Sequoia Fund Tries to Recover from Valeant Misstep

Damaged by a huge bet gone awry, a fund once endorsed by Warren Buffett seeks to regain its glory.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

The view of Central Park from the 50th floor of a midtown Manhattan skyscraper is breathtaking. The office is home to Ruane, Cunniff & Goldfarb, which runs Sequoia Fund (symbol SEQUX), a 46-year-old mutual fund with a once-great record and ties to Warren Buffett. The firm moved in two years ago, fulfilling a dream of its then-CEO, Robert Goldfarb.

But Goldfarb is no longer around to enjoy the view. He resigned in March after the fund suffered huge losses because of a large and ultimately misplaced bet on Valeant Pharmaceuticals, which at one point accounted for 32% of the fund’s assets. The stock plunged 93% from August 2015 to June 2016 as the controversial drug maker faced scrutiny over its business practices. Over that period, Sequoia fell 34%, lagging Standard & Poor’s 500-stock index by 31 percentage points.

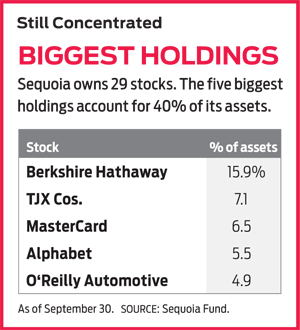

The stumble underscored the risks of concentrated portfolios—Sequoia normally holds only 20 to 40 stocks—and stained an otherwise solid record. For example, from the start of 2000 through July 2015, Sequoia earned 10.1% annualized, crushing the S&P 500 by an average of 5.8 percentage points per year. Valeant’s soaring share price helped Sequoia beat the market from 2011 through 2013, a feat that only one-third of actively managed U.S. funds could claim. It seemed that Buffett had made the right call when, in the course of liquidating his investment partnership, he suggested that his clients invest with his friend Bill Ruane, who, with Richard Cunniff, would launch Sequoia in 1970.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

The founding managers didn’t live to see the recent chaos. Between October 2015 and August 2016, two members of the fund’s board resigned. Shareholders pulled $1.9 billion more from Sequoia than they added and filed lawsuits against both the fund and the management firm. Sequoia’s assets, $9.3 billion at their peak, now stand at $4.8 billion.

Last March, David Poppe, Sequoia’s comanager since 2006, was promoted to CEO of the management firm. He named four new comanagers, all longtime analysts at the firm. The new team quickly altered the decision-making process for buying and selling stocks. During Goldfarb’s tenure, he, Poppe and the analyst who covered a stock had to agree unanimously before Sequoia could buy or sell a single share. The new team decreed that a four-to-one vote among them would be sufficient to take action, “so that one person can’t paralyze the process,” says Poppe.

The subtext, of course, is that Goldfarb was responsible for blocking disposal of Valeant stock even as the firm’s woes were mushrooming. Says Poppe: “That’s where we got in trouble, where Bob said, ‘I’m right and you guys are wrong.’ The problem was that the one time Bob was really wrong was on the biggest position in the portfolio.” With Goldfarb gone, the five managers unanimously agreed to sell all of the Valeant shares. The deed was done by June. (Goldfarb declined to comment.)

Comanager John Harris says he and his colleagues practice “gumshoe journalism” when they investigate companies, peppering customers, rivals, suppliers and employees (current and former) with questions. Not surprisingly, their ranks include several former journalists—including Poppe, once a reporter for the Miami Herald, as well as veteran analyst Greg Steinmetz, a one-time London bureau chief for the Wall Street Journal.

The managers seek high-quality, growing companies with a sustainable competitive edge in their industry and a smart and trustworthy CEO. They buy when prices are reasonable relative to a company’s growth potential. “We’re not bargain hunters,” says comanager Trevor Magyar. “We’re just very careful purchasers of high-quality businesses.”

Sequoia has a long way to go to mend its reputation. One notch in its favor is that, aside from the departures of Goldfarb and the analyst who covered Valeant, the team that has picked stocks for the past decade remains intact. The fund does not levy a sales charge, and annual fees, at 1%, are below average. We’re not ready to endorse Sequoia, but we will be watching it closely in the coming months.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Nellie joined Kiplinger in August 2011 after a seven-year stint in Hong Kong. There, she worked for the Wall Street Journal Asia, where as lifestyle editor, she launched and edited Scene Asia, an online guide to food, wine, entertainment and the arts in Asia. Prior to that, she was an editor at Weekend Journal, the Friday lifestyle section of the Wall Street Journal Asia. Kiplinger isn't Nellie's first foray into personal finance: She has also worked at SmartMoney (rising from fact-checker to senior writer), and she was a senior editor at Money.

-

A Top Vanguard ETF Pick Outperforms on International Strength

A Top Vanguard ETF Pick Outperforms on International StrengthA weakening dollar and lower interest rates lifted international stocks, which was good news for one of our favorite exchange-traded funds.

-

Is There Such a Thing As a Safe Stock? 17 Safe-Enough Ideas

Is There Such a Thing As a Safe Stock? 17 Safe-Enough IdeasNo stock is completely safe, but we can make educated guesses about which ones are likely to provide smooth sailing.

-

We're 64 with $4.3 million and can't agree on when to retire.

We're 64 with $4.3 million and can't agree on when to retire.I want to retire now and pay for health insurance until we get Medicare. My wife says we should work 10 more months. Who's right?

-

The 5 Best Actively Managed Fidelity Funds to Buy and Hold

The 5 Best Actively Managed Fidelity Funds to Buy and Holdmutual funds Sometimes it's best to leave the driving to the pros – and these actively managed Fidelity funds do just that, at low costs to boot.

-

The 12 Best Bear Market ETFs to Buy Now

The 12 Best Bear Market ETFs to Buy NowETFs Investors who are fearful about the more uncertainty in the new year can find plenty of protection among these bear market ETFs.

-

Don't Give Up on the Eurozone

Don't Give Up on the Eurozonemutual funds As Europe’s economy (and stock markets) wobble, Janus Henderson European Focus Fund (HFETX) keeps its footing with a focus on large Europe-based multinationals.

-

Vanguard Global ESG Select Stock Profits from ESG Leaders

Vanguard Global ESG Select Stock Profits from ESG Leadersmutual funds Vanguard Global ESG Select Stock (VEIGX) favors firms with high standards for their businesses.

-

Kip ETF 20: What's In, What's Out and Why

Kip ETF 20: What's In, What's Out and WhyKip ETF 20 The broad market has taken a major hit so far in 2022, sparking some tactical changes to Kiplinger's lineup of the best low-cost ETFs.

-

ETFs Are Now Mainstream. Here's Why They're So Appealing.

ETFs Are Now Mainstream. Here's Why They're So Appealing.Investing for Income ETFs offer investors broad diversification to their portfolios and at low costs to boot.

-

Do You Have Gun Stocks in Your Funds?

Do You Have Gun Stocks in Your Funds?ESG Investors looking to make changes amid gun violence can easily divest from gun stocks ... though it's trickier if they own them through funds.

-

How to Choose a Mutual Fund

How to Choose a Mutual Fundmutual funds Investors wanting to build a portfolio will have no shortage of mutual funds at their disposal. And that's one of the biggest problems in choosing just one or two.