Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

A common goal for financial advisors is constructing a portfolio that successfully aligns with the investment objectives of the individual investor. Most advisors focus on constructing a traditional portfolio expected to generate a total return consisting of an optimal blend of current yield and capital appreciation.

But relatively few advisors take into account what we know about the emotional factors that powerfully influence how most investors actually behave. Unfortunately, this oversight can have a significantly negative impact on ultimate investment results.

Traditional portfolios and fear-based selling have caused many investors to miss the mark when it comes to long-term returns.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

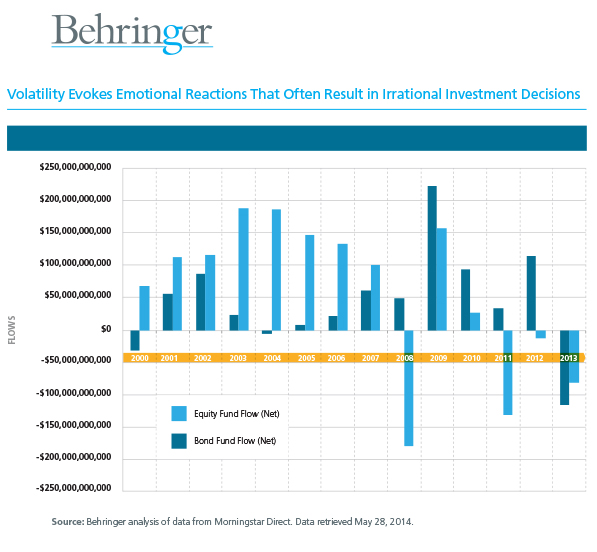

For some time, the standard model for traditional portfolio construction has comprised 60% stocks and 40% bonds. But in recent years, many of the portfolios constructed upon this model have not delivered the long-term returns anticipated. A significant factor in these results has been massive net redemptions in equity funds during market downturns, such as those of 2002 and 2008. (Source: Morningstar Direct.)

Unfortunately, investors usually do the wrong thing at the wrong time.

As the market statistics demonstrate, investors persistently buy when the asset price is high and sell when the price is low. (Source: DALBAR’s 20th Annual Quantitative Analysis of Investor Behavior 2014.) Since this approach is likely to promote losses rather than gains, why do investors usually behave this way?

Volatility evokes emotional reactions that often result in irrational investment decisions.

There is a strong temptation for fearful investors to “join the bandwagon” by selling assets during a downturn. Nothing tests an investor’s tolerance for risk like the stressful, real-world situation of a market downturn. In a perceived crisis, most investors simply respond emotionally and act accordingly. Driven by the fear of further losses, they fail to rationally consider the long-term impact of their impulsive decisions.

What’s the answer? Broader portfolio diversification that tempers volatility.

Education seldom addresses the root emotions of fear and greed that prompt irrational investor behavior, and its impact tends to fade over time without frequent repetition. A more effective solution is broader diversification that tempers volatility. Lower investment volatility reduces the probability that an investor will develop fear sufficient to motivate a self-defeating decision to sell at the wrong time.

A wider range of allocations to non-correlated asset classes can temper volatility, reducing the perception of risk that prompts fear-based selling. Investments in non-traditional asset classes have the potential to further enhance portfolio diversification and provide more comfort for risk-adverse investors without sacrificing real rates of return.

Constructing Portfolios Well-Diversified for Today’s Realities

Help your clients make smart choices about not just what they own, but also what they allocate to each portfolio component. To construct well-diversified portfolios that reflect the realities faced by your clients today, consider incorporating private debt and equity, where appropriate. (Bear in mind that some investment vehicles may be restricted to accredited investors.) There also is the potential to further enhance diversification for suitable investors with allocations to directional strategies like long/short, arbitrage and spread investing concepts, or the balanced use of leverage.

More Information for Financial Advisors

To find out more, download the informative white paper (Diversifying with Alts: Constructing Portfolios that Reduce Volatility and the Likelihood of Fear-based Selling) available at behringerinvestments.com/evolve. This resource helps financial advisors hone their expertise in using alternative investments to help improve long-term returns by reducing the volatility that often tempts investors to do the wrong thing at the wrong time.

About Behringer

Behringer creates, manages and distributes specialized investments through a multi-manager approach that presents unique options for allocating capital, managing risk and diversifying assets. Investments sponsored and managed by the Behringer group of companies have invested into more than $11 billion in assets. For more information, call toll-free 866.655.3600 or visit behringerinvestments.com.

This content was provided by Behringer and did not involve the Kiplinger editorial staff.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

-

Quiz: Do You Know How to Avoid the "Medigap Trap?"

Quiz: Do You Know How to Avoid the "Medigap Trap?"Quiz Test your basic knowledge of the "Medigap Trap" in our quick quiz.

-

5 Top Tax-Efficient Mutual Funds for Smarter Investing

5 Top Tax-Efficient Mutual Funds for Smarter InvestingMutual funds are many things, but "tax-friendly" usually isn't one of them. These are the exceptions.

-

AI Sparks Existential Crisis for Software Stocks

AI Sparks Existential Crisis for Software StocksThe Kiplinger Letter Fears that SaaS subscription software could be rendered obsolete by artificial intelligence make investors jittery.

-

Best Banks for High-Net-Worth Clients

Best Banks for High-Net-Worth Clientswealth management These banks welcome customers who keep high balances in deposit and investment accounts, showering them with fee breaks and access to financial-planning services.

-

Stock Market Holidays in 2026: NYSE, NASDAQ and Wall Street Holidays

Stock Market Holidays in 2026: NYSE, NASDAQ and Wall Street HolidaysMarkets When are the stock market holidays? Here, we look at which days the NYSE, Nasdaq and bond markets are off in 2026.

-

Stock Market Trading Hours: What Time Is the Stock Market Open Today?

Stock Market Trading Hours: What Time Is the Stock Market Open Today?Markets When does the market open? While the stock market has regular hours, trading doesn't necessarily stop when the major exchanges close.

-

Bogleheads Stay the Course

Bogleheads Stay the CourseBears and market volatility don’t scare these die-hard Vanguard investors.

-

The Current I-Bond Rate Is Mildly Attractive. Here's Why.

The Current I-Bond Rate Is Mildly Attractive. Here's Why.Investing for Income The current I-bond rate is active until April 2026 and presents an attractive value, if not as attractive as in the recent past.

-

What Are I-Bonds? Inflation Made Them Popular. What Now?

What Are I-Bonds? Inflation Made Them Popular. What Now?savings bonds Inflation has made Series I savings bonds, known as I-bonds, enormously popular with risk-averse investors. How do they work?

-

This New Sustainable ETF’s Pitch? Give Back Profits.

This New Sustainable ETF’s Pitch? Give Back Profits.investing Newday’s ETF partners with UNICEF and other groups.

-

As the Market Falls, New Retirees Need a Plan

As the Market Falls, New Retirees Need a Planretirement If you’re in the early stages of your retirement, you’re likely in a rough spot watching your portfolio shrink. We have some strategies to make the best of things.