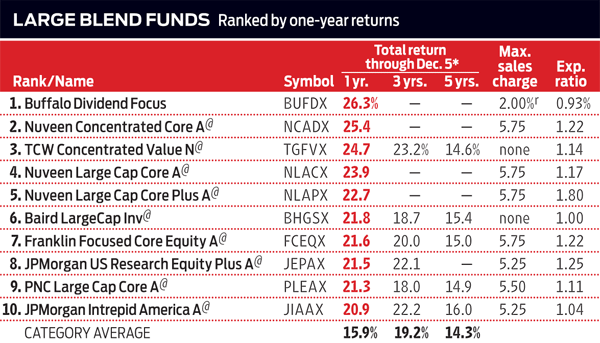

Buffalo Dividend Focus Charges to the Top

Helped by energy-related partnerships, this young fund has delivered stellar results.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

It pays to invest in companies that regularly boost their dividends. But you don’t have to follow strict rules to succeed, as Paul Dlugosch and Scott Moore, the managers of Buffalo Dividend Focus (BUFDX), have shown. Over the past year, their two-year-old fund has bested Standard & Poor’s 500-stock index by eight percentage points.

Dlugosch and Moore focus on steady dividend raisers. But unlike some investors who employ a similar strategy, they don’t demand a certain number of years of consecutive payout boosts. The managers start with U.S.-traded stocks with a market value of at least $1 billion and a minimum yield of 2.0%—about 800 firms in all. They then home in on bargain-priced companies that have a strong competitive edge in their industry and that generate enough cash profits to support—and boost—dividends over time. The resulting portfolio includes companies that have only recently begun to pay dividends, such as Apple, and firms that have been sharing the wealth for decades, such as General Mills.

Much of the fund’s success has been fueled by its stake in energy-related master limited partnerships, says Moore. These partnerships typically own oil refineries, pipelines and other infrastructure. Shares of two holdings, Phillips 66 Partners and EQT Midstream Partners LP, both of which own and operate oil and gas pipelines, returned 96% and 68%, respectively, over the past year.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

-

Timeless Trips for Solo Travelers

Timeless Trips for Solo TravelersHow to find a getaway that suits your style.

-

A Top Vanguard ETF Pick Outperforms on International Strength

A Top Vanguard ETF Pick Outperforms on International StrengthA weakening dollar and lower interest rates lifted international stocks, which was good news for one of our favorite exchange-traded funds.

-

Is There Such a Thing As a Safe Stock? 17 Safe-Enough Ideas

Is There Such a Thing As a Safe Stock? 17 Safe-Enough IdeasNo stock is completely safe, but we can make educated guesses about which ones are likely to provide smooth sailing.

-

The 5 Best Actively Managed Fidelity Funds to Buy and Hold

The 5 Best Actively Managed Fidelity Funds to Buy and Holdmutual funds Sometimes it's best to leave the driving to the pros – and these actively managed Fidelity funds do just that, at low costs to boot.

-

The 12 Best Bear Market ETFs to Buy Now

The 12 Best Bear Market ETFs to Buy NowETFs Investors who are fearful about the more uncertainty in the new year can find plenty of protection among these bear market ETFs.

-

Don't Give Up on the Eurozone

Don't Give Up on the Eurozonemutual funds As Europe’s economy (and stock markets) wobble, Janus Henderson European Focus Fund (HFETX) keeps its footing with a focus on large Europe-based multinationals.

-

Vanguard Global ESG Select Stock Profits from ESG Leaders

Vanguard Global ESG Select Stock Profits from ESG Leadersmutual funds Vanguard Global ESG Select Stock (VEIGX) favors firms with high standards for their businesses.

-

Kip ETF 20: What's In, What's Out and Why

Kip ETF 20: What's In, What's Out and WhyKip ETF 20 The broad market has taken a major hit so far in 2022, sparking some tactical changes to Kiplinger's lineup of the best low-cost ETFs.

-

ETFs Are Now Mainstream. Here's Why They're So Appealing.

ETFs Are Now Mainstream. Here's Why They're So Appealing.Investing for Income ETFs offer investors broad diversification to their portfolios and at low costs to boot.

-

Do You Have Gun Stocks in Your Funds?

Do You Have Gun Stocks in Your Funds?ESG Investors looking to make changes amid gun violence can easily divest from gun stocks ... though it's trickier if they own them through funds.

-

How to Choose a Mutual Fund

How to Choose a Mutual Fundmutual funds Investors wanting to build a portfolio will have no shortage of mutual funds at their disposal. And that's one of the biggest problems in choosing just one or two.