore them? As a financial adviser, I'm most troubled by these issues.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

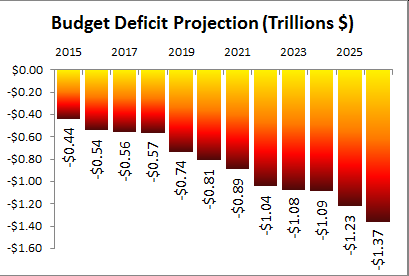

Issue #1: The Trillion-Dollar Deficit

Remember the budget deficit? It was all the rage during the last election and guess what? Nobody did anything about it. Good for us! The Congressional Budget Office's January 2016 economic outlook projects the deficit will average just under $1 trillion per year for the next 10 years.

In order to eliminate the deficit, spending has to be cut by $1 trillion annually, or taxes and other income have to go up by $1 trillion, or some combination of both.

"Cut spending! Raise taxes!" Not the campaign slogan I'm hearing.

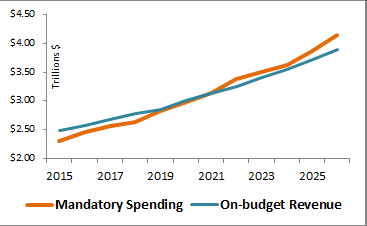

Issue #2: Mandatory Spending

Margaret Thatcher is famously credited for saying, "The problem with socialism is that you eventually run out of other people's money."

Mandatory spending is the portion of the federal budget earmarked for entitlement programs such as Social Security, Medicaid, Medicare and food stamps, among others. One side of the aisle screams, "They want to throw your Gramma into the street!" The other side of the aisle yells, "They are lazy bums who are just scamming the system." Both are right, and both are wrong.

Bottom line: Mandatory spending represented 93% of the on-budget revenue that the government received in 2015, according to CBO data. In five years, it will be 100%. By 2026 it will reach 106% of the on-budget revenue.

This leaves nothing for so-called discretionary budget items such as the departments of Defense, Homeland Security, Justice and Veterans Affairs, as well as NASA and other programs. So deficit spending, going into more debt, is Washington's brave solution.

Something has to be done. Since discretionary spending represents about a third of the federal budget and mandatory spending represents about two-thirds, it would make sense to cut proportionately. The phrase "it would make sense" is the problem. Washington doesn't make sense and doing the right thing is not in the nature of most politicians.

"Cut Social Security! Cut Medicaid! Cut the Defense budget!" Another campaign slogan you will never hear.

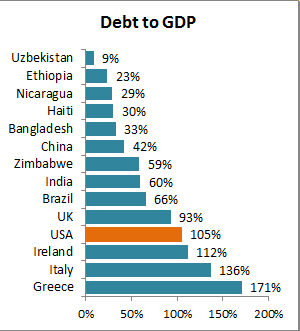

Issue #3: Debt-to-GDP Above 100%

Thanks to continued deficit spending, the ratio of total federal debt to gross domestic product has topped the dreaded 100% level. In other words, the federal debt is bigger than the entire economy. This puts the U.S. in some pretty poor company. Greece, Ireland, Spain and Italy were the focus of Europe's fiscal problems due to their debt-to-GDP ratios rising above 100%.

Studies show that when a country's debt-to-GDP ratio goes over 100%, two things happen: (1) the economy slows; and (2) the debt-to-GDP ratio accelerates faster, slowing the economy further.

The real danger is rising interest rates. It can cause the debt level to explode higher as the cost of the debt, the interest paid on the debt, goes higher. Governments can cut spending; they can't cut the interest they owe.

The fix can be as bad as the problem. Spending can be slashed and taxes raised. The resulting recession and social unrest is more than most politicians can take. Greece didn't like the idea of slashing spending, so they dared the European Union to do something about it and the EU blinked. Now the EU is pumping so much money into a failing system that they now have negative interest rates.

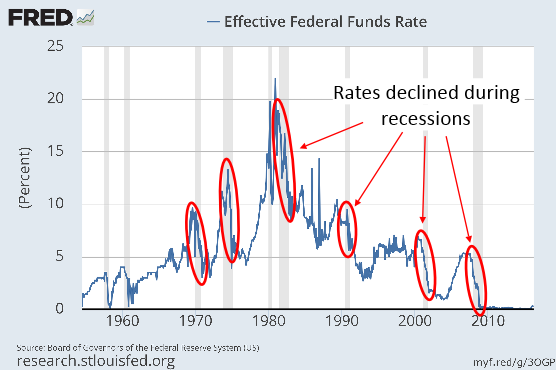

Issue #4: The Coming Recession

Since 1929, the median duration between recessions has been 50 months (4 years and 2 months), according to the National Bureau of Economic Research. The current expansion is 81 months old. Each month we get closer to the next recession, but the Federal Reserve is unprepared.

HSBC Bank's senior economic adviser, Stephen King, wrote in May 2015: "The world economy is like an ocean liner without lifeboats. If another recession hits, it could be a truly titanic struggle for policymakers… In all recessions since the 1970s, the U.S. federal funds rate has fallen by a minimum of 5 percentage points. That kind of traditional stimulus is now completely ruled out."

With the fed funds rate currently close to zero, rates would need to climb to over 5% for the Fed to be ready for the next recession. The irony is that raising rates even to 1% might send the economy into a recession. This is the legacy of the Fed's zero interest rate policy. The Fed has painted itself into a corner. It can't raise rates for fear of starting a recession, and it can't lower rates once one starts.

[page break]

Issue #5: Stagnant Wages

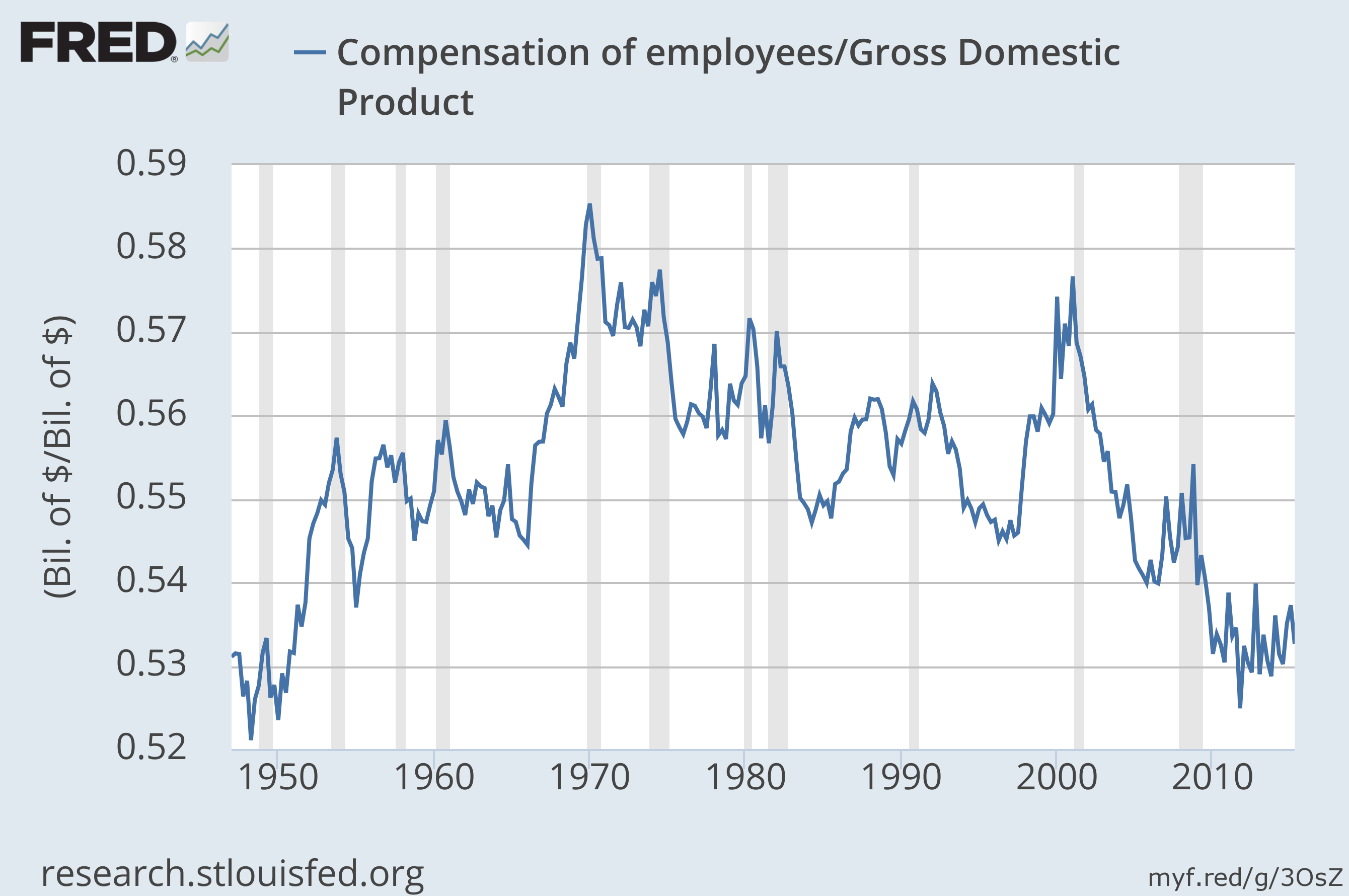

Jobs! Jobs! Jobs! This is the presidential candidates' mantra. Who is going to run for office and not promise jobs? Jobs are important, but pay is even more important. Employees are being left behind when it comes to wages relative to the economy (GDP). After strong gains through the 50s and 60s, wages relative to GDP have been in decline, with the decline accelerating since 2000. The flattening out of the recent few years is only due to the slow economy, not wage gains.

Raise the minimum wage? Do you want to pay more for your Big Gulp, quarter pounder or Snickers bar? It doesn't end there. Do you want to pay more for your plumber, your car repairs or dinner out at your favorite restaurant? In order for the compensation chart above to get back to normal levels, employee costs will have to rise across the board, not just at the minimum wage level. History shows that cycles tend to revert to the mean, which means compensation relative to GDP should rise significantly, regardless of what any president does.

"Higher pay! Higher inflation!" I doubt anyone would be elected to office advocating higher inflation.

Issue #6: Record Corporate Profit Margins

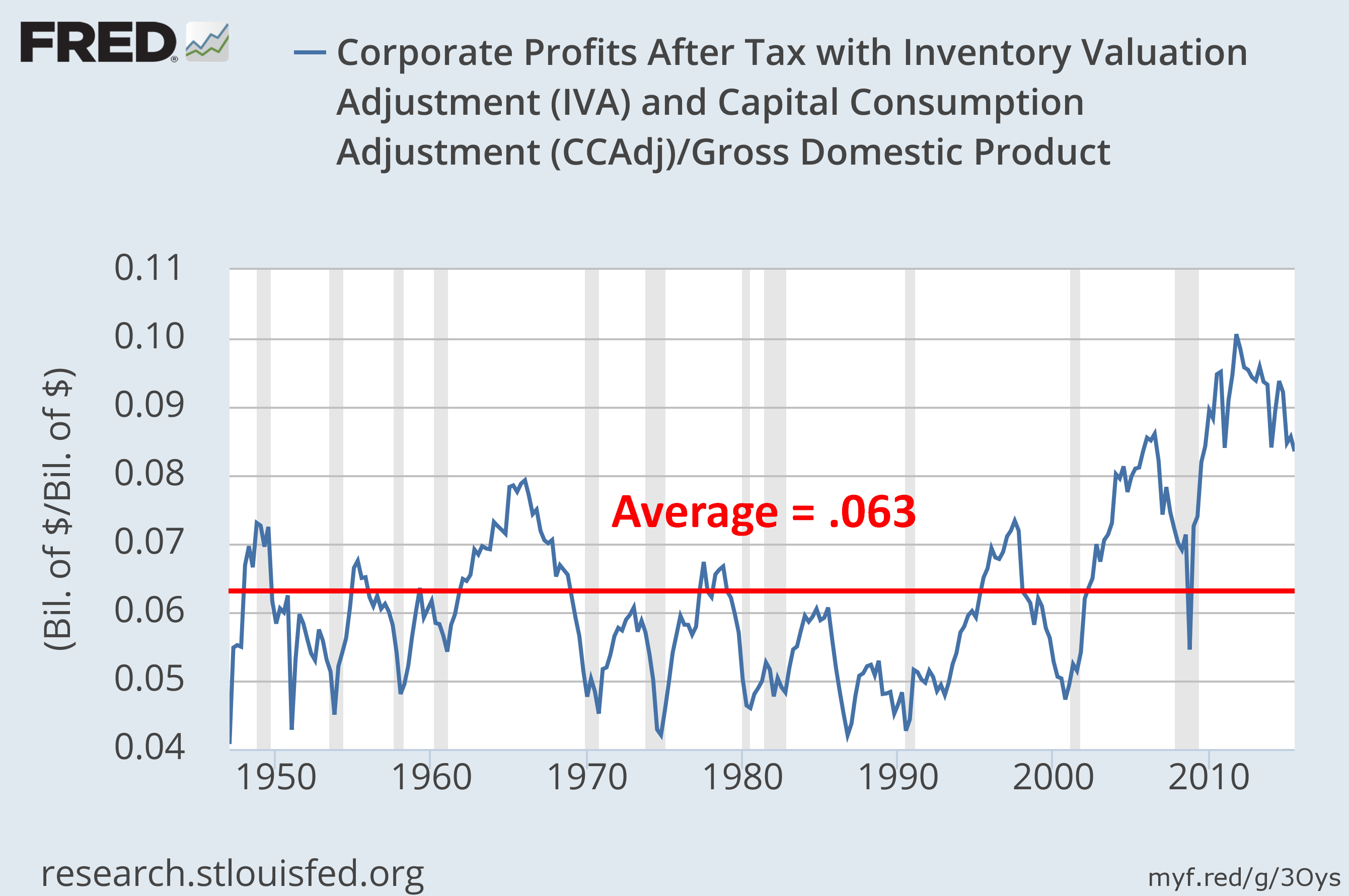

It's a little complicated, but if you take corporate profits with inventory value adjustments and capital consumption adjustments divided by the GDP, you get a rough estimate of the country's overall profit margin. Luckily, the Fed has all this data available on their site.

In the past few months, corporate profit margins have started to come down from record highs. Since the late 1940s, the average profit margin has been about 6.30%. It recently hit 10% and is currently about 8.40%. This is still about 33% above average and more than double the historic lows. If the cycle continues, a reversion to the mean will bring profit margins back down, maybe even to previous lows.

Everybody (except maybe Bernie) understands that a company needs to make a profit. In fact, it's kind of a requirement to make a profit in order to continue serving the public.

But to be making record profit margins at a time when the economy is barely limping along and while employee compensation has hit a record low seems wrong. Investors and companies should be prepared for both of these charts, profit margins and employee compensation, to revert to their mean levels. This translates to lower profit margins and higher employee compensation. How does a presidential candidate address this?

"A vote for me is a vote for more expensive employees and lower profits!" Never gonna happen.

How to Deal With These Issues

The common thread among all these issues is that their fixes involve economic pain. To get the economy from where it is today to where it needs to be—with lower debt, no deficit, higher wages and higher interest rates—would likely involve a deep and wide recession, much worse than the last.

But if the government doesn't do something about the issues, the natural economic cycles may do so on their own—giving us crashing bonds and stocks, spiking interest rates, recession, collapse in confidence and global economic turmoil. A strong leader is needed to keep the natural cycles from taking over.

Instead, the presidential candidates nibble around the edges like a mouse on a pie. None have the nerve to attack these issues and do something that will make real change. There is no magic wand. To get from where we are today to a healthy, self-sustaining economy will require a reset of the system, which will involve a lot of economic pain. The last time the Fed had the nerve to do something drastic and unpopular, as is needed today, was in the early 1980s. Where are you Paul Volcker?

While we wait for that leader, investors need to stay nimble. Forget long-term thinking and be prepared to raise cash or hedge your portfolios.

John Riley, registered Research Analyst and the Chief Investment Strategist at CIS, has been defending his clients from the surprises Wall Street misses since 1999.

Disclosure: Third party posts do not reflect the views of Cantella & Co Inc. or Cornerstone Investment Services, LLC. Any links to third party sites are believed to be reliable but have not been independently reviewed by Cantella & Co. Inc or Cornerstone Investment Services, LLC. Securities offered through Cantella & Co., Inc., Member FINRA/SIPC. Advisory Services offered through Cornerstone Investment Services, LLC's RIA. Please refer to my website for states in which I am registered.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

In 1999, John Riley established Cornerstone Investment Services to offer investors an alternative to Wall Street. He is unique among financial advisers for having passed the Series 86 and 87 exams to become a registered Research Analyst. Since breaking free of the crowd, John has been able to manage clients' money in a way that prepares them for the trends he sees in the markets and the surprises Wall Street misses.

-

Over 65? Here's What the New $6K 'Senior Deduction' Means for Medicare IRMAA Costs

Over 65? Here's What the New $6K 'Senior Deduction' Means for Medicare IRMAA CostsTax Breaks A new deduction for people over age 65 has some thinking about Medicare premiums and MAGI strategy.

-

U.S. Congress to End Emergency Tax Bill Over $6,000 Senior Deduction and Tip, Overtime Tax Breaks in D.C.

U.S. Congress to End Emergency Tax Bill Over $6,000 Senior Deduction and Tip, Overtime Tax Breaks in D.C.Tax Law Here's how taxpayers can amend their already-filed income tax returns amid a potentially looming legal battle on Capitol Hill.

-

5 Investing Rules You Can Steal From Millennials

5 Investing Rules You Can Steal From MillennialsMillennials are reshaping the investing landscape. See how the tech-savvy generation is approaching capital markets – and the strategies you can take from them.

-

When Estate Plans Don't Include Tax Plans, All Bets Are Off: 2 Financial Advisers Explain Why

When Estate Plans Don't Include Tax Plans, All Bets Are Off: 2 Financial Advisers Explain WhyEstate plans aren't as effective as they can be if tax plans are considered separately. Here's what you stand to gain when the two strategies are aligned.

-

Counting on Real Estate to Fund Your Retirement? Avoid These 3 Costly Mistakes

Counting on Real Estate to Fund Your Retirement? Avoid These 3 Costly MistakesThe keys to successful real estate planning for retirees: Stop thinking of property income as a reliable paycheck, start planning for tax consequences and structure your assets early to maintain flexibility.

-

I'm a Financial Planner: These Small Money Habits Stick (and Now Is the Perfect Time to Adopt Them)

I'm a Financial Planner: These Small Money Habits Stick (and Now Is the Perfect Time to Adopt Them)February gets a bad rap for being the month when resolutions fade — in fact, it's the perfect time to reset and focus on small changes that actually pay off.

-

Social Security Break-Even Math Is Helpful, But Don't Let It Dictate When You'll File

Social Security Break-Even Math Is Helpful, But Don't Let It Dictate When You'll FileYour Social Security break-even age tells you how long you'd need to live for delaying to pay off, but shouldn't be the sole basis for deciding when to claim.

-

I'm an Opportunity Zone Pro: This Is How to Deliver Roth-Like Tax-Free Growth (Without Contribution Limits)

I'm an Opportunity Zone Pro: This Is How to Deliver Roth-Like Tax-Free Growth (Without Contribution Limits)Investors who combine Roth IRAs, the gold standard of tax-free savings, with qualified opportunity funds could enjoy decades of tax-free growth.

-

One of the Most Powerful Wealth-Building Moves a Woman Can Make: A Midcareer Pivot

One of the Most Powerful Wealth-Building Moves a Woman Can Make: A Midcareer PivotIf it feels like you can't sustain what you're doing for the next 20 years, it's time for an honest look at what's draining you and what energizes you.

-

I'm a Wealth Adviser Obsessed With Mahjong: Here Are 8 Ways It Can Teach Us How to Manage Our Money

I'm a Wealth Adviser Obsessed With Mahjong: Here Are 8 Ways It Can Teach Us How to Manage Our MoneyThis increasingly popular Chinese game can teach us not only how to help manage our money but also how important it is to connect with other people.

-

Looking for a Financial Book That Won't Put Your Young Adult to Sleep? This One Makes 'Cents'

Looking for a Financial Book That Won't Put Your Young Adult to Sleep? This One Makes 'Cents'"Wealth Your Way" by Cosmo DeStefano offers a highly accessible guide for young adults and their parents on building wealth through simple, consistent habits.