Apple Stock: The Dividend Investor's Guide

As AAPL dedicates increasing sums of cash to its dividend, does it belong in buy-and-hold income portfolios?

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

On its face, Apple (AAPL, $308.95) might not seem like your typical "income stock."

For one, AAPL's dividend yield hasn't eclipsed 2.4% at any point in the past five years. And a long rally in Apple stock has driven its current yield to a mere 1%.

Apple's revenue stream has long been lumpy and overly dependent on the iPhone upgrade cycle, too. That's not generally what you want to see in an income stock. Ideally, a dividend holding produces stable and predictable cash flows that come in every quarter like clockwork.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

However, given our current low-interest-rate environment, with bond yields not far from all-time lows, dividend investors should keep an open mind when building an income strategy, particularly if you are still a few years away from needing the money.

"Retirement can last years, even decades," says Gregory Lindberg, a commodity trading advisor based in San Francisco, California. "Focusing solely on current yield at the expense of growth is a recipe for a disappointing retirement."

Besides, a closer look under the hood reveals that Apple stock might be a better income-oriented portfolio holding than it seems at first glance.

Apple Has Been Defined by Growth

Apple is one of the great growth stories of the past two decades. Since the start of 2006, shares have delivered a total return (price plus dividends) of almost 3,400%. AAPL has more than tripled since 2016, and it has doubled in the past year alone.

It's extremely unlikely that you would've been able to find returns like that in a less risky, higher-yielding dividend stock.

Those kinds of returns can't last forever, of course.

Apple's market cap is already $1.4 trillion. Were it to rise by another 3,400%, its market cap would be larger than the current annual GDP of America. The company's growth rate is slower than it was a few years ago. You could even argue that Apple's stock price has gotten a little ahead of itself and is due for a correction.

Apple's growth might moderate more in the years ahead. However, its presence in technology and communications, positioning as a premium brand and its ample cash hoard (which would allow it to make transformative acquisitions, or at the least, buy back large amounts of its own stock) make it likely that AAPL can continue to generate competitive share-price appreciation.

"While the stock has had a massive rally over the past year … we continue to believe this is a must own stock into what we would characterize as a transformational 5G supercycle over the next 12 to 18 months with Apple being our favorite 5G play," writes Wedbush analyst Dan Ives.

Still, income will increasingly matter as its red-hot growth cools. So where does Apple stand on that front?

Apple Stock: The Dividend Case

Don't let the low yield fool you. Apple is no slouch on the dividend front.

The modest current yield on Apple stock isn't due to any stinginess on Tim Cook's part. Rather, it's because AAPL shares have exploded higher. Remember: Dividend yield is just the current annual dividend payment divided by the current stock price. So as price goes up, yield goes down.

But importantly, Apple is delivering dividend growth.

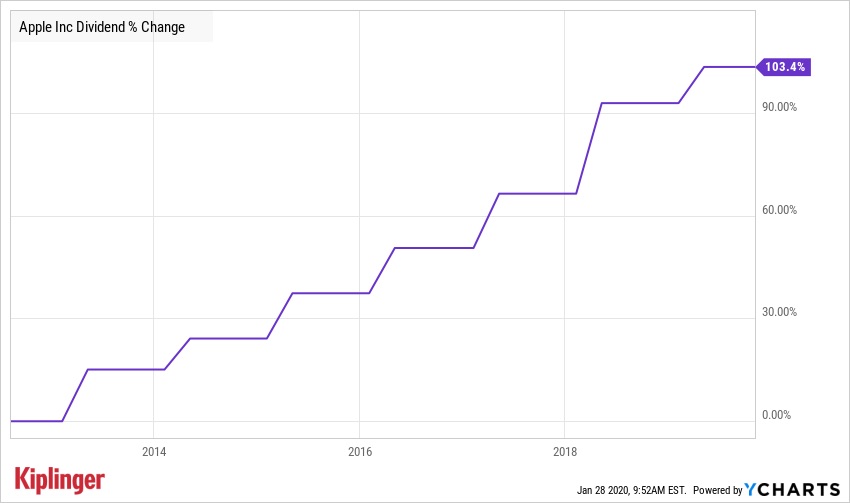

Indeed, since initiating its dividend in late 2012, Apple has raised its quarterly dividend by 103%, working out to a compound annual dividend growth rate of about 10%.

To put that in perspective, consider the yield on cost. Had you bought Apple in August 2012 just before it paid its first dividend, your AAPL shares would be delivering a yield of 3.5% based on your original cost.

That's not high, per se. But it's much more attractive than Apple stock's yield on new money, and it's certainly competitive considering today's low interest rates.

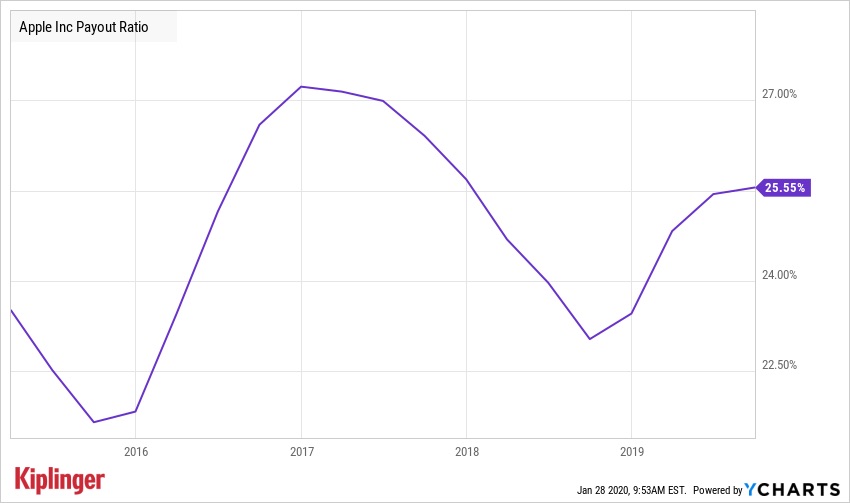

There's plenty of room for continued dividend growth, too. Apple only pays out about a quarter of its profits as dividends – a ratio it has kept relatively stable for the past five years. Apple may or may not continue to pad its earnings at the torrid clip of the past two decades. But even at slower profit expansion, AAPL can continue to aggressively grow its dividend by 5% to 10% annually for years, if not a decade or more.

Apple also is making improvements to its business that should make dividend investors happy. Historically, Apple has been almost exclusively a hardware company. Users pay top dollar for Apple's phones, notebooks and other devices because of their perceived quality.

That might be more difficult to maintain in the future, with Samsung and Huawei making hardware that is at the very least equal to (and arguably better than) Apple's. The global smartphone market is also becoming saturated, meaning less growth for the industry as a whole.

But Apple saw that handwriting on the wall years ago. That's why it has been aggressively building out its Services division – offerings such as the App Store, iCloud, Apple TV+ and more.

As of Apple's final quarter of its fiscal year ended September 2019, services revenues had climbed to an all-time high $12.5 billion, accounting for nearly 25% of the total. That's up from less than 20% the year before, and you can expect that number to continue climbing.

Under CEO Satya Nadella, Microsoft (MSFT) revolutionized itself by ditching the concept of software as a product and instead selling it as a service. Customers who might have upgraded their operating systems and office software once every three to five years instead began paying the company a monthly subscription fee. This streamlined revenues and made them far less lumpy.

This is what Apple wants to do in selling music, TV, data storage and other services. And it's working.

The Final Call

So, does Apple stock belong in a long-term dividend portfolio?

Yes, especially for investors who are willing to take on a little more risk than stable consumer staples and utility stocks.

Whether it's a buy right this moment depends on how much of a premium you're willing to pay. Nonetheless, while AAPL's yield is modest, its dividend growth rate is excellent, and the company is de-emphasizing its cyclical hardware business in favor of a more stable services model.

That sounds better than reaching for dividend yield in a slow-growth utility stock.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Charles Lewis Sizemore, CFA is the Chief Investment Officer of Sizemore Capital Management LLC, a registered investment advisor based in Dallas, Texas, where he specializes in dividend-focused portfolios and in building alternative allocations with minimal correlation to the stock market.

-

Over 65? Here's What the New $6K 'Senior Deduction' Means for Medicare IRMAA Costs

Over 65? Here's What the New $6K 'Senior Deduction' Means for Medicare IRMAA CostsTax Breaks A new deduction for people over age 65 has some thinking about Medicare premiums and MAGI strategy.

-

U.S. Congress to End Emergency Tax Bill Over $6,000 Senior Deduction and Tip, Overtime Tax Breaks in D.C.

U.S. Congress to End Emergency Tax Bill Over $6,000 Senior Deduction and Tip, Overtime Tax Breaks in D.C.Tax Law Here's how taxpayers can amend their already-filed income tax returns amid a potentially looming legal battle on Capitol Hill.

-

5 Investing Rules You Can Steal From Millennials

5 Investing Rules You Can Steal From MillennialsMillennials are reshaping the investing landscape. See how the tech-savvy generation is approaching capital markets – and the strategies you can take from them.

-

Nasdaq Leads a Rocky Risk-On Rally: Stock Market Today

Nasdaq Leads a Rocky Risk-On Rally: Stock Market TodayAnother worrying bout of late-session weakness couldn't take down the main equity indexes on Wednesday.

-

AI Unwind Takes 2% Off the Nasdaq: Stock Market Today

AI Unwind Takes 2% Off the Nasdaq: Stock Market TodayMarkets are paying more and more attention to hyperscalers' plans to spend more and more money on artificial intelligence.

-

Stocks Sink With Alphabet, Bitcoin: Stock Market Today

Stocks Sink With Alphabet, Bitcoin: Stock Market TodayA dismal round of jobs data did little to lift sentiment on Thursday.

-

Nasdaq Slides 1.4% on Big Tech Questions: Stock Market Today

Nasdaq Slides 1.4% on Big Tech Questions: Stock Market TodayPalantir Technologies proves at least one publicly traded company can spend a lot of money on AI and make a lot of money on AI.

-

Stocks Close Down as Gold, Silver Spiral: Stock Market Today

Stocks Close Down as Gold, Silver Spiral: Stock Market TodayA "long-overdue correction" temporarily halted a massive rally in gold and silver, while the Dow took a hit from negative reactions to blue-chip earnings.

-

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have TodayAdvanced Micro Devices stock is soaring thanks to AI, but as a buy-and-hold bet, it's been a market laggard.

-

Nasdaq Drops 172 Points on MSFT AI Spend: Stock Market Today

Nasdaq Drops 172 Points on MSFT AI Spend: Stock Market TodayMicrosoft, Meta Platforms and a mid-cap energy stock have a lot to say about the state of the AI revolution today.

-

S&P 500 Tops 7,000, Fed Pauses Rate Cuts: Stock Market Today

S&P 500 Tops 7,000, Fed Pauses Rate Cuts: Stock Market TodayInvestors, traders and speculators will probably have to wait until after Jerome Powell steps down for the next Fed rate cut.