The Trouble with Index Funds

You’ll need to look elsewhere for protection from the full brunt of the next bear market.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

Nowadays everybody loves index funds. What’s not to love? On average, index funds outpace roughly two-thirds of actively managed funds. And because most major market indexes are way up since the nadir of the bear market on March 9, 2009, anyone who has been in an index fund since then has undoubtedly earned a lot of money.

Consider just a few performance numbers: Standard & Poor’s 500-stock index has returned an annualized 25.6% (192.2% on a cumulative basis). The Russell 2000 index of small companies has done even better, soaring an annualized 29.9% (242.2% cumulative). The MSCI EAFE index, which follows stocks in developed foreign markets, has risen an annualized 20.8% (143.2% cumulative). Even Barclays Aggregate U.S. Bond index, which tracks the high-quality part of the domestic bond market, has gained an annualized 5.1%, or a cumulative 26.5%. (All returns are through November 19.)

Any half-decently run index fund has matched the returns of those indexes, minus 0.1 or 0.2 percentage point to account for fund expenses. So why bother with any other kind of fund?

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

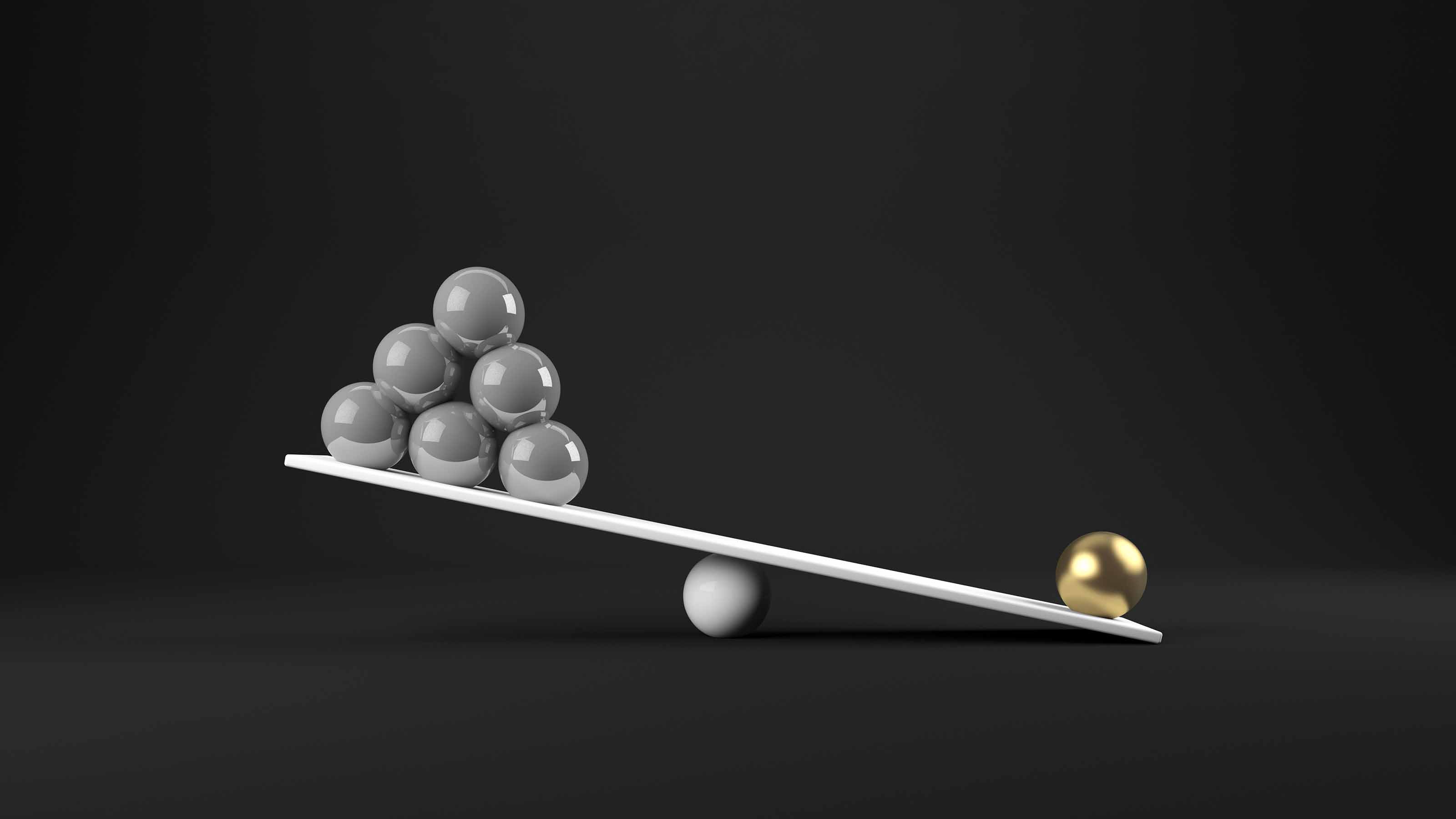

Here’s the rub: Stock-index funds seek to reflect the overall stock market, and that means tracking the market’s downs as well as its ups. Most investors want to be cushioned from the brunt of bear markets, and actively managed funds are a better place to look for that protection. That’s why a mix of index funds and actively managed funds may be your best bet as an investor.

It’s no coincidence that index funds have increased in popularity during the current bull market. The charm will likely fade for many during the next bear market. During the last bear market, when the S&P 500 plunged 55.3%, many investors flocked to actively managed funds that promised some relief from the pain—whether by holding cash or bonds or buying stocks that were less volatile than those that dominate the S&P 500, the most popular index for passive funds.

Don’t get me wrong. There’s a lot to like about broad-based index mutual funds and exchange-traded funds, most of which track indexes. (I’d avoid most of the narrow ETFs, which are proliferating like rabbits.) Index funds are cheap, especially if they come from a low-cost firm such as Vanguard. It’s easy to pick index funds; you don’t have to pore over newsletters, fund reports and magazine articles. Index funds are tax-friendly in that they don’t pay out big capital gains the way actively managed funds do. Finally, broad index funds offer diversification—the one free lunch in investing.

But don’t put all your money in index funds, especially if you’re worried about the next vicious bear market. That’s ample reason to favor funds that should produce solid returns in good markets but that also held up relatively well in the 2007-09 massacre. For example, FPA Crescent (symbol FPACX) lost only 27.9% during the bloodbath, compared with a 55.3% plunge for the S&P 500. Others that held up reasonably well were Matthews Asian Growth & Income (MACSX), down 39.4%, Vanguard Dividend Growth (VDIGX), off 42.3%, and Yacktman Fund (YACKX), down 46.5%.

Index funds don’t have those shock absorbers. “There are a lot of good defensive strategies in active management,” says Russel Kinnel, director of fund research at Morningstar. Of course, the trick is to find good actively managed funds. Many actively run funds lost as much as or more than index funds during the last bear market.

When to use index funds? Start with large-company U.S. stocks. These companies are so widely followed and so carefully scrutinized by investors and analysts that it’s difficult for active managers to add value through their stock-picking skills. Large foreign companies in the developed world are almost as thoroughly researched.

When to use actively managed funds? When you can find a relatively low-cost fund that has produced strong risk-adjusted results compared with its benchmark over a long period (at least five years) under the same manager.

In more normal times, index fund investors could sensibly reduce their portfolio’s overall volatility simply by increasing their allocations to bonds and cash. But these are still not normal times, and the outlook for high-quality bonds, particularly bond index funds, many of which are filled with government debt, is dismal. Even John Bogle, the former Vanguard Group chief who was instrumental in bringing index funds to the masses, says to avoid generic bond index funds because they own too many government bonds, which are especially susceptible to rising interest rates (bond prices and rates move in opposite directions). And cash, of course, is earning almost nothing.

For most of my money, I’d rather have a manager such as FPA Crescent’s Steve Romick decide how much to invest in stocks, bonds and cash—and have him change those allocations a bit as opportunities emerge. Or I’d like a fund such as Yacktman, which takes a low-risk approach to the markets by loading up on inexpensive, high-quality stocks.

Low-volatility funds, which are becoming more popular, are intriguing. They start with a regular index and remove its most-volatile stocks. But these funds are too new and untested for me to trust yet. The ones I’ve looked at have big exposures to some industry sectors and little to others. They’re not truly index funds—at least they don’t fully reflect the overall market.

To me, a mix of index and actively managed funds makes the most sense. That way you keep your costs low and keep your risks relatively low, too.

Steven T. Goldberg is an investment adviser in the Washington, D.C., area.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

-

Nasdaq Leads a Rocky Risk-On Rally: Stock Market Today

Nasdaq Leads a Rocky Risk-On Rally: Stock Market TodayAnother worrying bout of late-session weakness couldn't take down the main equity indexes on Wednesday.

-

Quiz: Do You Know How to Avoid the "Medigap Trap?"

Quiz: Do You Know How to Avoid the "Medigap Trap?"Quiz Test your basic knowledge of the "Medigap Trap" in our quick quiz.

-

5 Top Tax-Efficient Mutual Funds for Smarter Investing

5 Top Tax-Efficient Mutual Funds for Smarter InvestingMutual funds are many things, but "tax-friendly" usually isn't one of them. These are the exceptions.

-

ESG Gives Russia the Cold Shoulder, Too

ESG Gives Russia the Cold Shoulder, TooESG MSCI jumped on the Russia dogpile this week, reducing the country's ESG government rating to the lowest possible level.

-

The 10 Best Schwab Funds for 2022

The 10 Best Schwab Funds for 2022ETFs Whether you're looking to build a core portfolio or position yourself for 2022, Schwab funds offer diversified exposure for a song.

-

New PINK Healthcare ETF Will Donate Fees to Cancer Research

New PINK Healthcare ETF Will Donate Fees to Cancer ResearchIndex Funds Simplify has launched a rare actively managed fund in the healthcare sector. It’s not cheap, but you’ll feel good about where your fees are going.

-

A Simple Portfolio Is All You Need

A Simple Portfolio Is All You NeedFinancial Planning It’s possible to build wealth with only a few funds—or even just one.

-

PODCAST: ETFs and Mutual Funds with Todd Rosenbluth

PODCAST: ETFs and Mutual Funds with Todd RosenbluthIndex Funds Which is better: ETFs or mutual funds? And how do you decide where to put your investments? CFRA fund expert Todd Rosenbluth has some answers. Also, how to take advantage of your leased car’s true value.

-

Water Investing: 5 Funds You Should Tap

Water Investing: 5 Funds You Should TapETFs As the importance of water sustainability becomes ever more apparent, so too do the potential rewards of investing in water.

-

The Truth About Index Funds

The Truth About Index FundsIndex Funds You may think you're diversified by buying an S&P 500 Index fund, but you're making a substantial wager on a handful of stocks.

-

10 Best Value ETFs to Buy for Bundled Bargains

10 Best Value ETFs to Buy for Bundled BargainsETFs Value stocks are finally having their day, and many expect the run to continue. These are the best value ETFs to leverage this long-awaited revival.