This Short-Term Bond Fund Provides Protection From Rising Rates

Pimco Low Duration Income fund plays defense against rising rates and delivers a decent yield.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

At last, short-term bonds offer respectable yields that surpass 2%—and it only took six interest-rate hikes over three years by the Federal Reserve. With more increases to come, short-term bonds have an added bonus: Their prices sink less than those of longer-dated debt when interest rates rise (bond prices and interest rates tend to move in opposite directions). That's because short-term bonds typically have a lower duration, a measure of interest-rate sensitivity, than their longer-term counterparts.

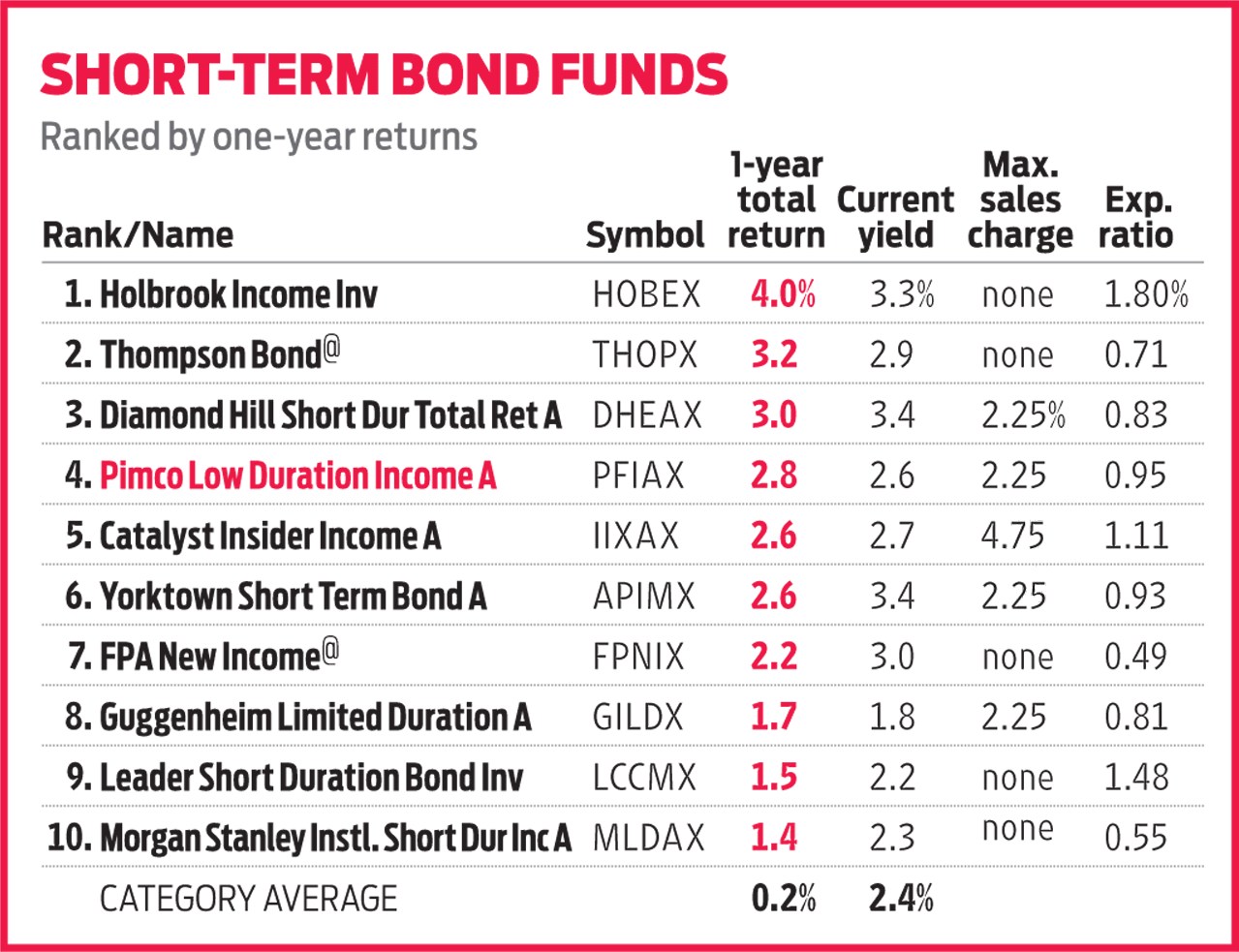

Pimco Low Duration Income (PFIAX) boasts a duration of 1.4 years. That implies the fund's value would decline by 1.4% if rates were to rise one percentage point. By contrast, the Bloomberg Barclays U.S. Aggregate Bond index has an average duration of 5.9 years.

Managers Daniel Ivascyn, Alfred Murata and Eve Tournier want to generate income and keep interest-rate sensitivity in check. They hunt for bonds with durations of three years or less and divide the portfolio into two groups: high-yield bonds that perform well in growing economies, and high-quality debt that will rally during weak economies. The managers are willing to take on more credit risk—that is, the risk that a bond issuer will default—than the average short-term bond fund. But riskier bonds must pay more to attract borrowers, and that helps to boost the fund's yield to 2.6%—more than the 2.4% yield of the typical short-term bond fund.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

The fund takes its cue from Pimco's overarching view of the economy and the bond market. The current outlook is a cautious one, given the well-above-average length of the current economic recovery and pockets of the bond market looking rich compared with historical values. As a result, the fund's managers have grown more defensive recently and have added to the fund's positions in U.S. Treasuries and foreign government debt. On the high-yield side, the crew favors mortgage-backed securities that are not guaranteed by the U.S. government.

Earlier this year, Pimco converted the no-load, Class D shares of all of its mutual funds to A shares, which carry sales charges of 2.25% to 3.75%. To avoid the load, investors can purchase shares at Fidelity, Schwab or Vanguard for no load and no transaction fee.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Ryan joined Kiplinger in the fall of 2013. He wrote and fact-checked stories that appeared in Kiplinger's Personal Finance magazine and on Kiplinger.com. He previously interned for the CBS Evening News investigative team and worked as a copy editor and features columnist at the GW Hatchet. He holds a BA in English and creative writing from George Washington University.

-

Timeless Trips for Solo Travelers

Timeless Trips for Solo TravelersHow to find a getaway that suits your style.

-

A Top Vanguard ETF Pick Outperforms on International Strength

A Top Vanguard ETF Pick Outperforms on International StrengthA weakening dollar and lower interest rates lifted international stocks, which was good news for one of our favorite exchange-traded funds.

-

Is There Such a Thing As a Safe Stock? 17 Safe-Enough Ideas

Is There Such a Thing As a Safe Stock? 17 Safe-Enough IdeasNo stock is completely safe, but we can make educated guesses about which ones are likely to provide smooth sailing.

-

The 5 Best Actively Managed Fidelity Funds to Buy and Hold

The 5 Best Actively Managed Fidelity Funds to Buy and Holdmutual funds Sometimes it's best to leave the driving to the pros – and these actively managed Fidelity funds do just that, at low costs to boot.

-

The 12 Best Bear Market ETFs to Buy Now

The 12 Best Bear Market ETFs to Buy NowETFs Investors who are fearful about the more uncertainty in the new year can find plenty of protection among these bear market ETFs.

-

Don't Give Up on the Eurozone

Don't Give Up on the Eurozonemutual funds As Europe’s economy (and stock markets) wobble, Janus Henderson European Focus Fund (HFETX) keeps its footing with a focus on large Europe-based multinationals.

-

Vanguard Global ESG Select Stock Profits from ESG Leaders

Vanguard Global ESG Select Stock Profits from ESG Leadersmutual funds Vanguard Global ESG Select Stock (VEIGX) favors firms with high standards for their businesses.

-

Kip ETF 20: What's In, What's Out and Why

Kip ETF 20: What's In, What's Out and WhyKip ETF 20 The broad market has taken a major hit so far in 2022, sparking some tactical changes to Kiplinger's lineup of the best low-cost ETFs.

-

ETFs Are Now Mainstream. Here's Why They're So Appealing.

ETFs Are Now Mainstream. Here's Why They're So Appealing.Investing for Income ETFs offer investors broad diversification to their portfolios and at low costs to boot.

-

Do You Have Gun Stocks in Your Funds?

Do You Have Gun Stocks in Your Funds?ESG Investors looking to make changes amid gun violence can easily divest from gun stocks ... though it's trickier if they own them through funds.

-

How to Choose a Mutual Fund

How to Choose a Mutual Fundmutual funds Investors wanting to build a portfolio will have no shortage of mutual funds at their disposal. And that's one of the biggest problems in choosing just one or two.