BBH Limited Duration: More Income, a Bit More Risk

The short-term bonds in this fund are stress-tested.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Money that you need at your fingertips in the very short term should be stashed in federally insured accounts, period. But if you’ve got some money that you don’t want to lock up long-term and that can stand a little volatility—perhaps you’ve sold some stocks and you’re waiting to redeploy the proceeds—then consider an ultrashort bond mutual fund.

Bonds in these funds, which typically yield more than cash accounts for a little more risk, usually come with maturities of a year or less. Bonds with short maturities have less time to default, making them less risky than longer-dated debt. And with yields on 10-year Treasuries languishing in the basement, there’s little incentive for income investors to venture out of the shallow end of the pool.

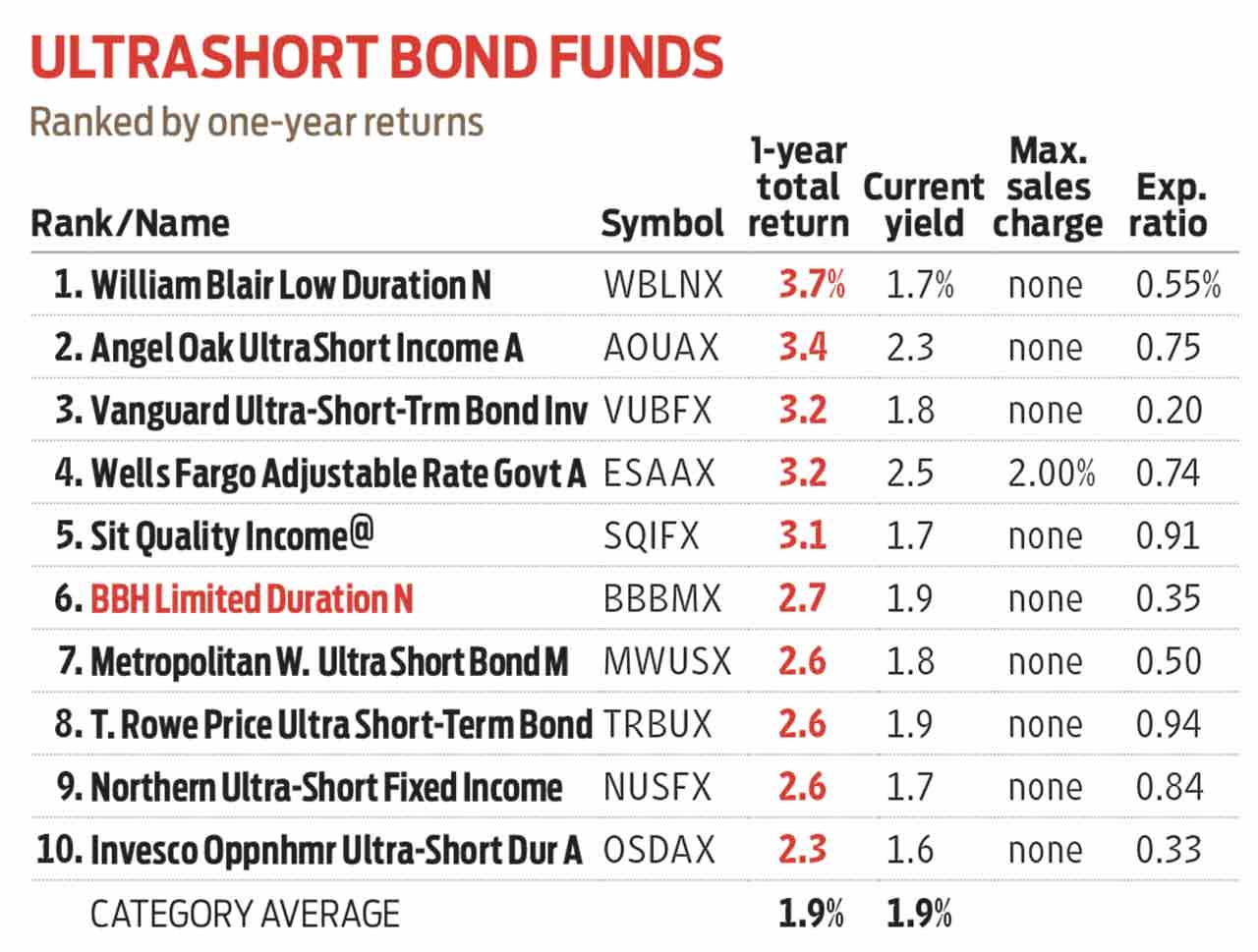

BBH Limited Duration (symbol BBBMX) currently yields 1.9%—a bit less than Standard & Poor’s 500-stock index and about the same as Bloomberg Barclays U.S. Aggregate Bond index, a benchmark for the broad bond market. To build the portfolio, managers Andrew Hofer and Neil Hohmann start by screening the broad bond universe, including corporate and municipal bonds as well as bundles of loans known as securitized debt, to hunt for undervalued issues—those projected to comfortably outperform similarly dated Treasuries, but whose risks the bond market overestimates. In early February, 7% or 8% of corporate bonds passed the screen. By mid March, amid market turmoil, more than 60% looked like potential deals, says Hofer.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

From there, the fund’s management team goes bond by bond, favoring offerings from experienced issuers and those backed by understandable, transparent cash flows. Managers “stress test” each bond in the portfolio to assess how it would hold up under worst-case scenarios. Bonds backed by consumer loans assume 20% unemployment, for instance. Such rigor allows the fund to venture into slightly riskier territory than peer funds.

Over the past decade, Limited Duration has been about 25% more volatile than the average ultrashort bond fund, but 75% less volatile than the broad bond market. The fund posted a positive return in each of the past 10 calendar years. Over the past 15 years, its 2.7% annualized return led all ultrashort bond funds.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Ryan joined Kiplinger in the fall of 2013. He wrote and fact-checked stories that appeared in Kiplinger's Personal Finance magazine and on Kiplinger.com. He previously interned for the CBS Evening News investigative team and worked as a copy editor and features columnist at the GW Hatchet. He holds a BA in English and creative writing from George Washington University.

-

Timeless Trips for Solo Travelers

Timeless Trips for Solo TravelersHow to find a getaway that suits your style.

-

A Top Vanguard ETF Pick Outperforms on International Strength

A Top Vanguard ETF Pick Outperforms on International StrengthA weakening dollar and lower interest rates lifted international stocks, which was good news for one of our favorite exchange-traded funds.

-

Is There Such a Thing As a Safe Stock? 17 Safe-Enough Ideas

Is There Such a Thing As a Safe Stock? 17 Safe-Enough IdeasNo stock is completely safe, but we can make educated guesses about which ones are likely to provide smooth sailing.

-

The 5 Best Actively Managed Fidelity Funds to Buy and Hold

The 5 Best Actively Managed Fidelity Funds to Buy and Holdmutual funds Sometimes it's best to leave the driving to the pros – and these actively managed Fidelity funds do just that, at low costs to boot.

-

The 12 Best Bear Market ETFs to Buy Now

The 12 Best Bear Market ETFs to Buy NowETFs Investors who are fearful about the more uncertainty in the new year can find plenty of protection among these bear market ETFs.

-

Don't Give Up on the Eurozone

Don't Give Up on the Eurozonemutual funds As Europe’s economy (and stock markets) wobble, Janus Henderson European Focus Fund (HFETX) keeps its footing with a focus on large Europe-based multinationals.

-

Vanguard Global ESG Select Stock Profits from ESG Leaders

Vanguard Global ESG Select Stock Profits from ESG Leadersmutual funds Vanguard Global ESG Select Stock (VEIGX) favors firms with high standards for their businesses.

-

Kip ETF 20: What's In, What's Out and Why

Kip ETF 20: What's In, What's Out and WhyKip ETF 20 The broad market has taken a major hit so far in 2022, sparking some tactical changes to Kiplinger's lineup of the best low-cost ETFs.

-

ETFs Are Now Mainstream. Here's Why They're So Appealing.

ETFs Are Now Mainstream. Here's Why They're So Appealing.Investing for Income ETFs offer investors broad diversification to their portfolios and at low costs to boot.

-

Do You Have Gun Stocks in Your Funds?

Do You Have Gun Stocks in Your Funds?ESG Investors looking to make changes amid gun violence can easily divest from gun stocks ... though it's trickier if they own them through funds.

-

How to Choose a Mutual Fund

How to Choose a Mutual Fundmutual funds Investors wanting to build a portfolio will have no shortage of mutual funds at their disposal. And that's one of the biggest problems in choosing just one or two.